Global Siding Industry Market - Key Trends & Drivers Summarized

How Are Technological Innovations Transforming the Siding Industry?

Technological innovations are playing a crucial role in transforming the siding industry, enhancing the durability, aesthetics, and energy efficiency of siding materials. Advances in manufacturing technologies have led to the development of high-performance materials such as fiber cement, insulated vinyl, and engineered wood. These materials offer superior resistance to weather, pests, and fire, while also providing improved insulation properties that contribute to energy efficiency. Innovations in color retention and UV protection technologies ensure that siding maintains its appearance over time, reducing the need for frequent maintenance. Furthermore, the integration of smart technology allows for the creation of siding products with built-in sensors that can monitor environmental conditions and structural integrity, providing homeowners and contractors with valuable data for maintenance and repair. These technological advancements are driving the adoption of modern siding solutions in both residential and commercial construction.What Role Do Consumer Preferences and Sustainability Trends Play in Market Dynamics?

Consumer preferences and sustainability trends are significantly influencing the dynamics of the siding industry market. Today's consumers are increasingly focused on sustainability and environmental responsibility, driving demand for eco-friendly and energy-efficient siding options. Materials such as fiber cement and engineered wood are gaining popularity due to their lower environmental impact compared to traditional options like vinyl and aluminum. Additionally, the rising awareness of the long-term benefits of energy-efficient homes is prompting homeowners to invest in insulated siding products that reduce heating and cooling costs. The aesthetic appeal of siding materials is also a major consideration for consumers, with a growing preference for products that offer a wide range of colors, textures, and styles. As consumers seek to enhance the curb appeal and value of their properties, manufacturers are responding by offering innovative and customizable siding solutions that meet these demands.How Are Market Dynamics and Competitive Strategies Influencing Growth?

The siding industry market is highly competitive, with numerous players striving to differentiate themselves through innovation and strategic initiatives. Companies are investing heavily in research and development to create advanced siding materials that offer superior performance and aesthetic appeal. Strategic partnerships, mergers, and acquisitions are common, enabling companies to expand their product portfolios and market reach. For instance, collaborations between siding manufacturers and construction firms can facilitate the development of integrated building solutions that enhance the overall efficiency and durability of structures. Additionally, companies are focusing on expanding their presence in emerging markets, where rapid urbanization and infrastructure development are driving demand for high-quality building materials. Marketing strategies that highlight the benefits of modern siding products, such as enhanced durability, energy efficiency, and aesthetic appeal, are also crucial for driving market growth. The competitive landscape, characterized by constant innovation and strategic moves, is a significant factor propelling the market forward.What Are the Key Drivers of Growth in the Siding Industry Market?

The growth in the siding industry market is driven by several factors. The increasing focus on energy efficiency and sustainability in the construction industry is a primary driver, prompting the adoption of advanced siding materials that offer improved insulation and lower environmental impact. Technological advancements, such as the development of high-performance fiber cement and engineered wood siding, are enhancing the durability and aesthetic appeal of siding products, boosting their popularity among homeowners and contractors. Regulatory policies and building codes that promote energy-efficient and sustainable construction practices are also driving demand for modern siding solutions. Additionally, the rising trend of home renovation and remodeling projects is contributing to market growth, as homeowners seek to enhance the appearance and value of their properties. The expanding construction activities in emerging markets, driven by rapid urbanization and infrastructure development, are further propelling the demand for siding materials.Report Scope

The report analyzes the Siding Industry market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Fiber Cement, Vinyl, Wood, Other Materials); End-Use (Residential, Non-Residential).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fiber Cement Material segment, which is expected to reach US$112.1 Billion by 2030 with a CAGR of a 4.2%. The Vinyl Material segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $60.8 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $57.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Siding Industry Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Siding Industry Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Siding Industry Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alside Inc., American Building Components, Associated Materials Inc., Boral Limited, Certain Teed Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 113 companies featured in this Siding Industry market report include:

- Alside Inc.

- American Building Components

- Associated Materials Inc.

- Boral Limited

- Certain Teed Corporation

- Designer Panel Systems

- Etex

- Forterra Building Products Limited

- Gentek Building Products Inc.

- Georgia-Pacific Corporation

- James Hardie Industries PLC

- Kaycan Ltd.

- LIXIL Group Corporation

- Louisiana-Pacific Corporation

- Metal Building Components Inc.

- National Cladding Wales Ltd.

- NCI Building Systems

- Nichiha Corporation

- Palagio Engineering Srl

- Peter L. Brown Co.,

- Ply Gem Holdings Inc.

- Royal Building Products

- Ruukki Construction

- Sto Corp.

- The Alumasc Group PLC

- Wienerberger AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alside Inc.

- American Building Components

- Associated Materials Inc.

- Boral Limited

- Certain Teed Corporation

- Designer Panel Systems

- Etex

- Forterra Building Products Limited

- Gentek Building Products Inc.

- Georgia-Pacific Corporation

- James Hardie Industries PLC

- Kaycan Ltd.

- LIXIL Group Corporation

- Louisiana-Pacific Corporation

- Metal Building Components Inc.

- National Cladding Wales Ltd.

- NCI Building Systems

- Nichiha Corporation

- Palagio Engineering Srl

- Peter L. Brown Co.,

- Ply Gem Holdings Inc.

- Royal Building Products

- Ruukki Construction

- Sto Corp.

- The Alumasc Group PLC

- Wienerberger AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

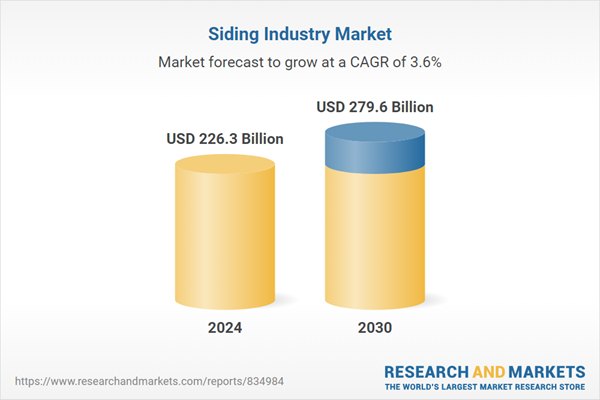

| Estimated Market Value ( USD | $ 226.3 Billion |

| Forecasted Market Value ( USD | $ 279.6 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |