Sugar substitutes, also known as artificial sweeteners or sugar alternatives, are substances used in food and beverages to mimic the sweet taste of sugar while providing fewer or no calories. They are commonly preferred by individuals looking to reduce their sugar intake for various reasons, such as weight management or blood sugar control. Sugar substitutes can be derived from natural sources like plants (e.g., stevia extract) or created synthetically in laboratories (e.g., aspartame or saccharin). They are significantly sweeter than sugar, thus only small amounts are needed to achieve the desired level of sweetness. Sugar substitutes offer the advantage of sweetening foods and drinks without causing a rapid increase in blood glucose levels, making them suitable for diabetics and those regulating their sugar consumption.

The increasing shift toward healthier dietary choices due to rising global concern over high obesity rates and related health issues will stimulate the growth of the sugar substitutes market during the forecast period. Sugar substitutes, which offer a sweet taste without the calories, have gained immense popularity as a means of reducing sugar intake and managing weight. Moreover, the growing prevalence of diabetes, a condition requiring careful sugar control, has augmented the demand for sugar-free alternatives. Apart from this, food and beverage manufacturers are reformulating their products to lower sugar content as consumers become more health-conscious, which in turn has accelerated the adoption of sugar substitutes as key ingredients. Additionally, advancements in sugar substitute technologies have improved taste profiles and led to the development of more versatile substitutes, expanding their applications in various food and beverage categories, thereby propelling market growth. Furthermore, increasing regulatory efforts to enforce sugar reduction in food products and labeling requirements for added sugars is contributing to market growth.

Sugar Substitutes Market Trends/Drivers

Growing health consciousness among the masses

The increasing awareness about the health risks associated with excessive sugar consumption is a major growth-inducing factor. As consumers become more health conscious, they are actively seeking ways to reduce their sugar intake. High sugar consumption is linked to numerous health issues such as obesity, type 2 diabetes, and dental problems. This awareness has prompted individuals to look for sugar alternatives that allow them to enjoy sweet flavors without the negative health consequences. As a result, sugar substitutes, which offer sweetness without the calorie load of sugar, have become a preferred choice for health-conscious consumers who want to manage their weight and reduce the risk of developing chronic diseases. This heightened awareness about the health impacts of excessive sugar consumption is expected to catalyze the demand for sugar substitutes in various food and beverage products.Escalating demand for low-calories and sugar-free products

The rising demand for low-calorie and sugar-free food and beverages is another significant driving force in the sugar substitutes market. Consumers are increasingly seeking products that align with their dietary preferences, which often include reducing calorie intake and avoiding added sugars. Sugar substitutes enable food and beverage manufacturers to meet this demand by formulating products that are lower in calories and free from added sugars. Whether it is sugar-free sodas, reduced-sugar snacks, or desserts with fewer calories, sugar substitutes play a pivotal role in creating these offerings. This trend is fueled by consumers' desire for healthier dietary choices and a growing interest in weight management and overall well-being, positioning sugar substitutes as a key ingredient in meeting these preferences.Favorable government initiatives

Government regulations and initiatives aimed at reducing sugar intake in food and beverage products have a substantial impact on the sugar substitutes market. Health authorities and policymakers recognize the public health challenges posed by excessive sugar consumption and have taken steps to address them. These measures include requiring clear labeling of added sugars on product packaging and implementing sugar reduction targets for various food categories. As a result, food manufacturers are motivated to reformulate their products with sugar alternatives to comply with these regulations and meet health guidelines. This regulatory environment creates a favorable market landscape for sugar substitutes, driving their adoption as a means of reducing sugar content in a wide range of consumer products.Sugar Substitutes Industry Segmentation

This report provides an analysis of the key trends in each sub-segment of the global sugar substitutes market report, along with forecasts at the global and regional levels for 2025-2033. The report has categorized the market based on product type, application and origin.Breakup by Product Type

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-intensity sweeteners (stevia, aspartame, cyclamate, sucralose, saccharin and others); low-intensity sweeteners (D-tagatose, sorbitol, maltitol, xylitol, mannitol and others); and high fructose syrup. According to the report, high intensity sweeteners represented the largest segment.

High-intensity sweeteners are sugar substitutes known for their exceptional sweetness, often hundreds or even thousands of times sweeter than sugar, while providing negligible to zero calories. These sweeteners, which include aspartame, saccharin, sucralose, and steviol glycosides (from stevia), are used to add sweetness to foods and beverages without the caloric impact of sugar. They address the increasing consumer concerns about calorie intake and sugar-related health issues and the desire for sweet-tasting products with fewer calories.

Moreover, high-intensity sweeteners are a critical component in the development of sugar-free and reduced-sugar products, including diet sodas, sugar-free desserts, and low-calorie snacks. They allow manufacturers to create healthier alternatives while maintaining the sweet taste that consumers crave, thereby driving the market growth. Along with this, the rising demand for reduced-calorie and sugar-free options in the food and beverage industry is further propelling the segment growth.

Breakup by Application

- Foods

- Beverages

- Health and Personal Care

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes foods, beverages, and health and personal care. According to the report, beverages accounted for the largest market share.

Beverages refer to a wide range of liquid consumables, including soft drinks, fruit juices, energy drinks, and more. Manufacturers are widely incorporating sugar substitutes in beverages due to their ubiquity and the consumer demand for reduced-sugar and low-calorie options. As health-consciousness grows, consumers are increasingly seeking healthier beverage choices to reduce their sugar intake and manage their weight. Beverages are a prominent source of added sugars in the diet, and sugar substitutes offer an effective way to maintain sweetness while cutting calories and sugar content. The adoption of sugar substitutes in beverages has been accelerated by the implementation of sugar taxes and regulations aimed at reducing sugar consumption. This has prompted beverage manufacturers to reformulate their products with sugar substitutes to meet both regulatory requirements and consumer preferences for healthier options, thus driving the segment growth.

Breakup by Origin

- Artificial

- Natural

A detailed breakup and analysis of the market based on the origin has also been provided in the report. This includes artificial and natural. According to the report, natural accounted for the largest market share.

Natural origin refers to sweeteners derived from natural sources, such as plants or fruits, as opposed to synthetic or artificial sweeteners. Natural origin sweeteners, like steviol glycosides from the stevia plant or monk fruit extract, are gaining popularity owing to the increasing consumer demand for clean-label and healthier alternatives to sugar. They align with the growing preference for natural ingredients, as they are perceived as less processed and more wholesome. Consumers are becoming more aware of the origins of their food and beverages, and the desire for natural sweeteners has led to their incorporation into various products, including beverages, snacks, and desserts. Food and beverage manufacturers are leveraging this trend by using natural origin sweeteners to formulate products that cater to health-conscious consumers, thus fueling the market growth.

Breakup by Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa and Latin America. According to the report, North America accounted for the largest market share.

North America held the biggest share in the market due to the rising health consciousness and increasing awareness of the negative health impacts of excessive sugar consumption that prompts consumers to seek alternatives. This demand for reduced sugar and low-calorie products has fueled the incorporation of sugar substitutes into a wide range of food and beverages. Moreover, favorable regulatory initiatives in North America, such as sugar taxes and mandatory labeling of added sugars, have pushed food and beverage manufacturers to reformulate their products using sugar substitutes to meet regulatory requirements and consumer preferences. Besides this, the prevalence of obesity and diabetes in North America has led to a greater emphasis on sugar reduction and healthier dietary choices. As a result, sugar substitutes have become integral to the region's food industry, driving innovation and growth in the market. Additionally, North America's well-established food and beverage sector, coupled with the adoption of sugar substitutes by major brands, further propels the market expansion in the region.

Competitive Landscape

Key players in the sugar substitutes industry have been at the forefront of innovation to meet consumer demand for healthier alternatives. Recent innovations include the development of natural sugar substitutes sourced from stevia, monk fruit, and other plant-based ingredients, addressing the growing consumer preference for clean-label and natural products. Additionally, advancements in the formulation of sugar substitutes have improved taste profiles, reducing the aftertaste often associated with some artificial sweeteners. Furthermore, key players have introduced sugar substitutes specifically tailored for use in baking and cooking, expanding their versatility in various culinary applications. Sugar substitute blends that combine different sweeteners for a more sugar-like taste and texture have also gained popularity. Apart from this, innovative packaging and delivery formats, such as liquid sweeteners and dissolvable tablets, provide convenience and precision in sweetening beverages and foods. These innovations collectively cater to evolving consumer demands for healthier, better-tasting, and more convenient sugar substitute options.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Tate & Lyle PLC

- Cargill, Incorporated

- PureCircle Limited

- Roquette Frères S.A.

- E. I. du Pont de Nemours and Company

- Archer Daniels Midland Company

- Ajinomoto Co. Inc.

- Ingredion Incorporated

- Flavors Holdings Inc.

- Jk Sucralose Inc.

Key Questions Answered in This Report

1. How big is the sugar substitutes market?2. What is the future outlook of sugar substitutes market?

3. What are the key factors driving the sugar substitutes market?

4. Which region accounts for the largest sugar substitutes market share?

5. Which are the leading companies in the global sugar substitutes market?

Table of Contents

Companies Mentioned

- Tate & Lyle PLC

- Cargill

- Incorporated

- PureCircle Ltd.

- Roquette Frères S.A.

- E. I. du Pont de Nemours and Company

- Archer Daniels Midland Company

- Ajinomoto Co. Inc.

- Ingredion Incorporated

- Flavors Holdings Inc.

- JK Sucralose Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

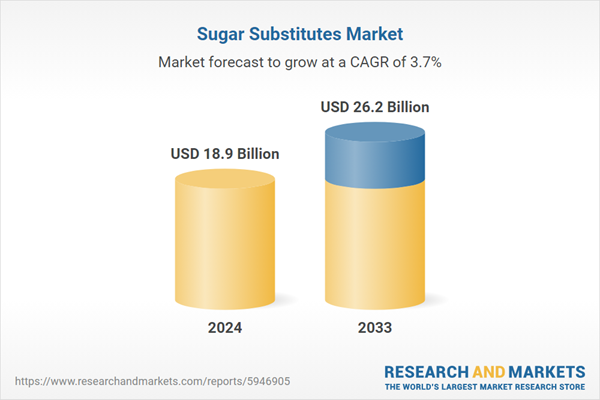

| Estimated Market Value ( USD | $ 18.9 Billion |

| Forecasted Market Value ( USD | $ 26.2 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |