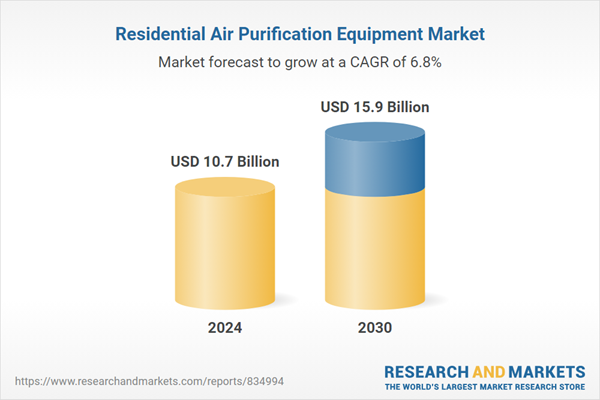

The global market for Residential Air Purification Equipment was estimated at US$10.7 Billion in 2024 and is projected to reach US$15.9 Billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Residential Air Purification Equipment market.

Technological advancements have played a crucial role in enhancing the effectiveness and accessibility of residential air purification equipment. Modern air purifiers are now equipped with smart features such as air quality sensors, Wi-Fi connectivity, and compatibility with smart home ecosystems, allowing users to monitor and control air quality remotely. Additionally, the development of more efficient and quieter motors has made air purifiers suitable for continuous use in bedrooms and other living areas without causing disturbances. Innovations like electrostatic precipitators and photocatalytic oxidation have further improved the ability of air purifiers to remove a wider range of pollutants, including bacteria and viruses. The design and aesthetics of air purifiers have also evolved, with sleek and compact models that blend seamlessly into home decor, making them more appealing to consumers.

The growth in the residential air purification equipment market is driven by several factors. Increasing awareness of the health impacts of indoor air pollution, exacerbated by events like wildfires and rising pollution levels, has spurred consumer demand. The COVID-19 pandemic has heightened the focus on air hygiene, leading to a surge in sales of air purifiers as people seek to reduce the risk of airborne transmission of viruses. Technological advancements have made air purifiers more efficient, user-friendly, and integrated with smart home systems, appealing to tech-savvy consumers. The rise in respiratory conditions and allergies has also driven demand, as more people look for solutions to alleviate their symptoms. Additionally, government initiatives and regulations aimed at improving air quality standards in residential areas have supported market growth. The increasing disposable incomes in emerging economies have enabled more households to invest in air purification equipment, expanding the market`s reach globally. As these trends continue, the residential air purification equipment market is expected to see sustained growth, driven by ongoing technological innovations and a heightened awareness of the importance of clean indoor air.

Global Residential Air Purification Equipment Market - Key Trends & Drivers Summarized

Residential air purification equipment has become increasingly important in modern homes as concerns over indoor air quality grow. These devices are designed to remove contaminants from the air, including dust, pollen, pet dander, mold spores, and volatile organic compounds (VOCs), providing a healthier living environment. Air purifiers utilize various technologies such as HEPA filters, activated carbon filters, and UV light to effectively cleanse the air. The importance of clean indoor air has been highlighted by studies linking poor air quality to respiratory issues, allergies, and other health problems. As a result, more homeowners are investing in air purification systems to ensure their living spaces are safe and comfortable, especially in urban areas where outdoor pollution can significantly impact indoor air quality.Technological advancements have played a crucial role in enhancing the effectiveness and accessibility of residential air purification equipment. Modern air purifiers are now equipped with smart features such as air quality sensors, Wi-Fi connectivity, and compatibility with smart home ecosystems, allowing users to monitor and control air quality remotely. Additionally, the development of more efficient and quieter motors has made air purifiers suitable for continuous use in bedrooms and other living areas without causing disturbances. Innovations like electrostatic precipitators and photocatalytic oxidation have further improved the ability of air purifiers to remove a wider range of pollutants, including bacteria and viruses. The design and aesthetics of air purifiers have also evolved, with sleek and compact models that blend seamlessly into home decor, making them more appealing to consumers.

The growth in the residential air purification equipment market is driven by several factors. Increasing awareness of the health impacts of indoor air pollution, exacerbated by events like wildfires and rising pollution levels, has spurred consumer demand. The COVID-19 pandemic has heightened the focus on air hygiene, leading to a surge in sales of air purifiers as people seek to reduce the risk of airborne transmission of viruses. Technological advancements have made air purifiers more efficient, user-friendly, and integrated with smart home systems, appealing to tech-savvy consumers. The rise in respiratory conditions and allergies has also driven demand, as more people look for solutions to alleviate their symptoms. Additionally, government initiatives and regulations aimed at improving air quality standards in residential areas have supported market growth. The increasing disposable incomes in emerging economies have enabled more households to invest in air purification equipment, expanding the market`s reach globally. As these trends continue, the residential air purification equipment market is expected to see sustained growth, driven by ongoing technological innovations and a heightened awareness of the importance of clean indoor air.

SCOPE OF STUDY:

The report analyzes the Residential Air Purification Equipment market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Type (Stand-Alone, In-Duct); Technology (High Efficiency Particulate Air (HEPA), Other Technologies); Product (Dust Collectors, Fume & Smoke Collectors, Other Products)

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Stand-Alone segment, which is expected to reach US$12.6 Billion by 2030 with a CAGR of a 7.0%. The In-Duct segment is also set to grow at 6.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Residential Air Purification Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Residential Air Purification Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Residential Air Purification Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Fujitsu Ltd., 3M Company, Daikin Industries Ltd., AB Electrolux, Eureka Forbes Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 125 companies featured in this Residential Air Purification Equipment market report include:

- Fujitsu Ltd.

- 3M Company

- Daikin Industries Ltd.

- AB Electrolux

- Eureka Forbes Ltd.

- Carrier Corporation

- Dyson Ltd.

- Alen Corporation

- Continental Fan Manufacturing, Inc.

- De`Longhi Group

- Fujitsu General Ltd.

- Air Quality Engineering

- Aprilaire

- Fellowes Brands

- Goodman Manufacturing Company, L.P.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIII. MARKET ANALYSISITALYSPAINRUSSIAREST OF EUROPESOUTH KOREAARGENTINABRAZILMEXICOREST OF LATIN AMERICAIRANISRAELSAUDI ARABIAUNITED ARAB EMIRATESREST OF MIDDLE EASTIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

UNITED STATES

CANADA

JAPAN

CHINA

EUROPE

FRANCE

GERMANY

UNITED KINGDOM

ASIA-PACIFIC

AUSTRALIA

INDIA

REST OF ASIA-PACIFIC

LATIN AMERICA

MIDDLE EAST

AFRICA

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Fujitsu Ltd.

- 3M Company

- Daikin Industries Ltd.

- AB Electrolux

- Eureka Forbes Ltd.

- Carrier Corporation

- Dyson Ltd.

- Alen Corporation

- Continental Fan Manufacturing, Inc.

- De`Longhi Group

- Fujitsu General Ltd.

- Air Quality Engineering

- Aprilaire

- Fellowes Brands

- Goodman Manufacturing Company, L.P.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.7 Billion |

| Forecasted Market Value ( USD | $ 15.9 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |