Global Aquaculture Market - Key Trends & Drivers Summarized

How Does Aquaculture Contribute to Global Food Security and Economic Stability?

Aquaculture, also known as fish farming, entails the controlled cultivation of aquatic organisms including fish, shellfish, and seaweed in various aquatic environments such as ponds, rivers, and oceans. It stands as the fastest-growing sector in the global food industry, providing essential nutrients to billions and alleviating pressure on overfished wild stocks. This method of food production enhances global food security by producing a steady supply of seafood without the environmental drawbacks associated with traditional fishing, such as habitat destruction and overfishing. Aquaculture's role extends beyond food production; it fosters economic growth in coastal and rural areas, providing jobs and supporting communities, particularly in Asia and the Pacific where it integrates deeply into local cultures and economies.Innovations Driving Efficiency and Sustainability in Aquaculture

Recent advances in technology have propelled aquaculture towards greater sustainability and efficiency. The adoption of recirculating aquaculture systems (RAS) marks a significant shift, allowing water reuse in enclosed systems and reducing the need for large water bodies. Enhancements in fish feed quality and feeding practices reduce waste and improve water quality, while genetic research contributes to healthier and faster-growing species. Aquaponics, a system that combines fish farming with plant cultivation, illustrates a sustainable closed-loop system, where plant life uses fish waste as nutrients and purifies the water in return. These technological advancements address critical environmental challenges like water pollution and ecosystem disruption traditionally associated with aquaculture.Emerging Consumer and Regulatory Trends Impacting Aquaculture

The aquaculture sector is increasingly influenced by consumer preferences for sustainability and health, which drive demand for eco-friendly and nutritious seafood. Certification programs and eco-labels have become more popular, guiding consumers towards products that meet high environmental and ethical standards. Health trends have also spurred increased consumption of fish due to its beneficial nutrients and lower fat content compared to red meat. On the regulatory side, governments are tightening aquaculture regulations to ensure sustainable practices, with policies focusing on reducing environmental impact and improving disease management within aquaculture operations. These consumer and regulatory trends are pivotal in shaping industry practices, promoting transparency, and encouraging the adoption of best practices in sustainable aquaculture.What's Driving Growth in the Global Aquaculture Market?

The growth in the aquaculture market is driven by several factors, showcasing a complex interplay between global demand and innovative solutions. Rising global population and the associated increase in demand for protein-rich food underscore aquaculture's vital role in global food security. Technological advancements in breeding, disease control, and feed efficiency continue to enhance production capacity and sustainability, bolstering the sector's growth. Economic expansion in developing regions is prompting greater investment in aquaculture infrastructure, further stimulating market growth. Moreover, consumer shifts towards healthier dietary choices and sustainably sourced food are increasing demand for aquaculture products. Governmental initiatives providing support through funding, research, and sustainable guidelines underpin this expansion, ensuring aquaculture remains a key player in addressing future food needs and environmental challenges.Report Scope

The report analyzes the Aquaculture market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Aquaculture).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Carps segment, which is expected to reach US$63.4 Billion by 2030 with a CAGR of 5.3%. The Salmon segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $210.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aquaculture Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aquaculture Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aquaculture Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Charoen Pokphand Foods PCL, AKVA Group ASA, Maruha Nichiro Corporation, Aalesundfisk A/S, Austevoll Seafood ASA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 150 companies featured in this Aquaculture market report include:

- Charoen Pokphand Foods PCL

- AKVA Group ASA

- Maruha Nichiro Corporation

- Aalesundfisk A/S

- Austevoll Seafood ASA

- Bremnes Seashore AS

- Jealsa

- Cooke Aquaculture Scotland Ltd.

- Grieg Seafood ASA

- Groupe Aqualande

- Huon Aquaculture Group Ltd.

- Leroy Seafood Group ASA (LSG)

- Compania Pesquera Camanchaca SA

- Domstein Fish AS

- Lipidos Toledo SA (LIPTOSA)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Charoen Pokphand Foods PCL

- AKVA Group ASA

- Maruha Nichiro Corporation

- Aalesundfisk A/S

- Austevoll Seafood ASA

- Bremnes Seashore AS

- Jealsa

- Cooke Aquaculture Scotland Ltd.

- Grieg Seafood ASA

- Groupe Aqualande

- Huon Aquaculture Group Ltd.

- Leroy Seafood Group ASA (LSG)

- Compania Pesquera Camanchaca SA

- Domstein Fish AS

- Lipidos Toledo SA (LIPTOSA)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 312 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

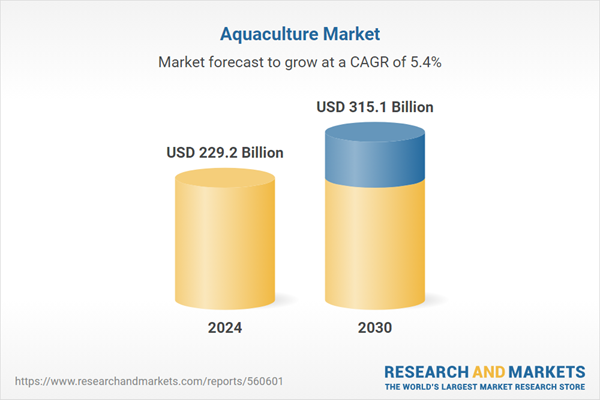

| Estimated Market Value ( USD | $ 229.2 Billion |

| Forecasted Market Value ( USD | $ 315.1 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |