Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The demand for premium textiles is growing, particularly in the apparel and home textile sectors, along with progress in textile processing technologies. Additionally, there is a growing focus on sustainable manufacturing practices, prompting the adoption of eco-friendly and biodegradable chemicals. Innovations in chemical formulations are enhancing the efficiency and quality of textile goods. As a major exporter of textiles, India benefits from a rising global demand for high-quality textile chemicals, creating significant opportunities for local manufacturers. Challenges such as stringent environmental regulations and fluctuating raw material prices can impact production costs and profit margins. The market is characterized by a diverse range of players, from large multinational corporations to smaller enterprises.

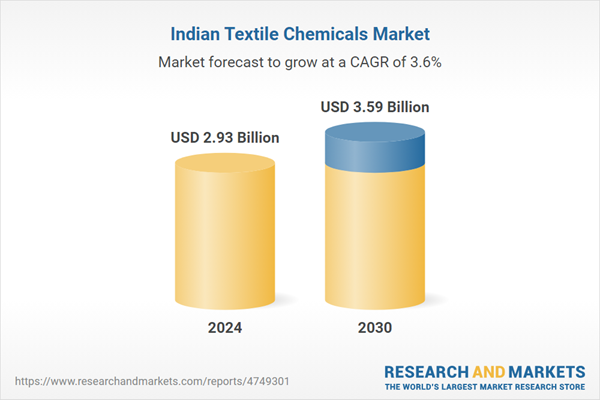

The India textile chemicals market is well-positioned for significant growth in the coming years, driven by the expanding textile sector, sustainability initiatives, and technological progress. While challenges exist, the potential for development and investment makes this market an appealing opportunity for stakeholders.

Key Market Drivers

Urbanization and Changing Lifestyles

Urbanization is resulting in larger city populations, which is increasing the demand for a wide variety of clothing styles. This trend motivates textile manufacturers to develop innovative dyes, finishes, and functional chemicals. As lifestyles evolve, consumers are showing a greater preference for fashionable, high-quality textiles. There is a growing demand for garments with features like moisture-wicking, wrinkle resistance, and antimicrobial properties, all of which require specialized textile chemicals.Urban residents are also investing in home furnishings, such as curtains, upholstery, and bed linens, further driving the demand for textile chemicals used in dyeing and finishing to enhance both aesthetic appeal and durability. The rise of online shopping has facilitated access to a broad range of textile products. According to IBEF, India has approximately 936.16 million internet subscribers, with about 350 million mature online users actively engaged in transactions. This accessibility compels manufacturers to produce a wider array of textiles, necessitating innovative chemical solutions for effective branding and differentiation.

Additionally, urban consumers are becoming more environmentally conscious, increasing the demand for sustainable and eco-friendly textile products. This shift encourages manufacturers to invest in textile chemicals that support green practices. Rapid fashion cycles, influenced by urban lifestyles, result in higher turnover rates for clothing styles, requiring manufacturers to implement efficient chemical processes for dyeing and finishing to meet fast production timelines. Moreover, the heightened focus on health and wellness has led to increased demand for textiles with functional properties, such as moisture control and odor resistance, driving the need for specialized chemicals that provide these attributes.

Urbanization and changing lifestyles are creating a dynamic environment for the textile chemicals market in India, driving the need for innovation, sustainability, and responsiveness to evolving consumer trends.

Growing Textile Industry

The Indian textile industry has experienced substantial investments in the expansion of production facilities, including spinning mills, weaving units, and garment factories. This growth has led to increased output, resulting in a heightened demand for textile chemicals across various processes. India is a major global player in textile production, being one of the largest producers of cotton and jute, the second-largest producer of silk, and accounting for 95% of the world's hand-woven fabrics. According to an Invest India report, India’s textile exports currently stand at USD 34.43 billion and are expected to reach USD 100 billion by 2030.With enhanced production capacity, manufacturers can achieve economies of scale, lowering per-unit costs and encouraging the use of textile chemicals to improve efficiency and quality. The industry encompasses a wide range of products, from traditional handlooms to technical textiles, necessitating specialized chemicals for different applications such as specific dyes, finishing agents for performance enhancement, and specialty chemicals for technical textiles.

The Indian government has introduced various initiatives, including the Textile Policy and Make in India, to support the textile sector. These policies offer financial incentives and promote modernization and skill development. For example, the government has launched the Production Linked Incentive (PLI) Scheme with an approved budget of USD 1.27 billion to boost the production of MMF apparel, MMF fabrics, and technical textiles, enabling the industry to scale up and enhance competitiveness.

As manufacturers seek to differentiate their products, there is a continuous drive for innovation in textile chemicals to meet the specific needs of various textile categories. Advances in manufacturing technology, such as automation and digitalization, lead to more efficient production processes, which in turn necessitate advanced textile chemicals that enhance operational efficiency and product performance. Investment in R&D facilitates the creation of new chemical formulations that improve dyeing, finishing, and treatment processes. For instance, in June 2023, the government approved R&D projects worth USD 7.4 million in the textile sector.

Compliance with international certifications and regulations, such as Oeko-Tex and REACH, further increases the demand for specialized textile chemicals that ensure product safety and environmental sustainability. The rise of fast fashion has also transformed the textile landscape, necessitating rapid production cycles and a wide range of styles, which drives the demand for diverse textile chemicals to swiftly respond to changing trends. The combination of expanded production capacities, product diversity, technological advancements, and global market opportunities fosters a robust demand for innovative and specialized chemical solutions.

Key Market Challenges

Environmental concerns

The textile chemicals industry is often linked to the discharge of hazardous substances into water bodies, resulting in pollution that affects ecosystems and poses health risks to surrounding communities. The production processes can generate significant amounts of solid waste, which must be managed effectively to reduce environmental impact. Textile processing, especially dyeing and finishing, requires considerable water resources, contributing to water scarcity, particularly in areas already experiencing water stress. While treating wastewater to eliminate harmful chemicals is crucial, many facilities lack the necessary treatment infrastructure, leading to environmental degradation.Manufacturers face increasingly stringent environmental regulations that mandate compliance with laws related to emissions, effluents, and waste management. Failure to comply can result in legal penalties and operational disruptions. Rising consumer awareness of environmental issues has heightened demand for sustainable and eco-friendly textiles, pressuring manufacturers to adopt greener practices and materials. Transitioning to these sustainable methods, such as utilizing eco-friendly dyes and improving waste management systems, often necessitates significant investment, posing a challenge for smaller manufacturers with limited resources. By emphasizing environmental responsibility, industry can improve its reputation, comply with regulatory requirements, and contribute to a more sustainable future.

Fluctuating Raw Material Costs

Raw materials for textile chemicals, including dyes, pigments, and synthetic fibers, are often subject to fluctuations in the global market. Factors such as changes in supply and demand, geopolitical tensions, and trade policies can result in sudden price increases or decreases. Additionally, speculative trading in the commodities market can exacerbate price volatility. When raw material costs rise, manufacturers can find it difficult to absorb these increases, especially in a highly competitive environment where price sensitivity is pronounced. This situation can lead to diminished profit margins. Since many raw materials are imported, the industry is also vulnerable to disruptions in global supply chains. Events like natural disasters, pandemics, or geopolitical conflicts can impact both the availability and pricing of these materials.Fluctuations in prices complicate inventory management, as companies must navigate the need to maintain adequate stock while mitigating the risk of price declines. Unpredictable raw material costs make it challenging for firms to accurately budget and forecast expenses, hindering long-term planning and investments in growth initiatives. Sudden spikes in material costs can also strain cash flow, particularly for smaller manufacturers with limited financial resources.

To manage costs, manufacturers may turn to cheaper alternatives for raw materials, which could jeopardize the quality of the final products and damage brand reputation. Variability in sourcing can lead to fluctuations in quality, resulting in inconsistencies in the performance of textile chemicals and negatively affecting customer satisfaction and reliability. Adapting to this volatility is essential for sustaining profitability and competitiveness in a dynamic market.

Key Market Trends

Adoption of Eco-Friendly Products

As consumers grow more conscious of environmental issues, the demand for sustainable textiles is increasing. Buyers are increasingly favoring brands that show a commitment to eco-friendly practices and materials. Many consumers are willing to pay a premium for environmentally friendly products, prompting manufacturers to adapt their offerings accordingly.There is a strong focus on developing eco-friendly dyes, finishing agents, and other textile chemicals that reduce environmental impact, including innovations in biodegradable and non-toxic options. For example, in October 2023, researchers in Assam, India, known for its tea and silk, discovered that mulberry silk fabrics dyed with green tea extract exhibit a wide range of color variations, showcasing the potential of green tea extract as a natural dye in the textile industry. This research was published in the journal Industrial Crops and Products. New formulations aim not only for sustainability but also to enhance textile functionality, improving durability and performance while remaining eco-friendly.

Governments and regulatory bodies are enforcing stringent laws related to emissions, waste management, and chemical use in the textile industry. Compliance with these regulations is driving manufacturers to seek eco-friendly alternatives. Certifications such as GOTS (Global Organic Textile Standard) and Oeko-Tex are becoming crucial for manufacturers, motivating the development of sustainable chemical solutions. For instance, in October 2023, Vipul Organics Limited, a specialty chemicals company focusing on pigments and dyes for textiles, achieved the prestigious OEKO-TEX ECO PASSPORT certification. This certification covers its full range of Pigment Dispersions and Reactive Dyes, marketed under the brands SunPrint and SunActive, ensuring compliance with ZDHC (Zero Discharge of Hazardous Chemicals) Level 3 standards.

Manufacturers are increasingly adopting circular economy principles, focusing on recycling waste materials, and incorporating recycled inputs in textile chemical production. Investments in improved waste management and treatment processes are being prioritized to minimize the environmental footprint of production. As sustainability becomes a central concern for consumers, manufacturers are leveraging eco-friendly practices as a competitive advantage to enhance brand loyalty and increase market share. This trend towards sustainability in the Indian textile chemicals market reflects a broader movement toward responsible consumption and production. By embracing eco-friendly practices, manufacturers can meet consumer demand, comply with regulations, strengthen their market position, and contribute positively to environmental sustainability.

Segmental Insights

Process Type Insights

Based on Process Type, the Dyeing & Printing emerged as the dominating segment in the Indian market for Textile Chemicals during the forecast period. The primary function of dyeing and printing is to add color and design to textiles, which is essential for attracting consumers. As fashion trends evolve, there is a growing demand for unique, vibrant, and diverse colors in clothing and home textiles. The variety of dyes available enables manufacturers to cater to different consumer preferences, further increasing demand in this area. The rise of fast fashion has created a need for rapid production turnaround, necessitating efficient dyeing and printing processes, which boosts growth in this segment. Frequent updates in fashion collections also require regular dyeing and printing activities, driving further engagement.Advancements in digital printing technology enable more intricate designs and customization options, making these processes more appealing to manufacturers. Digital methods also help reduce water and chemical usage, aligning with sustainability objectives. For example, in July 2024, Orange O Tec Pvt. Ltd., a leader in digital textile printing, showcased its impact at the Gartex New Delhi exhibition by launching the Made in Bharat digital textile printing machine, the Fabpro 1i. This machine features a Ricoh 8-head production system, achieving an impressive speed of 2,200 linear meters per day while maintaining exceptional precision in a compact design. Additionally, Orange O Tec provides a comprehensive range of custom digital inkjet printing solutions, software, inks, accessories, and professional services to meet various customer needs.

The dyeing and printing processes typically offer higher profit margins compared to pre-treatment and finishing processes, creating a financial incentive for manufacturers to invest more in this segment. As production scales up to meet demand, this segment benefits from economies of scale, which helps reduce costs and enhance competitiveness.

The growth of technical textiles, which often require specialized dyeing and printing, also contributes to overall demand in this segment. Industries such as automotive, healthcare, and sportswear increasingly rely on textiles that necessitate advanced dyeing techniques. Together, these factors enhance the growth and significance of the dyeing and printing segment within the textile production process. As manufacturers adapt to evolving market demands, this segment is likely to remain a focal point for innovation and investment.

Application Insights

Based on Application, Technical Textile emerged as the fastest growing segment in the Indian market for Textile Chemicals in 2024. Technical textiles are designed for specific functions, such as providing strength, durability, and resistance to environmental factors like moisture and heat. As industries increasingly seek textiles that fulfill these specialized requirements, demand continues to rise.Various sectors, including automotive and healthcare, utilize technical textiles for applications such as protective clothing, medical textiles, and insulation materials, contributing to market growth. India's technical textiles market shows substantial potential, with a robust growth rate of 10%, positioning it as the fifth largest technical textiles market globally. The Indian government acknowledges the sector's potential to enhance the economy and generate jobs. Initiatives such as the Production Linked Incentive (PLI) scheme offer financial incentives for manufacturers to invest in this area, fostering growth.

Ongoing advancements in textile technology, including innovations in smart textiles and nanotechnology, are leading to the development of cutting-edge products. This attracts investments and interest from manufacturers looking to differentiate themselves. Additionally, the adoption of advanced manufacturing processes improves efficiency and quality in the production of technical textiles, making this segment increasingly appealing to manufacturers. The global emphasis on health and hygiene, particularly in the wake of the pandemic, has amplified the demand for medical textiles. Applications such as surgical gowns, masks, and bandages require high-performance, specialized textiles. Similarly, the automotive industry's shift toward lightweight, high-performance materials drives demand for technical textiles used in vehicle interiors, insulation, and safety applications.

There is also a growing focus on sustainability within the textile industry, with increasing attention to recycled materials and environmentally friendly production methods. Technical textiles often meet these sustainability criteria, attracting eco-conscious consumers and businesses. As India seeks to bolster its position in the global textile market, the demand for high-quality technical textiles presents significant export opportunities, particularly in sectors like automotive and healthcare, where India can capitalize on its manufacturing capabilities. With a focus on innovation and sustainability, the technical textiles segment is well-positioned for continued expansion, making it a critical area of growth in the Indian textile chemicals market.

Regional Insights

Based on Region, South India emerged as the dominant region in the Indian market for Textile Chemicals in 2024. The Southern region of India boasts a rich textile heritage, particularly in states like Tamil Nadu, which are historically recognized for their textile production. This legacy has cultivated a strong ecosystem of manufacturers, suppliers, and service providers in the textile sector.The region is known for producing a diverse array of textiles, including cotton, silk, and technical textiles, generating significant demand for various textile chemicals. Southern states have made substantial investments in infrastructure, including spinning mills, weaving units, and dyeing and finishing facilities. This well-developed network enhances production efficiency and drives the need for specialized textile chemicals. Additionally, the proximity to major ports facilitates the smooth transportation of raw materials and finished products, bolstering both domestic and international trade opportunities.

State governments in the South have enacted supportive policies and incentives aimed at promoting the textile industry, such as subsidies, tax breaks, and investments in research and development. For example, in February 2024, the Tamil Nadu government announced the development of the PM MITRA Park in Virudhunagar, a textile park in Salem, which includes higher capital subsidies for investments in technical textiles and support for technology upgrades in spinning mills as part of the 2024 budget. Various government initiatives also focus on skill development within the textile sector, ensuring a consistent supply of trained labor to meet industry demands. The region hosts numerous research institutions and innovation centers dedicated to advancing textile technology and chemicals, fostering the creation of new, high-performance chemical solutions.

With its established manufacturing capabilities and robust infrastructure, the South enjoys easy access to international markets, positioning the region favorably for the export of textiles and textile chemicals, thus contributing to its growth. The presence of many textile exporters further stimulates demand for quality textile chemicals, enhancing market expansion. These combined factors create a vibrant environment that promotes growth and establishes the Southern region as a leader in the textile chemicals industry in India.

Key Market Players

- Anshika Polysurf Limited

- Croda India Company Private Limited

- Fineotex Chemical Limited

- NICCA INDIA PRIVATE LTD.

- Bodal Chemicals Ltd.

- Fibro Organic India Pvt. Ltd.

- Rossari Biotech Limited

- Kiri Industries Limited

- Jaysynth Dyestuff India Ltd.

- Sudha Speciality Chemicals Private Limited

Report Scope:

In this report, the India Textile Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Textile Chemicals Market, By Type:

- Coating & Sizing Agents

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Desizing Agents

- Bleaching Agents

- Others

India Textile Chemicals Market, By Process Type:

- Pre-treatment

- Dyeing & Printing

- Finishing

India Textile Chemicals Market, By Fiber Type:

- Natural

- Synthetic

India Textile Chemicals Market, By Application:

- Apparel

- Home Textile

- Technical Textile

- Others

India Textile Chemicals Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Textile Chemicals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Anshika Polysurf Limited

- Croda India Company Private Limited

- Fineotex Chemical Limited

- NICCA INDIA PRIVATE LTD.

- Bodal Chemicals Ltd.

- Fibro Organic India Pvt. Ltd.

- Rossari Biotech Limited

- Kiri Industries Limited

- Jaysynth Dyestuff India Ltd.

- Sudha Speciality Chemicals Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | November 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.93 Billion |

| Forecasted Market Value ( USD | $ 3.59 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |