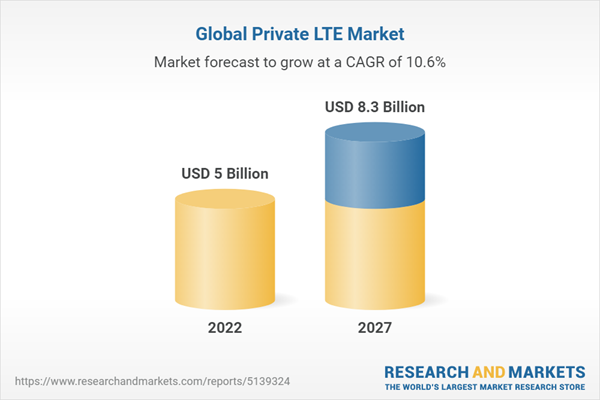

The global private LTE market size is projected to grow from USD 5.0 billion in 2022 to USD 8.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.6% during the forecast period. Major factors such as the need for unique and defined network quality are expected to drive the growth of the global private LTE market. However, the fragmented spectrum may limit the market growth.

Mobile Core Network segment to grow at a higher CAGR during the forecast period

A mobile core network is an important element of the private LTE infrastructure. It has a complex architecture on the enterprise’s data centers, the edge, or the cloud. In the network-in-box concept, this network is a part of eNodeB. EPC is a familiar name in the mobile core network. Currently, virtualized EPC has been pervasive across enterprises. All the greenfield deployment of private LTE networks has witnessed the implementation of cloud-based driving the segment

Unlicensed segment to grow at the highest CAGR during the forecast period

3GPP has industrialized a new approach with LTE License Assisted Access (LAA) to enable access to LTE-U in the 5GHz Industrial, Scientific, and Medical (ISM) band. Globally, a substantial amount of unlicensed spectrum available in the ISM band can be used across a wide range of applications. Enterprises can design, develop, and operate private LTE networks in unlicensed bands. For instance, MulteFire, with its unlicensed band, provides optimum network coverage, improves network capacity, offers seamless mobility, and increases QoS. Apart from enterprises, telecom operators can also use unlicensed bands with carrier aggregation technology to extend their network coverage. Unlicensed bands have opened up several opportunities for enterprises, ISPs, CSPs, MSPs, MNOs, and cable operators by acting as a neutral host to support multiple business use cases.

North America region to record the highest market share in the Private LTE market in 2022

North America is expected to have the largest share in the overall private LTE market. The growth is attributed to the rising deployments of own high-speed private networks to optimize the security of business applications. The US holds a major portion of the adoption of private LTE in this region. Also, the expansive demand for critical business applications with security, upgradeability, and scalability requirements is fueling the market growth.

Network technology providers, wireless integrators, and other players in the ecosystem are entering into partnerships to offer private LTE and 5G and CBRS Citizens Broadband Radio Services solutions to different industry verticals in North America. For instance, Athonet and BearCom partnered to offer private LTE and installations in education, healthcare, Industry 4.0, and other key industries.

- By Company Type: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-level - 55%, Directors - 40%, and Others - 5%

- By Region: North America - 38%, Europe - 40%, Asia Pacific - 21%, and Rest of the World (RoW) - 1%

This research study outlines the market potential, market dynamics, and major vendors operating in the private LTE market. Key and innovative vendors in the private LTE market include Nokia( Finland), Ericsson (Sweden), Huawei (China), ZTE(China), NEC(Japan), Aviat Networks, Samsung (South Korea) Affirmed Networks(US), Athonet (Italy), Airspan (US), ASOCS (US), Boingo Wireless (US), Casa Systems (US), Cisco (US), Comba (China), CommScope (US), Druid Software (Ireland), ExteNet Systems, Fujitsu (Japan), Lemko (US), Mavenir (US), Quortus (UK), Star Solutions (Canada), Tecore (US), Telrad Networks (Israel), Wireless Excellence (UK), Accelleran (Belgium), Altiostar (US), Amarisoft (France), Baicells Technologies (US), Celona (US), IPLOOK (Hong Kong), JMA Wireless (US), Parallel Wireless (US), Phluido (US), NetNumber (US), JI Technology (Japan), Verizon (US), Sierra Wireless (Canada), Future Technologies (US), Ambra Solutions (Canada), URSYS (Australia), Geoverse (US), Cradlepoint (US). These vendors have adopted many organic as well as inorganic growth strategies, such as new product launches, and partnerships and collaborations, to expand their offerings and market shares in the private LTE market.

Research Coverage

The market study covers the private LTE market across different segments. It aims at estimating the market size and the growth potential of this market across different segments based on component, technology, frequency band, end users, and regions. The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying the report

The report is expected to help the market leaders/new entrants in this market by providing them information on the closest approximations of the revenue numbers for the overall private LTE market and its segments. This report is also expected to help stakeholders understand the competitive landscape and gain insights to improve the position of their businesses and to plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates, 2019-2021

1.5 Stakeholders

1.6 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 1 Private Lte Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 List of Primary Interviewers and Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

Figure 2 Data Triangulation

2.3 Market Size Estimation

Figure 3 Market Size Estimation Methodology: Approach 1 (Supply Side): Revenue of Infrastructure and Services of Market

Figure 4 Market Size Estimation Methodology: Approach 1- Bottom-Up (Supply Side): Collective Revenue of Infrastructure and Services of Market

Figure 5 Market Size Estimation Methodology- Approach 2 (Demand Side): Market

2.3.1 Market Forecast

Table 2 Factor Analysis

2.4 Company Evaluation Matrix Methodology

Figure 6 Company Evaluation Matrix: Criteria Weightage

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary

3.1 Private Lte Market: Recession Impact

Figure 7 Market to Witness Decline in Y-O-Y Growth in 2022

Figure 8 Market: Holistic View

Figure 9 Asia-Pacific to Grow at Highest Growth Rate During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities in Private Lte Market

Figure 10 Industrial Automation and Digitalization Across Enterprises to Drive Market During Forecast Period

4.2 Market, by Frequency Band

Figure 11 Licensed Segment to Hold Largest Market Share in 2022

4.3 Market in North America, by Component and Deployment Model

Figure 12 Infrastructure and Centralized Subsegments to Account for Larger Market Shares in North America in 2022

4.4 Market in Europe, by Component and Deployment Model

Figure 13 Infrastructure and Centralized Subsegments to Account for Larger Market Shares in Europe in 2022

4.5 Market in Asia-Pacific, by Component and Deployment Model

Figure 14 Infrastructure and Centralized Subsegments to Account for Larger Market Shares in Asia-Pacific in 2022

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Private Lte Market

5.2.1 Drivers

5.2.1.1 Availability of Unlicensed Spectrums: Cbrs and Multefire Bands

Figure 16 Unlicensed Bands: Us, Europe, Japan, and China

5.2.1.2 Open Networking Model and Infusion of Cloud and Virtualization

5.2.1.3 Dedicated Network with Higher Security, Privacy, and Control

5.2.1.4 Need for Unique and Defined Network Qualities

5.2.1.5 Digital Transformation Initiatives in Businesses to Pave Way for Advanced Wireless Networks

Figure 17 Emerging Technological Adoption in Digital Transformation

5.2.2 Restraints

5.2.2.1 Frequency Bands Interference

5.2.3 Opportunities

5.2.3.1 Emergence of Industrial and Commercial Iot

Figure 18 Key Functional Areas to Deploy Private Lte Networks in Manufacturing Segment

5.2.3.2 Convergence of 5G and Private Lte

5.2.3.3 Upsurge in Business Use Cases Across Manufacturing, Oil and Gas, Mining, and Government Sectors

Table 3 Private Lte Market Use Cases by Industry Vertical

5.2.3.4 Rising Adoption of Mobile Robotics and Ml

5.2.4 Challenges

5.2.4.1 High Initial Cost of Deploying Network Infrastructure

5.2.4.2 Long-Term Investments in Leasing Licensed Frequency Bands

5.3 Market: Recession Impact

5.4 Key Stakeholders and Buying Criteria

5.4.1 Key Stakeholders in Buying Process

Figure 19 Influence of Stakeholders on Buying Process for Top Three Verticals

Table 4 Influence of Stakeholders on Buying Process for Top Three Verticals

5.4.2 Buying Criteria

Figure 20 Key Buying Criteria for Top Three Verticals

Table 5 Key Buying Criteria for Top Three Verticals

5.5 Regulatory Implications

5.5.1 General Data Protection Regulation

5.5.2 California Consumer Privacy Act

5.5.3 Payment Card Industry Data Security Standard

5.5.4 Health Insurance Portability and Accountability Act

5.5.5 Digital Imaging and Communications in Medicine

5.5.6 Health Level Seven

5.5.7 Gramm-Leach-Bliley Act

5.5.8 Sarbanes-Oxley Act

5.5.9 Service Organization Control 2

5.5.10 Communications Decency Act

5.5.11 Digital Millennium Copyright Act

5.5.12 Anti-Cybersquatting Consumer Protection Act

5.5.13 Lanham Act

5.6 Architecture

Figure 21 Private Lte Architecture

5.7 Ecosystem

Figure 22 Private Lte Market: Ecosystem

5.7.1 Network Infrastructure Enablers

5.7.2 Government Regulatory Authorities

5.7.3 System Integrators

5.7.4 Industrial Partners

5.7.5 Strategic Consultants

5.7.6 Original Equipment Manufacturers

5.7.7 Customer Premises Equipment

5.7.8 Virtualization Vendors

5.7.9 Cloud Service Providers

5.7.10 Mobile Network Operators

5.8 Value Chain Analysis

Figure 23 Private Lte Market: Value Chain Analysis

5.9 Patent Analysis

Figure 24 Top Ten Companies with Highest Number of Patent Applications

Table 6 Top Twenty Patent Owners (Us)

Figure 25 Number of Patents Granted Annually, 2012-2021

Figure 26 Standard Essential Patents: 5G

Figure 27 4G and 5G to Declare Patent Portfolios by Declaring Company

5.10 Average Selling Price Trend

Table 7 Pricing Analysis

5.11 Case Study Analysis

5.11.1 Energy

5.11.1.1 Nokia and Elektro

5.11.2 Oil and Gas

5.11.2.1 Cisco and Beach Energy

5.11.3 Mining

5.11.3.1 Challenge Network and Gold Fields

5.11.3.2 Ericsson and Ambra Solutions

5.11.3.3 Nokia and Minera Las Bambas

5.11.3.4 Athonet and Smartfren

5.11.4 Smart Ports

5.11.4.1 Nokia

5.11.5 Government

5.11.5.1 Parallel Wireless and UK Emergency Services Network

5.11.6 Manufacturing

5.11.6.1 Nokia and Airtel

5.12 Technology Analysis

5.12.1 Wi-Fi

5.12.2 Wimax

5.12.3 Small Cell Network

5.12.4 Lte Network

Figure 28 Lte Network Launched Worldwide (2019)

5.12.5 Citizens Broadband Radio Service

Figure 29 Three-Tier Model for Cbrs Spectrum Access

5.12.6 Multefire

5.12.7 Private 5G

5.13 Porter's Five Forces Analysis

Table 8 Private Lte Market: Porter's Five Forces Model Analysis

5.13.1 Threat of New Entrants

5.13.2 Threat of Substitutes

5.13.3 Bargaining Power of Buyers

5.13.4 Bargaining Power of Suppliers

5.13.5 Intensity of Competitive Rivalry

5.13.6 Cumulative Growth Analysis

Table 9 Market: Cumulative Growth Analysis

6 Private Lte Market, by Component

6.1 Introduction

Figure 30 Infrastructure Segment to Grow at Higher CAGR During Forecast Period

Table 10 Market, by Component, 2016-2021 (USD Million)

Table 11 Market, by Component, 2022-2027 (USD Million)

6.1.1 Component: Market Drivers

6.2 Infrastructure

6.2.1 Need to Transform Operations, Increase Automation and Efficiency, or Deliver New Services to Drive Market

Figure 31 Mobile Core Network Segment to Grow at Highest CAGR During Forecast Period

Table 12 Infrastructure: Private Lte Market, by Type, 2016-2021 (USD Million)

Table 13 Infrastructure: Market, by Type, 2022-2027 (USD Million)

Table 14 Infrastructure: Market, by Region, 2016-2021 (USD Million)

Table 15 Infrastructure: Market, by Region, 2022-2027 (USD Million)

6.2.2 Radio Access Network

Table 16 Radio Access Network: Market, by Region, 2016-2021 (USD Million)

Table 17 Radio Access Network: Market, by Region, 2022-2027( USD Million)

6.2.3 Mobile Core Network

Table 18 Mobile Core Network: Market, by Region, 2016-2021 (USD Million)

Table 19 Mobile Core Network: Market, by Region, 2022-2027 (USD Million)

6.2.4 Backhaul

Table 20 Backhaul: Private Lte Market, by Region, 2016-2021 (USD Million)

Table 21 Backhaul: Market, by Region, 2022-2027 (USD Million)

6.3 Services

6.3.1 Demand from Organizations to Streamline Network Operations to Drive Market

Figure 32 Managed Services Segment to Grow at Highest CAGR During Forecast Period

Table 22 Services: Market, by Region, 2016-2021 (USD Million)

Table 23 Services: Market, by Region, 2022-2027 (USD Million)

6.3.2 Consulting

Table 24 Consulting: Market, by Region, 2016-2021 (USD Million)

Table 25 Consulting: Market, by Region, 2022-2027 (USD Million)

6.3.3 Integration and Deployment

Table 26 Integration and Deployment: Private Lte Market, by Region, 2016-2021 (USD Million)

Table 27 Integration and Deployment: Market, by Region, 2022-2027 (USD Million)

6.3.4 Support and Maintenance

Table 28 Support and Maintenance: Market, by Region, 2016-2021 (USD Million)

Table 29 Support and Maintenance: Market, by Region, 2022-2027 (USD Million)

6.3.5 Managed Services

Table 30 Managed Services: Market, by Region, 2016-2021 (USD Million)

Table 31 Managed Services: Market, by Region, 2022-2027 (USD Million)

7 Private Lte Market, by Frequency Band

7.1 Introduction

Figure 33 Unlicensed Segment to Grow at Highest CAGR During Forecast Period

Table 32 Market, by Frequency Band, 2016-2021 (USD Million)

Table 33 Market, by Frequency Band, 2022-2027 (USD Million)

7.1.1 Frequency Band: Market Drivers

Table 34 Global Private Lte Spectrum, by Country

Table 35 Global 4G Lte Spectrum Landscape

7.2 Licensed

7.2.1 Significant Deployment of Licensed Bands in Industrial Sectors to Drive Market

Table 36 Licensed: Market, by Region, 2016-2021 (USD Million)

Table 37 Licensed: Market, by Region, 2022-2027 (USD Million)

7.3 Unlicensed

7.3.1 Opportunities for Enterprises, Isps, Csps, Msps, Mnos, and Cable Operators to Act as Neutral Hosts to Drive Market

Table 38 Unlicensed: Market, by Region, 2016-2021 (USD Million)

Table 39 Unlicensed: Market, by Region, 2022-2027 (USD Million)

7.4 Shared Spectrum

7.4.1 Availability of Cbrs Bands to Boost Market

Table 40 Shared Spectrum: Market, by Region, 2016-2021 (USD Million)

Table 41 Shared Spectrum: Market, by Region, 2022-2027 (USD Million)

8 Private Lte Market, by Technology

8.1 Introduction

Figure 34 Time Division Duplex Segment to Register at Higher CAGR During Forecast Period

Table 42 Market, by Technology, 2016-2021 (USD Million)

Table 43 Market, by Technology, 2022-2027 (USD Million)

8.1.1 Technology: Market Drivers

8.2 Frequency Division Duplex

8.2.1 Demand for Uplink and Downlink to Enable Asymmetric Traffic and Time Dependency

Table 44 Frequency Division Duplex: Market, by Region, 2016-2021 (USD Million)

Table 45 Frequency Division Duplex: Market, by Region, 2022-2027 (USD Million)

8.3 Time Division Duplex

8.3.1 Demand for Time Division Duplex to Provide High-Speed Mobile Broadband Access in Unpaired Spectrum

Table 46 Time Division Duplex: Market, by Region, 2016-2021 (USD Million)

Table 47 Time Division Duplex: Market, by Region, 2022-2027 (USD Million)

9 Private Lte Market, by Deployment Model

9.1 Introduction

Figure 35 Distributed Deployment Model to Grow at Higher CAGR During Forecast Period

Table 48 Market, by Deployment Model, 2016-2021 (USD Million)

Table 49 Market, by Deployment Model, 2022-2027 (USD Million)

9.1.1 Deployment Model: Market Drivers

9.2 Centralized

9.2.1 Growth of Centralized Deployment Model to Assure High Network Performance, Greater Security, and Privacy

Table 50 Centralized: Market, by Region, 2016-2021 (USD Million)

Table 51 Centralized: Market, by Region, 2022-2027 (USD Million)

9.3 Distributed

9.3.1 Rising Adoption of Distributed Deployment Model by Small-Scale Industries due to Flexibility

Table 52 Distributed: Market, by Region, 2016-2021 (USD Million)

Table 53 Distributed: Market, by Region, 2022-2027 (USD Million)

10 Private Lte Market, by End-user

10.1 Introduction

Figure 36 Manufacturing Segment to Account for Largest Market Size During Forecast Period

Table 54 Market, by End-user, 2016-2021 (USD Million)

Table 55 Market, by End-user, 2022-2027 (USD Million)

10.1.1 End-user: Market Drivers

Table 56 Number of Industries, by Sector

10.2 Utilities

10.2.1 Private Lte to Provide High Speed to Maintain Grid Integrity and Reliability

Table 57 Utilities: Market, by Type, 2016-2021 (USD Million)

Table 58 Utilities: Market, by Type, 2022-2027 (USD Million)

10.2.2 Energy

Table 59 Energy: Private Lte Market, by Region, 2016-2021 (USD Million)

Table 60 Energy: Market, by Region, 2022-2027 (USD Million)

10.2.3 Water and Gas

Table 61 Water and Gas: Market, by Region, 2016-2021 (USD Million)

Table 62 Water and Gas: Market, by Region, 2022-2027 (USD Million)

10.3 Mining

10.3.1 Private Lte to Provide Support for Mission-Critical Communication for Efficient Digital Mining Operations

Table 63 Mining: Market, by Type, 2016-2021 (USD Million)

Table 64 Mining: Market, by Type, 2022-2027 (USD Million)

Table 65 Mining: Market, by Region, 2016-2021 (USD Million)

Table 66 Mining: Market, by Region, 2022-2027 (USD Million)

10.3.2 Surface Mining

Table 67 Surface Mining: Market, by Region, 2016-2021 (USD Million)

Table 68 Surface Mining: Market, by Region, 2022-2027 (USD Million)

10.3.3 Underground Mining

Table 69 Underground Mining: Private Lte Market, by Region, 2016-2021 (USD Million)

Table 70 Underground Mining: Market, by Region, 2022-2027 (USD Million)

10.4 Oil and Gas

10.4.1 Private Lte to Provide Support for Digitalization in Onshore and Offshore Fields

Table 71 Oil and Gas: Market, by Type, 2016-2021 (USD Million)

Table 72 Oil and Gas: Market, by Type, 2022-2027 (USD Million)

Table 73 Oil and Gas: Market, by Region, 2016-2021 (USD Million)

Table 74 Oil and Gas: Market, by Region, 2022-2027 (USD Million)

10.4.2 Onshore

Table 75 Onshore: Market, by Region, 2016-2021 (USD Million)

Table 76 Onshore: Market, by Region, 2022-2027 (USD Million)

10.4.3 Offshore

Table 77 Offshore: Market, by Region, 2016-2021 (USD Million)

Table 78 Offshore: Market, by Region, 2022-2027 (USD Million)

10.5 Manufacturing

10.5.1 Private Lte to Offer Connectivity, Reliability, Speed, and Safety for Smooth Functioning

Table 79 Manufacturing: Private Lte Market, by Type, 2016-2021 (USD Million)

Table 80 Manufacturing: Market, by Type, 2022-2027 (USD Million)

Table 81 Manufacturing: Market, by Region, 2016-2021 (USD Million)

Table 82 Manufacturing: Market, by Region, 2022-2027 (USD Million)

10.5.2 Discrete Manufacturing

Table 83 Discrete Manufacturing: Market, by Region, 2016-2021 (USD Million)

Table 84 Discrete Manufacturing: Market, by Region, 2022-2027 (USD Million)

10.5.3 Process Manufacturing

Table 85 Process Manufacturing: Market, by Region, 2016-2021 (USD Million)

Table 86 Process Manufacturing: Market, by Region, 2022-2027 (USD Million)

10.6 Transportation and Logistics

10.6.1 Private Lte to Enable Operators to Consolidate Multiple Services Onto Single Data Communications Network

Table 87 Transportation and Logistics: Private Lte Market, by Type, 2016-2021 (USD Million)

Table 88 Transportation and Logistics: Market, by Type, 2022-2027 (USD Million)

Table 89 Transportation and Logistics: Market, by Region, 2016-2021 (USD Million)

Table 90 Transportation and Logistics: Market, by Region, 2022-2027 (USD Million)

10.6.2 Airways

Table 91 Airways: Market, by Region, 2016-2021 (USD Million)

Table 92 Airways: Market, by Region, 2022-2027 (USD Million)

10.6.3 Railways

Table 93 Railways: Market, by Region, 2016-2021 (USD Million)

Table 94 Railways: Market, by Region, 2022-2027 (USD Million)

10.6.4 Maritime

Table 95 Maritime: Market, by Region, 2016-2021 (USD Million)

Table 96 Maritime: Market, by Region, 2022-2027 (USD Million)

10.6.5 Logistics

Table 97 Logistics: Private Lte Market, by Region, 2016-2021 (USD Million)

Table 98 Logistics: Market, by Region, 2022-2027 (USD Million)

10.7 Government

10.7.1 Private Lte to Ensure Timely Response During Emergencies

Table 99 Government: Private Lte Market, by Type, 2016-2021 (USD Million)

Table 100 Government: Market, by Type, 2022-2027 (USD Million)

Table 101 Government: Market, by Region, 2016-2021 (USD Million)

Table 102 Government: Market, by Region, 2022-2027 (USD Million)

10.7.2 Government and Public Safety

Table 103 Government and Public Safety: Market, by Region, 2016-2021 (USD Million)

Table 104 Government and Public Safety: Market, by Region, 2022-2027 (USD Million)

10.7.3 Military and Intelligence Agencies

Table 105 Military and Intelligence Agencies: Market, by Region, 2016-2021 (USD Million)

Table 106 Military and Intelligence Agencies: Market, by Region, 2022-2027 (USD Million)

10.8 Healthcare

10.8.1 Private Lte to Enable Healthcare Stakeholders to Have Secure In-Building Wireless Access

Table 107 Healthcare: Private Lte Market, by Type, 2016-2021 (USD Million)

Table 108 Healthcare: Market, by Type, 2022-2027 (USD Million)

Table 109 Healthcare: Market, by Region, 2016-2021 (USD Million)

Table 110 Healthcare: Market, by Region, 2022-2027 (USD Million)

10.8.2 Hospitals and Clinics

Table 111 Hospitals and Clinics: Market, by Region, 2016-2021 (USD Million)

Table 112 Hospitals and Clinics: Market, by Region, 2022-2027 (USD Million)

10.8.3 Diagnostics Imaging Center and Laboratories

Table 113 Diagnostics Imaging Center and Laboratories: Market, by Region, 2016-2021 (USD Million)

Table 114 Diagnostics Imaging Center and Laboratories: Market, by Region, 2022-2027 (USD Million)

10.9 Other End-users

Table 115 Other End-users: Market, by Region, 2016-2021 (USD Million)

Table 116 Other End-users: Market, by Region, 2022-2027 (USD Million)

11 Private Lte Market, by Region

11.1 Introduction

Figure 37 Asia-Pacific to Record Highest Growth Rate During Forecast Period

Figure 38 Asia-Pacific to Grow at Highest CAGR During Forecast Period

Table 117 Private Lte Market, by Region, 2016-2021 (USD Million)

Table 118 Market, by Region, 2022-2027 (USD Million)

11.2 North America

11.2.1 North America: Market Drivers

11.2.2 North America: Recession Impact

11.2.3 North America: PESTLE Analysis of Market

Table 119 North America: PESTLE Analysis

Figure 39 North America: Market Snapshot

Table 120 North America: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 121 North America: Market, by Component, 2022-2027 (USD Million)

Table 122 North America: Market, by Infrastructure, 2016-2021 (USD Million)

Table 123 North America: Market, by Infrastructure, 2022-2027 (USD Million)

Table 124 North America: Market, by Service, 2016-2021 (USD Million)

Table 125 North America: Market, by Service, 2022-2027 (USD Million)

Table 126 North America: Market, by Technology, 2016-2021 (USD Million)

Table 127 North America: Market, by Technology, 2022-2027 (USD Million)

Table 128 North America: Market, by End-user, 2016-2021 (USD Million)

Table 129 North America: Market, by End-user, 2022-2027 (USD Million)

Table 130 North America: Market, by Frequency Band, 2016-2021 (USD Million)

Table 131 North America: Market, by Frequency Band, 2022-2027 (USD Million)

Table 132 North America: Market, by Deployment Model, 2016-2021 (USD Million)

Table 133 North America: Private Lte Market, by Deployment Model, 2022-2027 (USD Million)

Table 134 North America: Market, by Transportation and Logistics, 2016-2021 (USD Million)

Table 135 North America: Market, by Transportation and Logistics, 2022-2027 (USD Million)

Table 136 North America: Market, by Manufacturing, 2016-2021 (USD Million)

Table 137 North America: Market, by Manufacturing, 2022-2027 (USD Million)

Table 138 North America: Market, by Oil and Gas, 2016-2021 (USD Million)

Table 139 North America: Market, by Oil and Gas, 2022-2027 (USD Million)

Table 140 North America: Market, by Utility, 2016-2021 (USD Million)

Table 141 North America: Market, by Utility, 2022-2027 (USD Million)

Table 142 North America: Market, by Mining, 2016-2021 (USD Million)

Table 143 North America: Market, by Mining, 2022-2027 (USD Million)

Table 144 North America: Market, by Government, 2016-2021 (USD Million)

Table 145 North America: Market, by Government, 2022-2027 (USD Million)

Table 146 North America: Market, by Healthcare, 2016-2021 (USD Million)

Table 147 North America: Market, by Healthcare, 2022-2027 (USD Million)

Table 148 North America: Market, by Country, 2016-2021 (USD Million)

Table 149 North America: Market, by Country, 2022-2027 (USD Million)

11.2.4 US

11.2.4.1 Increasing Initiatives by Government Toward Infrastructure Development to Drive Market

Table 150 US: Recent Deployments of Private Lte Networks

11.2.4.2 US: Regulatory Norms

Table 151 US: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 152 US: Market, by Component, 2022-2027 (USD Million)

Table 153 US: Market, by Infrastructure, 2016-2021 (USD Million)

Table 154 US: Market, by Infrastructure, 2022-2027 (USD Million)

Table 155 US: Market, by Service, 2016-2021 (USD Million)

Table 156 US: Market, by Service, 2022-2027 (USD Million)

Table 157 US: Market, by Technology, 2016-2021 (USD Million)

Table 158 US: Market, by Technology, 2022-2027 (USD Million)

Table 159 US: Market, by Frequency Band, 2016-2021 (USD Million)

Table 160 US: Market, by Frequency Band, 2022-2027 (USD Million)

Table 161 US: Market, by Deployment Model, 2016-2021 (USD Million)

Table 162 US: Market, by Deployment Model, 2022-2027 (USD Million)

11.2.5 Canada

11.2.5.1 Increasing Partnerships and Agreements to Drive Market

Table 163 Canada: Recent Deployments of Private Lte Networks

11.2.5.2 Canada: Regulatory Norms

Table 164 Canada: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 165 Canada: Market, by Component, 2022-2027 (USD Million)

Table 166 Canada: Market, by Infrastructure, 2016-2021 (USD Million)

Table 167 Canada: Market, by Infrastructure, 2022-2027 (USD Million)

Table 168 Canada: Market, by Service, 2016-2021 (USD Million)

Table 169 Canada: Market, by Service, 2022-2027 (USD Million)

Table 170 Canada: Market, by Technology, 2016-2021 (USD Million)

Table 171 Canada: Market, by Technology, 2022-2027 (USD Million)

Table 172 Canada: Market, by Frequency Band, 2016-2021 (USD Million)

Table 173 Canada: Market, by Frequency Band, 2022-2027 (USD Million)

Table 174 Canada: Market, by Deployment Model, 2016-2021 (USD Million)

Table 175 Canada: Market, by Deployment Model, 2022-2027 (USD Million)

11.3 Europe

11.3.1 Europe: Market Drivers

11.3.2 Europe: Recession Impact

11.3.3 Europe: PESTLE Analysis of Market

Table 176 Europe: PESTLE Analysis

Table 177 Europe: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 178 Europe: Market, by Component, 2022-2027 (USD Million)

Table 179 Europe: Market, by Infrastructure, 2016-2021 (USD Million)

Table 180 Europe: Market, by Infrastructure, 2022-2027 (USD Million)

Table 181 Europe: Market, by Service, 2016-2021 (USD Million)

Table 182 Europe: Market, by Service, 2022-2027 (USD Million)

Table 183 Europe: Market, by Technology, 2016-2021 (USD Million)

Table 184 Europe: Market, by Technology, 2022-2027 (USD Million)

Table 185 Europe: Market, by End-user, 2016-2021 (USD Million)

Table 186 Europe: Market, by End-user, 2022-2027 (USD Million)

Table 187 Europe: Market, by Frequency Band, 2016-2021 (USD Million)

Table 188 Europe: Market, by Frequency Band, 2022-2027 (USD Million)

Table 189 Europe: Market, by Deployment Model, 2016-2021 (USD Million)

Table 190 Europe: Market, by Deployment Model, 2022-2027 (USD Million)

Table 191 Europe: Market, by Transportation and Logistics, 2016-2021 (USD Million)

Table 192 Europe: Market, by Transportation and Logistics, 2022-2027 (USD Million)

Table 193 Europe: Private Lte Market, by Manufacturing, 2016-2021 (USD Million)

Table 194 Europe: Market, by Manufacturing, 2022-2027 (USD Million)

Table 195 Europe: Market, by Oil and Gas, 2016-2021 (USD Million)

Table 196 Europe: Market, by Oil and Gas, 2022-2027 (USD Million)

Table 197 Europe: Market, by Utility, 2016-2021 (USD Million)

Table 198 Europe: Market, by Utility, 2022-2027 (USD Million)

Table 199 Europe: Market, by Mining, 2016-2021 (USD Million)

Table 200 Europe: Market, by Mining, 2022-2027 (USD Million)

Table 201 Europe: Market, by Government, 2016-2021 (USD Million)

Table 202 Europe: Market, by Government, 2022-2027 (USD Million)

Table 203 Europe: Market, by Healthcare, 2016-2021 (USD Million)

Table 204 Europe: Market, by Healthcare, 2022-2027 (USD Million)

Table 205 Europe: Market, by Country, 2016-2021 (USD Million)

Table 206 Europe: Market, by Country, 2022-2027 (USD Million)

11.3.4 UK

11.3.4.1 Demand for Innovative Services That Rely on Fast Digital Connectivity to Drive Market

11.3.4.2 UK: Regulatory Norms

Table 207 UK: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 208 UK: Market, by Component, 2022-2027 (USD Million)

Table 209 UK: Market, by Infrastructure, 2016-2021 (USD Million)

Table 210 UK: Market, by Infrastructure, 2022-2027 (USD Million)

Table 211 UK: Market, by Service, 2016-2021 (USD Million)

Table 212 UK: Market, by Service, 2022-2027 (USD Million)

Table 213 UK: Market, by Technology, 2016-2021 (USD Million)

Table 214 UK: Market, by Technology, 2022-2027 (USD Million)

Table 215 UK: Market, by Frequency Band, 2016-2021 (USD Million)

Table 216 UK: Market, by Frequency Band, 2022-2027 (USD Million)

Table 217 UK: Market, by Deployment Model, 2016-2021 (USD Million)

Table 218 UK: Market, by Deployment Model, 2022-2027 (USD Million)

11.3.5 Germany

11.3.5.1 Emerging High Power Wide Area Edge Within Enterprises to Drive Market

11.3.5.2 Germany: Regulatory Norms

Table 219 Germany: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 220 Germany: Market, by Component, 2022-2027 (USD Million)

Table 221 Germany: Market, by Infrastructure, 2016-2021 (USD Million)

Table 222 Germany: Market, by Infrastructure, 2022-2027 (USD Million)

Table 223 Germany: Market, by Service, 2016-2021 (USD Million)

Table 224 Germany: Market, by Service, 2022-2027 (USD Million)

Table 225 Germany: Market, by Technology, 2016-2021 (USD Million)

Table 226 Germany: Market, by Technology, 2022-2027 (USD Million)

Table 227 Germany: Market, by Frequency Band, 2016-2021 (USD Million)

Table 228 Germany: Market, by Frequency Band, 2022-2027 (USD Million)

Table 229 Germany: Market, by Deployment Model, 2016-2021 (USD Million)

Table 230 Germany: Market, by Deployment Model, 2022-2027 (USD Million)

11.3.6 Nordic Countries

11.3.6.1 Need for Wide Range of Devices and Applications to Boost Market Growth

11.3.6.2 Nordic Countries: Regulatory Norms

Table 231 Nordic Countries: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 232 Nordic Countries: Market, by Component, 2022-2027 (USD Million)

Table 233 Nordic Countries: Market, by Infrastructure, 2016-2021 (USD Million)

Table 234 Nordic Countries: Market, by Infrastructure, 2022-2027 (USD Million)

Table 235 Nordic Countries: Market, by Service, 2016-2021 (USD Million)

Table 236 Nordic Countries: Market, by Service, 2022-2027 (USD Million)

Table 237 Nordic Countries: Market, by Technology, 2016-2021 (USD Million)

Table 238 Nordic Countries: Market, by Technology, 2022-2027 (USD Million)

Table 239 Nordic Countries: Market, by Frequency Band, 2016-2021 (USD Million)

Table 240 Nordic Countries: Market, by Frequency Band, 2022-2027 (USD Million)

Table 241 Nordic Countries: Market, by Deployment Model, 2016-2021 (USD Million)

Table 242 Nordic Countries: Market, by Deployment Model, 2022-2027 (USD Million)

11.3.7 Rest of Europe

Table 243 Rest of Europe: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 244 Rest of Europe: Market, by Component, 2022-2027 (USD Million)

Table 245 Rest of Europe: Market, by Infrastructure, 2016-2021 (USD Million)

Table 246 Rest of Europe: Market, by Infrastructure, 2022-2027 (USD Million)

Table 247 Rest of Europe: Market, by Service, 2016-2021 (USD Million)

Table 248 Rest of Europe: Market, by Service, 2022-2027 (USD Million)

Table 249 Rest of Europe: Market, by Technology, 2016-2021 (USD Million)

Table 250 Rest of Europe: Market, by Technology, 2022-2027 (USD Million)

Table 251 Rest of Europe: Market, by Frequency Band, 2016-2021 (USD Million)

Table 252 Rest of Europe: Market, by Frequency Band, 2022-2027 (USD Million)

Table 253 Rest of Europe: Market, by Deployment Model, 2016-2021 (USD Million)

Table 254 Rest of Europe: Market, by Deployment Model, 2022-2027 (USD Million)

11.4 Asia-Pacific

11.4.1 Asia-Pacific: Market Drivers

11.4.2 Asia-Pacific: Recession Impact

11.4.3 Asia-Pacific: PESTLE Analysis of Market

Table 255 Asia-Pacific: PESTLE Analysis

Figure 40 Asia-Pacific: Market Snapshot

Table 256 Asia-Pacific: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 257 Asia-Pacific: Market, by Component, 2022-2027 (USD Million)

Table 258 Asia-Pacific: Market, by Infrastructure, 2016-2021 (USD Million)

Table 259 Asia-Pacific: Market, by Infrastructure, 2022-2027 (USD Million)

Table 260 Asia-Pacific: Market, by Service, 2016-2021 (USD Million)

Table 261 Asia-Pacific: Market, by Service, 2022-2027 (USD Million)

Table 262 Asia-Pacific: Market, by Technology, 2016-2021 (USD Million)

Table 263 Asia-Pacific: Market, by Technology, 2022-2027 (USD Million)

Table 264 Asia-Pacific: Market, by End-user, 2016-2021 (USD Million)

Table 265 Asia-Pacific: Market, by End-user, 2022-2027 (USD Million)

Table 266 Asia-Pacific: Market, by Frequency Band, 2016-2021 (USD Million)

Table 267 Asia-Pacific: Market, by Frequency Band, 2022-2027 (USD Million)

Table 268 Asia-Pacific: Market, by Deployment Model, 2016-2021 (USD Million)

Table 269 Asia-Pacific: Market, by Deployment Model, 2022-2027 (USD Million)

Table 270 Asia-Pacific: Market, by Transportation and Logistics, 2016-2021 (USD Million)

Table 271 Asia-Pacific: Market, by Transportation and Logistics, 2022-2027 (USD Million)

Table 272 Asia-Pacific: Market, by Manufacturing, 2016-2021 (USD Million)

Table 273 Asia-Pacific: Private Lte Market, by Manufacturing, 2022-2027 (USD Million)

Table 274 Asia-Pacific: Market, by Oil and Gas, 2016-2021 (USD Million)

Table 275 Asia-Pacific: Market, by Oil and Gas, 2022-2027 (USD Million)

Table 276 Asia-Pacific: Market, by Utility, 2016-2021 (USD Million)

Table 277 Asia-Pacific: Market, by Utility, 2022-2027 (USD Million)

Table 278 Asia-Pacific: Market, by Mining, 2016-2021 (USD Million)

Table 279 Asia-Pacific: Market, by Mining, 2022-2027 (USD Million)

Table 280 Asia-Pacific: Market, by Government, 2016-2021 (USD Million)

Table 281 Asia-Pacific: Market, by Government, 2022-2027 (USD Million)

Table 282 Asia-Pacific: Market, by Healthcare, 2016-2021 (USD Million)

Table 283 Asia-Pacific: Market, by Healthcare, 2022-2027 (USD Million)

Table 284 Asia-Pacific: Market, by Country, 2016-2021 (USD Million)

Table 285 Asia-Pacific: Market, by Country, 2022-2027 (USD Million)

11.4.4 China

11.4.4.1 Initiatives by Chinese Government to Drive Market

11.4.4.2 China: Regulatory Norms

Table 286 China: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 287 China: Market, by Component, 2022-2027 (USD Million)

Table 288 China: Market, by Infrastructure, 2016-2021 (USD Million)

Table 289 China: Market, by Infrastructure, 2022-2027 (USD Million)

Table 290 China: Market, by Service, 2016-2021 (USD Million)

Table 291 China: Market, by Service, 2022-2027 (USD Million)

Table 292 China: Market, by Technology, 2016-2021 (USD Million)

Table 293 China: Market, by Technology, 2022-2027 (USD Million)

Table 294 China: Market, by Frequency Band, 2016-2021 (USD Million)

Table 295 China: Market, by Frequency Band, 2022-2027 (USD Million)

Table 296 China: Market, by Deployment Model, 2016-2021 (USD Million)

Table 297 China: Market, by Deployment Model, 2022-2027 (USD Million)

11.4.5 Japan

11.4.5.1 Favorable Effort by Government to Drive Market

11.4.5.2 Japan: Regulatory Norms

Table 298 Japan: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 299 Japan: Market, by Component, 2022-2027 (USD Million)

Table 300 Japan: Market, by Infrastructure, 2016-2021 (USD Million)

Table 301 Japan: Market, by Infrastructure, 2022-2027 (USD Million)

Table 302 Japan: Market, by Service, 2016-2021 (USD Million)

Table 303 Japan: Market, by Service, 2022-2027 (USD Million)

Table 304 Japan: Market, by Technology, 2016-2021 (USD Million)

Table 305 Japan: Market, by Technology, 2022-2027 (USD Million)

Table 306 Japan: Market, by Frequency Band, 2016-2021 (USD Million)

Table 307 Japan: Market, by Frequency Band, 2022-2027 (USD Million)

Table 308 Japan: Market, by Deployment Model, 2016-2021 (USD Million)

Table 309 Japan: Market, by Deployment Model, 2022-2027 (USD Million)

11.4.6 Australia

11.4.6.1 Regulations to Promote Secure Networking Experience to Drive Market

11.4.6.2 Australia: Regulatory Norms

Table 310 Australia: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 311 Australia: Market, by Component, 2022-2027 (USD Million)

Table 312 Australia: Market, by Infrastructure, 2016-2021 (USD Million)

Table 313 Australia: Market, by Infrastructure, 2022-2027 (USD Million)

Table 314 Australia: Market, by Service, 2016-2021 (USD Million)

Table 315 Australia: Market, by Service, 2022-2027 (USD Million)

Table 316 Australia: Market, by Technology, 2016-2021 (USD Million)

Table 317 Australia: Market, by Technology, 2022-2027 (USD Million)

Table 318 Australia: Market, by Frequency Band, 2016-2021 (USD Million)

Table 319 Australia: Market, by Frequency Band, 2022-2027 (USD Million)

Table 320 Australia: Market, by Deployment Model, 2016-2021 (USD Million)

Table 321 Australia: Market, by Deployment Model, 2022-2027 (USD Million)

11.4.7 Rest of Asia-Pacific

11.5 Middle East & Africa

11.5.1 Middle East & Africa: Market Drivers

11.5.2 Middle East & Africa: Recession Impact

Table 322 Middle East & Africa: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 323 Middle East & Africa: Market, by Component, 2022-2027 (USD Million)

Table 324 Middle East & Africa: Market, by Infrastructure, 2016-2021 (USD Million)

Table 325 Middle East & Africa: Market, by Infrastructure, 2022-2027 (USD Million)

Table 326 Middle East & Africa: Market, by Service, 2016-2021 (USD Million)

Table 327 Middle East & Africa: Market, by Service, 2022-2027 (USD Million)

Table 328 Middle East & Africa: Market, by Technology, 2016-2021 (USD Million)

Table 329 Middle East & Africa: Market, by Technology, 2022-2027 (USD Million)

Table 330 Middle East & Africa: Market, by End-user, 2016-2021 (USD Million)

Table 331 Middle East & Africa: Market, by End-user, 2022-2027 (USD Million)

Table 332 Middle East & Africa: Market, by Frequency Band, 2016-2021 (USD Million)

Table 333 Middle East & Africa: Market, by Frequency Band, 2022-2027 (USD Million)

Table 334 Middle East & Africa: Market, by Deployment Model, 2016-2021 (USD Million)

Table 335 Middle East & Africa: Market, by Deployment Model, 2022-2027 (USD Million)

Table 336 Middle East & Africa: Market, by Transportation and Logistics, 2016-2021 (USD Million)

Table 337 Middle East & Africa: Market, by Transportation and Logistics, 2022-2027 (USD Million)

Table 338 Middle East & Africa: Private Lte Market, by Manufacturing, 2016-2021 (USD Million)

Table 339 Middle East & Africa: Market, by Manufacturing, 2022-2027 (USD Million)

Table 340 Middle East & Africa: Market, by Oil and Gas, 2016-2021 (USD Million)

Table 341 Middle East & Africa: Market, by Oil and Gas, 2022-2027 (USD Million)

Table 342 Middle East & Africa: Market, by Utility, 2016-2021 (USD Million)

Table 343 Middle East & Africa: Market, by Utility, 2022-2027 (USD Million)

Table 344 Middle East & Africa: Market, by Mining, 2016-2021 (USD Million)

Table 345 Middle East & Africa: Market, by Mining, 2022-2027 (USD Million)

Table 346 Middle East & Africa: Market, by Government, 2016-2021 (USD Million)

Table 347 Middle East & Africa: Market, by Government, 2022-2027 (USD Million)

Table 348 Middle East & Africa: Market, by Healthcare, 2016-2021 (USD Million)

Table 349 Middle East & Africa: Market, by Healthcare, 2022-2027 (USD Million)

Table 350 Middle East & Africa: Market, by Country, 2016-2021 (USD Million)

Table 351 Middle East & Africa: Market, by Country, 2022-2027 (USD Million)

11.5.3 Ksa

11.5.3.1 Digital Transformation Ambitions in Line with Saudi Vision 2030 to Drive Market

11.5.3.2 Ksa: Regulatory Norms

Table 352 Ksa: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 353 Ksa: Market, by Component, 2022-2027 (USD Million)

Table 354 Ksa: Market, by Infrastructure, 2016-2021 (USD Million)

Table 355 Ksa: Market, by Infrastructure, 2022-2027 (USD Million)

Table 356 Ksa: Market, by Service, 2016-2021 (USD Million)

Table 357 Ksa: Market, by Service, 2022-2027 (USD Million)

Table 358 Ksa: Market, by Technology, 2016-2021 (USD Million)

Table 359 Ksa: Market, by Technology, 2022-2027 (USD Million)

Table 360 Ksa: Market, by Frequency Band, 2016-2021 (USD Million)

Table 361 Ksa: Market, by Frequency Band, 2022-2027 (USD Million)

Table 362 Ksa: Market, by Deployment Model, 2016-2021 (USD Million)

Table 363 Ksa: Market, by Deployment Model, 2022-2027 (USD Million)

11.5.4 UAE

11.5.4.1 Smart Cities Initiatives to Drive Market

11.5.4.2 UAE: Regulatory Norms

Table 364 UAE: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 365 UAE: Market, by Component, 2022-2027 (USD Million)

Table 366 UAE: Market, by Infrastructure, 2016-2021 (USD Million)

Table 367 UAE: Market, by Infrastructure, 2022-2027 (USD Million)

Table 368 UAE: Market, by Service, 2016-2021 (USD Million)

Table 369 UAE: Market, by Service, 2022-2027 (USD Million)

Table 370 UAE: Market, by Technology, 2016-2021 (USD Million)

Table 371 UAE: Market, by Technology, 2022-2027 (USD Million)

Table 372 UAE: Market, by Frequency Band, 2016-2021 (USD Million)

Table 373 UAE: Market, by Frequency Band, 2022-2027 (USD Million)

Table 374 UAE: Market, by Deployment Model, 2016-2021 (USD Million)

Table 375 UAE: Market, by Deployment Model, 2022-2027 (USD Million)

11.5.5 Rest of Middle East & Africa

11.6 Latin America

11.6.1 Latin America: Market Drivers

11.6.2 Latin America: Recession Impact

Table 376 Latin America: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 377 Latin America: Market, by Component, 2022-2027 (USD Million)

Table 378 Latin America: Market, by Infrastructure, 2016-2021 (USD Million)

Table 379 Latin America: Market, by Infrastructure, 2022-2027 (USD Million)

Table 380 Latin America: Market, by Service, 2016-2021 (USD Million)

Table 381 Latin America: Market, by Service, 2022-2027 (USD Million)

Table 382 Latin America: Market, by Technology, 2016-2021 (USD Million)

Table 383 Latin America: Market, by Technology, 2022-2027 (USD Million)

Table 384 Latin America: Market, by End-user, 2016-2021 (USD Million)

Table 385 Latin America: Market, by End-user, 2022-2027 (USD Million)

Table 386 Latin America: Market, by Frequency Band, 2016-2021 (USD Million)

Table 387 Latin America: Market, by Frequency Band, 2022-2027 (USD Million)

Table 388 Latin America: Market, by Deployment Model, 2016-2021 (USD Million)

Table 389 Latin America: Market, by Deployment Model, 2022-2027 (USD Million)

Table 390 Latin America: Market, by Transportation and Logistics, 2016-2021 (USD Million)

Table 391 Latin America: Market, by Transportation and Logistics, 2022-2027 (USD Million)

Table 392 Latin America: Market, by Manufacturing, 2016-2021 (USD Million)

Table 393 Latin America: Private Lte Market, by Manufacturing, 2022-2027 (USD Million)

Table 394 Latin America: Market, by Oil and Gas, 2016-2021 (USD Million)

Table 395 Latin America: Market, by Oil and Gas, 2022-2027 (USD Million)

Table 396 Latin America: Market, by Utility, 2016-2021 (USD Million)

Table 397 Latin America: Market, by Utility, 2022-2027 (USD Million)

Table 398 Latin America: Market, by Mining, 2016-2021 (USD Million)

Table 399 Latin America: Market, by Mining, 2022-2027 (USD Million)

Table 400 Latin America: Market, by Government, 2016-2021 (USD Million)

Table 401 Latin America: Market, by Government, 2022-2027 (USD Million)

Table 402 Latin America: Market, by Healthcare, 2016-2021 (USD Million)

Table 403 Latin America: Market, by Healthcare, 2022-2027 (USD Million)

Table 404 Latin America: Market, by Country, 2016-2021 (USD Million)

Table 405 Latin America: Market, by Country, 2022-2027 (USD Million)

11.6.3 Brazil

11.6.3.1 Need to Provide Business-Critical Connectivity to Drive Market

11.6.3.2 Brazil: Regulatory Norms

Table 406 Brazil: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 407 Brazil: Market, by Component, 2022-2027 (USD Million)

Table 408 Brazil: Market, by Infrastructure, 2016-2021 (USD Million)

Table 409 Brazil: Market, by Infrastructure, 2022-2027 (USD Million)

Table 410 Brazil: Market, by Service, 2016-2021 (USD Million)

Table 411 Brazil: Market, by Service, 2022-2027 (USD Million)

Table 412 Brazil: Market, by Technology, 2016-2021 (USD Million)

Table 413 Brazil: Market, by Technology, 2022-2027 (USD Million)

Table 414 Brazil: Market, by Frequency Band, 2016-2021 (USD Million)

Table 415 Brazil: Market, by Frequency Band, 2022-2027 (USD Million)

Table 416 Brazil: Market, by Deployment Model, 2016-2021 (USD Million)

Table 417 Brazil: Market, by Deployment Model, 2022-2027 (USD Million)

11.6.4 Mexico

11.6.4.1 Need for Industry 4.0 By Mexican Businesses to Drive Market

11.6.4.2 Mexico: Regulatory Norms

Table 418 Mexico: Private Lte Market, by Component, 2016-2021 (USD Million)

Table 419 Mexico: Market, by Component, 2022-2027 (USD Million)

Table 420 Mexico: Market, by Infrastructure, 2016-2021 (USD Million)

Table 421 Mexico: Market, by Infrastructure, 2022-2027 (USD Million)

Table 422 Mexico: Market, by Service, 2016-2021 (USD Million)

Table 423 Mexico: Market, by Service, 2022-2027 (USD Million)

Table 424 Mexico: Market, by Technology, 2016-2021 (USD Million)

Table 425 Mexico: Market, by Technology, 2022-2027 (USD Million)

Table 426 Mexico: Market, by Frequency Band, 2016-2021 (USD Million)

Table 427 Mexico: Market, by Frequency Band, 2022-2027 (USD Million)

Table 428 Mexico: Market, by Deployment Model, 2016-2021 (USD Million)

Table 429 Mexico: Market, by Deployment Model, 2022-2027 (USD Million)

11.6.5 Rest of Latin America

12 Competitive Landscape

12.1 Introduction

12.2 Market Evaluation Framework

Figure 41 Market Evaluation Framework

12.3 Revenue Analysis of Top Market Players

Figure 42 Revenue Analysis of Top Players in Market

12.4 Historical Revenue Analysis

12.4.1 Introduction

Figure 43 Historic Revenue Analysis of Leading Players

12.5 Ranking of Key Players in Private Lte Market

Figure 44 Ranking of Key Players, 2020

12.6 Company Evaluation Matrix

12.6.1 Stars

12.6.2 Emerging Leaders

12.6.3 Pervasive Players

12.6.4 Participants

Figure 45 Market (Global), Company Evaluation Matrix, 2022

12.7 Startup/Sme Evaluation Matrix

12.7.1 Progressive Companies

12.7.2 Responsive Companies

12.7.3 Dynamic Companies

12.7.4 Starting Blocks

Figure 46 Private Lte Market (Global), Startup/Sme Evaluation Matrix, 2022

12.8 Key Market Developments

12.8.1 Product Launches

Table 430 Market: Product Launches, (2019-2022)

12.8.2 Deals

Table 431 Market: Deals (2019-2022)

13 Company Profiles

13.1 Major Players

(Business Overview, Products/Solutions/Services Offered, and Recent Developments)*

13.1.1 Nokia

Table 432 Nokia: Business Overview

Figure 47 Nokia: Company Snapshot

Table 433 Nokia: Products/Solutions/Services Offered

Table 434 Nokia: Product Launches

Table 435 Nokia: Deals

13.1.2 Ericsson

Table 436 Ericsson: Business Overview

Figure 48 Ericsson: Company Snapshot

Table 437 Ericsson: Products/Solutions/Services Offered

Table 438 Ericsson: Product Launches

Table 439 Ericsson: Deals

13.1.3 Huawei

Table 440 Huawei: Business Overview

Figure 49 Huawei: Company Snapshot

Table 441 Huawei: Products/Solutions/Services Offered

Table 442 Huawei: Product Launches

13.1.4 Zte

Table 443 Zte: Business Overview

Figure 50 Zte: Company Snapshot

Table 444 Zte: Products/Solutions/Services Offered

Table 445 Zte: Deals

13.1.5 Nec

Table 446 Nec: Business Overview

Figure 51 Nec: Company Snapshot

Table 447 Nec: Products/Solutions/Services Offered

Table 448 Nec: Product Launches

Table 449 Nec: Deals

13.1.6 Aviat Networks

Table 450 Aviat Networks: Business Overview

Figure 52 Aviat Networks: Company Snapshot

Table 451 Aviat Networks: Product/Solutions/Services Offered

Table 452 Aviat Networks: Deals

13.1.7 Samsung

Table 453 Samsung: Business Overview

Figure 53 Samsung: Company Snapshot

Table 454 Samsung: Product/Solutions/Services Offered

Table 455 Samsung: Deals

13.1.8 Affirmed Networks (Microsoft)

13.1.9 Athonet

13.1.10 Airspan

13.1.11 Asocs

13.1.12 Boingo Wireless

13.1.13 Casa Systems

13.1.14 Cisco

13.1.15 Comba

13.1.16 Commscope

13.1.17 Druid Software

13.1.18 Extenet Systems

13.1.19 Fujitsu

13.1.20 Lemko

13.1.21 Mavenir

13.1.22 Quortus

13.1.23 Star Solutions

13.1.24 Tecore

13.1.25 Telrad Networks

13.1.26 Wireless Excellence (Cablefree)

13.2 Startups

13.2.1 Accelleran

13.2.2 Altiostar

13.2.3 Amarisoft

13.2.4 Baicells Technologies

13.2.5 Celona

13.2.6 Iplook

13.2.7 Jma Wireless

13.2.8 Parallel Wireless

13.2.9 Phluido

13.3 Other Key Ecosystem Vendors

13.3.1 Netnumber

13.3.2 Ji Technology

13.3.3 Verizon

13.3.4 Sierra Wireless

13.3.5 Future Technologies

13.3.6 Ambra Solutions

13.3.7 Ursys

13.3.8 Geoverse

13.3.9 Cradlepoint

* Business Overview, Products/Solutions/Services Offered, and Recent Developments Might Not be Captured in Case of Unlisted Companies.

14 Appendix

14.1 Adjacent/Related Markets

14.1.1 5G Infrastructure Market

14.1.1.1 Market Definition

14.1.1.2 Limitations

14.1.1.3 Market Overview

14.1.1.4 5G Infrastructure Market, by Communication Infrastructure

Table 456 5G Infrastructure Market, by Communication Infrastructure, 2018-2027 (USD Million)

Table 457 5G Communication Infrastructure Market, by Region, 2018-2027 (USD Million)

Table 458 5G Communication Infrastructure Market in Row, by Region, 2018-2027 (USD Million)

Table 459 5G Communication Infrastructure Market, by End-user, 2018-2027 (USD Million)

14.1.1.5 5G Infrastructure Market, by Region

Table 460 5G Infrastructure Market, by Region, 2018-2027 (USD Million)

Table 461 5G Infrastructure Market in North America, by Operational Frequency, 2018-2027 (USD Million)

Table 462 5G Infrastructure Market in North America, by Core Network Technology, 2018-2027 (USD Million)

Table 463 5G Infrastructure Market in Canada, by Core Network Technology, 2020-2027 (USD Million)

Table 464 5G Infrastructure Market in Mexico, by Communication Infrastructure, 2020-2027 (USD Million)

Table 465 5G Infrastructure Market in Europe, by Operational Frequency, 2018-2027 (USD Million)

Table 466 5G Infrastructure Market in Germany, by Communication Infrastructure, 2019-2027 (USD Million)

Table 467 5G Infrastructure Market in Italy, by Core Network Technology, 2019-2027 (USD Million)

Table 468 5G Infrastructure Market in Rest of Europe, by Communication Infrastructure, 2018-2027 (USD Million)

Table 469 5G Infrastructure Market in Rest of Europe, by Core Network Technology, 2018-2027 (USD Million)

Table 470 5G Infrastructure Market in Asia-Pacific, by Country, 2018-2027 (USD Million)

Table 471 5G Infrastructure Market in Asia-Pacific, by Communication Infrastructure, 2018-2027 (USD Million)

Table 472 5G Infrastructure Market in Asia-Pacific, by End-user, 2018-2027 (USD Million)

Table 473 5G Infrastructure Market in Asia-Pacific, by Core Network Technology, 2018-2027 (USD Million)

Table 474 5G Infrastructure Market in Japan, by Communication Infrastructure, 2019-2027 (USD Million)

Table 475 5G Infrastructure Market in Japan, by Core Network Technology, 2019-2027 (USD Million)

Table 476 5G Infrastructure Market in Rest of Asia-Pacific, by Communication Infrastructure, 2019-2027 (USD Million)

Table 477 5G Infrastructure Market in Row, by Region, 2018-2027 (USD Million)

Table 478 5G Infrastructure Market in Row, by Communication Infrastructure, 2018-2027 (USD Million)

Table 479 5G Infrastructure Market in Row, by End-user, 2018-2027 (USD Million)

Table 480 5G Infrastructure Market in Row, by Core Network Technology, 2018-2027 (USD Million)

Table 481 5G Infrastructure Market in Middle East & Africa, by Communication Infrastructure, 2018-2027 (USD Million)

Table 482 5G Infrastructure Market in South America, by Communication Infrastructure, 2020-2027 (USD Million)

Table 483 5G Infrastructure Market in South America, by Core Network Technology, 2020-2027 (USD Million)

14.1.2 Cloud-Radio Access Network Market

14.1.2.1 Market Overview

14.1.2.2 Cloud-Radio Access Network Market, by Component

Table 484 Cloud-Radio Access Network Market, by Component, 2016-2019 (USD Million)

Table 485 Cloud-Radio Access Network Market, by Component, 2019-2025 (USD Million)

14.1.2.3 Solutions

Table 486 Solutions: Cloud-Radio Access Network Market, by Region, 2016-2019 (USD Million)

Table 487 Solutions: Cloud-Radio Access Network Market, by Region, 2019-2025 (USD Million)

14.1.2.3.1 Services

Table 488 Services: Cloud-Radio Access Network Market, by Region, 2016-2019 (USD Million)

Table 489 Services: Cloud-Radio Access Network Market, by Region, 2019-2025 (USD Million)

Table 490 Services: Cloud-Radio Access Network Market, by Type, 2016-2019 (USD Million)

Table 491 Services: Cloud-Radio Access Network Market, by Type, 2019-2025 (USD Million)

14.1.2.4 Cloud-Radio Access Network Market, by Network Type

Table 492 Cloud-Radio Access Network Market, by Network Type, 2016-2019 (USD Million)

Table 493 Cloud-Radio Access Network Market, by Network Type, 2019-2025 (USD Million)

14.1.2.5 Cloud- Radio Access Network Market, by Deployment

Table 494 Cloud-Radio Access Network Market, by Deployment, 2016-2019 (USD Million)

Table 495 Cloud-Radio Access Network Market, by Deployment, 2019-2025 (USD Million)

14.1.2.6 Cloud-Radio Access Network Market, by End-user

Table 496 Cloud-Radio Access Network Market, by End-user, 2016-2019 (USD Million)

Table 497 Cloud-Radio Access Network Market, by End-user, 2019-2025 (USD Million)

14.2 Discussion Guide

14.3 Knowledgestore: The Subscription Portal

14.4 Customization Options

Companies Mentioned

- Accelleran

- Affirmed Networks (Microsoft)

- Airspan

- Altiostar

- Amarisoft

- Ambra Solutions

- Asocs

- Athonet

- Aviat Networks

- Baicells Technologies

- Boingo Wireless

- Casa Systems

- Celona

- Cisco

- Comba

- Commscope

- Cradlepoint

- Druid Software

- Ericsson

- Extenet Systems

- Fujitsu

- Future Technologies

- Geoverse

- Huawei

- Iplook

- Ji Technology

- Jma Wireless

- Lemko

- Mavenir

- Nec

- Netnumber

- Nokia

- Parallel Wireless

- Phluido

- Quortus

- Samsung

- Sierra Wireless

- Star Solutions

- Tecore

- Telrad Networks

- Ursys

- Verizon

- Wireless Excellence (Cablefree)

- Zte

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 349 |

| Published | January 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 44 |