PVC pipes are made up of polyvinyl chloride (PVC), a chemical polymer resin. These pipes are made from a blend of PVC and other additives. PVC pipes have numerous applications in drain waste vent, water service lines, irrigation, sewers and other industrial installations. The PVC pipes are used extensively in electric systems due to its properties of heat and electrical insulation. Apart from that, these pipes have high resistance to chemicals and a high tensile strength to withstand very high fluid pressure, so they are widely used in long distance water supply and underground sewerage systems. They are strong and can withstand extreme movements, so can be used in earthquake prone areas without experiencing any damage.

These pipes are also cost-effective, light-weight and long-lasting, which makes it widely acceptable over its competing piping materials. The PVC pipes are rapidly replacing the concrete and metal pipes as they can be used in cases of energy, gas, conduit, and other industrial applications too. The rapid economic growth in Bahrain is pushing the demand for better infrastructure thereby boosting the demand for PVC pipes in the region.

In Bahrain, the government is focusing on improving the country's infrastructure and is undertaking various construction projects. This is a key factor that will drive the market in this region. Also, the housing supply in Bahrain is too less as compared to the demand for housing, especially among the low and mid-income groups, hence there is a scope for increase in residential property development and this will provide a thrust to the PVC pipes market. Furthermore, the heightened awareness of consumers on the smaller environmental footprint of PVC pipes as compared to the other piping materials is expected to influence the market’s growth in this region.

Key Market Segmentation:

The research provides an analysis of the key trends in each sub-segment of the Bahrain PVC pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on application.Breakup by Application:

- Sewerage and Drainage

- Irrigation

- Plumbing

- Water Supply

- HVAC

- Oil & Gas

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being Gulf Plastic, Bahrain National Plastics Company (BANAPCO), and Tylos Plastic Industries.This report provides a deep insight into the Bahrain PVC pipes market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. The report also provides a comprehensive analysis for setting up a PVC pipe manufacturing plant.

The study analyses the processing and manufacturing requirements, project cost, project funding, project economics, expected returns on investment, profit margins, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into Bahrain PVC pipes market in any manner.

Key Questions Answered in This Report

- What was the size of the Bahrain PVC pipes market in 2024?

- What is the expected growth rate of the Bahrain PVC pipes market during 2025-2033?

- What are the key factors driving the Bahrain PVC pipes market?

- What has been the impact of COVID-19 on the Bahrain PVC pipes market?

- What is the breakup of the Bahrain PVC pipes market based on the application?

- Who are the key players/companies in the Bahrain PVC pipes market?

Table of Contents

Companies Mentioned

- Gulf Plastic

- Bahrain National Plastics Company (BANAPCO)

- Tylos Plastic Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

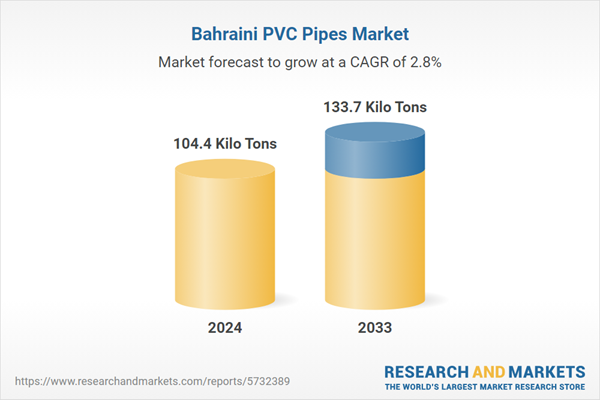

| Estimated Market Value in 2024 | 104.4 Kilo Tons |

| Forecasted Market Value by 2033 | 133.7 Kilo Tons |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Bahrain |

| No. of Companies Mentioned | 3 |