Covid-19 has significantly impacted the market growth due to the rise in the adoption of vital signs monitoring devices as care for conditions other than COVID-19 was severely impacted during the pandemic, and also, vital sign monitoring of COVID-19 increased owing to the severity of the disease which led to the development of many technologies which are expected to have a significant impact on the studied market. For instance, according to a research study published in November 2021, titled "Cost-Effective Vital Signs Monitoring System for COVID-19 Patients in Smart Hospital", owing to the high influx of COVID-19 patients, providers needed to deploy monitoring devices and develop new devices and the researchers of the study developed a simple, reliable, and cost-effective microcontroller-based wireless vital signs monitoring system with high mobility and low power consumption that can measure the BT, HR, SpO2, RR, and ECG of patients for large hospitals, and it was found to be accurate and safe. Hence, developments like these are expected to have a significant impact on the market over the forecast period.

The growth of the geriatric population and the rising prevalence and incidence of chronic diseases increased the applications of devices monitoring vital signs in emergency medicine and ambulatory care. This led to increasing demand for advanced algorithm-based and home care monitoring equipment. For instance, according to the World Health Organization statistics updated in October 2021, the proportion of the world's population aged 60 is growing and the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion by 2030. Therefore, the rise in the geriatric population is a most significant contributor to diseases, and there is an increased need for the observation of vital signs in the elderly population as there is a greater tendency for reduced homeostasis, which makes it difficult for the body to carry out optimal physiological functions, driving the market growth.

In addition, rising product approvals for vital sign monitoring are also expected to drive market growth. For instance, in March 2022, the Food and Drug Administration granted 510(k) clearance to Biobeat's wearable remote patient monitoring device to monitor respiratory rate, body temperature, cuffless blood pressure, blood oxygen saturation, and pulse rate.

As vital signs provide a quantification of physiological functions used for monitoring acute and chronic diseases, vital sign monitoring essentially serves as a communication tool about patient status, propelling market growth. The rising prevalence of cardiovascular diseases such as hypertension, atrial fibrillation, and stroke, among others, are further contributing to the market growth. For instance, according to the August 2021 update of the World Health Organization, about 1.28 billion people of age 30-79 years have hypertension across the world, with two-thirds of this population living in low- and middle-income countries. Further, as per the same source, about 46% of adults are unaware of their hypertension situation. Hence, in such instances, cardiovascular vital sign monitoring becomes an indispensable tool for disease management, fuelling the market for these devices. Therefore, due to the factors mentioned above, the vital sign monitoring market is expected to grow over the forecast period of the study. However, factors such as the unresponsiveness of some monitoring devices, pricing pressures, and the rise in counterfeit products are expected to hinder the market growth.

Vital Signs Monitoring Market Trends

Hospitals and Clinics Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

Vital sign monitors have been conventional in hospitals and clinics and play an essential role in indicating a patient's clinical conditions. Monitoring blood pressure, pulse, and respiration rates are crucial to hospital patient care. In hospitals, nursing assistants or technicians were responsible for collecting patients' vital signs on a scheduled basis at a periodic interval, which used to have errors. The vital sign monitors thus minimize the chances of errors, which results in safer patient care. Hence, hospitals generate more demand as patients and providers can adopt vital sign monitors for ease of monitoring. Thus, it results in a higher share of hospitals in the end-user segment.Moreover, with the rise in IoT-enabled consumer health wearables, the market will likely grow as the line between consumer health wearables and medical devices begins to blur. It is now possible for a single wearable device to monitor a range of medical risk factors. These devices can give patients direct access to personal analytics that can contribute to their health, facilitate preventive care, and aid in managing an ongoing illness. For instance, in May 2021, Essence SmartCare launched VitalOn, a comprehensive remote patient monitoring (RPM) platform for active seniors and older adults living with chronic conditions. The system is always on, providing continuous monitoring and chronic conditions management for a wide range of healthcare needs, both at home and on the go. It continually gathers and analyzes patient data from multiple health and monitoring devices to facilitate proactive, predictive, and preventative care. Thus, launching such devices is expected to drive the studied segment.

In December 2020, Konica Minolta launched a patient monitoring system in Japan for Covid-19 hospitalized patients with mild to moderate disease treated in isolation zones. This patient monitoring system enables spot checks of such patients' vital signs, measured by a pulse oximeter, a thermometer, and a blood-pressure monitor, as well as continuous monitoring data from the pulse oximeter, to be transmitted to the nurses' station, which is located outside the isolation zone, via a sub-GHz wireless network, allowing for collective data management at the station. The rising launch of such products amid pandemics and innovations in the products are expected to drive this segment's growth further. Therefore, owing to the above-mentioned factors, the segment is expected to drive this segment's growth.

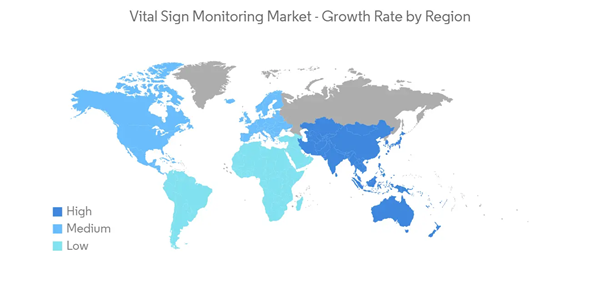

North America Holds a Major Share and Expected to do Same in the Forecast Period

North America holds a significant share in the market, and it is expected to do the same over the forecast period. This region is expected to increase its market share, owing to the well-established healthcare industry and better reimbursement facilities. Moreover, the expanding base of the geriatric populace, developing interest for remote and wireless devices combined with streamlined coverage policies, and rising occurrences of interminable disorders drive the market growth in the region.The United States holds most of the market in the North American region due to the higher adoption of digital healthcare in the country, rising investments made by companies in the region, and the rise in the prevalence of cardiovascular diseases, among others. For instance, According to the July 2022 update of the Centers for Disease Control and Prevention (CDC), approximately 805,000 heart attack incidences are recorded every year in the United States, of which 605,000 people had a heart attack the first time and the remaining 200,000 were those who already had a heart attack before. Further as per the same source, about 1 in 5 heart attacks are silent which means the person had a heart attack but was not aware of it. hence, due to the high burden of diseases, the demand for vital sign monitoring devices is expected to increase in the country, fueling growth in the studied market.

In addition, the rise in approvals and product launches in the United States is further expected to boost market growth over the forecast period. For instance, in August 2020, Stasis Labs announced the United States launch of their mobile-connected remote patient monitoring technology for hospital and outpatient use. The Stasis system comprises a smart device, traditional vital sign sensors, a bedside monitor, and a supporting cloud platform. Such launches will drive the market due to the adoption of these devices.

Moreover, in January 2022, Aktiia rolled out a plan to launch its automated 24/7 blood pressure monitor in the United States. The new device is designed to gather more than 100 times the blood pressure data of other monitors and provides ten times more engagement. Thus, the launch of technologically advanced blood pressure monitors will increase the efficiency of blood pressure monitoring, which is expected to further drive market growth in the country.

Therefore, the market is expected to drive in the North American region due to the above-mentioned factors.

Vital Signs Monitoring Industry Overview

The vital sign monitoring market is moderately competitive and consists of several major players. The market is driven by the launch of new products and increasing initiatives from the major players, the rise in partnerships, and technological advancements in the products, among others. Some major players in this market include A&D Medical, Medtronic Plc, Nihon Kohden Corporation, Koninklijke Philips N.V., Apple Inc, Biobeat Inc, and Samsung, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Medtronic PLC

- Apple Inc.

- Masimo Corporation

- Contec Medical Systems Limited

- GE Healthcare

- iRhythm Technologies

- BioBeat Technologies

- Nihon Kohden Corporation

- Omron Healthcare Inc

- A&D Company Limited

- Mindray

- Koninklijke Philips N.V.