Coated Paper Market Size:

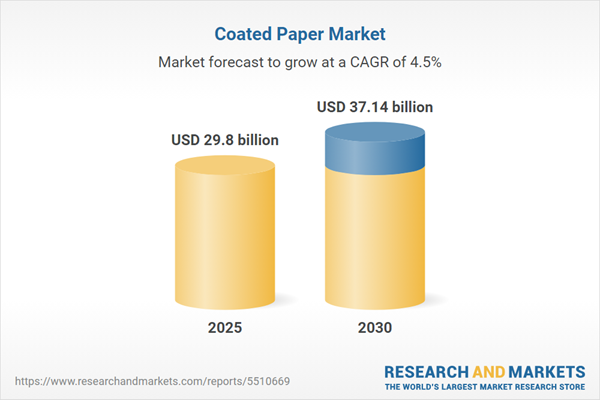

The Coated Paper Market is expected to grow from USD 29.804 billion in 2025 to USD 37.141 billion in 2030, at a CAGR of 4.50%.The coated paper market represents a dynamic segment within the broader paper industry, characterized by evolving applications and shifting market dynamics. Coated paper, enhanced with chemical mixtures including clay, calcium carbonate, kaolinite, bentonite, and talc, offers superior surface properties compared to uncoated alternatives, delivering enhanced gloss, weight, smoothness, and ink retention capabilities.

Product Characteristics and Technical Advantages

The coating process incorporates polymers such as polyethylene and polyolefin to enhance waterproofing properties and tear strength. Chemical additives including resins and dispersants are integrated to improve wet strength and UV resistance, creating a product with distinct performance advantages. Coated paper delivers brighter, smoother prints with improved reflectivity and professional appearance, while preventing ink bleeding and producing sharp imagery. The superior ink holdout properties result in dust resistance and reduced ink consumption, making these products suitable for advanced finishing techniques including spot varnish applications.Market Growth Drivers

E-commerce and Digital Commerce Expansion

The rapid growth of online retail platforms and digital commerce has significantly expanded market opportunities for coated paper through packaging innovation demands. The surge in home delivery services has created substantial demand for premium packaging and labeling solutions, positioning coated paper as a preferred material for attractive, professional packaging applications.Flexible Packaging Market Evolution

Market preference is shifting toward flexible paper packaging alternatives over plastic-based solutions. This transition is driven by increasing demand for environmentally friendly and biodegradable packaging options, creating substantial growth opportunities for coated paper manufacturers focused on sustainable solutions.High-Quality Print Applications

The continued demand for superior print quality across advertising media, including magazines, catalogs, brochures, and promotional materials, maintains strong market demand for coated paper. The aesthetic enhancement capabilities of coated paper make it indispensable for applications requiring professional appearance and visual impact.Specialized Applications

Coated paper maintains critical applications in security documents, banknotes, and checkbooks, ensuring stable demand in specialized market segments. Additionally, consistent usage in product documentation for electronics, including smartphone and laptop manuals, provides ongoing market stability.Food Packaging Applications

The protective properties of coated paper in food packaging, including moisture and oxygen barrier capabilities, contribute to extended shelf life and product freshness, supporting continued demand in the food and beverage sector.Market Constraints and Challenges

Digital Transformation Impact

Widespread digitalization across industries presents the most significant challenge to market growth. Companies increasingly adopt digital alternatives including e-newspapers, e-magazines, and online tutorials, reducing traditional paper consumption. This shift toward digital media platforms directly impacts printing industry demand for coated paper products.Manufacturing Investment Requirements

The capital-intensive nature of coated paper manufacturing presents barriers to market expansion. Significant investments required for land acquisition, manufacturing facility establishment, equipment procurement, and regulatory compliance may constrain new market entry and capacity expansion initiatives.Strategic Market Considerations

Industry participants are implementing diverse growth strategies including organic and inorganic approaches such as facility expansions, mergers and acquisitions, and new product development to maintain competitive positioning. Technological advancement and product innovation represent critical focus areas for overcoming market challenges and expanding application opportunities.The market demonstrates resilience through diversification into packaging applications, security documents, and specialized printing requirements, while confronting the fundamental challenge of digital substitution. Success in this market requires strategic balance between traditional applications and emerging opportunities in sustainable packaging and specialized security applications.

Market participants must navigate the tension between declining traditional print media demand and growing opportunities in e-commerce packaging and premium applications to maintain growth trajectories in an evolving industry landscape.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Coated Paper Market Segments:

By Paper Type

- Coated Fine Paper

- Coated Groundwood Paper

- Art Paper

- Cast-coated and Specialty Papers

By Coating Material

- Clay Coated

- Calcium Carbonate Coated

- Titanium Dioxide Coated

- Polymer Coated

- Others

By Finish Type

- Glossy Finish

- Matte Finish

- Silk Finish

- Dull Finish

- High-gloss UV

- Others

By Application

- Printing

- Packaging

- Labelling

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

Table of Contents

Companies Mentioned

- JK Paper

- Verso Corporation (Billerud AB)

- Mohawk Fine Papers

- Neenah Papers

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Mondi Group plc

- Sappi Limited

- Asia Pulp and Paper Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 29.8 billion |

| Forecasted Market Value ( USD | $ 37.14 billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |