Global Heat Exchangers Market - Key Trends & Drivers Summarized

Why Are Heat Exchangers Central to Modern Industrial Operations?

Heat exchangers have become indispensable components of modern industrial and commercial infrastructure, facilitating thermal energy transfer in applications ranging from power generation to chemical processing and HVAC systems. Their fundamental purpose is to transfer heat efficiently between two fluids, typically without mixing them, which allows for optimized energy utilization and process control. Across industries, plate, shell-and-tube, air-cooled, and finned-tube designs dominate usage, with the choice driven by space constraints, thermal efficiency requirements, and cost considerations. These systems play a pivotal role in maintaining operational stability, reducing energy consumption, and meeting stringent environmental standards. As global energy demand continues to rise, their role in improving thermal management and supporting energy recovery systems has become even more pronounced. The increased adoption of renewable energy systems, such as concentrated solar power and biomass plants, also relies on heat exchangers for optimal thermal transfer, making them key enablers of a low-carbon economy.The technological evolution of heat exchangers has been significant, with recent advancements enabling compactness, higher thermal efficiency, and lower fouling rates. Emerging designs focus on enhancing turbulence at lower pressure drops, which maximizes heat transfer while minimizing operational costs. Materials engineering has also played a role, with a shift from conventional carbon steel to corrosion-resistant alloys, stainless steels, titanium, and even advanced composites to improve durability in aggressive process environments. Digitalization is transforming maintenance and monitoring through the use of IoT-enabled sensors that enable predictive maintenance, reducing downtime and extending service life. This convergence of material science and smart monitoring is making heat exchangers more reliable and cost-effective over their lifecycle.

How Is Innovation Reshaping the Technology Landscape for Heat Exchangers?

A major trend driving innovation is the need for compact, space-saving solutions without compromising heat transfer efficiency. Microchannel heat exchangers, widely used in automotive and air-conditioning applications, exemplify this shift by offering high surface area-to-volume ratios and enabling lightweight system designs. Additive manufacturing, or 3D printing, is beginning to influence the market, allowing for complex geometries that were previously unachievable with traditional fabrication techniques. This not only improves performance but also reduces material usage, supporting sustainability goals. Hybrid heat exchangers that combine plate-fin and tubular configurations are also gaining popularity where high thermal duty and compact design must coexist.Energy efficiency regulations worldwide are pushing industries toward heat recovery solutions that utilize waste heat for secondary processes. For instance, in district heating networks and industrial steam systems, recuperative heat exchangers are being deployed to capture energy that would otherwise be lost, thereby improving overall system efficiency. The chemical and petrochemical sectors are investing in heat exchangers with enhanced fouling resistance to maintain performance over long service intervals. The growing demand for cryogenic heat exchangers, especially in LNG production and hydrogen liquefaction, highlights how the technology is evolving to support the global energy transition. These innovations are being accelerated by computational fluid dynamics (CFD)-based design optimization, which allows manufacturers to simulate and refine performance before production, cutting development cycles and improving reliability.

Where Are Heat Exchangers Seeing Rising Demand Across Industries?

The application footprint of heat exchangers is expanding across diverse sectors. In power generation, they are integral to condensers, feedwater heaters, and economizers, making them essential for both conventional and renewable plants. The oil and gas industry remains a major consumer, with heat exchangers deployed in gas compression, refining, and LNG terminals. The chemical industry uses them extensively for process cooling, heating, and distillation column duties. In food and beverage, hygienic plate heat exchangers support pasteurization and sterilization processes, ensuring compliance with safety standards. The automotive industry continues to adopt advanced thermal management systems for internal combustion engines, battery cooling in electric vehicles, and air conditioning systems, which collectively push the demand for compact and high-performance exchangers.Healthcare and pharmaceuticals represent another fast-growing segment where precise temperature control is vital for biologics production and storage. The electronics sector, driven by the proliferation of data centers and semiconductor manufacturing, is also fueling demand for liquid-cooled heat exchangers that manage rising thermal loads. Urbanization trends and rising global temperatures are boosting HVAC demand, and with it, the adoption of energy-efficient heat exchangers that comply with stricter building energy codes. Additionally, desalination plants, which are proliferating in water-scarce regions, rely on heat exchangers for thermal distillation processes, thereby expanding the technology's relevance to global sustainability challenges.

What Is Driving the Growth Trajectory of the Heat Exchangers Market?

The growth in the global heat exchangers market is driven by several factors that are closely tied to technological progress, industrial demand patterns, and sustainability imperatives. Increasing investments in renewable energy infrastructure such as solar thermal power, geothermal projects, and biomass facilities are creating robust demand for specialized heat transfer systems. The accelerating electrification of transport, particularly electric vehicles, is driving adoption of advanced battery cooling solutions that rely on compact liquid-to-liquid heat exchangers. Industrial decarbonization initiatives are further encouraging adoption of waste heat recovery systems across heavy industries, which enhances energy efficiency and reduces carbon emissions.Consumer and regulatory pressure for energy-efficient systems in residential and commercial HVAC is leading to higher uptake of plate heat exchangers and microchannel technology, especially in regions with strict emission and building energy standards. Rapid expansion of chemical and petrochemical capacity in Asia-Pacific and the Middle East is boosting demand for large shell-and-tube exchangers. The rising number of data centers worldwide, driven by cloud computing and AI adoption, is also a powerful growth engine for liquid cooling solutions. Additionally, ongoing material innovations, such as the use of titanium and duplex stainless steel, are enabling reliable operation in corrosive media, opening new application opportunities in marine, desalination, and offshore oil sectors. These combined drivers are creating a sustained and diversified growth path for the heat exchanger market, making it a cornerstone of global energy and process efficiency strategies.

Report Scope

The report analyzes the Heat Exchangers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Shell & Tube Heat Exchangers, Cooling Towers, Air-Cooled Heat Exchangers, Gasketed Plate Heat Exchangers, Welded Plate Heat Exchangers, Brazed Plate Heat Exchangers, Other Product Segments); End-Use (Chemicals End-Use, HVAC & Refrigeration End-Use, Oil & Gas End-Use, Power Generation End-Use, Food & Beverages End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Shell & Tube Heat Exchangers segment, which is expected to reach US$7.4 Billion by 2030 with a CAGR of 6%. The Cooling Towers segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heat Exchangers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heat Exchangers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heat Exchangers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMETEK, Inc., Alfa Laval AB, Actini Group, Advanced Cooling Technologies, Inc., AB Arex and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 590 companies featured in this Heat Exchangers market report include:

- AMETEK, Inc.

- Alfa Laval AB

- Actini Group

- Advanced Cooling Technologies, Inc.

- AB Arex

- Altex Industries, Inc.

- Anguil Environmental Systems, Inc.

- Applied Thermal Control Ltd.

- Armstrong Air

- Armstrong Fluid Technology

- Armstrong International, Inc.

- American Heating Co., Inc.

- Armstrong Engineering Associates, Inc.

- Air Products Inc.

- Ambrell

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMETEK, Inc.

- Alfa Laval AB

- Actini Group

- Advanced Cooling Technologies, Inc.

- AB Arex

- Altex Industries, Inc.

- Anguil Environmental Systems, Inc.

- Applied Thermal Control Ltd.

- Armstrong Air

- Armstrong Fluid Technology

- Armstrong International, Inc.

- American Heating Co., Inc.

- Armstrong Engineering Associates, Inc.

- Air Products Inc.

- Ambrell

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 2023 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

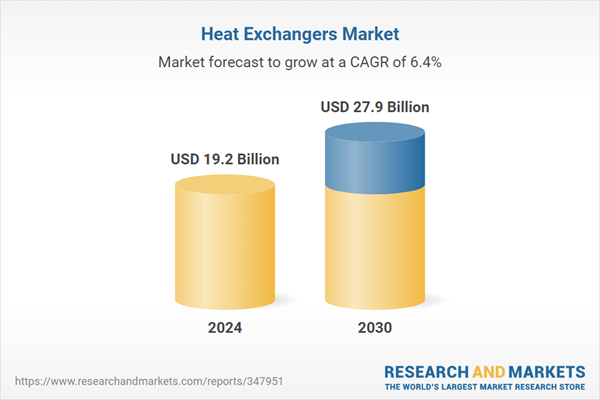

| Estimated Market Value ( USD | $ 19.2 Billion |

| Forecasted Market Value ( USD | $ 27.9 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |