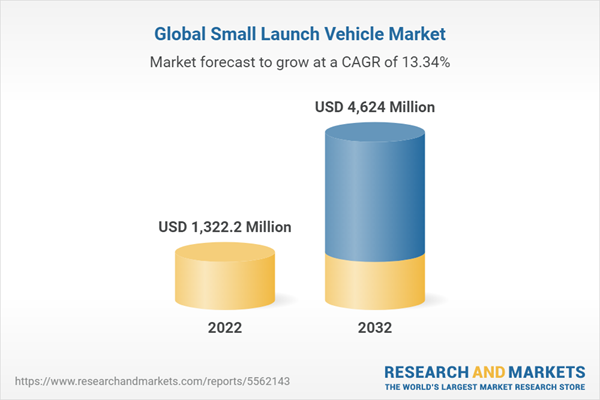

The global small launch vehicle market is expected to reach $4,624.0 million by 2032, with a CAGR of 13.34% during the forecast period 2022-2032.

Market Report Coverage - Small Launch Vehicle (SLV)

Market Segmentation

- End User: Academic, Commercial, Government, Military and Defense, Non-Profit Organization

- Satellite Mass: 0-500 Kg, 501-2,200 Kg

- Platform Type: Land, Air, Sea, Balloon

- Propulsion Type: Solid, Liquid, Hybrid

- Service Type: Pre-Launch Service, Post-Launch Service

Regional Segmentation

- North America: U.S., Canada

- Europe: Germany, U.K., France, Russia, Rest of Europe

- Asia-Pacific: Japan, China, India, Australia, Rest-of-Asia-Pacific

- Rest-of-the-World: Middle East and Africa, Latin America

Market Growth Drivers

- Increasing Usage of Commercial Off-The-Shelf (COTS) Components

- Growing Demand for Small Satellites and Constellations in LEO

- Increasing Cooperation among Space Agencies for Space Missions

Market Challenges

- Absence of Efficient and Reliable Micro-Propulsion Systems

- High Cost Associated with Space Launch Vehicles

Market Opportunities

- Increasing Developments in Low-Cost Launching Sites

- Emerging Startups in SLV Manufacturing

- Advancements in 3D Printing Technology for Space Industry

Key Companies Profiled

Arianespace, Astra Space, Inc., Galactic Energy (Beijing) Space Technology Co., LTD., China Aerospace Science and Technology Corporation (CASC), IHI Aerospace Co. Ltd., Interorbital System, Israel Aerospace Industries Ltd., Northrop Grumman Corporation, Rocket Lab USA, Inc., ABL Space Systems, Agnikul Cosmos Private Limited, CubeCab, EUROCKOT Launch Services GmbH, Firefly Aerospace Inc., Gilmour Space Technologies, HyImpulse Technologies GmbH, Orbex, PLD Space, Skyroot Aerospace Private Limited, Virgin Orbit

How This Report Can Add Value

This extensive report can help with:

- A dedicated section focusing on the futuristic trends adopted by key players operating in the global small launch vehicle (SLV) market.

- Extensive competitive benchmarking of top 20 players (including SLV manufacturers and launch service providers) offering a holistic view of the global small launch vehicle (SLV) landscape.

- Detailed qualitative and quantitative mapping of satellite launches and manufacturing from 2021-2032.

- Qualitative and quantitative analysis of small launch vehicle (SLV) at the region and country-level granularity by application and product segments.

Recent Developments in Global Small Launch Vehicle Market

- In January 2022, European Space Agency (ESA) awarded a launch contract to Arianespace on behalf of the European Commission.

- In November 2021, Amazon partnered with ABL Space Systems to launch the first two prototype satellites for its Project Kuiper satellite broadband constellation by late 2022. RS-1 rocket will be used for the launch.

- In September 2021, Firefly Aerospace Inc. conducted the maiden flight of its Alpha launch vehicle from Vandenberg Space Force Base in California.

- In August 2021, Gilmour Space Technologies partnered with Exolaunch to sell a full suite of launch and deployment services to a growing number of small satellite operators using the Gilmour designed and built Eris launch vehicle.

Key Questions Answered in the Report

- What are the futuristic trends in the global small launch vehicle market, and how is the market expected to change over the forecast years 2022-2032?

- What are the key drivers and challenges faced by the companies that are currently working in the small launch vehicle (SLV) market?

- How is the global small launch vehicle market expected to grow during the forecast period 2022-2032?

- What are the opportunities for the companies to expand their businesses in the global small launch vehicle (SLV) market?

- Which region is expected to be leading the global small launch vehicle (SLV) market by 2032?

- What are the key developmental strategies implemented by the key players to sustain in this highly competitive market?

- What is the current and future revenue scenario of the global small launch vehicle market?

Global Small Launch Vehicle

A small launch vehicle (SLV) refers to a launch vehicle (rocket) that can carry a payload of a maximum of 2,200 Kg to low Earth orbit (LEO) in a single mission, either dedicated or rideshare. Since the middle of the 1950s, small-lift launch vehicles have been in development and operation across the globe.

After 2014, the SLV market witnessed exponential growth due to an increase in the number of SLV manufacturers and launch service providers. The increasing number of satellite constellations for applications such as communication, technology development, Earth observation, and remote sensing is expected to be the major driving factor for SLV market growth.

As of February 2022, there were 17 operational small-lift launch vehicles and 99 small launch vehicles under development.

Global Small Launch Vehicle (SLV) Industry Overview

The global small launch vehicle market is expected to reach $4,624.0 million by 2032, with a CAGR of 13.34% during the forecast period 2022-2032. The use of small satellites for several applications such as Earth observation, communication, and space exploration is expected to drive the growth of the SLV market.

Several programs such as Airborne Launch Assist Space Access (ALASA) are organized for developing an affordable method for launching small satellites. In addition, with rigorous testing of new technologies and research and development work, ALASA is expected to introduce small launch systems to provide more reasonable, routine, and reliable access to space in less than $1 million per launch.

Market Segmentation

Global Small Launch Vehicle (SLV) Market by Satellite Mass

Satellite mass is a prominent market segment. The 501-2,200 Kg satellite mass segment has the highest market share and is estimated to grow over the forecast years due to the rise in the number of small satellite constellations from various key manufacturers such as SpaceX, Amazon, Cloud Constellation, Urthecast, and ISRO.

Global Small Launch Vehicle (SLV) Market by Platform Type

The land platform has the highest market penetration in the global SLV market during the forecast period 2022-2032. The market growth is due to cost-effective launch and high success rate.

Global Small Launch Vehicle (SLV) Market by Propulsion Type

Solid propulsion technology is expected to have the highest market penetration in the global small launch vehicle market during the forecast period 2022-2032. This is due to the high demand for solid propellant rockets, which are much easier to store and handle during launch.

Global Small Launch Vehicle (SLV) Market by End-User

The commercial end user is anticipated to witness huge growth over the forecast period. It had a significant market share in 2021 due to the increasing demand for commercial applications such as remote sensing, Earth observation and navigation, surveillance, and satellite internet. The satellite internet constellation is a major project in this segment.

Global Small Launch Vehicle (SLV) Market by Service Type

The pre-launch services segment had a significant market share in 2021 and is estimated to hold significant market share over the forecast period due to an increase in the number of commercial launches per year.

Global Small Launch Vehicle (SLV) Market by Region

In 2021, the contribution of Asia-Pacific held the highest share of the global small launch vehicle market. The region is anticipated to hold a significant share in the global market by the end of 2032. The majority of the market growth in the Asia-Pacific region is contributed by the market in China owing to the presence of key market players such as China Aerospace Science and Technology Corporation (CASC) and Galactic Energy (Beijing) Space Technology Co., LTD. CASC and Galactic accounted for more than 30 successful SLV launches per year.

Key Market Players and Competition Synopsis

The companies profiled in the report have been selected post-in-depth interviews with experts and understanding details around companies such as product portfolios, annual revenues, market penetration, research and development initiatives, and domestic and international presence in the small launch vehicle market.

Some key players in the global small launch vehicle (SLV) market include Arianespace, Astra Space, Inc., Northrop Grumman, Rocket Lab USA, Inc., ABL Space Systems, Blue Origin, Firefly Aerospace Inc., China Aerospace Science and Technology Corporation (CASC), and Interorbital Systems among others.

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Global Small Launch Vehicle (SLV) Market: An Overview

1.1.2 Launch Vehicle Mapping with Satellite/Payload, Orbit, and Launch Site

1.1.3 Global Small Satellite Industry Scenario: Business Opportunity for SLV Market

1.1.4 Trends: Current and Future

1.1.4.1 Cost Advantage in Reusable Launch Vehicle

1.1.4.2 Propulsion System

1.1.4.3 Modernization in Structure Composition of Small Launch Vehicle (SLV)

1.1.5 Spaceports: Capability Analysis

1.1.6 Start-Up and Investment Landscape

1.1.6.1 Key Start-Ups in the Ecosystem

1.1.6.2 Funding Analysis

1.1.7 Supply Chain Analysis

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Increasing Usage of Commercial Off-The-Shelf (COTS) Components

1.2.1.2 Growing Demand for Small Satellites and Constellations in LEO

1.2.1.3 Increasing Cooperation among Space Agencies for Space Missions

1.2.2 Business Challenges

1.2.2.1 Absence of Efficient and Reliable Micro-Propulsion Systems

1.2.2.2 High Cost Associated with Space Launch Vehicles

1.2.3 Business Opportunities

1.2.3.1 Increasing Developments in Low-Cost Launching Sites

1.2.3.2 Emerging Startups in SLV Manufacturing

1.2.3.3 Advancements in 3D Printing Technology for Space Industry

1.2.4 Key Business Development

1.2.5 Partnerships, Collaborations, Agreements, and Contracts

1.2.6 Mergers & Acquisitions

2 Application

2.1 Global Small Launch Vehicle (SLV) Market (by End User)

2.1.1 Market Overview

2.1.1.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (by End User)

2.1.2 Academic

2.1.3 Commercial

2.1.4 Government

2.1.5 Military and Defense

2.1.6 Non-Profit Organization

3 Products

3.1 Global Small Launch Vehicle (SLV) Market (by Satellite Mass)

3.1.1 Market Overview

3.1.1.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (by Satellite Mass)

3.1.2 0-500 Kg

3.1.3 501-2,200 Kg

3.2 Global Small Launch Vehicle (SLV) Market (by Platform Type)

3.2.1 Market Overview

3.2.1.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (by Platform Type)

3.2.2 Land

3.2.3 Air

3.2.4 Sea

3.2.5 Balloon

3.3 Global Small Launch Vehicle (SLV) Market (by Propulsion Type)

3.3.1 Market Overview

3.3.1.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (by Propulsion Type)

3.3.2 Solid

3.3.3 Liquid

3.3.4 Hybrid

3.4 Global Small Launch Vehicle (SLV) Market (by Service Type)

3.4.1 Market Overview

3.4.1.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (by Service Type)

3.4.2 Pre-Launch Service

3.4.2.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (Pre-Launch Service, by Service Type)

3.4.3 Post-Launch Service

3.4.3.1 Demand Analysis of the Global Small Launch Vehicle (SLV) Market (Post-Launch Service, by Service Type)

3.5 Product and Pricing Analysis

3.5.1 Launch Vehicle Manufacturing

3.5.2 Satellite Launch Services

3.5.3 Payload Manufacturing and Deployment Cost Analysis

4 Region

4.1 Global Small Launch Vehicle (SLV) Market (by Region)

4.2 North America

4.2.1 Market

4.2.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in North America

4.2.1.2 Business Drivers

4.2.1.3 Business Challenges

4.2.2 Application

4.2.2.1 North America Small Launch Vehicle (SLV) Market (by End User)

4.2.3 Product

4.2.3.1 North America Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.2.4 North America (by Country)

4.2.4.1 U.S.

4.2.4.1.1 Market

4.2.4.1.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in the U.S.

4.2.4.1.1.2 Business Drivers

4.2.4.1.1.3 Business Challenges

4.2.4.1.2 Application

4.2.4.1.2.1 U.S. Small Launch Vehicle (SLV) Market (by End User)

4.2.4.1.3 Product

4.2.4.1.3.1 U.S. Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.2.4.2 Canada

4.2.4.2.1 Market

4.2.4.2.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in Canada

4.2.4.2.1.2 Business Drivers

4.2.4.2.1.3 Business Challenges

4.2.4.2.2 Application

4.2.4.2.2.1 Canada Small Launch Vehicle (SLV) Market (by End User)

4.2.4.2.3 Product

4.2.4.2.3.1 Canada Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3 Europe

4.3.1 Market

4.3.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in Europe

4.3.1.2 Business Drivers

4.3.1.3 Business Challenges

4.3.2 Application

4.3.2.1 Europe Small Launch Vehicle (SLV) Market (by End User)

4.3.3 Product

4.3.3.1 Europe Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3.4 Europe (by Country)

4.3.4.1 U.K.

4.3.4.1.1 Market

4.3.4.1.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in the U.K.

4.3.4.1.1.2 Business Drivers

4.3.4.1.2 Application

4.3.4.1.2.1 U.K. Small Launch Vehicle (SLV) Market (by End User)

4.3.4.1.3 Product

4.3.4.1.3.1 U.K. Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3.4.2 Germany

4.3.4.2.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in Germany

4.3.4.2.2 Market

4.3.4.2.2.1 Business Drivers

4.3.4.2.2.2 Business Challenges

4.3.4.2.3 Application

4.3.4.2.3.1 Germany Small Launch Vehicle (SLV) Market (by End User)

4.3.4.2.4 Product

4.3.4.2.4.1 Germany Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3.4.3 France

4.3.4.3.1 Market

4.3.4.3.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in France

4.3.4.3.1.2 Business Drivers

4.3.4.3.1.3 Business Challenges

4.3.4.3.2 Application

4.3.4.3.2.1 France Small Launch Vehicle (SLV) Market (by End User)

4.3.4.3.3 Product

4.3.4.3.3.1 France Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3.4.4 Russia

4.3.4.4.1 Market

4.3.4.4.1.1 Business Drivers

4.3.4.4.1.2 Business Challenges

4.3.4.4.2 Application

4.3.4.4.2.1 Russia Small Launch Vehicle (SLV) Market (by End User)

4.3.4.4.3 Product

4.3.4.4.3.1 Russia Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.3.4.5 Rest-of-Europe

4.3.4.5.1 Market

4.3.4.5.1.1 Business Drivers

4.3.4.5.1.2 Business Challenges

4.3.4.5.2 Application

4.3.4.5.2.1 Rest-of-Europe Small Launch Vehicle (SLV) Market (by End User)

4.3.4.5.3 Product

4.3.4.5.3.1 Rest-of-Europe Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4 Asia-Pacific

4.4.1 Market

4.4.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in Asia-Pacific

4.4.1.2 Business Drivers

4.4.1.3 Business Challenges

4.4.2 Application

4.4.2.1 Asia-Pacific Small Launch Vehicle (SLV) Market (by End User)

4.4.3 Product

4.4.3.1 Asia-Pacific Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4.4 Asia-Pacific (by Country)

4.4.4.1 China

4.4.4.1.1 Market

4.4.4.1.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in China

4.4.4.1.1.2 Business Drivers

4.4.4.1.1.3 Business Challenges

4.4.4.1.2 Application

4.4.4.1.2.1 China Small Launch Vehicle (SLV) Market (by End User)

4.4.4.1.3 Product

4.4.4.1.3.1 China Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4.4.2 India

4.4.4.2.1 Market

4.4.4.2.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in India

4.4.4.2.1.2 Business Drivers

4.4.4.2.1.3 Business Challenges

4.4.4.2.2 Application

4.4.4.2.2.1 India Small Launch Vehicle (SLV) Market (by End User)

4.4.4.2.3 Product

4.4.4.2.3.1 India Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4.4.3 Japan

4.4.4.3.1 Market

4.4.4.3.1.1 Key Small Launch Vehicle Manufacturers and Launch Service Providers in Japan

4.4.4.3.1.2 Business Drivers

4.4.4.3.1.3 Business Challenges

4.4.4.3.2 Application

4.4.4.3.2.1 Japan Small Launch Vehicle (SLV) Market (by End User)

4.4.4.3.3 Product

4.4.4.3.3.1 Japan Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4.4.4 Australia

4.4.4.4.1 Market

4.4.4.4.1.1 Business Driver

4.4.4.4.1.2 Business Challenges

4.4.4.4.2 Application

4.4.4.4.2.1 Australia Small Launch Vehicle (SLV) Market (by End User)

4.4.4.4.3 Product

4.4.4.4.3.1 Australia Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.4.4.5 Rest-of-Asia-Pacific

4.4.4.5.1 Market

4.4.4.5.1.1 Business Drivers

4.4.4.5.1.2 Business Challenges

4.4.4.5.2 Application

4.4.4.5.2.1 Rest-of-Asia-Pacific Small Launch Vehicle (SLV) Market (by End User)

4.4.4.5.3 Product

4.4.4.5.3.1 Rest-of-Asia-Pacific Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.5 Rest-of-the-World

4.5.1 Market

4.5.1.1 Business Drivers

4.5.1.2 Business Challenges

4.5.2 Application

4.5.2.1 Rest-of-the-World Small Launch Vehicle (SLV) Market (by End User)

4.5.3 Product

4.5.3.1 Rest-of-the-World Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.5.4 Rest-of-the-World (by Region)

4.5.4.1 Middle East and Africa

4.5.4.1.1 Market

4.5.4.1.1.1 Business Drivers

4.5.4.1.1.2 Business Challenges

4.5.4.1.2 Application

4.5.4.1.2.1 Middle East and Africa Small Launch Vehicle (SLV) Market (by End User)

4.5.4.1.3 Product

4.5.4.1.3.1 Middle East and Africa Small Launch Vehicle (SLV) Market (by Satellite Mass)

4.5.4.2 Latin America

4.5.4.2.1 Market

4.5.4.2.1.1 Business Drivers

4.5.4.2.1.2 Business Challenges

4.5.4.2.2 Application

4.5.4.2.2.1 Latin America Small Launch Vehicle (SLV) Market (by End User)

4.5.4.2.3 Product

4.5.4.2.3.1 Latin America Small Launch Vehicle (SLV) Market (by Satellite Mass)

5 Market - Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.2 Market Share Analysis

5.3 Key Market Players

5.3.1 Arianespace

5.3.1.1 Company Overview

5.3.1.1.1 Role of Arianespace in the Global Small Launch Vehicle (SLV) Market

5.3.1.1.2 Product Portfolio

5.3.1.2 Business Strategies

5.3.1.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.3.1.3 Strength of Arianespace

5.3.1.4 Analyst View

5.3.2 Astra Space, Inc.

5.3.2.1 Company Overview

5.3.2.1.1 Role of Astra Space, Inc. in the Global Small Launch Vehicle (SLV) Market

5.3.2.1.2 Product Portfolio

5.3.2.2 Business Strategies

5.3.2.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.3.2.3 Strength of Astra Space, Inc.

5.3.2.4 Analyst View

5.3.3 Galactic Energy (Beijing) Space Technology Co., LTD.

5.3.3.1 Company Overview

5.3.3.1.1 Role of Galactic Energy (Beijing) Space Technology Co., LTD. in the Global Small Launch Vehicle (SLV) Market

5.3.3.1.2 Product Portfolio

5.3.3.2 Business Strategies

5.3.3.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.3.3.3 Strength of Galactic Energy (Beijing) Space Technology Co., LTD.

5.3.3.4 Analyst View

5.3.4 China Aerospace Science and Technology Corporation (CASC)

5.3.4.1 Company Overview

5.3.4.1.1 Role of China Aerospace Science and Technology Corporation (CASC) in the Global Small Launch Vehicle (SLV) Market

5.3.4.1.2 Product Portfolio

5.3.4.2 Strength of China Aerospace Science and Technology Corporation (CASC)

5.3.4.3 Analyst View

5.3.5 IHI Aerospace Co. Ltd.

5.3.5.1 Company Overview

5.3.5.1.1 Role of IHI Aerospace Co. Ltd. in the Global Small Launch Vehicle (SLV) Market

5.3.5.1.2 Product Portfolio

5.3.5.2 Business Strategies

5.3.5.2.1 New Product Launches

5.3.5.3 Strength of IHI Aerospace Co. Ltd.

5.3.5.4 Analyst View

5.3.6 Interorbital System

5.3.6.1 Company Overview

5.3.6.1.1 Role of Interorbital System in the Global Small Launch Vehicle (SLV) Market

5.3.6.1.2 Product Portfolio

5.3.6.2 Strength of Interorbital System

5.3.6.3 Analyst View

5.3.7 Israel Aerospace Industries Ltd.

5.3.7.1 Company Overview

5.3.7.1.1 Role of Israel Aerospace Industries Ltd. in the Global Small Launch Vehicle (SLV) Market

5.3.7.1.2 Product Portfolio

5.3.7.2 Strength of Israel Aerospace Industries Ltd.

5.3.7.3 Analyst View

5.3.8 Northrop Grumman Corporation

5.3.8.1 Company Overview

5.3.8.1.1 Role of Northrop Grumman Corporation in the Global Small Launch Vehicle (SLV) Market

5.3.8.1.2 Product Portfolio

5.3.8.2 Business Strategies

5.3.8.2.1 New Product Launches

5.3.8.3 Strength of Northrop Grumman Corporation

5.3.8.4 Analyst View

5.3.9 Rocket Lab USA, Inc.

5.3.9.1 Company Overview

5.3.9.1.1 Role of Rocket Lab USA, Inc. in the Global Small Launch Vehicle (SLV) Market

5.3.9.1.2 Product Portfolio

5.3.9.2 Business Strategies

5.3.9.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.3.9.3 Corporate Strategies

5.3.9.3.1 Mergers & Acquisitions

5.3.9.4 Strength of Rocket Lab USA, Inc.

5.3.9.5 Analyst View

5.4 Key Emerging and Other Market Players

5.4.1 ABL Space Systems

5.4.1.1 Company Overview

5.4.1.1.1 Role of ABL Space Systems in the Global Small Launch Vehicle (SLV) Market

5.4.1.1.2 Product Portfolio

5.4.1.2 Business Strategies

5.4.1.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.1.3 Strength of ABL Space Systems

5.4.2 Agnikul Cosmos Private Limited

5.4.2.1 Company Overview

5.4.2.1.1 Role of Agnikul Cosmos Private Limited in the Global Small Launch Vehicle (SLV) Market

5.4.2.1.2 Product Portfolio

5.4.2.2 Business Strategies

5.4.2.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.2.3 Strength of Agnikul Cosmos Private Limited

5.4.3 CubeCab

5.4.3.1 Company Overview

5.4.3.1.1 Role of CubeCab in the Global Small Launch Vehicle (SLV) Market

5.4.3.1.2 Launch Capability of CubeCab

5.4.3.1.3 Product Portfolio

5.4.3.2 Strength of CubeCab

5.4.4 EUROCKOT Launch Services GmbH

5.4.4.1 Company Overview

5.4.4.1.1 Role of EUROCKOT Launch Services GmbH in the Global Small Launch Vehicle (SLV) Market

5.4.4.1.2 Product Portfolio

5.4.4.2 Strength of EUROCKOT Launch Services GmbH

5.4.5 Firefly Aerospace Inc.

5.4.5.1 Company Overview

5.4.5.1.1 Role of Firefly Aerospace Inc. in the Global Small Launch Vehicle (SLV) Market

5.4.5.1.2 Product Portfolio

5.4.5.2 Business Strategies

5.4.5.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.5.3 Strength of Firefly Aerospace Inc.

5.4.6 Gilmour Space Technologies

5.4.6.1 Company Overview

5.4.6.1.1 Role of Gilmour Space Technologies in the Global Small Launch Vehicle (SLV) Market

5.4.6.1.2 Product Portfolio

5.4.6.2 Business Strategies

5.4.6.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.6.3 Strength of Gilmour Space Technologies

5.4.7 HyImpulse Technologies GmbH

5.4.7.1 Company Overview

5.4.7.1.1 Role of HyImpulse Technologies GmbH in the Global Small Launch Vehicle (SLV) Market

5.4.7.1.2 Product Portfolio

5.4.7.2 Business Strategies

5.4.7.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.7.3 Strength of HyImpulse Technologies GmbH

5.4.8 Orbex

5.4.8.1 Company Overview

5.4.8.1.1 Role of Orbex in the Global Small Launch Vehicle (SLV) Market

5.4.8.1.2 Product Portfolio

5.4.8.2 Business Strategies

5.4.8.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.8.3 Strength of Orbex

5.4.9 PLD Space

5.4.9.1 Company Overview

5.4.9.1.1 Role of PLD Space in the Global Small Launch Vehicle (SLV) Market

5.4.9.1.2 Product Portfolio

5.4.9.2 Business Strategies

5.4.9.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.9.3 Strength of PLD Space

5.4.10 Skyroot Aerospace Private Limited

5.4.10.1 Company Overview

5.4.10.1.1 Role of Skyroot Aerospace Private Limited in the Global Small Launch Vehicle (SLV) Market

5.4.10.1.2 Product Portfolio

5.4.10.2 Business Strategies

5.4.10.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.10.3 Strength of Skyroot Aerospace Private Limited

5.4.11 Virgin Orbit

5.4.11.1 Company Overview

5.4.11.1.1 Role of Virgin Orbit in the Global Small Launch Vehicle (SLV) Market

5.4.11.1.2 Product Portfolio

5.4.11.2 Business Strategies

5.4.11.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.11.3 Corporate Strategies

5.4.11.3.1 Mergers & Acquisitions

5.4.11.4 Strength of Virgin Orbit

6 Research Methodology

6.1 Factors for Data Prediction and Modelling

7 Appendix

7.1 Global Satellite Launch Market by Mass (0 – 500 Kg), 2021-2032

7.1.1 LEO (Non-Polar Inclined)

7.1.2 LEO (Sun-synchronous orbit)

7.1.3 LEO (Polar)

7.1.4 Medium Earth Orbit (MEO)

7.1.5 Geostationary Earth Orbit (GEO)

7.2 Global Satellite Launch Market by Mass (501 – 2,200 Kg), 2021-2032

7.2.1 LEO (Non-Polar Inclined)

7.2.2 LEO (Sun-synchronous orbit)

7.2.3 LEO (Polar)

7.2.4 Medium Earth Orbit (MEO)

7.2.5 Geostationary Earth Orbit (GEO)

Note: Detailed information on satellite launches (as per mass category), both historic and forecast (2021-2032) can be accessed in spreadsheet format along with the report at an additional cost. It will cover the details for satellite mass category ranging from 0-50 Kg, 51-200 Kg, 201-600 Kg, 601-1,200 Kg 1,201-1,400 Kg and 1,401 Kg and above

List of Figures

Figure 1: Global Small Launch Vehicle (SLV) Market, Volume (Number of Successful Launches), 2021-2032

Figure 2: Global Small Launch Vehicle (SLV) Market, Value ($Million), 2021-2032

Figure 3: Global Small Launch Vehicle (SLV) Market (by Satellite Mass), Volume (Number of Successful Launches), 2021 and 2032

Figure 4: Global Small Launch Vehicle (SLV) Market (by Satellite Mass), Value ($Million), 2021 and 2032

Figure 5: Global Small Launch Vehicle (SLV) Market (by Platform Type), Value ($Million), 2021 and 2032

Figure 6: Global Small Launch Vehicle (SLV) Market (by Propulsion Type), Value ($Million), 2021 and 2032

Figure 7: Global Small Launch Vehicle (SLV) Market (by Service Type), Value ($Million), 2021 and 2032

Figure 8: Global Small Launch Vehicle (SLV) Market (by Pre-Launch Service Type), Value ($Million), 2021 and 2032

Figure 9: Global Small Launch Vehicle (SLV) Market (by Post-Launch Service Type), Value ($Million), 2021 and 2032

Figure 10: Global Small Launch Vehicle (SLV) Market (by End-User Type), Value ($Million), 2021 and 2032

Figure 11: Global Small Launch Vehicle (SLV) Market (by Region), $Million, 2032

Figure 12: Global Small Launch Vehicle (SLV) Market Coverage

Figure 13: Small Satellite Scenario (0-2,200Kg), 2021-2032

Figure 14: Global Small Launch Vehicle (SLV) Market: Business Dynamics

Figure 15: Global Small Launch Vehicle (SLV) Market (by End User)

Figure 16: Small Launch Vehicle Supply Players, Benchmarking Score, 2021

Figure 17: Small Launch Vehicle Market Share (by Market Player) (Number of Successful Launches), 2021

Figure 18: Research Methodology

Figure 19: Top-Down and Bottom-Up Approach

Figure 20: Assumptions and Limitations

List of Tables

Table 1: Evolution of SLVs, 2010-2021

Table 2: Launch Vehicle Mapping with Satellite/Payload, Orbit, and Launch Site

Table 3: Classification of small satellites, by mass category

Table 4: Expected Launches of Small Satellite Constellations by 2026

Table 5: Technological Roadmap, 2010-2035

Table 6: Key Start-Ups in the Ecosystem

Table 7: Partnerships, Collaborations, Agreements, and Contracts, January 2019-February 2022

Table 8: Mergers & Acquisitions, January 2020-February 2022

Table 9: Global Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 10: Global Small Launch Vehicle (SLV) Market (by Satellite Mass), Volume and Value, 2021-2032

Table 11: Global Small Launch Vehicle (SLV) Market (by Platform Type)

Table 12: Global Small Launch Vehicle (SLV) Market (by Platform Type), $Million, 2021-2032

Table 13: Global Small Launch Vehicle (SLV) Market (by Propulsion Type), 2021-2032

Table 14: Global Small Launch Vehicle (SLV) Market, (by Service Type), 2021-2032

Table 15: Global Small Launch Vehicle (SLV) Market (Pre-Launch Service, by Service Type), 2021-2032

Table 16: Global Small Launch Vehicle (SLV) Market, (Post-Launch Service, by Service Type), 2021-2032

Table 17: Launch Cost

Table 18: Work Breakdown Structure (WBS)

Table 19: Global Small Launch Vehicle (SLV) Market (by Region), Value and Volume, 2021-2032

Table 20: North America Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 21: North America Small Launch Vehicle (SLV) Market (by Satellite Mass), Value and Volume, 2021-2032

Table 22: U.S. Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 23: U.S. Small Launch Vehicle (SLV) Market (by Satellite Mass), Value and Volume, 2021-2032

Table 24: Canada Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 25: Canada Small Launch Vehicle (SLV) Market (by Satellite Mass), Value and Volume, 2021-2032

Table 26: Europe Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 27: Europe Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 28: U.K. Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 29: U.K. Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 30: Germany Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 31: Germany Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 32: France Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 33: France Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 34: Russia Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 35: Russia Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 36: Rest-of-Europe Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 37: Rest-of-Europe Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 38: Asia-Pacific Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 39: Asia-Pacific Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 40: China Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 41: China Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 42: India Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 43: India Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 44: Japan Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 45: Japan Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 46: Australia Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 47: Australia Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 48: Rest-of-Asia-Pacific Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 49: Rest-of-Asia-Pacific Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 50: Rest-of-the-World Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 51: Rest-of-the-World Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 52: Middle East and Africa Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 53: Middle East and Africa Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 54: Latin America Small Launch Vehicle (SLV) Market (by End User), $Million, 2021-2032

Table 55: Latin America Small Launch Vehicle (SLV) Market (by Satellite Mass), $Million, 2021-2032

Table 56: Benchmarking and Weightage Parameters

Table 57: Arianespace: Product and Service Portfolio

Table 58: Arianespace: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 59: Astra Space, Inc.: Product Portfolio

Table 60: Astra Space, Inc.: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 61: Galactic Energy (Beijing) Space Technology Co., LTD.: Product Portfolio

Table 62: Galactic Energy (Beijing) Space Technology Co., LTD.: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 63: China Aerospace Science and Technology Corporation (CASC): Product Portfolio

Table 64: IHI Aerospace Co. Ltd.: Product Portfolio

Table 65: IHI Aerospace Co. Ltd.: New Product Launches

Table 66: Interorbital System: Product Portfolio

Table 67: Israel Aerospace Industries Ltd.: Product Portfolio

Table 68: Northrop Grumman Corporation: Product Portfolio

Table 69: Northrop Grumman Corporation: New Product Launches

Table 70: Rocket Lab USA, Inc.: Product Portfolio

Table 71: Rocket Lab USA, Inc.: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 72: Rocket Lab USA, Inc.: Mergers & Acquisitions

Table 73: ABL Space Systems: Product Portfolio

Table 74: ABL Space Systems: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 75: Agnikul Cosmos Private Limited: Product Portfolio

Table 76: Agnikul Cosmos Private Limited: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 77: CubeCab: Product Portfolio

Table 78: EUROCKOT Launch Services GmbH: Product and Service Portfolio

Table 79: Firefly Aerospace Inc.: Product Portfolio

Table 80: Firefly Aerospace Inc.: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 81: Gilmour Space Technologies: Product Portfolio

Table 82: Gilmour Space Technologies: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 83: HyImpulse Technologies GmbH: Product Portfolio

Table 84: HyImpulse Technologies GmbH: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 85: Orbex: Product Portfolio

Table 86: Orbex: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 87: PLD Space: Product Portfolio

Table 88: PLD Space: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 89: Skyroot Aerospace Private Limited: Product Portfolio

Table 90: Skyroot Aerospace Private Limited: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 91: Virgin Orbit: Product Portfolio

Table 92: Virgin Orbit: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 93: Virgin Orbit: Mergers & Acquisitions

Table 94: Global Satellite Launch Market by Mass (0 – 500 Kg), Volume, 2021 - 2032

Table 95: Global Satellite Launch Market by Mass (501 – 2,200 Kg), Volume, 2021 - 2032

Companies Mentioned

- Arianespace

- Astra Space, Inc.

- Galactic Energy (Beijing) Space Technology Co., LTD.

- China Aerospace Science and Technology Corporation (CASC)

- IHI Aerospace Co. Ltd.

- Interorbital System

- Israel Aerospace Industries Ltd.

- Northrop Grumman Corporation

- Rocket Lab USA, Inc.

- ABL Space Systems

- Agnikul Cosmos Private Limited

- CubeCab

- EUROCKOT Launch Services GmbH

- Firefly Aerospace Inc.

- Gilmour Space Technologies

- HyImpulse Technologies GmbH

- Orbex

- PLD Space

- Skyroot Aerospace Private Limited

- Virgin Orbit

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | March 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 1322.2 Million |

| Forecasted Market Value ( USD | $ 4624 Million |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |