New Technology enablers, like e-Sim, AI, ML, and edge computing, are creating new opportunities for MVNOs.

Key Highlights

- The growing penetration of mobile devices is driving the market's growth. GSMA predicted that by the end of 2021, 5.3 billion individuals had subscribed to mobile services, accounting for 67% of the global population. Most people now own a mobile phone in increasing markets, implying that future growth will come from younger populations taking out their first mobile subscription. Over the next five years, an additional 400 million new mobile users are anticipated to be added, most of whom will be from the Asia-Pacific and Sub-Saharan Africa, bringing the total number of subscribers to 5.7 billion (70% of the global population).

- Furthermore, mobile technology and services generated USD 4.5 trillion in economic value added, or 5% of global GDP in 2021. This value is expected to more than double by 2025, reaching approximately USD 5 trillion, as countries benefit from higher productivity and efficiency brought about by the growing use of mobile services.

- As per GSMA, India is on its way to becoming the second-largest smartphone market globally by 2025, with around 1 billion installed devices. It is expected to have 920 million unique mobile subscribers by 2025, including 88 million 5G connections.

- Further, the leading companies in the market are indulging in partnerships to offer their innovative products in different markets to gain more market presence. For instance, in June 2022, Plan.com launched its second mobile network on its connectivity platform via its Mobile Virtual Network Operator (MVNO) agreement with BT Wholesale. The company has expertise in providing innovative connectivity and productivity solutions to businesses across the United Kingdom through my.plan. The deal with BT Wholesale gives customers a choice, flexibility, and access to a second mobile network to take advantage of EE's connectivity.

- The increasing number of services such as cloud, Machine to Machine (M2M) transactions, and mobile money are further expected to augment demand for mobile virtual network operators over the forecast period.

- Retail MVNO subscriptions may provide users with grocery discounts and loyalty card perks or may help the retailer better target its customer base. An example of a retail MVNO is Asda Supermarket's Asda Mobile.

- In June 2022, Reach Mobile announced that it had extended its strategic, turnkey Wholesale-as-a-Service (WaaS) agreement with T-Mobile, America's 5G leader, with the most prominent, fastest, and most reliable nationwide 5G network. The companies would use ReachNEXT, a Software-as-a-Service (SaaS) platform that accelerates and streamlines how businesses bring network-based services to market. T-Mobile wholesale customers can utilize ReachNEXT, a one-stop shop for launching and operating use cases such as MVNO, Fixed Wireless Access, Failover Internet, and IOT, with unprecedented simplicity and speed, potentially reaching millions of homes. The announcement also extends a multi-year MVNO agreement through which T-Mobile would continue to serve as the network for Reach Mobile's nationwide subscribers.

- The COVID-19 pandemic accelerated the demand for agile and flexible work styles and further pushed the adoption of communication services that enhance work-life balance. Moreover, telecom regulators had postponed their plans for a 5G spectrum auction amid the global pandemic. The pandemic forced telecom operators worldwide to test their network resiliency and revisit their planned investments, especially in 5G technology.

Mobile Virtual Network Operator (MVNO) Market Trends

Consumer Segment is Expected to Hold a Significant Market Share

- This is the primary and the most focused segment among MVNOs. The growing number of single mobile subscribers and the increasing mobile penetration in emerging economies are the major factors fuelling the segment's growth.

- The market's prominent players provide wireless services at competitive costs worldwide. For instance, in July 2022, Boost Mobile introduced Connected Car, a turnkey solution for mobile internet at flexible prices. With Boost, anyone can get Wi-Fi in their automobile. Connect multiple tablets, computers, and phones in the consumer car and take them everywhere. During long road journeys, they can now stream their favorite shows and movies, surf the web and listen to their favorite podcasts and songs without using their cell phone's data plan. The Connected Car plan users get a remote Wi-Fi hotspot and mobile access to 5GB of 4G LTE data.

- Moreover, in August 2022, Verizon announced that college students may now get Fios, a lightning-fast fiber optic network, for as little as USD 20 per month with AutoPay and specific 5G mobile plans. As colleges and institutions continue to provide students with virtual options for lectures - and some students admit to staying up until the wee hours of the morning on term papers - reliable and affordable home internet should not be an issue.

- Traditionally, B2C or consumer segment dominated over the B2B segment regarding innovation and pricing. Billing and managing a fleet of devices is much more difficult than simple consumer service. Due to convenience and profit margins, MVNOs prefer investing in the consumer segment.

- The growing adoption of e-SIM is also expected to expand the scope of the segment. The e-SIM, with the remote provisioning standards created by the GSMA, provides simplicity and flexibility to MVNOs' vendors.

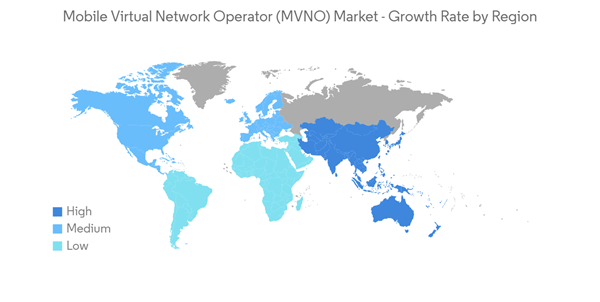

Asia-Pacific is Expected to Hold a Major Market Share

- The Asia-Pacific area accounts for a significant market share, as the region has always remained at the forefront in adopting technological advancements like 5G technology, connected mobile devices, and smartphone penetration, amongst others.

- The Asia-Pacific is a significant smartphone market, owing to the region's rapidly increasing telecom sector and extensive client base. Furthermore, the region is spending more on wireless network services. Countries like India, Japan, Australia, Singapore, and South Korea are expanding their investments in the growth of their domestic telecom markets, which are likely to boost the MVNO market demand across the region.

- China's mobile market has planned to open up to commercial licenses for MVNOs after the Ministry of Industry and Information and Technology (MIIT) launched a public consultation seeking industry input and feedback on the government's proposal to allow commercial MVNO licenses, including foreign-invested firms.

- The number of mobile phone base stations has continued to increase, and the construction of 5G networks has made steady progress. According to Huang Chengqing, vice president of the Internet Society of China, China will have 9.96 million mobile phone base stations by December 2021, and the number of mobile phone users is also rapidly increasing. By 2021, China's overall mobile phone user population reached 1.643 billion, with 355 million using 5G phones. These trends are expected to boost the revenues of MVNOs in China during the forecast period.

- The increased demand from developing countries, such as India and Indonesia, where smartphones are increasingly accessing rural regions as local governments push for digital and mobile economies, is likely to drive demand for smartphones at entry-level price points. For example, the Government of India's Digital India program is a flagship program aiming to transform the country into a digitally enabled society.

- For instance, in July 2021, with the Vivo Y72, Vivo Communication Technology Co. Ltd increased its 5G offering in India. At INR 20,990, the Y72 provides a superior smartphone experience with its powerful features and a visibly unique design in its category. The phone has 8GB+4GB extendable RAM, which keeps it from choking while multitasking.

- The Chinese government has also been pushing the development of its 5G industry, favoring its own companies, such as Huawei and ZTE, which make equipment necessary for the technology to work. Moreover, according to GSMA, there will be 807 million 5G connections by 2025. China is expected to account for the most significant number of 5G connections globally in 2025.

Mobile Virtual Network Operator (MVNO) Industry Overview

The MVNO market is highly competitive, primarily due to the presence of multiple players. The market is leading toward fragmentation, with the major players adopting strategies like service innovation and strategic partnerships to expand their client base and stay competitive in the market. Some major players include Lebara Group BV, TracFone Wireless Inc., and FRiENDi Mobile. Companies are involved in providing sales service, customer service, and mobile service to subscribers.In July 2022, PeP acquired Simapka to expand financial and mobile services in Poland. This acquisition would aid in developing an ecosystem wherein the payments would be bolstered by a variety of additional services provided by POS. The major objective is to ensure that retail outlets throughout Europe gain benefit from the steady digitization of payments through the solutions of Simapka's mobile application.

In May 2022, Cricket Wireless LLC announced a collaboration with the Southern Intercollegiate Athletic Conference (SIAC). This three-year agreement allows Cricket to provide unique experiences to SIAC fans at all Historically Black Colleges/Universities (HBCUs) member schools.

In December 2021, Lycamobile partnered with the Welsh Government to enable remote learning throughout the spring and summer. The Mobile Data Uplift Scheme was available to digitally excluded students in Wales as they returned to school and throughout the rest of the school year. This aimed to help guarantee that children had access to internet resources and did not miss out on crucial learning and development during a challenging time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Lebara Group BV

- TracFone Wireless Inc.

- FRiENDi Mobile

- Boost Mobile LLC (T-Mobile)

- Virgin Mobile USA Inc.

- Tesco Mobile Limited (Tesco PLC)

- Cricket Wireless LLC (AT&T Inc.)

- Lycamobile UK Limited

- PosteMobile SpA

- 1&1 Drillisch AG

- Airvoice Wireless LLC

- ASDA Mobile

- Giffgaff Ltd

- Kajeet Inc. (Arterra Mobility)

- Truphone GmbH

- Voiceworks GmbH

- Asahi Net Inc.