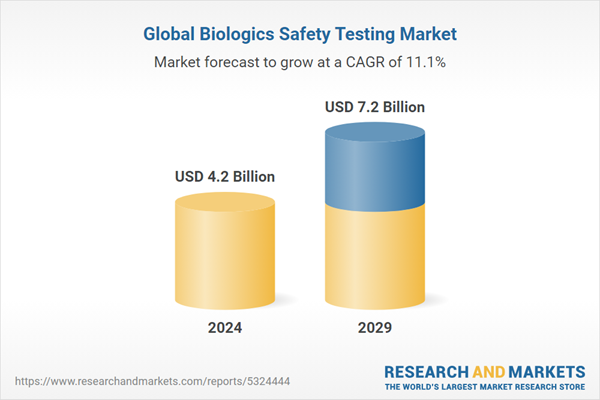

The biologics safety testing market is projected to reach USD 7.2 billion by 2029 from an estimated USD 4.2 billion in 2024, at a CAGR of 11.1% from 2024 to 2029. The growth of this market can be attributed to the increasing focus on the development and manufacturing of novel biologics. The rising demand for advanced therapies such as cell and gene therapies due to the growing rate of chronic diseases is propelling the growth of biologics safety testing. This trend is expected to drive the growth of the biologics safety testing market in the coming years.

The monoclonal antibodies development and manufacturing segment accounted for the largest share of by application segment in 2023.

In 2023, the monoclonal antibodies development and manufacturing segment accounted for the largest share of the global biologics safety testing market by application. Growing investments and funding in the development of novel biotherapeutics and rising demand for biological therapies for the treatment of chronic diseases are promoting the segment's growth in the biologics safety testing market.The US has continued to dominate the biologics safety testing market from 2024 to 2029.

The US dominated the biologics safety testing market in North America in 2023. The US is the world’s largest biopharmaceutical market and a leader in biopharmaceutical research/investments. Also, US has strong healthcare infrastructure which drives the research and development in life sciences sector. Additionally, US has large number of biopharmaceutical companies; thus, increasing number of biopharmaceutical companies and growing research activities in biotechnology sector are propelling the market growth in US. Moreover, increasing approvals for biosimilars are also driving the growth of biologics safety testing market.The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side - 60% and Demand Side 40%

- By Designation: Managers - 45%, CXO & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe - 25%, Asia-Pacific - 25%, Latin America - 5% and Middle East & Africa - 5%

List of Companies Profiled in the Report:

- Thermo Fisher Scientific Inc. (US)

- Merck KGaA (Germany)

- Lonza (Switzerland)

- FUJIFILM Corporation (Japan)

- Sartorius AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Charles River Laboratories (US)

- BIOMÉRIEUX (France)

- Maravai LifeSciences (US)

- WuXi AppTec (China)

- SGS Société Générale de Surveillance SA. (Switzerland)

- Sotera Health (Nelson Laboratories, LLC) (US)

- Samsung Biologics (South Korea)

- GenScript (US)

- Agilent Technologies, Inc. (US)

- Syngene International Limited (India)

- Eurofins Scientific (Luxembourg)

- Laboratory Corporation of America Holdings (US)

- Bio-Rad Laboratories, Inc. (US)

- QIAGEN (Netherlands)

- Promega Corporation (US)

- Catalent, Inc (US)

- ASSOCIATES OF CAPE COD, INC. (US)

- Pacific BioLabs (US)

- Clean Biologics (France)

- PathoQuest (France)

- ARL Bio Pharma, Inc. (US)

- Frontage Labs (US)

- Creative Biogene (US)

- Advaxia Biologics (Italy)

Research Coverage:

This research report categorizes the biologics safety testing market by product & service (services (mycoplasma testing services, sterility testing services, endotoxin testing services, virus safety testing services, bioburden testing services, and other testing services), consumables, and instrument), test type (residual host-cell proteins & DNA detection tests, mycoplasma tests, sterility tests, endotoxin tests, virus safety tests, bioburden tests, other biologics safety tests), application (monoclonal antibodies development and manufacturing, vaccine development and manufacturing, cellular & gene therapy products development and manufacturing, blood & blood products development and manufacturing, other applications), end user (pharmaceutical & biotechnology companies, CROs and CDMOs, and academic & research institutes), and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the biologics safety testing market. A thorough analysis of the key industry players has been done to provide insights into their business overview, products, services, solutions, key strategies, collaborations, partnerships, and agreements. Also, it includes new product launches, collaborations and acquisitions, and recent developments associated with the biologics safety testing market.Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the overall biologics safety testing market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.The report provides insights on the following pointers:

- Analysis of key drivers (growing development of mAbs and biosimilars, rising investments and fundings in biopharmaceutical industry, and stringent regulatory guidelines for biologics safety), restraints (ethical concern regarding animal testing), opportunities (growing opportunities in emerging economies, increasing focus on next generation therapeutics), and Challenges (high cost of biologics) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly launched products of the biologics safety testing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the biologics safety testing market

- Competitive Assessment: Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Lonza (Switzerland), FUJIFILM Corporation (Japan), Sartorius AG (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Charles River Laboratories (US), BIOMÉRIEUX (France), Maravai LifeSciences (US), WuXi AppTec (China), SGS Société Générale de Surveillance SA. (Switzerland), Sotera Health (Nelson Laboratories, LLC) (US), Samsung Biologics (South Korea), GenScript (US), Agilent Technologies, Inc. (US), Syngene International Limited (India), Eurofins Scientific (Luxembourg), Laboratory Corporation of America Holdings (US), Bio-Rad Laboratories, Inc. (US), QIAGEN (Netherlands), Promega Corporation (US), Catalent, Inc (US), ASSOCIATES OF CAPE COD, INC. (US), Pacific BioLabs (US), Clean Biologics (France), PathoQuest (France), ARL Bio Pharma, Inc. (US), Frontage Labs (US), Creative Biogene (US), Advaxia Biologics (Italy), among others in the market.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

1.7 Limitations

1.8 Summary of Changes

1.9 Recession Impact

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.3 Study Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

1.7 Limitations

1.8 Summary of Changes

1.9 Recession Impact

2 Research Methodology

2.1 Research Data

Figure 1 Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

Figure 2 Biologics Safety Testing Market: Breakdown of Primaries

2.2 Market Estimation Methodology

2.2.1 Global Market Size Estimation (Bottom-Up Approach)

Figure 3 Biologics Safety Testing Market Size Estimation (Supply-Side Analysis), 2023

Figure 4 Biologics Safety Testing Market Size Estimation: Approach 1 (Company Revenue Analysis-based Estimation), 2023

Figure 5 Revenue Share Analysis: Illustrative Example of Thermo Fisher Scientific Inc. (2023)

2.2.2 Insights from Primary Experts

Figure 6 Market Size Validation from Primary Sources

2.2.3 Segmental Market Assessment (Top-Down Approach)

Figure 7 Segmental Market Size Estimation Methodology: Top-Down Approach

2.3 Market Growth Rate Projections

Figure 8 Biologics Safety Testing Market: CAGR Projections

Table 1 Impact Analysis of Supply-Side and Demand-Side Factors

2.4 Data Triangulation

Figure 9 Data Triangulation Methodology

2.5 Research Assumptions

2.6 Risk Analysis

2.7 Recession Impact Analysis

Figure 1 Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

Figure 2 Biologics Safety Testing Market: Breakdown of Primaries

2.2 Market Estimation Methodology

2.2.1 Global Market Size Estimation (Bottom-Up Approach)

Figure 3 Biologics Safety Testing Market Size Estimation (Supply-Side Analysis), 2023

Figure 4 Biologics Safety Testing Market Size Estimation: Approach 1 (Company Revenue Analysis-based Estimation), 2023

Figure 5 Revenue Share Analysis: Illustrative Example of Thermo Fisher Scientific Inc. (2023)

2.2.2 Insights from Primary Experts

Figure 6 Market Size Validation from Primary Sources

2.2.3 Segmental Market Assessment (Top-Down Approach)

Figure 7 Segmental Market Size Estimation Methodology: Top-Down Approach

2.3 Market Growth Rate Projections

Figure 8 Biologics Safety Testing Market: CAGR Projections

Table 1 Impact Analysis of Supply-Side and Demand-Side Factors

2.4 Data Triangulation

Figure 9 Data Triangulation Methodology

2.5 Research Assumptions

2.6 Risk Analysis

2.7 Recession Impact Analysis

3 Executive Summary

Figure 10 Biologics Safety Testing Market, by Product & Service, 2024 vs. 2029 (USD Million)

Figure 11 Biologics Safety Testing Products Market, by Test Type, 2024 vs. 2029 (USD Million)

Figure 12 Biologics Safety Testing Market, by Application, 2024 vs. 2029 (USD Million)

Figure 13 Biologics Safety Testing Market, by End-user, 2024 vs. 2029 (USD Million)

Figure 14 Geographical Snapshot of Biologics Safety Testing Market

Figure 11 Biologics Safety Testing Products Market, by Test Type, 2024 vs. 2029 (USD Million)

Figure 12 Biologics Safety Testing Market, by Application, 2024 vs. 2029 (USD Million)

Figure 13 Biologics Safety Testing Market, by End-user, 2024 vs. 2029 (USD Million)

Figure 14 Geographical Snapshot of Biologics Safety Testing Market

4 Premium Insights

4.1 Biologics Safety Testing Market Overview

Figure 15 Increasing Development of Monoclonal Antibodies and Biosimilars to Support Market Growth

4.2 North America: Biologics Safety Testing Market, by Product & Service and Country (2023)

Figure 16 Services Segment Accounted for Largest Share in 2023

4.3 Biologics Safety Testing Market Share, by Application, 2023

Figure 17 Monoclonal Antibodies Segment Accounted for Largest Market Share in 2023

4.4 Biologics Safety Testing Market Share, by End-user, 2023

Figure 18 Pharmaceutical & Biopharmaceutical Companies Segment Dominated Market in 2023

4.5 Biologics Safety Testing Market: Geographic Growth Opportunities

Figure 19 Asia-Pacific Countries to Register Higher Growth During Forecast Period

Figure 15 Increasing Development of Monoclonal Antibodies and Biosimilars to Support Market Growth

4.2 North America: Biologics Safety Testing Market, by Product & Service and Country (2023)

Figure 16 Services Segment Accounted for Largest Share in 2023

4.3 Biologics Safety Testing Market Share, by Application, 2023

Figure 17 Monoclonal Antibodies Segment Accounted for Largest Market Share in 2023

4.4 Biologics Safety Testing Market Share, by End-user, 2023

Figure 18 Pharmaceutical & Biopharmaceutical Companies Segment Dominated Market in 2023

4.5 Biologics Safety Testing Market: Geographic Growth Opportunities

Figure 19 Asia-Pacific Countries to Register Higher Growth During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 20 Biologics Safety Testing Market: Drivers, Restraints, Opportunities, and Challenges

Table 2 Biologics Safety Testing Market: Impact Analysis

5.2.1 Drivers

5.2.1.1 Development of Mabs and Biosimilars

Table 3 List of Fda-Approved Biosimilar Products, 2022-2024

Figure 21 Number of Antibody Therapeutics Granted a First Approval in US or Eu, 2012-2023

5.2.1.2 Growing Concerns Over Cell Culture Contamination

5.2.1.3 Rising Investments in Biopharmaceutical R&D

Figure 22 Worldwide Total Pharmaceutical R&D Spend, 2014-2028

Table 4 Pharmaceutical R&D Spending, by Company, 2020 vs. 2026 (USD Billion)

5.2.1.4 Increasing Demand for Advanced Therapy Medicinal Products (Atmps)

Table 5 List of Approved Gene Therapies, 2023-2024

5.2.1.5 Stringent Regulatory Requirements for Biologics Safety Testing

5.2.2 Restraints

5.2.2.1 Ethical Concerns Related to Animal Testing

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Emerging Markets

5.2.3.2 Increasing Outsourcing of Biopharmaceutical Activities to Cros

5.2.3.3 Rising Focus on Next-Generation Therapeutics

5.2.4 Challenges

5.2.4.1 High Cost of Biologics

Table 6 Pricing of Advanced Therapies

5.2.4.2 Challenges Related to Biologics Complexity and Heterogenicity

5.3 Technology Analysis

5.3.1 Key Technologies

5.3.1.1 Polymerase Chain Reaction (Pcr)

Table 7 Applications of Pcr in Biologics Safety Testing

5.3.1.2 Next-Generation Sequencing (Ngs)

5.3.2 Complementary Technologies

5.3.2.1 Lab-On-A-Chip (Loc) Systems

5.3.2.2 High-Content Screening (Hcs)

5.3.3 Adjacent Technologies

5.3.3.1 Bioinformatics and Computational Biology

5.4 Supply Chain Analysis

Figure 23 Biologics Safety Testing Market: Supply Chain Analysis

5.5 Value Chain Analysis

Figure 24 Biologics Safety Testing Market: Value Chain Analysis

5.6 Pricing Analysis

Table 8 Average Selling Price Trend of Key Players, by Product

Table 9 Average Selling Price of Biologics Safety Testing Products, by Region

5.7 Ecosystem Analysis

Figure 25 Biologics Safety Testing Market: Ecosystem Analysis

5.7.1 Raw Material Vendors in Biologics Safety Testing Market

Table 10 Biologics Safety Testing Market: Role of Raw Material Vendors

5.7.2 Product Vendors in Biologics Safety Testing Market

Table 11 Biologics Safety Testing Market: Role of Product Vendors

5.7.3 Service Providers in Biologics Safety Testing Market

Table 12 Biologics Safety Testing Market: Role of Service Providers

5.7.4 End-users in Biologics Safety Testing Market

Table 13 Biologics Safety Testing Market: Role of End-users

5.7.5 Regulatory Bodies Governing Biologics Safety Testing Market

Table 14 Biologics Safety Testing Market: Role of Regulatory Bodies

5.8 Trends/Disruptions Impacting Customers’ Businesses

Figure 26 Trends/Disruptions Impacting Customers’ Businesses

5.9 Patent Analysis

5.9.1 Methodology

5.9.2 Patents Filed, by Document Type, 2014-2024

Table 15 Patents Filed, 2014-2024

5.9.3 Innovation and Patent Applications

Figure 27 Total Number of Patents Granted, 2014-2024

5.9.4 Top Applicants

Figure 28 Top Ten Players with Highest Number of Patent Applications, 2014-2024

Table 16 Top 20 Patent Owners in Biologics Safety Testing Market, 2014-2024

Table 17 Patents in Biologics Safety Testing Market, 2024

5.10 Key Conferences & Events

Table 18 Biologics Safety Testing Market: Key Conferences & Events, 2024-2025

5.11 Regulatory Landscape

5.11.1 Introduction

5.11.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 19 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 20 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 21 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 22 Rest of the World: Regulatory Bodies, Government Agencies, and Other Organizations

5.11.3 Regulatory Scenario

Table 23 Biologics Safety Testing Market: Regulatory Guidelines

5.12 Porter's Five Forces Analysis

Figure 29 Biologics Safety Testing Market: Porter's Five Analysis

Table 24 Biologics Safety Testing Market: Porter's Five Forces Analysis

5.12.1 Threat of New Entrants

5.12.2 Threat of Substitutes

5.12.3 Bargaining Power of Suppliers

5.12.4 Bargaining Power of Buyers

5.12.5 Intensity of Competitive Rivalry

5.13 Key Stakeholders & Buying Criteria

5.13.1 Key Stakeholders in Buying Process

Figure 30 Influence of Stakeholders on Buying Process of Biologics Safety Testing Products

5.13.2 Buying Criteria for Biologics Safety Testing Market

Figure 31 Key Buying Criteria for End-users

Table 25 Buying Criteria for Biologics Safety Testing Products & Services, by End-user

5.14 Investment/Funding Scenario

5.2 Market Dynamics

Figure 20 Biologics Safety Testing Market: Drivers, Restraints, Opportunities, and Challenges

Table 2 Biologics Safety Testing Market: Impact Analysis

5.2.1 Drivers

5.2.1.1 Development of Mabs and Biosimilars

Table 3 List of Fda-Approved Biosimilar Products, 2022-2024

Figure 21 Number of Antibody Therapeutics Granted a First Approval in US or Eu, 2012-2023

5.2.1.2 Growing Concerns Over Cell Culture Contamination

5.2.1.3 Rising Investments in Biopharmaceutical R&D

Figure 22 Worldwide Total Pharmaceutical R&D Spend, 2014-2028

Table 4 Pharmaceutical R&D Spending, by Company, 2020 vs. 2026 (USD Billion)

5.2.1.4 Increasing Demand for Advanced Therapy Medicinal Products (Atmps)

Table 5 List of Approved Gene Therapies, 2023-2024

5.2.1.5 Stringent Regulatory Requirements for Biologics Safety Testing

5.2.2 Restraints

5.2.2.1 Ethical Concerns Related to Animal Testing

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Emerging Markets

5.2.3.2 Increasing Outsourcing of Biopharmaceutical Activities to Cros

5.2.3.3 Rising Focus on Next-Generation Therapeutics

5.2.4 Challenges

5.2.4.1 High Cost of Biologics

Table 6 Pricing of Advanced Therapies

5.2.4.2 Challenges Related to Biologics Complexity and Heterogenicity

5.3 Technology Analysis

5.3.1 Key Technologies

5.3.1.1 Polymerase Chain Reaction (Pcr)

Table 7 Applications of Pcr in Biologics Safety Testing

5.3.1.2 Next-Generation Sequencing (Ngs)

5.3.2 Complementary Technologies

5.3.2.1 Lab-On-A-Chip (Loc) Systems

5.3.2.2 High-Content Screening (Hcs)

5.3.3 Adjacent Technologies

5.3.3.1 Bioinformatics and Computational Biology

5.4 Supply Chain Analysis

Figure 23 Biologics Safety Testing Market: Supply Chain Analysis

5.5 Value Chain Analysis

Figure 24 Biologics Safety Testing Market: Value Chain Analysis

5.6 Pricing Analysis

Table 8 Average Selling Price Trend of Key Players, by Product

Table 9 Average Selling Price of Biologics Safety Testing Products, by Region

5.7 Ecosystem Analysis

Figure 25 Biologics Safety Testing Market: Ecosystem Analysis

5.7.1 Raw Material Vendors in Biologics Safety Testing Market

Table 10 Biologics Safety Testing Market: Role of Raw Material Vendors

5.7.2 Product Vendors in Biologics Safety Testing Market

Table 11 Biologics Safety Testing Market: Role of Product Vendors

5.7.3 Service Providers in Biologics Safety Testing Market

Table 12 Biologics Safety Testing Market: Role of Service Providers

5.7.4 End-users in Biologics Safety Testing Market

Table 13 Biologics Safety Testing Market: Role of End-users

5.7.5 Regulatory Bodies Governing Biologics Safety Testing Market

Table 14 Biologics Safety Testing Market: Role of Regulatory Bodies

5.8 Trends/Disruptions Impacting Customers’ Businesses

Figure 26 Trends/Disruptions Impacting Customers’ Businesses

5.9 Patent Analysis

5.9.1 Methodology

5.9.2 Patents Filed, by Document Type, 2014-2024

Table 15 Patents Filed, 2014-2024

5.9.3 Innovation and Patent Applications

Figure 27 Total Number of Patents Granted, 2014-2024

5.9.4 Top Applicants

Figure 28 Top Ten Players with Highest Number of Patent Applications, 2014-2024

Table 16 Top 20 Patent Owners in Biologics Safety Testing Market, 2014-2024

Table 17 Patents in Biologics Safety Testing Market, 2024

5.10 Key Conferences & Events

Table 18 Biologics Safety Testing Market: Key Conferences & Events, 2024-2025

5.11 Regulatory Landscape

5.11.1 Introduction

5.11.2 Regulatory Bodies, Government Agencies, and Other Organizations

Table 19 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 20 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 21 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 22 Rest of the World: Regulatory Bodies, Government Agencies, and Other Organizations

5.11.3 Regulatory Scenario

Table 23 Biologics Safety Testing Market: Regulatory Guidelines

5.12 Porter's Five Forces Analysis

Figure 29 Biologics Safety Testing Market: Porter's Five Analysis

Table 24 Biologics Safety Testing Market: Porter's Five Forces Analysis

5.12.1 Threat of New Entrants

5.12.2 Threat of Substitutes

5.12.3 Bargaining Power of Suppliers

5.12.4 Bargaining Power of Buyers

5.12.5 Intensity of Competitive Rivalry

5.13 Key Stakeholders & Buying Criteria

5.13.1 Key Stakeholders in Buying Process

Figure 30 Influence of Stakeholders on Buying Process of Biologics Safety Testing Products

5.13.2 Buying Criteria for Biologics Safety Testing Market

Figure 31 Key Buying Criteria for End-users

Table 25 Buying Criteria for Biologics Safety Testing Products & Services, by End-user

5.14 Investment/Funding Scenario

6 Biologics Safety Testing Market, by Product & Service

6.1 Introduction

Table 26 Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

6.2 Services

Table 27 Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 28 Biologics Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 29 North America: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 30 Europe: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 31 Asia-Pacific: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 32 Latin America: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 33 Middle East: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 34 Gcc Countries: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.1 Mycoplasma Testing Services

6.2.1.1 Increasing Focus on Development of Biologics and Biosimilars to Support Segmental Growth

Table 35 Mycoplasma Testing Services Market, by Region, 2022-2029 (USD Million)

Table 36 North America: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 37 Europe: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 38 Asia-Pacific: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 39 Latin America: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 40 Middle East: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 41 Gcc Countries: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.2 Sterility Testing Services

6.2.2.1 Rising Focus on Development of Biologics and Biosimilars to Drive Demand for Sterility Testing Services

Table 42 Sterility Testing Services Market, by Region, 2022-2029 (USD Million)

Table 43 North America: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 44 Europe: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 45 Asia-Pacific: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 46 Latin America: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 47 Middle East: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 48 Gcc Countries: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.3 Endotoxin Testing Services

6.2.3.1 Stringent Regulatory Requirements to Drive Market

Table 49 Endotoxin Testing Services Market, by Region, 2022-2029 (USD Million)

Table 50 North America: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 51 Europe: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 52 Asia-Pacific: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 53 Latin America: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 54 Middle East: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 55 Gcc Countries: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.4 Virus Safety Testing Services

6.2.4.1 Rising Focus on Development of Advanced Therapies to Drive Growth

Table 56 Virus Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 57 North America: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 58 Europe: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 59 Asia-Pacific: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 60 Latin America: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 61 Middle East: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 62 Gcc Countries: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.5 Bioburden Testing Services

6.2.5.1 Growing Adoption of Advanced Testing Solutions for Contamination Risk Mitigation to Propel Growth

Table 63 Bioburden Testing Services Market, by Region, 2022-2029 (USD Million)

Table 64 North America: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 65 Europe: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 66 Asia-Pacific: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 67 Latin America: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 68 Middle East: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 69 Gcc Countries: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.6 Other Biologics Safety Testing Services

Table 70 Other Biologics Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 71 North America: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 72 Europe: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 73 Asia-Pacific: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 74 Latin America: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 75 Middle East: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 76 Gcc Countries: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.3 Consumables

6.3.1 Increasing Demand for High-Quality Assays and Reagents to Drive Market

Table 77 Biologics Safety Testing Consumables Market, by Region, 2022-2029 (USD Million)

Table 78 North America: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 79 Europe: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 80 Asia-Pacific: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 81 Latin America: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 82 Middle East: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 83 Gcc Countries: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

6.4 Instruments

6.4.1 Rising Adoption of Advanced Technologies to Support Market Growth

Table 84 Biologics Safety Testing Instruments Market, by Region, 2022-2029 (USD Million)

Table 85 North America: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 86 Europe: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 87 Asia-Pacific: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 88 Latin America: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 89 Middle East: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 90 Gcc Countries: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 26 Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

6.2 Services

Table 27 Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 28 Biologics Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 29 North America: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 30 Europe: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 31 Asia-Pacific: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 32 Latin America: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 33 Middle East: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 34 Gcc Countries: Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.1 Mycoplasma Testing Services

6.2.1.1 Increasing Focus on Development of Biologics and Biosimilars to Support Segmental Growth

Table 35 Mycoplasma Testing Services Market, by Region, 2022-2029 (USD Million)

Table 36 North America: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 37 Europe: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 38 Asia-Pacific: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 39 Latin America: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 40 Middle East: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

Table 41 Gcc Countries: Mycoplasma Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.2 Sterility Testing Services

6.2.2.1 Rising Focus on Development of Biologics and Biosimilars to Drive Demand for Sterility Testing Services

Table 42 Sterility Testing Services Market, by Region, 2022-2029 (USD Million)

Table 43 North America: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 44 Europe: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 45 Asia-Pacific: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 46 Latin America: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 47 Middle East: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

Table 48 Gcc Countries: Sterility Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.3 Endotoxin Testing Services

6.2.3.1 Stringent Regulatory Requirements to Drive Market

Table 49 Endotoxin Testing Services Market, by Region, 2022-2029 (USD Million)

Table 50 North America: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 51 Europe: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 52 Asia-Pacific: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 53 Latin America: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 54 Middle East: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

Table 55 Gcc Countries: Endotoxin Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.4 Virus Safety Testing Services

6.2.4.1 Rising Focus on Development of Advanced Therapies to Drive Growth

Table 56 Virus Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 57 North America: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 58 Europe: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 59 Asia-Pacific: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 60 Latin America: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 61 Middle East: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 62 Gcc Countries: Virus Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.5 Bioburden Testing Services

6.2.5.1 Growing Adoption of Advanced Testing Solutions for Contamination Risk Mitigation to Propel Growth

Table 63 Bioburden Testing Services Market, by Region, 2022-2029 (USD Million)

Table 64 North America: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 65 Europe: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 66 Asia-Pacific: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 67 Latin America: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 68 Middle East: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

Table 69 Gcc Countries: Bioburden Testing Services Market, by Country, 2022-2029 (USD Million)

6.2.6 Other Biologics Safety Testing Services

Table 70 Other Biologics Safety Testing Services Market, by Region, 2022-2029 (USD Million)

Table 71 North America: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 72 Europe: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 73 Asia-Pacific: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 74 Latin America: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 75 Middle East: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

Table 76 Gcc Countries: Other Biologics Safety Testing Services Market, by Country, 2022-2029 (USD Million)

6.3 Consumables

6.3.1 Increasing Demand for High-Quality Assays and Reagents to Drive Market

Table 77 Biologics Safety Testing Consumables Market, by Region, 2022-2029 (USD Million)

Table 78 North America: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 79 Europe: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 80 Asia-Pacific: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 81 Latin America: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 82 Middle East: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

Table 83 Gcc Countries: Biologics Safety Testing Consumables Market, by Country, 2022-2029 (USD Million)

6.4 Instruments

6.4.1 Rising Adoption of Advanced Technologies to Support Market Growth

Table 84 Biologics Safety Testing Instruments Market, by Region, 2022-2029 (USD Million)

Table 85 North America: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 86 Europe: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 87 Asia-Pacific: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 88 Latin America: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 89 Middle East: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

Table 90 Gcc Countries: Biologics Safety Testing Instruments Market, by Country, 2022-2029 (USD Million)

7 Biologics Safety Testing Products Market, by Test Type

7.1 Introduction

Table 91 Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

7.2 Residual Host Cell Proteins & DNA Detection Tests

7.2.1 Stringent Regulatory Guidelines for Biologic Drug Manufacturing to Propel Market

Table 92 Residual Host Cell Proteins & DNA Detection Tests Market, by Region, 2022-2029 (USD Million)

Table 93 North America: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 94 Europe: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 95 Asia-Pacific: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 96 Latin America: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 97 Middle East: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 98 Gcc Countries: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

7.3 Mycoplasma Tests

7.3.1 Rising Concerns of Cell Culture Contamination to Drive Market

Table 99 Mycoplasma Tests Market, by Region, 2022-2029 (USD Million)

Table 100 North America: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 101 Europe: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 102 Asia-Pacific: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 103 Latin America: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 104 Middle East: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 105 Gcc Countries: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

7.4 Sterility Tests

7.4.1 Compulsory Sterility Testing at Each Stage in Drug Development and Production Process to Support Segment Growth

Table 106 Sterility Tests Market, by Region, 2022-2029 (USD Million)

Table 107 North America: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 108 Europe: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 109 Asia-Pacific: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 110 Latin America: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 111 Middle East: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 112 Gcc Countries: Sterility Tests Market, by Country, 2022-2029 (USD Million)

7.5 Endotoxin Tests

7.5.1 Increasing Research and Development for Production of Biologics to Drive Market

Table 113 Endotoxin Tests Market, by Region, 2022-2029 (USD Million)

Table 114 North America: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 115 Europe: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 116 Asia-Pacific: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 117 Latin America: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 118 Middle East: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 119 Gcc Countries: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

7.6 Virus Safety Tests

7.6.1 Growing Demand for Biologics and Biosimilars to Drive Segment Growth

Table 120 Virus Safety Tests Market, by Region, 2022-2029 (USD Million)

Table 121 North America: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 122 Europe: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 123 Asia-Pacific: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 124 Latin America: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 125 Middle East: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 126 Gcc Countries: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

7.7 Bioburden Tests

7.7.1 Growing Stringency of Drug Safety Standards to Increase Demand for Microbiological Bioburden Testing

Table 127 Bioburden Tests Market, by Region, 2022-2029 (USD Million)

Table 128 North America: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 129 Europe: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 130 Asia-Pacific: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 131 Latin America: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 132 Middle East: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 133 Gcc Countries: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

7.8 Other Biologics Safety Tests

Table 134 Other Biologics Safety Tests Market, by Region, 2022-2029 (USD Million)

Table 135 North America: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 136 Europe: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 137 Asia-Pacific: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 138 Latin America: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 139 Middle East: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 140 Gcc Countries: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 91 Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

7.2 Residual Host Cell Proteins & DNA Detection Tests

7.2.1 Stringent Regulatory Guidelines for Biologic Drug Manufacturing to Propel Market

Table 92 Residual Host Cell Proteins & DNA Detection Tests Market, by Region, 2022-2029 (USD Million)

Table 93 North America: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 94 Europe: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 95 Asia-Pacific: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 96 Latin America: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 97 Middle East: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

Table 98 Gcc Countries: Residual Host Cell Proteins & DNA Detection Tests Market, by Country, 2022-2029 (USD Million)

7.3 Mycoplasma Tests

7.3.1 Rising Concerns of Cell Culture Contamination to Drive Market

Table 99 Mycoplasma Tests Market, by Region, 2022-2029 (USD Million)

Table 100 North America: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 101 Europe: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 102 Asia-Pacific: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 103 Latin America: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 104 Middle East: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

Table 105 Gcc Countries: Mycoplasma Tests Market, by Country, 2022-2029 (USD Million)

7.4 Sterility Tests

7.4.1 Compulsory Sterility Testing at Each Stage in Drug Development and Production Process to Support Segment Growth

Table 106 Sterility Tests Market, by Region, 2022-2029 (USD Million)

Table 107 North America: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 108 Europe: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 109 Asia-Pacific: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 110 Latin America: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 111 Middle East: Sterility Tests Market, by Country, 2022-2029 (USD Million)

Table 112 Gcc Countries: Sterility Tests Market, by Country, 2022-2029 (USD Million)

7.5 Endotoxin Tests

7.5.1 Increasing Research and Development for Production of Biologics to Drive Market

Table 113 Endotoxin Tests Market, by Region, 2022-2029 (USD Million)

Table 114 North America: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 115 Europe: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 116 Asia-Pacific: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 117 Latin America: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 118 Middle East: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

Table 119 Gcc Countries: Endotoxin Tests Market, by Country, 2022-2029 (USD Million)

7.6 Virus Safety Tests

7.6.1 Growing Demand for Biologics and Biosimilars to Drive Segment Growth

Table 120 Virus Safety Tests Market, by Region, 2022-2029 (USD Million)

Table 121 North America: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 122 Europe: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 123 Asia-Pacific: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 124 Latin America: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 125 Middle East: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 126 Gcc Countries: Virus Safety Tests Market, by Country, 2022-2029 (USD Million)

7.7 Bioburden Tests

7.7.1 Growing Stringency of Drug Safety Standards to Increase Demand for Microbiological Bioburden Testing

Table 127 Bioburden Tests Market, by Region, 2022-2029 (USD Million)

Table 128 North America: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 129 Europe: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 130 Asia-Pacific: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 131 Latin America: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 132 Middle East: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

Table 133 Gcc Countries: Bioburden Tests Market, by Country, 2022-2029 (USD Million)

7.8 Other Biologics Safety Tests

Table 134 Other Biologics Safety Tests Market, by Region, 2022-2029 (USD Million)

Table 135 North America: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 136 Europe: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 137 Asia-Pacific: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 138 Latin America: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 139 Middle East: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

Table 140 Gcc Countries: Other Biologics Safety Tests Market, by Country, 2022-2029 (USD Million)

8 Biologics Safety Testing Market, by Application

8.1 Introduction

Table 141 Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

8.2 Monoclonal Antibodies Development and Manufacturing

8.2.1 Growing Regulatory Approvals for Monoclonal Antibodies to Support Market Growth

Table 142 Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 143 North America: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 144 Europe: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 145 Asia-Pacific: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 146 Latin America: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 147 Middle East: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 148 Gcc: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.3 Vaccines Development and Manufacturing

8.3.1 Rising Prevalence of Infectious Diseases to Drive Growth

Table 149 Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 150 North America: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 151 Europe: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 152 Asia-Pacific: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 153 Latin America: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 154 Middle East: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 155 Gcc: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.4 Cellular & Gene Therapy Products Development and Manufacturing

8.4.1 Increasing Investments for Development of Cellular & Gene Therapies to Drive Growth

Table 156 Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 157 North America: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 158 Europe: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 159 Asia-Pacific: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 160 Latin America: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 161 Middle East: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 162 Gcc: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.5 Blood & Blood Products Development and Manufacturing

8.5.1 Growing Demand for Blood Products to Propel Growth

Table 163 Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 164 North America: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 165 Europe: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 166 Asia-Pacific: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 167 Latin America: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 168 Middle East: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 169 Gcc: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.6 Other Applications

Table 170 Biologics Safety Testing Market for Other Applications, by Region, 2022-2029 (USD Million)

Table 171 North America: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 172 Europe: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 173 Asia-Pacific: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 174 Latin America: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 175 Middle East: Biologics Safety Testing Market for Other Applications, by Region, 2022-2029 (USD Million)

Table 176 Gcc: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 141 Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

8.2 Monoclonal Antibodies Development and Manufacturing

8.2.1 Growing Regulatory Approvals for Monoclonal Antibodies to Support Market Growth

Table 142 Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 143 North America: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 144 Europe: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 145 Asia-Pacific: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 146 Latin America: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 147 Middle East: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 148 Gcc: Biologics Safety Testing Market for Monoclonal Antibodies Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.3 Vaccines Development and Manufacturing

8.3.1 Rising Prevalence of Infectious Diseases to Drive Growth

Table 149 Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 150 North America: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 151 Europe: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 152 Asia-Pacific: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 153 Latin America: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 154 Middle East: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 155 Gcc: Biologics Safety Testing Market for Vaccines Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.4 Cellular & Gene Therapy Products Development and Manufacturing

8.4.1 Increasing Investments for Development of Cellular & Gene Therapies to Drive Growth

Table 156 Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 157 North America: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 158 Europe: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 159 Asia-Pacific: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 160 Latin America: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 161 Middle East: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 162 Gcc: Biologics Safety Testing Market for Cellular & Gene Therapy Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.5 Blood & Blood Products Development and Manufacturing

8.5.1 Growing Demand for Blood Products to Propel Growth

Table 163 Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 164 North America: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 165 Europe: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 166 Asia-Pacific: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 167 Latin America: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

Table 168 Middle East: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Region, 2022-2029 (USD Million)

Table 169 Gcc: Biologics Safety Testing Market for Blood & Blood Products Development and Manufacturing, by Country, 2022-2029 (USD Million)

8.6 Other Applications

Table 170 Biologics Safety Testing Market for Other Applications, by Region, 2022-2029 (USD Million)

Table 171 North America: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 172 Europe: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 173 Asia-Pacific: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 174 Latin America: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

Table 175 Middle East: Biologics Safety Testing Market for Other Applications, by Region, 2022-2029 (USD Million)

Table 176 Gcc: Biologics Safety Testing Market for Other Applications, by Country, 2022-2029 (USD Million)

9 Biologics Safety Testing Market, by End-user

9.1 Introduction

Table 177 Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

9.2 Pharmaceutical & Biotechnology Companies

9.2.1 Increasing Pharmaceutical R&D Spending and Growing Strategic Alliances to Drive Growth

Figure 32 Global Pharmaceutical R&D Spending, 2014-2028 (USD Billion)

Table 178 Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Region, 2022-2029 (USD Million)

Table 179 North America: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 180 Europe: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 181 Asia-Pacific: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 182 Latin America: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 183 Middle East: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Region, 2022-2029 (USD Million)

Table 184 Gcc: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

9.3 Cros & Cdmos

9.3.1 Increasing Focus on Expansion of Cros and Cdmos to Propel Growth

Table 185 Biologics Safety Testing Market for Cros & Cdmos, by Region, 2022-2029 (USD Million)

Table 186 North America: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 187 Europe: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 188 Asia-Pacific: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 189 Latin America: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 190 Middle East: Biologics Safety Testing Market for Cros & Cdmos, by Region, 2022-2029 (USD Million)

Table 191 Gcc: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

9.4 Academic & Research Institutes

9.4.1 Surge in R&D Activities for Development of Advanced Therapies to Boost Market Growth

Table 192 Biologics Safety Testing Market for Academic & Research Institutes, by Region, 2022-2029 (USD Million)

Table 193 North America: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 194 Europe: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 195 Asia-Pacific: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 196 Latin America: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 197 Middle East: Biologics Safety Testing Market for Academic & Research Institutes, by Region, 2022-2029 (USD Million)

Table 198 Gcc: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 177 Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

9.2 Pharmaceutical & Biotechnology Companies

9.2.1 Increasing Pharmaceutical R&D Spending and Growing Strategic Alliances to Drive Growth

Figure 32 Global Pharmaceutical R&D Spending, 2014-2028 (USD Billion)

Table 178 Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Region, 2022-2029 (USD Million)

Table 179 North America: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 180 Europe: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 181 Asia-Pacific: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 182 Latin America: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

Table 183 Middle East: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Region, 2022-2029 (USD Million)

Table 184 Gcc: Biologics Safety Testing Market for Pharmaceutical & Biotechnology Companies, by Country, 2022-2029 (USD Million)

9.3 Cros & Cdmos

9.3.1 Increasing Focus on Expansion of Cros and Cdmos to Propel Growth

Table 185 Biologics Safety Testing Market for Cros & Cdmos, by Region, 2022-2029 (USD Million)

Table 186 North America: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 187 Europe: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 188 Asia-Pacific: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 189 Latin America: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

Table 190 Middle East: Biologics Safety Testing Market for Cros & Cdmos, by Region, 2022-2029 (USD Million)

Table 191 Gcc: Biologics Safety Testing Market for Cros & Cdmos, by Country, 2022-2029 (USD Million)

9.4 Academic & Research Institutes

9.4.1 Surge in R&D Activities for Development of Advanced Therapies to Boost Market Growth

Table 192 Biologics Safety Testing Market for Academic & Research Institutes, by Region, 2022-2029 (USD Million)

Table 193 North America: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 194 Europe: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 195 Asia-Pacific: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 196 Latin America: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

Table 197 Middle East: Biologics Safety Testing Market for Academic & Research Institutes, by Region, 2022-2029 (USD Million)

Table 198 Gcc: Biologics Safety Testing Market for Academic & Research Institutes, by Country, 2022-2029 (USD Million)

10 Biologics Safety Testing Market, by Region

10.1 Introduction

Table 199 Biologics Safety Testing Market, by Region, 2022-2029 (USD Million)

10.2 North America

Figure 33 Number of Biosimilars Approved Annually by US Fda, 2015 to 2023

10.2.1 North America: Recession Impact

Figure 34 North America: Biologics Safety Testing Market Snapshot

Table 200 North America: Biologics Safety Testing Market, by Country, 2022-2029 (USD Million)

Table 201 North America: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 202 North America: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 203 North America: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 204 North America: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 205 North America: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.2.2 US

10.2.2.1 Increasing Investments in Biotechnology Industry to Drive Market Growth

Figure 35 Total US Nih Biotechnology Funding, Fy 2013 to Fy 2024

Table 206 US: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 207 US: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 208 US: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 209 US: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 210 US: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.2.3 Canada

10.2.3.1 Investments for Expanding Biomanufacturing Capacity to Propel Market Growth

Table 211 Canada: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 212 Canada: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 213 Canada: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 214 Canada: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 215 Canada: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3 Europe

Table 216 Europe: Indicative List of Approved Monoclonal Antibody Treatments

10.3.1 Europe: Recession Impact

Table 217 Europe: Biologics Safety Testing Market, by Country/Region, 2022-2029 (USD Million)

Table 218 Europe: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 219 Europe: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 220 Europe: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 221 Europe: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 222 Europe: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.2 Germany

10.3.2.1 Expansion Initiatives by Key Market Players to Support Market Growth

Table 223 Germany: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 224 Germany: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 225 Germany: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 226 Germany: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 227 Germany: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.3 Uk

10.3.3.1 Emphasis on Vaccine Manufacturing and Biotech R&D to Drive Market

Table 228 Uk: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 229 Uk: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 230 Uk: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 231 Uk: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 232 Uk: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.4 France

10.3.4.1 Rising Focus on Cell & Gene Therapy R&D to Promote Market Growth

Table 233 France: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 234 France: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 235 France: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 236 France: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 237 France: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.5 Italy

10.3.5.1 Rising Life Sciences R&D and Growing Biotech Industry to Boost Market

Table 238 Italy: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 239 Italy: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 240 Italy: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 241 Italy: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 242 Italy: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.6 Spain

10.3.6.1 Growing Expansion of Biotech Companies and Increasing R&D Expenditure to Drive Market

Table 243 Spain: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 244 Spain: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 245 Spain: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 246 Spain: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 247 Spain: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.3.7 Rest of Europe

Table 248 Rest of Europe: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 249 Rest of Europe: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 250 Rest of Europe: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 251 Rest of Europe: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 252 Rest of Europe: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Recession Impact

Figure 36 Asia-Pacific: Biologics Safety Testing Market Snapshot

Table 253 Asia-Pacific: Biologics Safety Testing Market, by Country, 2022-2029 (USD Million)

Table 254 Asia-Pacific: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 255 Asia-Pacific: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 256 Asia-Pacific: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 257 Asia-Pacific: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 258 Asia-Pacific: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.2 China

10.4.2.1 China to Dominate APAC Market

Table 259 China: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 260 China: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 261 China: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 262 China: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 263 China: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.3 Japan

10.4.3.1 Growing Government Initiatives and Expansion of Biopharma Companies to Boost Market

Table 264 Japan: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 265 Japan: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 266 Japan: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 267 Japan: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 268 Japan: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.4 India

10.4.4.1 Funding for Biopharma Sector and Focus on Cell-based Therapies to Propel Market Growth

Table 269 India: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 270 India: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 271 India: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 272 India: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 273 India: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.5 South Korea

10.4.5.1 Growing Focus on Advancing Bioprocessing Sector to Drive Market

Table 274 South Korea: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 275 South Korea: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 276 South Korea: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 277 South Korea: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 278 South Korea: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.6 Australia

10.4.6.1 Rising Incidence of Chronic Diseases and Booming Life Science Sector to Drive Market

Table 279 Australia: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 280 Australia: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 281 Australia: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 282 Australia: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 283 Australia: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.4.7 Rest of Asia-Pacific

Table 284 Rest of Asia-Pacific: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 285 Rest of Asia-Pacific: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 286 Rest of Asia-Pacific: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 287 Rest of Asia-Pacific: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 288 Rest of Asia-Pacific: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.5 Latin America

10.5.1 Latin America: Recession Impact

Table 289 Latin America: Biologics Safety Testing Market, by Country/Region, 2022-2029 (USD Million)

Table 290 Latin America: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 291 Latin America: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 292 Latin America: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 293 Latin America: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 294 Latin America: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.5.2 Brazil

10.5.2.1 Brazil to Hold Largest Share of Latam Market

Table 295 Brazil: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)

Table 296 Brazil: Biologics Safety Testing Services Market, by Type, 2022-2029 (USD Million)

Table 297 Brazil: Biologics Safety Testing Products Market, by Test Type, 2022-2029 (USD Million)

Table 298 Brazil: Biologics Safety Testing Market, by Application, 2022-2029 (USD Million)

Table 299 Brazil: Biologics Safety Testing Market, by End-user, 2022-2029 (USD Million)

10.5.3 Mexico

10.5.3.1 Increasing Government Support for Biopharmaceutical Production to Drive Market

Table 300 Mexico: Biologics Safety Testing Market, by Product & Service, 2022-2029 (USD Million)