Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A system created to automatically maintain a constant voltage is known as a voltage regulator. Negative feedback or a straightforward feed-forward architecture can be used in a voltage regulator. It might make use of electronic parts or an electromechanical mechanism. It may be used to control one or more AC or DC voltages depending on the design. Electronic voltage regulators are used to regulate the DC voltages required by the processor and other components in devices like power supply. Voltage regulators manage the plant's output in central power plant generators and automotive alternators.

Building Automation Shows Steady Growth as Consumers Seek Safety

The HVAC, building automation, industries (other than electricity), communication systems, power transmission and distribution, and consumer electronics are the application segments of the India voltage stabilizer systems market. Owing to the rising desire for automation and centralized access in developed nations, building automation is the most popular of these. Furthermore, the demand for voltage stabilizer systems has increased along with the demand for HVAC systems, which include centralized heating, ventilation, and air conditioning. The overall market has also been driven by the desire for centralized security access due to increased safety concerns. Finally, the market for voltage stabilizer system is anticipated to be driven by the growing adoption of these systems in developing industrial locations where power fluctuations are common.Rising Expenditure on Consumer Electronics to Propel Market Growth

The increased use of building automation, particularly in developing nations that experience severe power shortages, is to blame for the rising demand for voltage stabilizer systems. Furthermore, the need for voltage stabilizer systems has increased as a result of rising disposable incomes spent on consumer gadgets. According to the paper, the ongoing modernization of transmission and power distribution networks in industrialized nations will have a substantial impact on the rising profits of the worldwide market. The market does, however, confront some difficulties, such as the new development of the green revolution. Both customers and governments should cut back on their spending on gadgets as they compete to reduce carbon emissions. This will lessen the demand for voltage stabilizer equipment.Increasing Demand for Electronic Products across Tier-II, III, and IV Cities

Consumer appliances such as air conditioners, televisions, and freezers have been more popular recently, particularly in the wake of the COVID-19 pandemic as individuals continue to work from home. As a result, the average ticket size of sales for comfort home goods has significantly increased. For instance, tier-II cities and towns have a 12% higher demand for split air conditioners than tier-I cities. Additionally, there is a high demand for premium goods in the smaller tier-II cities, including larger-screen TVs, better refrigerators, washing machines, and gadgets with IoT and AI capabilities. People in tier-II, -III, and -IV cities rely heavily on e-commerce platforms to buy these things; big e-commerce businesses such as Amazon, Flipkart, and Snapdeal receive 60% of their online orders from tier-II towns. Owing to the direct relationship between the sales of stabilizers and those of consumer appliances, the growth in the sales of consumer appliances would eventually lead to a high demand for stabilizers throughout these cities.Investments Under Make in India and Invest India Initiatives Driving Market

The Make in India and Invest in India programs were developed to turn India into a center for design and manufacture across over 27 industries. For the purpose of carrying out its Make in India action plans, the Indian government is always looking for suitable investors. Additionally, the goal is to promote FDIs and make it easier for foreign investors to do business in the nation. In order to achieve this, the government has created a number of programs to encourage both domestic and foreign businesses to establish manufacturing and R&D facilities in India. Examples of these programs include the Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing and the Modified Electronics Manufacturing Clusters Scheme (EMC 2.0).Market Segmentation

The India Voltage Stabilizer Market is segmented into type, application, and controller. Based on type, the market is further bifurcated into single phase and three phase. Based on application, the market is further segmented into mainline, air conditioner, refrigerator, TV, washing machine and others. Based on controller, the market is further segmented into servo and static.Market player

Major players operating in the India Voltage Stabilizer Market are V-Guard Industries, Capri Group, Servomax India Pvt Limited, Consul Neowatt Power Solutions Private Limited, Livguard Energy Technologies Private Limited, Luminous Power Technologies Pvt. Ltd., Jindal Electric & Machinery Corporation, Bluebird Power Controls Pvt. Ltd, Servokon System Ltd, and Microtek International Private Limited.Report Scope:

In this report, India Voltage Stabilizer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Voltage Stabilizer Market, By Type:

- Single Phase

- Three Phase

India Voltage Stabilizer Market, By Application:

- Mainline

- Air Conditioner

- Refrigerator

- TV

- Washing Machine

- Others

India Voltage Stabilizer Market, By Controller:

- Servo

- Static

India Voltage Stabilizer Market, By Region:

- West

- North

- South

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in India Voltage Stabilizer Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- V-Guard Industries

- CAPRI GROUP

- SERVOMAX INDIA PVT LIMITED

- Consul Neowatt Power Solutions Private Limited

- Livguard Energy Technologies Private Limited

- Luminous Power Technologies Pvt. Ltd.

- Jindal Electric & Machinery Corporation

- Bluebird Power Controls Pvt. Ltd

- Servokon System Ltd

- Microtek International Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | September 2023 |

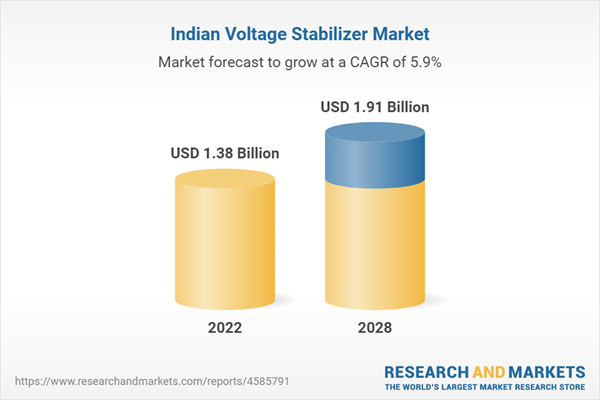

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.38 Billion |

| Forecasted Market Value ( USD | $ 1.91 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |