Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Energy Demand and Exploration Activities

The Global Oilfield Services Market is propelled by the relentless surge in global energy demand, serving as a linchpin for exploration and production activities. With the world's increasing reliance on hydrocarbons to meet its energy needs, oilfield services become instrumental in uncovering new reserves and optimizing existing fields. The escalating demand for oil and gas, particularly in emerging economies, stimulates heightened exploration efforts, thereby driving the need for specialized services. Oilfield service providers play a pivotal role in enabling the discovery and extraction of hydrocarbons, ensuring a continuous and reliable supply to meet the ever-growing energy requirements of industries and consumers worldwide. As the nexus between energy demand and exploration activities intensifies, the oilfield services market remains a key facilitator in satiating the global appetite for hydrocarbon resources.Technological Advancements and Enhanced Oil Recovery (EOR) Techniques

Technological advancements constitute a major driver propelling the Global Oilfield Services Market. The industry is witnessing a transformative era with the integration of advanced technologies such as artificial intelligence, robotics, and data analytics into oilfield operations. These innovations enhance exploration accuracy, improve drilling efficiency, and optimize reservoir management. Furthermore, the adoption of Enhanced Oil Recovery (EOR) techniques, including advanced well stimulation and injection methods, underscores the industry's commitment to maximizing hydrocarbon recovery from reservoirs. As oilfield services embrace cutting-edge technologies, they play a pivotal role in unlocking the potential of unconventional resources and extending the productive life of mature fields, thereby ensuring sustained energy supply in an era of increasing complexity and resource scarcity.Globalization and Expanding Offshore Exploration

The globalization of the energy landscape and the expansion of offshore exploration activities emerge as key drivers shaping the trajectory of the Global Oilfield Services Market. As accessible onshore reserves become increasingly tapped, oil and gas operators venture into deeper waters and more challenging offshore environments in pursuit of untapped resources. This shift necessitates specialized services, including offshore drilling, subsea engineering, and well intervention, which are integral components of the oilfield services market. The globalization of exploration efforts reflects the industry's adaptability to geographical shifts in resource abundance, driving the demand for services tailored to the intricacies of offshore operations, and positioning oilfield service providers as indispensable partners in the evolving energy landscape.Regulatory Frameworks and Environmental Compliance

The regulatory landscape and a heightened focus on environmental compliance represent crucial drivers influencing the Global Oilfield Services Market. As governments worldwide implement stringent regulations to ensure safe and environmentally responsible oil and gas operations, oilfield service providers play a pivotal role in assisting operators in meeting compliance standards. The market responds to evolving environmental norms by offering technologies and services that minimize ecological impacts, such as advanced drilling technologies, eco-friendly well completion methods, and environmentally conscious waste management practices. The commitment to sustainable and responsible energy extraction positions oilfield services as a critical component in aligning the industry with global environmental goals, ensuring that exploration and production activities meet stringent regulatory requirements.Geopolitical Factors and OPEC+ Dynamics

Geopolitical factors and the dynamics of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) significantly influence the Global Oilfield Services Market. The oil and gas sector is inherently sensitive to geopolitical tensions, supply disruptions, and fluctuations in oil prices driven by geopolitical events. The strategic decisions of major oil-producing nations and their collaboration through OPEC+ agreements impact production levels and investment patterns in the industry. Oilfield service providers navigate this geopolitical landscape by adapting to changing market dynamics, providing services aligned with production strategies set by major oil-producing nations, and contributing to the industry's resilience amid geopolitical uncertainties. As geopolitical factors continue to shape the global energy market, oilfield services remain essential in enabling the industry to respond effectively to geopolitical shifts and maintain a stable and reliable supply of hydrocarbons to the global market.Key Market Challenges

Volatility in Oil Prices and Market Uncertainties

A paramount challenge confronting the Global Oilfield Services Market is the inherent volatility in oil prices and the resultant market uncertainties. The industry's dependency on oil and gas prices renders oilfield services providers susceptible to fluctuations in global economic conditions, geopolitical tensions, and supply-demand dynamics. Periods of low oil prices often lead to reduced exploration and production activities as companies curtail capital expenditures, impacting the demand for oilfield services. Conversely, surges in oil prices may trigger increased activity but also introduce uncertainties, as companies navigate shifting market dynamics. This volatility poses a formidable challenge for oilfield services providers in terms of business planning, financial stability, and strategic decision-making. Adapting to this ever-changing landscape requires a combination of risk management strategies, cost-efficiency measures, and the ability to provide flexible solutions that align with the cyclical nature of the oil and gas industry.Technological and Digitalization Challenges

The rapid pace of technological advancements presents a complex challenge for the Global Oilfield Services Market. While embracing innovations such as artificial intelligence, data analytics, and automation can enhance operational efficiency and optimize resource extraction, the integration of these technologies poses hurdles. The oilfield services sector faces challenges related to the implementation of new technologies, including substantial upfront investments, the need for skilled personnel, and the integration of advanced systems into existing operations. Additionally, ensuring cybersecurity in an era of increasing digitalization becomes imperative to safeguard critical data and maintain the integrity of operations. Balancing the adoption of cutting-edge technologies with the associated challenges of implementation, training, and cybersecurity remains a significant task for oilfield services providers seeking to stay at the forefront of technological innovation while ensuring the reliability and security of their services.Environmental and Regulatory Compliance Pressures

Environmental and regulatory compliance pressures emerge as substantial challenges for the Global Oilfield Services Market, driven by a global shift towards sustainable and responsible energy practices. Stringent environmental regulations, aimed at minimizing the ecological footprint of oil and gas operations, necessitate significant adjustments in the industry's practices. Oilfield services providers must navigate compliance with evolving environmental standards, including emissions reduction targets, waste management regulations, and adherence to sustainable practices. These compliance pressures introduce complexities in project planning, execution, and ongoing operations, requiring continual adaptation to evolving regulatory landscapes. Striking a balance between meeting environmental goals and ensuring operational efficiency poses a significant challenge for oilfield services providers as they work towards minimizing environmental impacts without compromising the industry's ability to meet global energy demands.Geopolitical Tensions and Supply Chain Disruptions

The Global Oilfield Services Market faces persistent challenges arising from geopolitical tensions and supply chain disruptions. Geopolitical uncertainties, including trade conflicts, regional conflicts, and sanctions, can impact the accessibility of oil reserves, introduce market uncertainties, and influence investment decisions. Additionally, the interconnected nature of the global supply chain exposes oilfield services providers to disruptions in the availability of critical equipment, materials, and skilled personnel. Geopolitical events, such as sanctions on key oil-producing nations or disruptions in major transportation routes, can create bottlenecks in the supply chain, leading to delays and increased costs. Navigating these geopolitical complexities and ensuring the resilience of the supply chain become crucial challenges for oilfield services providers, necessitating strategic planning, risk mitigation measures, and the development of agile, adaptable business models to withstand geopolitical uncertainties and supply chain disruptions.Key Market Trends

Integration of Digital Technologies and IoT in Oilfield Operations

The Global Oilfield Services Market is witnessing a transformative trend with the increasing integration of digital technologies and the Internet of Things (IoT) into oilfield operations. This shift towards digitization is driven by the industry's quest for enhanced efficiency, real-time monitoring, and predictive maintenance. Oilfield services providers are leveraging advanced sensors, data analytics, and connectivity to collect and analyze vast amounts of data from drilling rigs, production equipment, and reservoirs. This wealth of information enables operators to make data-driven decisions, optimize performance, and proactively address equipment issues. The adoption of IoT technologies facilitates seamless communication between various components of oilfield operations, creating a more interconnected and responsive ecosystem. As the industry continues to embrace digital transformation, the integration of IoT in oilfield services is a trend that not only enhances operational efficiency but also positions the sector at the forefront of technological innovation within the broader energy landscape.Focus on Sustainability and Environmentally Friendly Practices

A prominent trend shaping the Global Oilfield Services Market is the increasing emphasis on sustainability and environmentally friendly practices. As the world grapples with climate change concerns, oil and gas companies, along with their service providers, are aligning their operations with stringent environmental standards. Oilfield services are evolving to incorporate eco-friendly practices in areas such as drilling techniques, well completion methods, and waste management. Providers are investing in technologies that reduce carbon footprints, minimize water usage, and mitigate environmental impacts. This trend reflects a broader industry commitment to sustainable resource extraction and responsible energy practices. As regulatory pressures intensify and stakeholder expectations for environmental responsibility rise, oilfield services are adapting to provide solutions that not only meet the industry's operational needs but also contribute to global efforts for a more sustainable and eco-conscious energy sector.Enhanced Focus on Unconventional Resources and Offshore Exploration

The Global Oilfield Services Market is experiencing a notable trend with an enhanced focus on unconventional resources and offshore exploration. As conventional reserves become more challenging to access, oil and gas operators are increasingly turning to unconventional resources such as shale and tight oil. This trend necessitates specialized services, including hydraulic fracturing and advanced drilling techniques, to unlock the potential of unconventional reservoirs. Simultaneously, offshore exploration is expanding into deeper waters and more complex environments, driving the demand for services tailored to the intricacies of offshore operations. Oilfield services providers are adapting their offerings to address the unique challenges posed by unconventional resources and offshore exploration, positioning themselves as vital partners in facilitating the industry's quest for new reserves and sustaining global energy supplies.Adoption of Rigless Intervention Techniques

A notable trend in the Global Oilfield Services Market is the increasing adoption of rigless intervention techniques. Traditionally, well interventions required the use of drilling rigs, which can be costly and time-consuming. However, advancements in technology and techniques have enabled the industry to conduct interventions without the need for a rig. Rigless interventions, such as coiled tubing, wireline, and hydraulic workovers, offer more cost-effective and efficient solutions for well maintenance, stimulation, and remediation. These techniques allow operators to perform interventions without shutting down production, reducing downtime and operational costs. The adoption of rigless intervention methods aligns with the industry's focus on operational efficiency, cost-effectiveness, and minimizing the environmental footprint of oilfield activities. As these techniques continue to evolve and gain wider acceptance, they are reshaping the landscape of well intervention services and contributing to the overall efficiency of oilfield operations.Increasing Role of Data Analytics and Predictive Maintenance

Data analytics and predictive maintenance are emerging as pivotal trends in the Global Oilfield Services Market, revolutionizing the way equipment is managed and maintained. Oilfield services providers are increasingly harnessing the power of big data to analyze equipment performance, identify potential issues, and predict maintenance needs. Predictive maintenance models leverage machine learning algorithms to analyze historical data, real-time sensor data, and operational patterns to forecast equipment failures before they occur. This proactive approach minimizes downtime, reduces operational costs, and enhances the reliability of oilfield equipment. The integration of data analytics and predictive maintenance aligns with the industry's broader digital transformation, emphasizing the importance of intelligent decision-making and efficient resource management. As the capabilities of data analytics continue to expand, its role in optimizing oilfield services is becoming increasingly pronounced, driving a paradigm shift towards more data-driven and efficient oil and gas operations.Segmental Insights

Service Type Insights

The Global Oilfield Services Market witnessed the dominance of the Drilling Services segment, establishing itself as the frontrunner in the array of services offered within the industry. Drilling Services, which encompass a spectrum of activities related to the initial phase of oil and gas exploration, from wellbore creation to reaching target reservoirs, emerged as the primary driver of market demand. The prominence of Drilling Services can be attributed to the critical role they play in the exploration and development of oil and gas resources, serving as the foundational element in the entire hydrocarbon extraction process. As the industry continues to explore complex geological formations and unconventional reserves, the demand for advanced and specialized drilling services remains robust. Drilling activities are pivotal in determining the success of oilfield operations, and thus, the dominance of the Drilling Services segment underscores its indispensable position in the overall oilfield services landscape. This trend is anticipated to persist during the forecast period, as the global energy landscape evolves, and oil and gas operators prioritize efficient and technologically advanced solutions for their drilling requirements. While other service segments, such as Completion Services, Production and Intervention Services, and Other Services, play vital roles in subsequent stages of oilfield operations, the enduring dominance of Drilling Services reflects its central role in shaping the trajectory of the Global Oilfield Services Market.Location of Deployment Insights

The Global Oilfield Services Market experienced the dominance of the Onshore segment, solidifying its pivotal role within the industry's operational landscape. Onshore deployment, involving oil and gas activities conducted on land, emerged as the primary driver of market demand. The dominance of the Onshore segment can be attributed to several factors, including the accessibility and relative simplicity of onshore exploration and production compared to offshore operations. Onshore projects generally involve less complex logistics, shorter project timelines, and reduced operational challenges, contributing to the sustained preference for onshore services. Furthermore, the global emphasis on increased domestic production, coupled with the abundance of onshore reserves in various regions, fueled substantial investments in onshore oil and gas projects. The Onshore segment's resilience is underpinned by its vital role in meeting the world's growing energy needs, as well as its adaptability to evolving market conditions. While offshore operations remain essential for tapping into deepwater and challenging reservoirs, the logistical and cost complexities associated with offshore projects contribute to the continued dominance of the Onshore segment in the Global Oilfield Services Market. This trend is anticipated to endure during the forecast period, highlighting the enduring significance of onshore activities in driving the demand for oilfield services within the dynamic and evolving energy landscape.Regional Insights

Middle East & Africa region emerged as the dominant force in the Global Oilfield Services Market, underscoring its pivotal role in the global energy landscape. The Middle East & Africa, renowned for its vast oil and gas reserves and strategic position as a major player in the global energy market, exhibited a robust demand for oilfield services. Key countries such as Saudi Arabia, the United Arab Emirates, and Iraq witnessed substantial investments in both onshore and offshore exploration and production activities, contributing significantly to the dominance of the Middle East & Africa in the oilfield services sector. The region's dominance is further propelled by its proactive approach in adopting advanced technologies and its commitment to maintaining leadership in global oil production. Ongoing projects, including the development of unconventional reserves and the exploration of challenging environments, solidify the Middle East & Africa's position as a key influencer in the oilfield services market. The region's enduring dominance is anticipated to persist during the forecast period, driven by its continuous focus on technological advancements, exploration of new reserves, and sustained investments in the oil and gas sector. While other regions contribute substantially to the global oilfield services market, the unique combination of abundant reserves, strategic investments, and a commitment to technological progress solidifies the Middle East & Africa's role as the primary driver in the dynamic and competitive landscape of the Global Oilfield Services Market.Report Scope

In this report, the Global Oilfield Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Oilfield Services Market, By Service Type:

- Drilling Services

- Completion Services

- Production and Intervention Services

- Other Services

Oilfield Services Market, By Location of Deployment:

- Onshore

- Offshore

Oilfield Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oilfield Services Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Oilfield Services market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco, Inc.

- Saipem S.p.A.

- Petrofac Limited

- TechnipFMC plc

- C&J Energy Services, Inc.

- Archer Well Company

Table Information

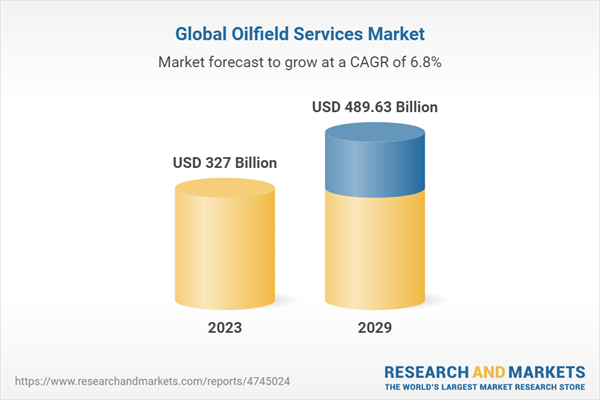

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 327 Billion |

| Forecasted Market Value ( USD | $ 489.63 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |