The growth of the aviation market, fuelled by increasing deliveries of commercial and military aircraft, is expected to drive the growth of the aircraft paints market during the forecast period. The need to refurbish the old aircraft that are in service is also generating revenues for the aircraft paints market. The development of new eco-friendly aircraft painting and coating products that can reduce weight and increase fuel efficiency is expected to impact the growth of the market. In April 2023, AkzoNobel developed the Aerofleet Coatings Management system, which uses data gathered over several years. It is to ensure that aircraft are only repainted when needed, not according to a fixed schedule alone.

Aircraft Paint Market Trends

Commercial Aviation Segment Accounts for the Highest Market Share

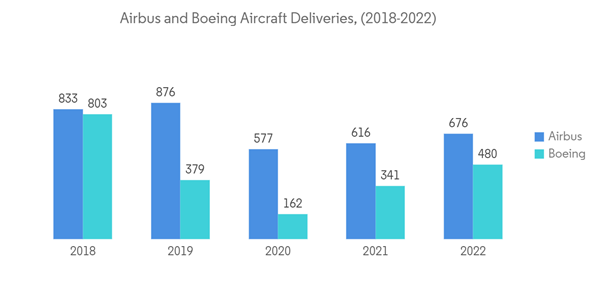

Currently, the commercial aircraft segment dominates the market, and it is expected to continue to hold a major share throughout the forecasted period. Passenger traffic is gradually recovering from the impact of the pandemic and is expected to surpass the pre-pandemic levels by the end of 2023. The recovery is attributed to growing domestic travel across the globe. With the growing domestic passengers, the demand for commercial aircraft is expected to witness robust growth in the coming years, with a subsequent demand impact on the aircraft's electrical systems. The procurement of aircraft by the airlines to cater to the increasing air travel also increased tremendously. By the end of 2022, Airbus had delivered 676 aircraft, and Boeing had delivered 480 aircraft. Thus, continuous production and deliveries of commercial aircraft are expected during the forecast period. The production and delivery of commercial aircraft are expected to drive the growth of the commercial segment of the aircraft paints market.Asia-Pacific Will Showcase Remarkable Growth During the Forecast Period

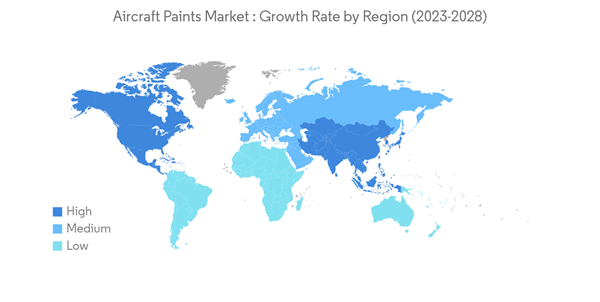

The robust economic growth, favorable population, and demographic profiles of the populace in developing countries in the Asia-Pacific region are driving air passenger traffic. The region saw a significant increase in air passenger traffic during the past decade, mostly due to the tourist destinations in the region and the ease of access to air travel, which is expected to continue during the forecast period.China is leading the recovery of global commercial aviation due to great domestic demand, helping the airlines witness financial recovery. It became a major hub for the aviation industry over the years due to high demand from civilian and military customers. Commercial aviation is a key contributor to China's aviation industry over the years. According to Boeing, China is the largest market in aviation due to an increase in domestic air passenger traffic, which surpassed the North American region and is expected to grow rapidly at a rate of 4.4% by 2040.

With the increase in military spending of the countries in the region due to tensions between neighboring countries and with foreign nations investing in arranging military base stations in countries like Australia, military aviation in the Asia-Pacific region is also increasing. China is increasing its military airborne capabilities. A new stealth fighter aircraft, the new version of the J-20, which is the world's first twin-seat stealth fighter aircraft, was unveiled in October of 2021. Developments such as these are boosting the growth of the aircraft paints market in this region.

Aircraft Paint Industry Overview

The aircraft paints market is moderately fragmented, occupied by major manufacturers like Akzo Nobel NV, PPG Industries Inc., IHI Ionbond AG, Mankiewicz Gebr. & Co., and Hentzen Coatings Inc. Currently, most of the paints and coating providers are present in North America and Europe. The increase in the global presence of the companies will help companies to gain a competitive advantage over others. Also, the development of paints that reduce weight, increase fuel efficiency, increase the stealth characteristics of aircraft, and are eco-friendly will help companies attain a better position in the market. In April 2023, AkzoNobel announced that airlines and operators could optimize the paint maintenance schedules for their entire fleets through a digital management system developed by AkzoNobel's Aerospace Coatings business. Developments such as these will help companies to gain a competitive advantage over others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- DuPont

- BASF SE

- 3M Co

- PPG Industries Inc.

- Mankiewicz Gebr. & Co.

- Hentzen Coatings, Inc.

- Sherwin-Williams Co

- Akzo Nobel NV

- Mapaero Coatings

- Henkel AG & Company

- IHI Ionbond AG