Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Consumer expectations for seamless, safe, and flexible urban mobility are accelerating technological innovations within ride hailing platforms. Features like real-time tracking, digital payments, and AI-enabled routing are becoming standard offerings. Electrification of ride hailing fleets is also gaining traction as sustainability and emission reduction become policy and consumer priorities. Investors are eyeing the sector's long-term potential, which is leading to increased funding and app development targeted toward regional needs and linguistic preferences.

Despite growth prospects, the market faces barriers linked to regulatory inconsistencies, traffic congestion, and infrastructure challenges in several countries. Informal taxi networks, fragmented urban planning, and limited charging infrastructure for electric vehicles can hamper seamless service delivery. To overcome these challenges, collaboration between private operators and governments will be vital. Enhanced vehicle safety protocols, efficient driver onboarding processes, and user-friendly interfaces will be key to building customer trust and market stability in the long term.

Market Drivers

Urban Population Growth

Increasing migration toward urban centers is leading to a surge in demand for on-demand transportation. According to the International Energy Agency (IEA), the Middle East’s passenger car fleet reached around 40 million vehicles in 2023, with urban centers like Riyadh, Dubai, and Cairo driving rising demand for ride-hailing services. Urban congestion and young populations are key factors behind the region’s appetite for shared mobility solutions.The influx of people into cities puts pressure on public transit systems, making ride hailing an attractive alternative due to its convenience and responsiveness. With limited parking spaces and congestion in metro areas, the appeal of accessing transport on a per-use basis continues to grow. Ride hailing apps are catering to this need by offering scalable and reliable mobility options, helping bridge the gap left by traditional taxi services or underdeveloped public networks. As cities expand both horizontally and vertically, the need for flexible transport solutions that offer last-mile connectivity grows more urgent, making ride hailing a strategic mobility partner in urban planning.

Key Market Challenges

Regulatory and Licensing Barriers

Varying regulations across countries and cities create operational uncertainties for ride hailing services. Differences in licensing, driver background checks, fare limits, and vehicle requirements complicate compliance efforts. Regulatory gaps or sudden policy changes can lead to service disruptions, fines, or even bans. Navigating these bureaucratic landscapes requires significant legal expertise and local engagement, particularly in regions where transport laws are still evolving. A lack of standardization limits scalability and can increase operational costs for platforms aiming to expand.Key Market Trends

Integration with Public Transport Networks

Ride hailing platforms are increasingly integrating with city transport systems to enable multimodal journey planning. This includes linking app services with metro, bus, or light rail networks for first and last-mile connectivity. Users benefit from a single platform that maps out entire commutes, enabling smoother transitions between modes. Such integration supports city-wide transport optimization, reduces road congestion, and enhances commuter convenience. Partnerships with municipal authorities and the adoption of Mobility-as-a-Service (MaaS) platforms are central to this trend.Key Market Players

- Uber Middle East FZ LLC (Uber)

- Careem Networks FZ LLC

- Bolt Technology OU

- Soul Innovations Ltd (inDrive)

- Didi Global Inc

- Kayan Rehla Information Technology Company (Kaiian)

- KOI Ride

- Sixt Ride GmbH & Co. KG

- XXRIDE For Electronic Transport Services

- Cloud World Trading LLC - Otaxi

Report Scope:

In this report, the Middle East & Africa Ride Hailing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East & Africa Ride Hailing Market, By Service Type:

- Single

- Rental

Middle East & Africa Ride Hailing Market, By Vehicle Type:

- ICE

- Electric

Middle East & Africa Ride Hailing Market, By Fare Type:

- Economy

- Premium

Middle East & Africa Ride Hailing Market, By Country:

- Saudi Arabia

- UAE

- Egypt

- Qatar

- Oman

- South Africa

- Turkey

- Nigeria

- Rest of Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East & Africa Ride Hailing Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Uber Middle East FZ LLC (Uber)

- Careem Networks FZ LLC

- Bolt Technology OU

- Soul Innovations Ltd (inDrive)

- Didi Global Inc

- Kayan Rehla Information Technology Company (Kaiian)

- KOI Ride

- Sixt Ride GmbH & Co. KG

- XXRIDE For Electronic Transport Services

- Cloud World Trading LLC – Otaxi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

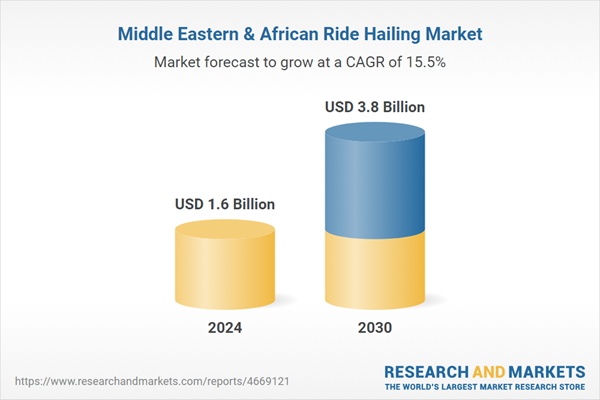

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |