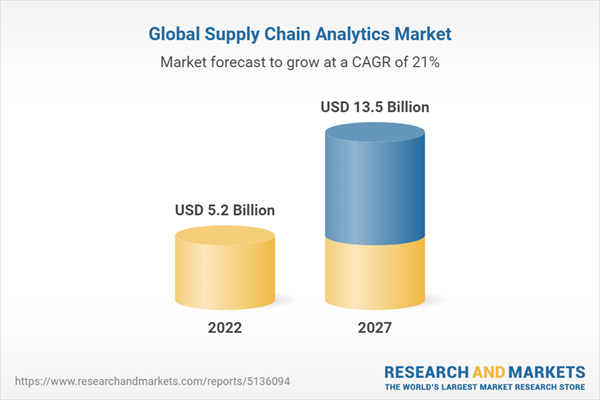

The global supply chain analytics market is expected to grow from USD 5.2 billion in 2022 to USD 13.5 billion by 2027, at a CAGR of 21% during the forecast period. Big data analytics has been used by a number of businesses in a variety of industries to improve tactical and real-time decision-making. As businesses want to use analytics to obtain a competitive advantage over rivals, the supply chain management sector has become one of the most popular places to use analytics solutions. The firms need assistance making decisions about crucial tactical and strategic supply chain operations, since the knowledge gained from these activities may help save costs and improve supply chains.

The automotive segment to have the largest market size during the forecast period

By vertical, the segments include automotive, retail and consumer goods, F&B manufacturing, machinery, and industrial equipment manufacturing, pharmaceutical, government, and energy and utilities. Automakers may use supply chain analytics to help them analyse ever-larger data sets. In essence, the capacity to mix various data sources and use effective big data approaches to help provide relevant insights has significantly improved in recent years. Automakers may estimate demand more precisely by using supply chain analytics to spot new developing trends early on, such as a shift to a certain option, like an automated transmission, or a particular colour. Automakers and their suppliers may get even greater understanding of their operations and the larger supply chain by using these methods and tools to identify patterns and relationships that may have previously gone unnoticed or undiscovered.

The service segment is registered to grow at the highest CAGR during the forecast period

With the growing acceptance of supply chain analytics solutions across key industrial verticals, the need for supporting services is also rising among businesses. The market for supply chain analytics offers managed and professional services. After the deployment of solutions, these services are crucial. Businesses are changing and looking for new methods to increase their Return on Investment (RoI) and enhance company optimization in the era of the digital economy. Enterprises are turning to services that are essential for simplifying corporate processes and maximising business resources in order to foster development and produce more income.

Among Vertical, pharmaceutical vertical is anticipated to register the highest CAGR during the forecast period

Due to intense rivalry from both local and foreign rivals, pharmaceutical companies are under enormous pressure to increase the efficiency of their supply chains and operations. Due to inadequate IT systems and infrastructure, it is difficult to see how the inventory and distribution operations are doing. To use supply chain analytics solutions to predict the growing demand and maintain appropriate inventory levels, top medical device firms are getting in touch with respected solution providers. If pharmaceutical companies can accurately predict how quickly their treatments and medications will be needed, supply chain analytics can help them better align production with demand. This data may be used by decision-makers to estimate how long a supply chain interruption will last and how long it will take to find a solution before there are significant shortages of medicines.

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the supply chain analytics market. North America is one of the leading markers for supply chain analytics in terms of market share. The region's supply chain analytics market is expanding as a result of the fast-paced infrastructure development, widespread acceptance of digital technologies, and rise in real-time data in supply chain organisations. The expansion of the supply chain analytics market in the area is attributed to the cutting-edge products provided by different vendors that concentrate on supplying dashboards for analysis to make strategic business choices.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the supply chain analytics market.

- By Company: Tier I: 34%, Tier II: 43%, and Tier III: 23%

- By Designation: C-Level Executives: 50%, Directors: 30%, and Others: 20%

- By Region: APAC: 30%, Europe: 30%, North America: 25%, MEA: 10%, and Latin America: 5%

The report includes the study of key players offering supply chain analytics and services. It profiles major vendors in the global supply chain analytics market. The major vendors in the global supply chain analytics market include SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT (Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data (US), Rosslyn Analytics (UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe, SS Supply Chain Solutions (US), and DataFactZ (US).

Research Coverage

The market study covers the supply chain analytics market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as components, service, deployment mode, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall supply chain analytics market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Industry Definition

1.2.2 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered

1.5 Currency Considered

Table 1 United States Dollar Exchange Rate, 2020-2022

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 Supply Chain Analytics Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Primary Interviews

2.1.2.2 Breakup of Primary Profiles

2.1.2.3 Key Industry Insights

2.2 Data Triangulation

2.3 Market Size Estimation

Figure 2 Supply Chain Analytics Market: Top-Down and Bottom-Up Approaches

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

Figure 3 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue from Solutions/Services of Market

Figure 4 Market Size Estimation Methodology - Approach 2, Bottom-Up (Supply Side): Collective Revenue from Software/Services of Market

Figure 5 Market Size Estimation Methodology - Approach 3, Bottom-Up (Supply Side): Collective Revenue from Software/Services of Market

Figure 6 Market Size Estimation Methodology - Approach 4, Bottom-Up (Demand Side): Share of Supply Chain Analytics Through Overall Supply Chain Analytics Spending

2.4 Market Forecast

Figure 7 Factor Analysis

2.5 Study Assumptions

2.6 Study Limitations

2.7 Recession Impact

3 Executive Summary

Table 2 Global Supply Chain Analytics Market Size and Growth Rate, 2016-2021 (USD Million, Y-O-Y%)

Table 3 Global Market Size and Growth Rate, 2022-2027 (USD Million, Y-O-Y%)

Figure 8 Software Held Larger Market Size in 2022

Figure 9 Professional Services Held Larger Market Share in 2022

Figure 10 Consulting Services Held Largest Market Size in 2022

Figure 11 Demand Analysis & Forecasting Held Largest Market Size in 2022

Figure 12 Cloud Deployment Mode Held Larger Market Size in 2022

Figure 13 Large Enterprises Held Larger Market Share in 2022

Figure 14 Retail and Consumer Goods Vertical Held Largest Market Size in 2022

Figure 15 North America Held Largest Market Share in 2022

4 Premium Insights

4.1 Attractive Opportunities for Players in Supply Chain Analytics Market

Figure 16 Rising Need for Data-Driven Decision-Making Across Supply Chain Operations to Drive Market

4.2 Market, by Vertical

Figure 17 Retail and Consumer Goods Vertical to Continue to Hold Largest Market Size During Forecast Period

4.3 Market, by Region

Figure 18 North America to Hold Largest Market Share in 2027

4.4 Market, by Software and Vertical

Figure 19 Demand Analysis & Forecasting and Retail and Consumer Goods to be Largest Shareholders in Market in 2027

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 20 Supply Chain Analytics Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Increasing Need for Greater Supply-Chain and Operational Efficiency

5.2.1.2 Growing Adoption of IoT in Supply Chains

5.2.1.3 Rising Adoption of Big Data Technologies

5.2.1.4 Growing Use of Analytics Technologies

5.2.2 Restraints

5.2.2.1 Increasing Concerns of Businesses Regarding Data Security

5.2.2.2 Rising Cyber Threats Hindering Adoption of SCA Solutions

5.2.3 Opportunities

5.2.3.1 Growing Use of Supply Chain Analytics on Cloud

5.2.3.2 Rising Awareness of Benefits of Supply Chain Management

5.2.3.3 Increasing Benefits of Using Supply Chain Analytics Software

5.2.4 Challenges

5.2.4.1 Lack of Qualified Employees

5.2.4.2 Reluctance to Switch from Manual Methods to Advanced Reporting Processes

5.2.4.3 Integration and Analysis of All Data

5.3 Supply Chain Analytics Market: Ecosystem

Table 4 Market: Ecosystem

5.4 Study Analysis

5.4.1 Automotive

5.4.1.1 Case Study 1: Mazda Motor Logistics Speeds Visibility Across Supply Chain

5.4.2 Manufacturing

5.4.2.1 Case Study 1: Titan International's Journey with Oracle Cloud and Internet of Things

5.4.2.2 Case Study 2: Electrolux Improved Customer Service and Reduced Inventory Management Cost by Using Demand Planning & Optimization Solution of SAS with Oracle Cloud and Internet of Things

5.4.3 BFSI

5.4.3.1 Case Study 1: Improved Distribution of Products to Target Audiences

5.4.4 Healthcare and Life Sciences

5.4.4.1 Case Study 1: EmblemHealth Modernizes Operations in Oracle Cloud

5.4.5 Distribution Analytics

5.4.5.1 Case Study 1: Cloud Automation Helps FedEx Respond to Changes 2x Faster

5.5 Technology Analysis

5.5.1 Artificial Intelligence

5.5.2 Big Data

5.5.3 IoT

5.5.4 Blockchain

5.6 Supply/Value Chain Analysis

Figure 21 Supply/Value Chain Analysis

5.7 Porter's Five Forces Analysis

Figure 22 Porter's Five Forces Analysis

Table 5 Porter's Five Forces Analysis

5.7.1 Threat from New Entrants

5.7.2 Threat from Substitutes

5.7.3 Bargaining Power of Suppliers

5.7.4 Bargaining Power of Buyers

5.7.5 Intensity of Competitive Rivalry

5.8 Pricing Model Analysis

Table 6 Supply Chain Analytics Market: Pricing Levels

5.9 Patent Analysis

5.9.1 Methodology

5.9.2 Document Type

Table 7 Patents Filed, 2019-2022

5.9.3 Innovation and Patent Applications

Figure 23 Total Number of Patents Granted, 2019-2022

5.9.3.1 Top Applicants

Figure 24 Top Ten Companies with Highest Number of Patent Applications, 2019-2022

Table 8 Top Ten Patent Owners, 2019-2022

5.10 Key Conferences and Events, 2023-2024

Table 9 Detailed List of Conferences and Events, 2023-2024

5.11 Tariff and Regulatory Landscape

5.11.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 10 North America: Regulatory Bodies, Government Agencies, and Other Organizations

Table 11 Europe: Regulatory Bodies, Government Agencies, and Other Organizations

Table 12 Asia-Pacific: Regulatory Bodies, Government Agencies, and Other Organizations

Table 13 Middle East and Africa: Regulatory Bodies, Government Agencies, and Other Organizations

Table 14 Latin America: Regulatory Bodies, Government Agencies, and Other Organizations

5.11.2 North America: Regulations

5.11.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

5.11.2.2 Gramm-Leach-Bliley (GLB) Act

5.11.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

5.11.2.4 Federal Information Security Management Act (FISMA)

5.11.2.5 Federal Information Processing Standards (FIPS)

5.11.2.6 California Consumer Privacy Act (CSPA)

5.11.3 Europe: Tariffs and Regulations

5.11.3.1 GDPR 2016/679

5.11.3.2 General Data Protection Regulation

5.11.3.3 European Committee for Standardization (CEN)

5.11.3.4 European Technical Standards Institute (ETSI)

5.12 Key Stakeholders and Buying Criteria

5.12.1 Key Stakeholders in Buying Process

Table 15 Influence of Stakeholders on Buying Process for Top Three Verticals (%)

5.12.2 Buying Criteria

Table 16 Key Buying Criteria for Top Three Verticals

5.13 Key Stages in Supply Chain

5.13.1 Planning

5.13.2 Management and Control

5.13.3 Execution

6 Supply Chain Analytics Market, by Component

6.1 Introduction

6.1.1 Component: Market Drivers

Figure 25 Services to Witness Higher CAGR During Forecast Period

Table 17 Market, by Component, 2016-2021 (USD Million)

Table 18 Market, by Component, 2022-2027 (USD Million)

6.2 Software

Figure 26 Inventory Analytics Software to Witness Highest CAGR During Forecast Period

Table 19 Supply Chain Analytics Market, by Software, 2016-2021 (USD Million)

Table 20 Market, by Software, 2022-2027 (USD Million)

Table 21 Software: Market, by Region, 2016-2021 (USD Million)

Table 22 Software: Market, by Region, 2022-2027 (USD Million)

6.3 Demand Analysis and Forecasting

6.3.1 Growing Need for Forecasting Customer Demand to Propel Market

6.4 Demand and Supply Planning

6.4.1 S&OP Process Management

6.4.2 Supply Chain Risk Management

6.4.3 Supply Chain Event Management

Table 23 Demand Analysis and Forecasting: Market, by Region, 2016-2021 (USD Million)

Table 24 Demand Analysis and Forecasting: Market, by Region, 2022-2027 (USD Million)

6.5 Supplier Performance Analytics

6.5.1 Rising Demand for Supplier Performance Analytics Platforms to Manage Delivery Concerns and Quality Control to Fuel Market

6.6 Supplier Performance Metrics Analysis

6.6.1 Delivery Performance Analysis

6.6.2 Price and Profit Margin Analysis

Table 25 Supplier Performance Analytics: Market, by Region, 2016-2021 (USD Million)

Table 26 Supplier Performance Analytics: Market, by Region, 2022-2027 (USD Million)

6.7 Spend and Procurement Analytics

6.7.1 Ability to Make Data-Driven Decisions to Reduce Risk and Discover Cost-Saving Opportunities to Drive Market

6.8 Types of Spend and Procurement Analysis

6.8.1 Tail Spend Analysis

6.8.2 Supplier Spend Analysis

6.8.3 Category Spend Analysis

6.8.4 Contract Spend Analysis

6.8.5 Strategic Sourcing Analysis

6.8.6 Source-To-Pay Analysis

Table 27 Spend and Procurement Analytics: Supply Chain Analytics Market, by Region, 2016-2021 (USD Million)

Table 28 Spend and Procurement Analytics: Market, by Region, 2022-2027 (USD Million)

6.9 Inventory Analytics

6.9.1 Increasing Need for Inventory Analytics to Fuel Market

6.9.2 ABC Analysis

6.9.3 HML Analysis

6.9.4 VED Analysis

6.9.5 SDE Analysis

6.9.6 Safety Stock Analysis

Table 29 Inventory Analytics: Market, by Region, 2016-2021 (USD Million)

Table 30 Inventory Analytics: Market, by Region, 2022-2027 (USD Million)

6.10 Distribution Analytics

6.10.1 Growing Use of Analytics in Distribution Management to Accelerate Market Growth

Table 31 Distribution Analytics: Market, by Region, 2016-2021 (USD Million)

Table 32 Distribution and Logistics Analytics: Market, by Region, 2022-2027 (USD Million)

6.10.2 Performance Management

6.10.3 Route Optimization

6.10.4 Outbound Logistics Management

7 Supply Chain Analytics Market, by Service

7.1 Introduction

7.1.1 Services: Market Drivers

Figure 27 Managed Services to Witness Higher CAGR During Forecast Period

Table 33 Market, by Service, 2016-2021 (USD Million)

Table 34 Market, by Service, 2022-2027 (USD Million)

Table 35 Services: Market, by Region, 2016-2021 (USD Million)

Table 36 Services: Market, by Region, 2022-2027 (USD Million)

7.2 Managed Services

7.2.1 Growing Demand for On-Time Delivery by Clients to Propel Market

Table 37 Managed Services: Market, by Region, 2016-2021 (USD Million)

Table 38 Managed Services: Market, by Region, 2022-2027 (USD Million)

7.3 Professional Services

Figure 28 Consulting Services to Hold Largest Market Size in 2027

Table 39 Supply Chain Analytics Market, by Professional Service Type, 2016-2021 (USD Million)

Table 40 Market, by Professional Service Type, 2022-2027 (USD Million)

Table 41 Professional Services: Market, by Region, 2016-2021 (USD Million)

Table 42 Professional Services: Market, by Region, 2022-2027 (USD Million)

7.3.1 Consulting Services

7.3.1.1 Rising Demand for Lowering Risks, Reducing Complexities, and Increasing ROI to Drive Market

Table 43 Consulting Services: Market, by Region, 2016-2021 (USD Million)

Table 44 Consulting Services: Market, by Region, 2022-2027 (USD Million)

7.3.2 Support and Maintenance Services

7.3.2.1 Increasing Demand for Data Management to Fuel Market

Table 45 Support and Maintenance Services: Market, by Region, 2016-2021 (USD Million)

Table 46 Support and Maintenance Services: Market, by Region, 2022-2027 (USD Million)

7.3.3 Deployment and Integration Services

7.3.3.1 Growing Need for Integrating IoT Devices and Solutions with Existing IT Infrastructure to Boost

Table 47 Deployment and Integration Services: Market, by Region, 2016-2021 (USD Million)

Table 48 Deployment and Integration Services: Market, by Region, 2022-2027 (USD Million)

8 Supply Chain Analytics Market, by Deployment Mode

8.1 Introduction

8.1.1 Deployment Mode: Market Drivers

Figure 29 Cloud Deployment Mode to Witness Higher CAGR During Forecast Period

Table 49 Market, by Deployment Mode, 2016-2021 (USD Million)

Table 50 Market, by Deployment Mode, 2022-2027 (USD Million)

8.2 On-Premises

8.2.1 Reduced Complexities Over AI Applications to Propel Market

Table 51 On-Premises: Market, by Region, 2016-2021 (USD Million)

Table 52 On-Premises: Market, by Region, 2022-2027 (USD Million)

8.3 Cloud

8.3.1 Growing Need for Adoption of Digital Solutions for Flexible and Scaled Productivity to Fuel Market

Table 53 Cloud: Market, by Region, 2016-2021 (USD Million)

Table 54 Cloud: Market, by Region, 2022-2027 (USD Million)

9 Supply Chain Analytics Market, by Organization Size

9.1 Introduction

9.1.1 Organization Size: Market Drivers

Figure 30 Small and Medium-Sized Enterprises to Witness Higher CAGR During Forecast Period

Table 55 Market, by Organization Size, 2016-2021 (USD Million)

Table 56 Market, by Organization Size, 2022-2027 (USD Million)

9.2 Small and Medium-Sized Enterprises

9.2.1 Rise in Innovative Business Approach in Supply Chain Management to Drive Market

Table 57 Small and Medium-Sized Enterprises: Market, by Region, 2016-2021 (USD Million)

Table 58 Small and Medium-Sized Enterprises: Market, by Region, 2022-2027 (USD Million)

9.3 Large Enterprises

9.3.1 Growing Investments by Large Enterprises to Implement Suitable Supply Chain Analytics Solutions and Services to Fuel Market

Table 59 Large Enterprises: Market, by Region, 2016-2021 (USD Million)

Table 60 Large Enterprises: Market, by Region, 2022-2027 (USD Million)

10 Supply Chain Analytics Market, by Vertical

10.1 Introduction

10.1.1 Vertical: Market Drivers

Figure 31 Retail and Consumer Goods Vertical to Hold Largest Market Size in 2027

Table 61 Market, by Vertical, 2016-2021 (USD Million)

Table 62 Market, by Vertical, 2022-2027 (USD Million)

10.2 Retail and Consumer Goods

10.2.1 Rising Demand for Better Customer Experience to Propel Market

Table 63 Retail and Consumer Goods: Market, by Region, 2016-2021 (USD Million)

Table 64 Retail and Consumer Goods: Market, by Region, 2022-2027 (USD Million)

10.3 Automotive

10.3.1 Growing Need to Improve Business Performance, Operational Efficiency, and Boost Visibility with Supply Chain Analytics Solutions to Drive Market

Table 65 Automotive: Market, by Region, 2016-2021 (USD Million)

Table 66 Automotive: Market, by Region, 2022-2027 (USD Million)

10.4 Pharmaceutical

10.4.1 Increasing Competition to Forecast Lifecycle of Specific Drugs to Fuel Market

Table 67 Pharmaceutical: Market, by Region, 2016-2021 (USD Million)

Table 68 Pharmaceutical: Market, by Region, 2022-2027 (USD Million)

10.5 Food & Beverage Manufacturing

10.5.1 Increasing Need to Minimize Waste with Better Understanding of Inventory Levels to Boost Market

Table 69 F&B Manufacturing: Supply Chain Analytics Market, by Region, 2016-2021 (USD Million)

Table 70 F&B Manufacturing: Market, by Region, 2022-2027 (USD Million)

10.6 Machinery and Industrial Equipment Manufacturing

10.6.1 Rising Demand for Capacity Planning to Help Businesses Adopt Supply Chain Analytics Solutions

Table 71 Machinery and Industrial Equipment Manufacturing: Market, by Region, 2016-2021 (USD Million)

Table 72 Machinery and Industrial Equipment Manufacturing: Market, by Region, 2022-2027 (USD Million)

10.7 Energy and Utilities

10.7.1 Growing Need for Operational Expenses and Project Delays to Generate Demand for Supply Chain Analytics

Table 73 Energy and Utilities: Market, by Region, 2016-2021 (USD Million)

Table 74 Energy and Utilities: Market, by Region, 2022-2027 (USD Million)

10.8 Government

10.8.1 Growing Government Initiatives to Drive Adoption of Supply Chain Analytics Software

Table 75 Government: Market, by Region, 2016-2021 (USD Million)

Table 76 Government: Market, by Region, 2022-2027 (USD Million)

11 Supply Chain Analytics Market, by Region

11.1 Introduction

11.1.1 Market: Impact of Recession

Figure 32 Asia-Pacific to Witness Highest CAGR During Forecast Period

Figure 33 United Arab Emirates to Witness Highest CAGR During Forecast Period

Table 77 Market, by Region, 2016-2021 (USD Million)

Table 78 Market, by Region, 2022-2027 (USD Million)

11.2 North America

11.2.1 North America: Market Drivers

Figure 34 North America: Market Snapshot

Table 79 North America: Supply Chain Analytics Market, by Component, 2016-2021 (USD Million)

Table 80 North America: Market, by Component, 2022-2027 (USD Million)

Table 81 North America: Market, by Software, 2016-2021 (USD Million)

Table 82 North America: Market, by Software, 2022-2027 (USD Million)

Table 83 North America: Market, by Service, 2016-2021 (USD Million)

Table 84 North America: Market, by Service, 2022-2027 (USD Million)

Table 85 North America: Market, by Deployment Mode, 2016-2021 (USD Million)

Table 86 North America: Market, by Deployment Mode, 2022-2027 (USD Million)

Table 87 North America: Market, by Organization Size, 2016-2021 (USD Million)

Table 88 North America: Market, by Organization Size, 2022-2027 (USD Million)

Table 89 North America: Market, by Vertical, 2016-2021 (USD Million)

Table 90 North America: Market, by Vertical, 2022-2027 (USD Million)

Table 91 North America: Market, by Country, 2016-2021 (USD Million)

Table 92 North America: Market, by Country, 2022-2027 (USD Million)

11.2.2 US

11.2.2.1 Advanced Infrastructure, Innovation, and Initiatives to Drive Market

11.2.3 Canada

11.2.3.1 Huge Investment Share of Canadian Companies to Strengthen Supply Chain Operations

11.3 Europe

11.3.1 Europe: Market Drivers

Table 93 Europe: Supply Chain Analytics Market, by Component, 2016-2021 (USD Million)

Table 94 Europe: Market, by Component, 2022-2027 (USD Million)

Table 95 Europe: Market, by Software, 2016-2021 (USD Million)

Table 96 Europe: Market, by Software, 2022-2027 (USD Million)

Table 97 Europe: Market, by Service, 2016-2021 (USD Million)

Table 98 Europe: Market, by Service, 2022-2027 (USD Million)

Table 99 Europe: Market, by Deployment Mode, 2016-2021 (USD Million)

Table 100 Europe: Market, by Deployment Mode, 2022-2027 (USD Million)

Table 101 Europe: Market, by Organization Size, 2016-2021 (USD Million)

Table 102 Europe: Market, by Organization Size, 2022-2027 (USD Million)

Table 103 Europe: Market, by Vertical, 2016-2021 (USD Million)

Table 104 Europe: Market, by Vertical, 2022-2027 (USD Million)

Table 105 Europe: Market, by Country, 2016-2021 (USD Million)

Table 106 Europe: Market, by Country, 2022-2027 (USD Million)

11.3.2 UK

11.3.2.1 Disruptions in Supply Chain to Drive Market

11.3.3 Germany

11.3.3.1 Industrial Developments and Advancements to Fuel Market

11.3.4 France

11.3.4.1 Initiatives by Government to Position France as Tech-Giant to Propel Market

11.3.5 Italy

11.3.5.1 Technological Developments to Boost Market

11.3.6 Spain

11.3.6.1 Cloud Adoption to Drive Investments in Data Centers

11.3.7 Rest of Europe

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Market Drivers

Figure 35 Asia-Pacific: Supply Chain Analytics Market Snapshot

Table 107 Asia-Pacific: Market, by Component, 2016-2021 (USD Million)

Table 108 Asia-Pacific: Market, by Component, 2022-2027 (USD Million)

Table 109 Asia-Pacific: Market, by Software, 2016-2021 (USD Million)

Table 110 Asia-Pacific: Market, by Software, 2022-2027 (USD Million)

Table 111 Asia-Pacific: Market, by Service, 2016-2021 (USD Million)

Table 112 Asia-Pacific: Market, by Service, 2022-2027 (USD Million)

Table 113 Asia-Pacific: Market, by Deployment Mode, 2016-2021 (USD Million)

Table 114 Asia-Pacific: Market, by Deployment Mode, 2022-2027 (USD Million)

Table 115 Asia-Pacific: Market, by Organization Size, 2016-2021 (USD Million)

Table 116 Asia-Pacific: Market, by Organization Size, 2022-2027 (USD Million)

Table 117 Asia-Pacific: Market, by Vertical, 2016-2021 (USD Million)

Table 118 Asia-Pacific: Market, by Vertical, 2022-2027 (USD Million)

Table 119 Asia-Pacific: Market, by Country, 2016-2021 (USD Million)

Table 120 Asia-Pacific: Market, by Country, 2022-2027 (USD Million)

11.4.2 China

11.4.2.1 Increasing Adoption of AI and IoT to Fuel Supply Chain Analytics Adoption

11.4.3 Japan

11.4.3.1 Rising Demand for Process Automation Among Enterprises to Drive Market

11.4.4 India

11.4.4.1 Growing Adoption of Supply Chain 4.0 to Boost Market

11.4.5 ASEAN

11.4.5.1 Increasing Adoption of Digital Tools and Real-Time Data to Propel Market

11.4.6 Rest of Asia-Pacific

11.5 Middle East and Africa

11.5.1 Middle East and Africa: Market Drivers

Table 121 Middle East and Africa: Supply Chain Analytics Market, by Component, 2016-2021 (USD Million)

Table 122 Middle East and Africa: Market, by Component, 2022-2027 (USD Million)

Table 123 Middle East and Africa: Market, by Software, 2016-2021 (USD Million)

Table 124 Middle East and Africa: Market, by Software, 2022-2027 (USD Million)

Table 125 Middle East and Africa: Market, by Service, 2016-2021 (USD Million)

Table 126 Middle East and Africa: Market, by Service, 2022-2027 (USD Million)

Table 127 Middle East and Africa: Market, by Deployment Mode, 2016-2021 (USD Million)

Table 128 Middle East and Africa: Market, by Deployment Mode, 2022-2027 (USD Million)

Table 129 Middle East and Africa: Market, by Organization Size, 2016-2021 (USD Million)

Table 130 Middle East and Africa: Market, by Organization Size, 2022-2027 (USD Million)

Table 131 Middle East and Africa: Market, by Vertical, 2016-2021 (USD Million)

Table 132 Middle East and Africa: Market, by Vertical, 2022-2027 (USD Million)

Table 133 Middle East and Africa: Market, by Country, 2016-2021 (USD Million)

Table 134 Middle East and Africa: Market, by Country, 2022-2027 (USD Million)

11.5.2 UAE

11.5.2.1 Government's Focus on Adopting Various Strategies to Drive Market

11.5.3 Kingdom of Saudi Arabia

11.5.3.1 Rising Digitization and Growing Partnership Strategies in KSA to Boost Demand for Supply Chain Analytics

11.5.4 Israel

11.5.4.1 Increasing Use of Cutting-Edge Solutions to Analyze and Gain Better Insights from Data to Fuel Market

11.5.5 Turkey

11.5.5.1 Growing Need for Smart Devices and Analytics to Fuel Market Growth

11.5.6 Qatar

11.5.6.1 Increasing Focus of Government on Enhancing Logistics Infrastructure to Drive Market

11.5.7 South Africa

11.5.7.1 Rising Number of Initiatives to Increase Infrastructure Expenditure to Propel Market

11.5.8 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Latin America: Market Drivers

Table 135 Latin America: Supply Chain Analytics Market, by Component, 2016-2021 (USD Million)

Table 136 Latin America: Market, by Component, 2022-2027 (USD Million)

Table 137 Latin America: Market, by Service, 2016-2021 (USD Million)

Table 138 Latin America: Market, by Service, 2022-2027 (USD Million)

Table 139 Latin America: Market, by Software, 2016-2021 (USD Million)

Table 140 Latin America: Market, by Software, 2022-2027 (USD Million)

Table 141 Latin America: Market, by Deployment Mode, 2016-2021 (USD Million)

Table 142 Latin America: Market, by Deployment Mode, 2022-2027 (USD Million)

Table 143 Latin America: Market, by Organization Size, 2016-2021 (USD Million)

Table 144 Latin America: Market, by Organization Size, 2022-2027 (USD Million)

Table 145 Latin America: Market, by Vertical, 2016-2021 (USD Million)

Table 146 Latin America: Market, by Vertical, 2022-2027 (USD Million)

Table 147 Latin America: Market, by Country, 2016-2021 (USD Million)

Table 148 Latin America: Market, by Country, 2022-2027 (USD Million)

11.6.2 Brazil

11.6.2.1 Increasing Sales and Operational Planning in Brazil Owing to Big Data Analytics to Boost Market

11.6.3 Mexico

11.6.3.1 Growing Digitalization of Supply Chain to Drive Market

11.6.4 Argentina

11.6.4.1 Increasing Use of Cutting-Edge Technologies to Fuel Market

11.6.5 Rest of Latin America

12 Competitive Landscape

12.1 Overview

12.2 Key Player Strategies

Table 149 Overview of Strategies Deployed by Key Players in Market

12.3 Revenue Analysis

Figure 36 Revenue Analysis for Key Companies, 2017-2021 (USD Million)

12.4 Market Share Analysis

Figure 37 Market Share Analysis for Key Players, 2021

Table 150 Supply Chain Analytics Market: Degree of Competition

12.5 Company Evaluation Quadrant

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 38 Key Market Players, Company Evaluation Matrix, 2022

12.6 Startup/SME Evaluation Matrix

12.6.1 Progressive Companies

12.6.2 Responsive Companies

12.6.3 Dynamic Companies

12.6.4 Starting Blocks

Figure 39 Startup/SME Supply Chain Analytics Market Evaluation

Matrix, 2022 181

12.7 Competitive Benchmarking

Table 151 Market: Competitive Benchmarking of Key Players, 2022

Table 152 Market: Detailed List of Key Startups/SMEs

Table 153 Supply Chain Analytics Market: Competitive Benchmarking of Key Players (Startups/SMEs)

12.8 Competitive Scenario

12.8.1 Product Launches

Table 154 Product Launches, 2021-2022

12.8.2 Deals

Table 155 Deals, 2019-2022

12.8.3 Others

Table 156 Others, 2019-2021

13 Company Profiles

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 Major Players

13.1.1 IBM

Table 157 IBM: Business Overview

Figure 40 IBM: Financial Overview

Table 158 IBM: Products/Solutions/Services Offered

Table 159 IBM: Product Launches

Table 160 IBM: Deals

13.1.2 Oracle

Table 161 Oracle: Business Overview

Figure 41 Oracle: Financial Overview

Table 162 Oracle: Products/Solutions/Services Offered

Table 163 Oracle: Product Launches

Table 164 Oracle: Deals

13.1.3 SAP

Table 165 SAP: Business Overview

Figure 42 SAP: Financial Overview

Table 166 SAP: Products/Solutions/Services Offered

Table 167 SAP: Product Launches

Table 168 SAP: Deals

13.1.4 Salesforce

Table 169 Salesforce: Business Overview

Figure 43 Salesforce: Financial Overview

Table 170 Salesforce: Products/Solutions/Services Offered

Table 171 Salesforce: Product Launches

Table 172 Salesforce: Deals

13.1.5 Software AG

Table 173 Software AG: Business Overview

Figure 44 Software AG: Financial Overview

Table 174 Software AG: Products/Solutions/Services Offered

Table 175 Software AG: Product Launches

Table 176 Software AG: Deals

13.1.6 MicroStrategy

Table 177 MicroStrategy: Business Overview

Figure 45 MicroStrategy: Financial Overview

Table 178 MicroStrategy: Products Offered

Table 179 MicroStrategy: Deals

13.1.7 SAS Institute

Table 180 SAS Institute: Business Overview

Figure 46 SAS Institute: Financial Overview

Table 181 SAS Institute: Products/Solutions/Services Offered

Table 182 SAS Institute: Deals

13.1.8 Cloudera

Table 183 Cloudera: Business Overview

Figure 47 Cloudera: Financial Overview

Table 184 Cloudera: Products/Solutions/Services Offered

13.1.9 Domo

Table 185 Domo: Business Overview

Figure 48 Domo: Financial Overview

Table 186 Domo: Products/Solutions/Services Offered

Table 187 Domo: Deals

13.1.10 Axway

Table 188 Axway: Business Overview

Figure 49 Axway: Financial Overview

Table 189 Axway: Products/Solutions/Services Offered

Table 190 Axway: Deals

13.1.11 Rosslyn Analytics

Table 191 Rosslyn Analytics: Business Overview

Figure 50 Rosslyn Analytics: Financial Overview

Table 192 Rosslyn Analytics: Products/Solutions/Services Offered

Table 193 Rosslyn Analytics: Product Launches

Table 194 Rosslyn Analytics: Deals

13.1.12 1010data

Table 195 1010data: Business Overview

Table 196 1010data: Products/Solutions/Services Offered

Table 197 1010data: Product Launches

Table 198 1010data: Deals

13.1.13 Qlik

Table 199 Qlik: Business Overview

Table 200 Qlik: Products Offered

Table 201 Qlik: Product Launches

Table 202 Qlik: Deals

Table 203 Qlik: Others

13.1.14 Logility

Table 204 Logility: Business Overview

Table 205 Logility: Products/Solutions/Services Offered

Table 206 Logility: Product Launches

Table 207 Logility: Deals

13.1.15 Infor

Table 208 Infor: Business Overview

Table 209 Infor: Products/Solutions/Services Offered

Table 210 Infor: Deals

13.1.16 Voxware

Table 211 Voxware: Business Overview

Table 212 Voxware: Products/Solutions/Services Offered

Table 213 Voxware: Others

13.2 Other Players

13.2.1 Manhattan Associates

13.2.2 DataFactZ

13.2.3 Dataiku

13.2.4 Relex Solutions

13.2.5 AIMMS

13.2.6 TARGIT

13.2.7 TIBCO Software

13.2.8 Zebra Technologies

13.2.9 The AnyLogic Company

13.2.10 Intugine Technologies

13.2.11 Lumachain

13.2.12 Hum Industrial Technology

13.2.13 Pafaxe

13.2.14 SS Supply Chain Solutions (3SC)

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies

14 Adjacent and Related Markets

14.1 Blockchain Supply Chain Market

14.1.1 Market Definition

14.1.2 Market Overview

14.1.3 Blockchain Supply Chain Market, by Offering

Table 214 Blockchain Supply Chain Market, by Offering, 2014-2019 (USD Million)

Table 215 Blockchain Supply Chain Market, by Offering, 2019-2026 (USD Million)

14.1.4 Blockchain Supply Chain Market, by Type

Table 216 Blockchain Supply Chain Market, by Type, 2014-2019 (USD Million)

Table 217 Blockchain Supply Chain Market, by Type, 2019-2026 (USD Million)

14.1.5 Blockchain Supply Chain Market, by Provider Type

Table 218 Blockchain Supply Chain Market, by Provider Type, 2014-2019 (USD Million)

Table 219 Blockchain Supply Chain Market, by Provider Type, 2019-2026 (USD Million)

14.1.6 Blockchain Supply Chain Market, by Application

Table 220 Blockchain Supply Chain Market, by Application, 2014-2019 (USD Million)

Table 221 Blockchain Supply Chain Market, by Application, 2019-2026 (USD Million)

14.1.7 Blockchain Supply Chain Market, by Organization Size

Table 222 Blockchain Supply Chain Market, by Organization Size, 2014-2019 (USD Million)

Table 223 Blockchain Supply Chain Market, by Organization Size, 2019-2026 (USD Million)

14.1.8 Blockchain Supply Chain Market, by End-user

Table 224 Blockchain Supply Chain Market, by End-user, 2014-2019 (USD Million)

Table 225 Blockchain Supply Chain Market, by End-user, 2019-2026 (USD Million)

14.1.9 Blockchain Supply Chain Market, by Region

Table 226 Blockchain Supply Chain Market, by Region, 2014-2019 (USD Million)

Table 227 Blockchain Supply Chain Market, by Region, 2019-2026 (USD Million)

14.2 Big Data Market

14.2.1 Market Definition

14.2.2 Market Overview

14.2.2.1 Big Data Market, by Component

Table 228 Big Data Market, by Component, 2016-2020 (USD Million)

Table 229 Big Data Market, by Component, 2021-2026 (USD Million)

Table 230 Big Data Market, by Solution Type, 2016-2020 (USD Million)

Table 231 Big Data Market, by Solution Type, 2021-2026 (USD Million)

Table 232 Big Data Market, by Service Type, 2016-2020 (USD Million)

Table 233 Big Data Market, by Service Type, 2021-2026 (USD Million)

Table 234 Professional Services: Big Data Market, by Type, 2016-2020 (USD Million)

Table 235 Professional Services: Big Data Market, by Type, 2021-2026 (USD Million)

14.2.2.2 Big Data Market, by Deployment Mode

Table 236 Big Data Market, by Deployment Mode, 2016-2020 (USD Million)

Table 237 Big Data Market, by Deployment Mode, 2021-2026 (USD Million)

Table 238 Cloud Deployment Market, by Type, 2016-2020 (USD Million)

Table 239 Cloud Deployment Market, by Type, 2021-2026 (USD Million)

14.2.2.3 Big Data Market, by Organization Size

Table 240 Big Data Market, by Organization Size, 2016-2020 (USD Million)

Table 241 Big Data Market, by Organization Size, 2021-2026 (USD Million)

14.2.2.4 Big Data Market, by Business Function

Table 242 Big Data Market, by Business Function, 2016-2020 (USD Million)

Table 243 Big Data Market, by Business Function, 2021-2026 (USD Million)

14.2.2.5 Big Data Market, by Industry Vertical

Table 244 Big Data Market, by Industry Vertical, 2016-2020 (USD Million)

Table 245 Big Data Market, by Industry Vertical, 2021-2026 (USD Million)

14.2.2.6 Big Data Market, by Region

Table 246 Big Data Market, by Region, 2016-2020 (USD Million)

Table 247 Big Data Market, by Region, 2021-2026 (USD Million)

15 Appendix

15.1 Discussion Guide

15.2 Knowledgestore: The Subscription Portal

15.3 Customization Options

Companies Mentioned

- 1010data

- AIMMS

- Axway

- Cloudera

- DataFactZ

- Dataiku

- Domo

- Electrolux

- EmblemHealth

- FedEx

- Hum Industrial Technology

- IBM

- Infor

- Intugine Technologies

- Logility

- Lumachain

- Manhattan Associates

- Mazda Motor Logistics

- MicroStrategy

- Oracle

- Pafaxe

- Qlik

- Relex Solutions

- Rosslyn Analytics

- Salesforce

- SAP

- SAS Institute

- Software AG

- SS Supply Chain Solutions (3SC)

- TARGIT

- The AnyLogic Company

- TIBCO Software

- Titan International

- Voxware

- Zebra Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | March 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 13.5 Billion |

| Compound Annual Growth Rate | 21.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |