LED lights are a type of lighting technology that utilizes semiconductors to produce visible light. LEDs are highly energy-efficient and durable compared to traditional incandescent or fluorescent lights. They operate by passing an electric current through a semiconductor material, which emits light in the process. LED lights are available in various colors and can be used for both general illumination and decorative purposes. They have gained widespread popularity in various applications, including residential, commercial, and industrial lighting as they offer several significant benefits and advantages compared to traditional lighting options.

The increasing awareness among consumers about the environmental benefits of LED lights, such as lower carbon emissions and reduced hazardous waste, has contributed to their uptake in Saudi Arabia. LED lights offer energy efficiency and provide improved lighting quality, durability, and versatility, which makes them a preferred choice for various applications. In addition, LED lights offer significant cost savings in the long run due to their energy efficiency and longer lifespan. Consumers and businesses in Saudi Arabia are increasingly realizing the financial benefits of LED lighting, including reduced electricity bills, lower maintenance costs, and longer replacement intervals. This cost-effectiveness is driving the market demand for LED lights. Moreover, the Government of Saudi Arabia has been undertaking significant infrastructure development projects, including the construction of smart cities, commercial complexes, and residential buildings. These projects require modern and efficient lighting solutions, thereby creating a demand for LED lights.

Saudi Arabia LED Lights Market Trends/Drivers:

Government Programs and Energy Efficiency Policies

The government of Saudi Arabia is constantly introducing energy efficiency measures and sustainability targets, which is considerably driving the use of LED lighting in the country. Organizations like the Saudi Energy Efficiency Center (SEEC) are mandating and incentivizing energy-saving devices, such as LEDs. These initiatives are complementary to Vision 2030, which is concentrating on diverting the Kingdom away from fossil fuels and minimizing electricity use. The government is also converting public infrastructure, such as streets, schools, and government offices, from conventional lighting to energy-saving LED systems. Furthermore, regulatory systems are mandating new building developments to abide by energy-efficient lighting standards. Since these programs are particularly actively implemented, the demand for LED light is rising in both residential and commercial markets. These continuous policy-led changes are speeding up the growth pattern of the market through various incentives to manufacturers and importers to boost product lines that match the government's energy standards. In 2024, A senior official from the National Energy Services Co., known as Tarshid, stated that Saudi Arabia aims to be the first G20 nation to implement LED street lights for energy conservation. During a panel called “Saudi Vision 2030 Outlook” on the opening day of the Global Project Management Forum 2024, held in Riyadh from June 2 to 3, Mohammed Muaafa, the technical services director of Tarshid, mentioned that the company has undertaken numerous projects aimed at saving electricity in different commercial and residential developments throughout the Kingdom.Increasing Construction and Infrastructure Projects

Saudi Arabia is focussing on infrastructure development powered by mega-projects under Vision 2030, including NEOM, Qiddiya, and the Red Sea Project, that are driving the demand for LED lighting systems. Advanced, sustainable, and smart lighting solutions that LED technologies are uniquely suited to deliver are being demanded by these projects. Both residential and commercial establishments under construction are also adopting smart and energy-efficient lighting as a norm, thus generating continuous demand. Additionally, contractors and builders are opting for LEDs based on their longer lifespan, low energy consumption, and less maintenance costs over conventional lighting systems. Urbanization, coupled with smart city projects, is also encompassing LED lighting in streetlights, signage, and public transport stations. Since building work is picking up momentum in urban and semi-urban regions, the demand for advanced lighting systems is developing speedily, which is further solidifying the market foothold of both local and overseas LED players in the nation. Moreover, the publisher predicts that the Saudi Arabia construction market size is projected to attain USD 135.6 Billion by 2033.Growing Awareness and Transition Towards Smart Lighting

At present, people are progressively developing awareness of the long-term cost benefits, green advantages, and enhanced performance of LED illumination, driving the market. With increasing electricity prices and greater environmental awareness, people and companies are choosing LEDs instead of conventional lighting. Additionally, the demand for smart homes and Internet of Things (IoT)-connected lighting solutions is expanding rapidly, especially in urban areas such as Riyadh and Jeddah. Domestic and business users are increasingly embracing smart LED lights that provide advantages in the form of remote control, automation, and energy consumption tracking. Retailers also are pressing LED-based products more vocally, citing their higher efficiency and sleek features. Because e-commerce sites are making LED products more convenient and affordable, penetration is increasing across all demographics. In 2025, Asheli announced its plans to establish a modern and advanced LED lighting manufacturing facility in Saudi Arabia.Saudi Arabia LED Lights Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Saudi Arabia LED lights market report, along with forecasts from 2025-2033. Our report has categorized the market based on product type, application, and imports and domestic manufacturing.Breakup by Product Type:

- LED Panel Lights

- LED Downlights

- LED Street Lights

- Others

LED panel lights represents the most widely used product type

The report has provided a detailed breakup and analysis of the Saudi Arabia LED lights market based on the product type. This includes LED panel lights, LED downlights, LED street lights, and others. According to the report, LED panel lights represented the largest segment.LED panel lights are highly energy-efficient compared to traditional lighting options. They can provide the same or higher levels of illumination while consuming significantly less energy. This energy efficiency leads to reduced electricity costs and overall energy savings, making them a cost-effective choice for both residential and commercial applications. Also, these lights are designed to provide uniform and diffused lighting. The panel design evenly distributes light across the entire surface, eliminating hotspots or areas of uneven brightness. This ensures consistent illumination without any harsh glare, creating a comfortable and visually pleasing lighting environment. LED panel lights come in a range of sizes, shapes, and color temperatures, providing versatility to suit different lighting requirements. They can be used for general lighting purposes as well as for creating specific lighting effects or highlighting architectural features. The availability of different color temperatures allows users to customize the lighting ambiance according to their needs.

Breakup by Application:

- Commercial

- Industrial

- Residential

- Others

Commercial applications account for the majority of the market share

A detailed breakup and analysis of the Saudi Arabia LED lights market based on the application has also been provided in the report. This includes commercial, industrial, residential, and others. According to the report, the commercial segment accounted for the largest market share.In the commercial sector, where lighting expenses can account for a substantial portion of operational costs, the energy efficiency of LED lights translates into significant cost savings. Businesses can experience reduced electricity bills, leading to improved financial performance. LED lights have a much longer lifespan compared to traditional lighting options such as incandescent or fluorescent bulbs. They can operate for tens of thousands of hours, significantly reducing the frequency of bulb replacements. This characteristic is particularly advantageous in commercial settings where lighting fixtures are often installed in large numbers and difficult-to-access areas. The extended lifespan of LED lights results in reduced maintenance efforts, minimizing disruption to business operations and lowering maintenance costs.

Breakup by Import and Domestic Manufacturing:

- Import

- Domestic Manufacturing

Imports hold the largest share in the Saudi Arabia LED lights market

A detailed breakup and analysis of the Saudi Arabia LED lights market has been provided based on imports and domestic manufacturing. According to the report, imports accounted for the largest market share.The import of LED lights complements domestic production, providing a comprehensive range of options and enabling businesses in Saudi Arabia to meet the growing demand for energy-efficient lighting solutions effectively. LED lighting technology requires specialized manufacturing processes and expertise. Many countries, particularly in East Asia, have established a strong presence in LED lighting manufacturing and possess advanced technological capabilities. These countries have made significant investments in research and development, enabling them to produce high-quality LED lights at competitive prices. As a result, Saudi Arabia imports LED lights to leverage the technological expertise and cost advantages offered by these manufacturing nations. Moreover, imported LED lights often adhere to international standards and certifications, ensuring compliance with quality, safety, and performance requirements. International standards and certifications provide assurance to end-users and regulatory bodies regarding the safety and efficacy of the imported LED lights.

Competitive Landscape:

The key players in the Saudi Arabia LED lights market have made several innovations and advancements to meet the evolving demands of consumers and businesses. Market players have introduced smart lighting solutions that integrate LED lights with advanced controls and connectivity features. In addition, some market players have focused on developing LED lights that mimic natural daylight and support human well-being. These lights have tunable white features that allow users to adjust the color temperature throughout the day, promoting better sleep patterns, increased productivity, and improved mood. They are also making continuous efforts to enhance the efficiency and performance of LED lights. This includes the development of LED chips and drivers that deliver higher lumen output while consuming less energy.The report has provided a comprehensive analysis of the competitive landscape in the Saudi Arabia LED lights market. Detailed profiles of all major companies have also been provided.

Key Questions Answered in This Report

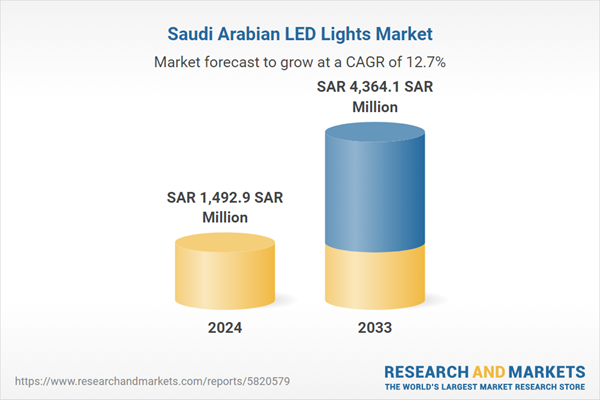

1. What was the size of the Saudi Arabia LED lights market in 2024?2. What is the expected growth rate of the Saudi Arabia LED lights market during 2025-2033?

3. What are the key factors driving the Saudi Arabia LED lights market?

4. What has been the impact of COVID-19 on the Saudi Arabia LED lights market?

5. What is the breakup of the Saudi Arabia LED lights market based on the product type?

6. What is the breakup of the Saudi Arabia LED lights market based on the application?

7. What is the breakup of the Saudi Arabia LED lights market based on the import and domestic manufacturing?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 GCC LED Lighting Industry

5.1 Market Overview

5.2 Market Performance

5.3 Market Breakup by Product Type

5.4 Market Breakup by Application

5.5 Market Breakup by Country

5.6 Market Breakup by Import and Domestic Manufacturing

5.7 Market Breakup by Public and Private Sectors

5.8 Market Breakup by Indoor and Outdoor Applications

5.9 Market Forecast

6 Saudi Arabia LED Lighting Industry

6.1 Market Overview

6.2 Market Performance

6.3 Impact of COVID-19

6.4 Market Breakup by Product Type

6.4.1 LED Panel Lights

6.4.2 LED Downlights

6.4.3 LED Street Lights

6.4.4 Others

6.5 Market Breakup by Application

6.5.1 Commercial

6.5.2 Industrial

6.5.3 Residential

6.5.4 Others

6.6 Market Breakup by Import and Domestic Manufacturing

6.6.1 Import

6.6.2 Domestic Manufacturing

6.7 Market Forecast

6.8 SWOT Analysis

6.8.1 Overview

6.8.2 Strengths

6.8.3 Weaknesses

6.8.4 Opportunities

6.8.5 Threats

6.9 Value Chain Analysis

6.9.1 Primary Raw Material Suppliers

6.9.2 LED Chip Manufacturers

6.9.3 LED Package and Module Manufacturers

6.9.4 Lighting/Electronic Products Manufacturers

6.9.5 Product Distributors

6.9.6 End Users

6.10 Porter’s Five Forces Analysis

6.10.1 Overview

6.10.2 Bargaining Power of Suppliers

6.10.3 Bargaining Power of Buyers

6.10.4 Degree of Competition

6.10.5 Threat of New Entrants

6.10.6 Threat from Substitutes

6.11 Key Market Drivers and Success Factors

6.12 Comparative Analysis of CFL and LED

6.13 Price Analysis

6.13.1 Key Price Indicators

6.13.2 Price Structure

7 LED Lights Manufacturing Process

7.1 Panel Light

7.1.1 Product Overview

7.1.2 Manufacturing Process and Process Flow

7.1.3 Raw Material Requirements

7.1.4 Major Machinery Pictures

7.1.5 Suppliers of Raw Materials and Delivery Time

7.2 Downlight

7.2.1 Product Overview

7.2.2 Manufacturing Process and Process Flow

7.2.3 Raw Material Requirements

7.2.4 Major Machinery Pictures

7.2.5 Suppliers of Raw Materials and Delivery Time

7.3 Flood Light

7.3.1 Product Overview

7.3.2 Manufacturing Process and Process Flow

7.3.3 Raw Material Requirements

7.3.4 Major Machinery Pictures

7.3.5 Suppliers of Raw Materials and Delivery Time

7.4 Street Light

7.4.1 Product Overview

7.4.2 Manufacturing Process and Process Flow

7.4.3 Raw Material Requirements

7.4.4 Major Machinery Pictures

7.4.5 Suppliers of Raw Materials and Delivery Time

7.5 Tube Light

7.5.1 Product Overview

7.5.2 Manufacturing Process and Process Flow

7.5.3 Raw Material Requirements

7.5.4 Major Machinery Pictures

7.5.5 Suppliers of Raw Materials and Delivery Time

7.6 Bulb

7.6.1 Product Overview

7.6.2 Manufacturing Process and Process Flow

7.6.3 Raw Material Requirements

7.6.4 Major Machinery Pictures

7.6.5 Suppliers of Raw Materials and Delivery Time

8 Project Details, Requirements and Costs Involved

8.1 Land Requirements and Expenditures

8.2 Construction Requirements and Expenditures

8.3 Plant Machinery

8.4 Raw Material Requirements and Expenditures

8.5 Packaging Requirements and Expenditures

8.6 Transportation Requirements and Expenditures

8.7 Utility Requirements and Expenditures

8.8 Manpower Requirements and Expenditures

8.9 Other Capital Investments

9 Loans and Financial Assistance

10 Project Economics

10.1 Capital Cost of the Project

10.2 Techno-Economic Parameters

10.3 Product Pricing and Margins Across Various Levels of the Supply Chain

10.4 Taxation and Depreciation

10.5 Income Projections

10.6 Expenditure Projections

10.7 Financial Analysis

10.8 Profit Analysis

11 Competitive Landscape

11.1 Market Structure

11.2 Key Players

11.3 Profiles of Key Players

List of Figures

Figure 1: Saudi Arabia: LED Lighting Market: Major Drivers and Challenges

Figure 2: GCC Region: LED Lighting Market: Sales Value (in SAR Million), 2019-2024

Figure 3: GCC Region: LED Lighting Market: Breakup by Product Type (in %), 2024

Figure 4: GCC Region: LED Lighting Market: Breakup by Application (in %), 2024

Figure 5: GCC Region: LED Lighting Market: Breakup by Country (in %), 2024

Figure 6: GCC Region: LED Lighting Market: Breakup by Imports and Domestic Manufacturing (in %), 2024

Figure 7: GCC Region: LED Lighting Market: Breakup by Private and Public Sector (in %), 2024

Figure 8: GCC Region: LED Lighting Market: Breakup by Indoor and Outdoor Applications (in %), 2024

Figure 9: GCC Region: LED Lighting Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 10: Saudi Arabia: LED Lighting Market: Sales Value (in SAR Million), 2019-2024

Figure 11: Saudi Arabia: LED Lighting Market: Breakup by Product Type (in %), 2024

Figure 12: Saudi Arabia: LED Lighting Market: Breakup by Application (in %), 2024

Figure 13: Saudi Arabia: LED Lighting Market: Breakup by Import and Domestic Manufacturing (in %), 2024

Figure 14: Saudi Arabia: LED Lighting Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 15: Saudi Arabia: LED Lighting (LED Panel Lights) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 16: Saudi Arabia: LED Lighting (LED Panel Lights) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 17: Saudi Arabia: LED Lighting (LED Downlights) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 18: Saudi Arabia: LED Lighting (LED Downlights) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 19: Saudi Arabia: LED Lighting (LED Street Lights) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 20: Saudi Arabia: LED Lighting (LED Street Lights) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 21: Saudi Arabia: LED Lighting (Others) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 22: Saudi Arabia: LED Lighting (Others) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 23: Saudi Arabia: LED Lighting (Commercial) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 24: Saudi Arabia: LED Lighting (Commercial) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 25: Saudi Arabia: LED Lighting (Industrial) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 26: Saudi Arabia: LED Lighting (Industrial) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 27: Saudi Arabia: LED Lighting (Residential) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 28: Saudi Arabia: LED Lighting (Residential) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 29: Saudi Arabia: LED Lighting (Others) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 30: Saudi Arabia: LED Lighting (Others) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 31: Saudi Arabia: LED Lighting (Import) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 32: Saudi Arabia: LED Lighting (Import) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 33: Saudi Arabia: LED Lighting (Domestic Manufacturing) Market: Sales Value (in SAR Million), 2019 & 2024

Figure 34: Saudi Arabia: LED Lighting (Domestic Manufacturing) Market Forecast: Sales Value (in SAR Million), 2025-2033

Figure 35: Saudi Arabia: LED Lighting Industry: SWOT Analysis

Figure 36: Saudi Arabia: LED Lighting Industry: Value Chain Analysis

Figure 37: Saudi Arabia: LED Lighting Industry: Porter’s Five Forces Analysis

Figure 38: Saudi: LED Lighting Market: Price Structure (SAR/Unit)

Figure 39: Panel Light Manufacturing: Various Types of Operation Involved

Figure 40: Panel Light Manufacturing: Conversion Rate of Products

Figure 41: Down Light Manufacturing: Various Types of Operation Involved

Figure 42: Down Light Manufacturing: Conversion Rate of Products

Figure 43: Flood Light Manufacturing: Various Types of Operation Involved

Figure 44: Flood Light Manufacturing: Conversion Rate of Products

Figure 45: Street Light Manufacturing: Various Types of Unit Operations Involved

Figure 46: Street Light Manufacturing: Conversion Rate of Products

Figure 47: Tube Light Manufacturing: Various Types of Units Operation Involved

Figure 48: Tube Light Manufacturing: Conversion Rate of Products

Figure 49: Bulb Manufacturing: Various Types of Operation Involved

Figure 50: Bulb Manufacturing: Conversion Rate of Products

Figure 51: LED Lights Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 52: LED Lights Industry: Breakup of Profit Margins at Various Level of Value Chain

Figure 53: LED Lights Manufacturing Plant: Breakup of Manufacturing Costs (in %)

Figure 54: Saudi Arabia: LED Lighting Market: Breakup by Key Players (in %), 2024

List of Tables

Table 1: GCC: LED Lighting Market: Key Industry Highlights, 2024 and 2033

Table 2: Saudi Arabia: LED Lighting Market: Key Industry Highlights, 2024 and 2033

Table 3: Saudi Arabia: LED Lighting Market Forecast: Breakup by Product Type (in SAR Million), 2025-2033

Table 4: Saudi Arabia: LED Lighting Market Forecast: Breakup by Application (in SAR Million), 2025-2033

Table 5: Saudi Arabia: LED Lighting Market Forecast: Breakup by Import and Domestic Manufacturing (in SAR Million), 2025-2033

Table 6: Panel Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 7: Down Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 8: Flood Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 9: Street Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 10: Tube Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 11: LED Lights Manufacturing Plant: Costs Related to Land and Site Development (in SAR)

Table 12: LED Lights Manufacturing Plant: Costs Related to Civil Works (in SAR)

Table 13: LED Lights Manufacturing Plant: Machinery Costs (in SAR)

Table 14: LED Lights Manufacturing Plant: Costs Related to Other Capital Investments (in SAR)

Table 15: LED Lights Manufacturing Plant: Raw Material Requirements (in Units/Day) and Expenditures (in SAR/Unit)

Table 16: LED Lights Manufacturing Plant: Outer Packaging Requirements and Expenditure

Table 17: LED Lights Manufacturing Plant: Inner Packaging Requirements and Expenditure

Table 18: LED Lights Manufacturing Plant: Transportation Expenditure (SAR/Unit of Light)

Table 19: LED Lights Manufacturing Plant: Costs Related to Utilities (in SAR)

Table 20: LED Lights Manufacturing Plant: Costs Related to Salaries and Wages (in SAR)

Table 21: LED Lights Manufacturing Plant: Techno-Economic Parameters

Table 22: LED Lights Manufacturing Plant: Income Projections (in SAR)

Table 23: LED Lights Manufacturing Plant: Expenditure Projections (in SAR)

Table 24: LED Lights Manufacturing Plant: Income Tax (in SAR/Year)

Table 25: LED Lights Manufacturing Plant: Depreciation (in SAR/Year)

Table 26: LED Lights Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in SAR)

Table 27: LED Lights Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in SAR)

Table 28: LED Lights Manufacturing Plant: Profit and Loss Account (in SAR)

Table 29: Saudi Arabia: LED Lighting Market: Competitive Structure

Table 30: Saudi Arabia: LED Lighting Market: Key Players

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( SAR | SAR 1492.9 SAR Million |

| Forecasted Market Value ( SAR | SAR 4364.1 SAR Million |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Saudi Arabia |