Cement is a versatile building material that is manufactured through a complex process involving the fusion of limestone, clay, and other materials. These raw materials are crushed and heated to high temperatures in a kiln, resulting in the formation of clinker. The clinker is then ground into a fine powder, which is known as cement. Cement consists mainly of calcium silicates and aluminates, which give it its binding properties. One of its key advantages is its ability to harden and bind various materials together, creating durable structures. It offers excellent compressive strength, making it ideal for the construction of foundations, walls, and other load-bearing elements. Moreover, cement comes in different types, such as Portland cement, blended cement, and specialty cement, each with unique properties suitable for different applications.

The global cement market is influenced by the burgeoning population and rapid urbanization. Moreover, government initiatives and investments in infrastructure projects, such as roads, bridges, and airports, is fueling the market growth. Furthermore, the expanding real estate sector, driven by rising incomes and changing lifestyles, is boosting the market growth. Besides this, rapid industrialization and the growth of the manufacturing sector drive the demand for cement in the construction of factories and industrial structures, further creating a positive outlook for the market. In line with this, the increasing focus on sustainable construction practices and the adoption of green building materials are supporting the market growth.

Cement Market Trends/Drivers:

Growing population and rapid urbanization

Population growth and urbanization are key drivers of the global cement market. As the world population continues to expand, the demand for infrastructure and housing increases. Rapid urbanization, particularly in developing countries, necessitates the construction of new cities, roads, bridges, and other infrastructure projects, all of which require cement. This driver is fueled by the need to accommodate the growing population and provide adequate living and working spaces. Additionally, urbanization often leads to higher incomes and changing lifestyles, further driving the demand for residential and commercial buildings.Government initiatives and investments in infrastructure projects

Governments worldwide recognize the importance of infrastructure development for economic growth and social well-being. They allocate substantial budgets to build and improve transportation networks, such as roads, highways, railways, and airports. These initiatives require massive amounts of cement to construct durable and reliable infrastructure. Moreover, investments in public facilities like schools, hospitals, and water treatment plants also contribute to the demand for cement. The proactive role of governments in infrastructure development ensures a steady flow of projects, providing a stable market for cement manufacturers and suppliers.Expanding real estate sector

The expanding real estate sector is another major driver of the global cement market. As economies grow and incomes rise, the demand for housing, commercial spaces, and other real estate properties increases. This leads to a surge in construction activities, which, in turn, drives the demand for cement. The real estate sector encompasses various segments, including residential, commercial, and industrial construction. Each segment requires cement for foundations, walls, floors, and other structural elements. Additionally, urbanization, population growth, and changing lifestyles contribute to the need for modern and aesthetically appealing buildings, further boosting the market growth. The continuous growth of the real estate sector, particularly in emerging markets, ensures a strong market for cement manufacturers and suppliers.Cement Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global cement market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on type and end-use.Breakup by Type:

- Blended

- Portland

- Others

Portland dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others. According to the report, Portland represented the largest segment.Portland cement dominates the market due to its excellent durability and strength characteristics, making it suitable for a wide range of construction applications. Its high compressive strength ensures long-lasting structures capable of withstanding heavy loads and adverse weather conditions. It offers versatility in terms of its composition, allowing for adjustments to meet specific project requirements. The precise control over its chemical and physical properties enables engineers and architects to tailor the cement mix for optimal performance. Additionally, Portland cement exhibits faster setting and hardening times compared to other cement types, reducing construction time and increasing efficiency. Its widespread availability and relatively lower cost compared to specialty cements further contribute to its dominance in the market.

Breakup by End Use:

- Residential

- Commercial

- Infrastructure

Residential holds the largest share in the market

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes residential, commercial, and infrastructure. According to the report, residential accounted for the largest market share.The residential segment holds the largest share in the market due to several key factors, such as the growing demand for housing, driven by population growth, rapid urbanization, and increasing disposable incomes. Residential construction projects, including single-family homes, apartments, and condominiums, contribute significantly to the overall cement market. Secondly, residential buildings require a substantial amount of cement for their foundations, walls, floors, and other structural components, which is acting as a significant growth-inducing factor. In confluence with this, cement's strength, durability, and versatility make it an ideal choice for constructing safe and long-lasting residential structures. Additionally, the renovation and remodeling activities in the residential sector is bolstering the market growth. Moreover, government initiatives and subsidies aimed at promoting affordable housing and infrastructure development in residential areas further drive the demand for cement in the residential construction sector.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Latin America

- The Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest cement market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.The Asia Pacific region holds the largest share in the global cement market. The region has a rapidly growing population, leading to increased urbanization and infrastructure development. The demand for housing, commercial spaces, and public infrastructure projects, such as roads, bridges, and airports, has been on the rise. As a result, there is a substantial need for cement in the construction sector.

Additionally, several countries in the Asia Pacific region, including China, India, and Japan, have witnessed significant economic growth over the years. This economic development has fueled the construction industry, driving the demand for cement. Moreover, the region is home to many emerging economies with a rising middle class and increasing disposable incomes. This, in turn, has led to a surge in housing and commercial construction activities, creating a substantial demand for cement. Furthermore, government initiatives promoting infrastructure development and urbanization, coupled with favorable investment policies, have attracted both domestic and foreign investments in the construction sector, contributing to the growth of the cement market in the Asia Pacific region.

Competitive Landscape:

The global cement market is highly competitive, characterized by the presence of major multinational corporations, regional players, and small-scale manufacturers. To maintain a competitive edge, companies in the cement market focus on strategies such as mergers and acquisitions, product innovation, and geographical expansion. Mergers and acquisitions allow companies to consolidate their market share, gain access to new technologies, and expand their customer base. Product innovation is another crucial aspect, with manufacturers investing in research and development to enhance the quality and sustainability of their cement products. Geographical expansion allows companies to tap into new markets and cater to the growing demand for cement in emerging economies. Moreover, sustainability has become a significant focus area for cement manufacturers. They are investing in eco-friendly practices and developing low-carbon cement solutions to reduce carbon emissions during production. Additionally, partnerships with construction companies and infrastructure developers play a crucial role in securing long-term contracts and maintaining a competitive position in the market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- China National Building Materials Group Corporation

- Holcim Ltd

- Anhui Conch Cement Co., Ltd.

- Jidong Development Group Co., Ltd.

- Heidelberg Materials

Key Questions Answered in This Report

1. What is cement?2. How big is the global cement market?

3. What is the expected growth rate of the global cement market during 2025-2033?

4. What are the key factors driving the global cement market?

5. What is the leading segment of the global cement market based on the type?

6. What is the leading segment of the global cement market based on end use?

7. What are the key regions in the global cement market?

8. Who are the key players/companies in the global cement market?

Table of Contents

Companies Mentioned

- China National Building Materials Group Corporation

- Holcim Ltd

- Anhui Conch Cement Co. Ltd.

- Jidong Development Group Co. Ltd.

- Heidelberg Materials

Table Information

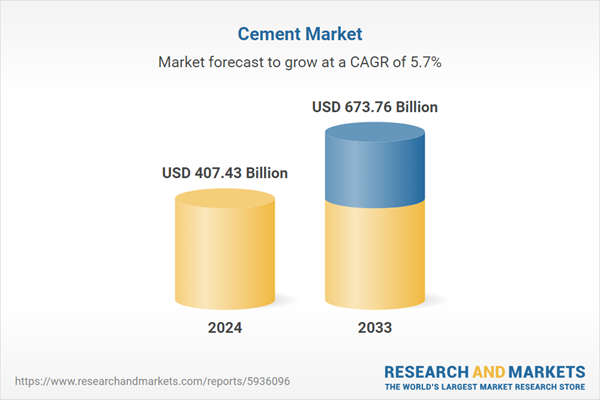

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 407.43 Billion |

| Forecasted Market Value ( USD | $ 673.76 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |