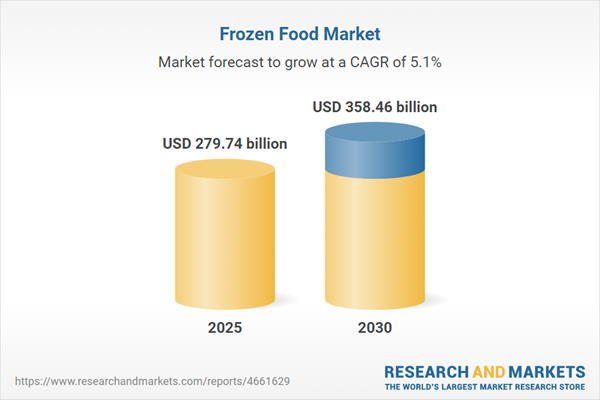

The global frozen food market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and a growing preference for convenient, long-shelf-life food solutions. Frozen foods, preserved at low temperatures, offer minimal preparation time and year-round access to seasonal produce, making them ideal for fast-paced lifestyles, particularly among urban professionals. The market is further propelled by a shift toward clean-label products and sustainable packaging, as manufacturers respond to consumer demands for healthier and eco-friendly options. While challenges such as high production costs and supply chain complexities may hinder growth, the market is poised for significant expansion, particularly in regions with strong consumer awareness and established food industries.

Key Growth Drivers

Urbanization and Demand for Convenience Foods

The global trend toward urbanization is a major driver of the frozen food market, as busy urban professionals seek quick and easy meal solutions. The rise in female labor force participation has further increased the demand for frozen foods, which are easy to store and prepare, catering to time-constrained lifestyles. This shift in consumer behavior, coupled with growing disposable incomes, is fueling demand for convenient, ready-to-eat frozen products that align with modern dietary preferences.Investments in Production Capacity

Major companies are expanding production capacity to meet the rising demand for frozen foods, signaling strong market confidence. These investments enable manufacturers to scale operations, innovate product offerings, and address consumer preferences for diverse and healthier frozen options, further driving market growth. Strategic expansions also enhance supply chain efficiency, ensuring broader market reach and availability.Market Segmentation

By Geography

The frozen food market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Europe is expected to hold a significant market share, driven by strong consumer awareness of frozen food benefits, particularly in the United Kingdom. The region's demand for premium products like ice cream, fish, meat, and poultry supports market growth. Asia-Pacific, led by Japan, is witnessing rapid expansion due to high imports of frozen vegetables and changing eating habits. Japan's strong reliance on frozen foods for family meals, coupled with dual-income households and diverse product options, further fuels market growth in the region.Market Developments

In June 2023, Unilever PLC acquired Yasso Holdings, Inc., a U.S.-based frozen food brand, to address growing consumer demand for healthier and varied frozen snacks in the UK and beyond. This strategic move highlights the industry's focus on expanding product portfolios to meet evolving consumer preferences for health-conscious options.Competitive Landscape

Key players like Unilever PLC and Nomad Foods are driving innovation in the frozen food market through acquisitions and sustainable packaging initiatives. These companies focus on developing clean-label, eco-friendly products to align with consumer trends, strengthening their market positions and supporting industry growth.The global frozen food market is set for significant growth, propelled by urbanization, rising demand for convenience foods, and strategic investments in production capacity. Europe leads due to strong consumer awareness, while Asia-Pacific, particularly Japan, drives growth through high imports and changing consumer habits. Despite challenges like production costs, innovations in healthier and sustainable products by key players ensure a positive market trajectory, catering to the needs of modern, time-constrained consumers.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Frozen Food Market Segmentation:

By Type

- Raw Material

- Half-Cooked

- Ready to Eat

By Product

- Frozen fruits and vegetables

- Frozen meat and poultry

- Frozen seafood

- Frozen ready meals

- Frozen desserts

- Frozen snacks

- Others

By Distribution Channel

- Offline

- Supermarkets & Hypermarkets

- Convenience Stores

- Others

- Online Channels

By End-User

- Food Service

- Residential

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- General Mills

- Unilever

- Nestle SA

- Tyson Foods

- Nomad Foods Ltd

- Conagra Foods

- Kellanova

- McCain Foods Limited

- Kraft Heinz Company

- Ajinomoto

- Cargill

- Bellisio Foods

- Wawona Frozen Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 279.74 billion |

| Forecasted Market Value ( USD | $ 358.46 billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |