The strongest driver of India's warehouse industry is the intense growth of the e-commerce market. According to the reports, in March 2025, India's warehousing market expanded by 12%, to 56.4 million sq ft in 2024. Mumbai topped the list with 10.3 million sq ft, fueled by third-party logistics and e-commerce sectors. Furthermore, with hundreds of millions of consumers making online purchases, there is a sharp increase in the demand for streamlined storage and distribution facilities. Strategically placed warehouses are needed by e-commerce operators to house inventories, fulfill orders promptly, and provide uninterrupted supply chain functions. As the shopping from websites becomes highly popular, package volume handled by it has also surged exponentially, with a real urgency for warehouse facilities at scale. With faster deliveries, particularly in metro and tier-II towns, being needed too, having warehouses at central points also gains validity in saving time and costs in transportation. Online market players are rapidly turning their attentions to solutions for last-mile delivery, a feat that only becomes possible via the optimal exploitation of urban-area warehouses. More importantly, an increase in the adoption of omnichannel selling, in which companies have the presence both on and offline, has further generated the need for integrated distribution networks and warehousing.

The efforts of the Indian government to facilitate ease of doing business and encourage infrastructure growth have been instrumental in encouraging the warehouse market. Initiatives like the Goods and Services Tax (GST) and the construction of dedicated logistics parks have facilitated the setup of large-size warehouses nationwide. As per the sources, in March 2025, India's logistics and warehousing industry witnessed steep growth in tier 2-3 cities during March 2025, powered by government thrust like the ₹10,000 crore yearly Urban Infrastructure Development Fund and infrastructural improvement. Moreover, the advent of GST has de-cluttered the tax architecture, removing inter-state hurdles and making it easy to transport goods across state boundaries, promoting warehousing efficiency. Further, the government drive for improving infrastructures such as highways, freight corridors, and multimodal logistic parks has contributed substantially to minimizing transportation costs and enhancing the viability of large-size warehouses. Such policies have rendered India a popular destination for both local and foreign logistics businesses, which has increased demand for contemporary warehouse facilities. The establishment of logistics parks and special economic zones (SEZs) also makes it easy to establish warehouses, which businesses are granted with incentives, such as tax exemptions and accelerated regulatory approval.

Indian Warehouse Market Trends:

Growing Demand for Warehouses with Logistics and Growth in E-commerce

The rising demand for Indian warehouses is primarily fueled by the requirement to preserve product freshness and timely delivery. Since logistics is used to add value to goods, warehouse services are becoming essential in keeping products reaching customers on time. One of the main drivers of growth for the Indian warehouse market forecast is an increased e-commerce business. As more consumers are switching to online shopping, warehouses play a critical role in managing inventory, order fulfillment, and stock availability when needed. India's e-commerce industry had a Gross Merchandise Value (GMV) of USD 60 billion in financial year 2023, registering a growth of 22% compared to the previous year, as per the India Brand Equity Foundation. This expanding e-retail market requires efficient warehouses that can process high volumes and provide services such as packaging and rapid order filling. With online shopping on the increase, warehouses became an essential part of India's retail and logistics environment.Government Initiatives and Export Growth

Another major trend is the active intervention of the Indian government in developing the logistics and warehousing industries. With programs such as the Export-oriented Units (EOU) scheme, India seeks to increase its share in international trade by promoting exports. The scheme is aimed at minimizing trade deficits and fostering the development of export activity, which subsequently fuels the demand for warehousing. The demand for warehouses is specifically great in the sectors that need well-efficient inventory management for export purposes, for keeping products safe and shipping them on time. With increasing strength of India in world trade, warehouses become more important in supporting amplified volumes of exports. Government policies and investments alongside a vision to minimize logistics cost further support this market. The growth of international trade and export business is likely to drive demand for warehouses with capabilities to meet complex logistics and transportation needs.Warehouse Usage in Automotive and Value-Added Services

Moreover, another strong contributor to Indian warehousing market growth is the demand driven by the automotive sector. Due to the high level of purchases of personal cars and electric vehicles (EVs), the need for warehouses has also been rising as a requirement for storing spare parts, components, and finished products. The dependency of the automotive industry on warehouses for distributing the product quickly across the country makes sure it goes efficiently to where it's needed. Also, warehouses are now highly utilized for value-added services, including packaging, docking, and consolidating goods to minimize delivery time. These services are being included by companies to streamline supply chain management, produce higher value, and improve customer satisfaction. With more than the basic storage, warehouses are now becoming central hubs that help ensure smoother logistics processes and quicker delivery times. The growing demand for value-added services is compelling warehouses to transform themselves into multi-functional logistical hubs.Indian Warehouse Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Indian warehouse market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on sector, ownership, and type of commodities stored.Analysis by Sector:

- Industrial Warehouses

- Agricultural Warehouses

Analysis by Ownership:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

Analysis by Type of Commodities Stored:

- General Warehouses

- Specialty Warehouses

- Refrigerated Warehouses

Competitive Landscape:

The Indian warehousing industry is propelled by the swift growth of industries like e-commerce, automotive, and manufacturing. Major players are increasingly embracing newer technologies such as automation, artificial intelligence (AI), and cloud-based solutions to make operations more efficient and improve supply chain effectiveness. These technologies enable optimized management of inventory, minimized delivery time, and better real-time tracking of products. Moreover, the accelerating need for value-added solutions like packaging and customization of products has resulted in an increased emphasis on offering full-fledged logistics solutions. The efforts of the government to boost global trade and spur export-driven activities also add to the market's optimistic outlook. With the boosting sales of personal and electric vehicles (EVs), the automotive industry's demand for warehouses is also picking up pace. This changing topography invites endless innovation, generating a scenario wherein firms continually improve warehouse design and operating models to comply with shifting marketplace demands.The report provides a comprehensive analysis of the competitive landscape in the Indian warehouse market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the Indian warehouse market?2. What is the future outlook of Indian warehouse market?

3. What are the key factors driving the Indian warehouse market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Indian Warehouse Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Sector

5.5 Market Breakup by Ownership

5.6 Market Breakup by Type of Commodities Stored

5.7 Market Forecast

5.8 SWOT Analysis

5.8.1 Overview

5.8.2 Strengths

5.8.3 Weaknesses

5.8.4 Opportunities

5.8.5 Threats

5.9 Value Chain Analysis

5.10 Porters Five Forces Analysis

5.10.1 Overview

5.10.2 Bargaining Power of Buyers

5.10.3 Bargaining Power of Suppliers

5.10.4 Degree of Competition

5.10.5 Threat of New Entrants

5.10.6 Threat of Substitutes

6 Market Breakup by Sector

6.1 Industrial Warehouses

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Agricultural Warehouses

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Ownership

7.1 Private Warehouses

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Public Warehouses

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Bonded Warehouses

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Type of Commodities Stored

8.1 General Warehouses

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Speciality Warehouses

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Refrigerated Warehouses

8.3.1 Market Trends

8.3.2 Market Forecast

9 Competitive Landscape

9.1 Market Structure

9.2 Key Players

9.3 Profiles of Key Players

List of Figures

Figure 1: India: Warehouse Market: Major Drivers and Challenges

Figure 2: India: Warehouse Market: Sales Value (in Billion INR), 2019-2024

Figure 3: India: Warehouse Market: Breakup by Sector (in %), 2024

Figure 4: India: Warehouse Market: Breakup by Ownership (in %), 2024

Figure 5: India: Warehouse Market: Breakup by Type of Commodities Stored (in %), 2024

Figure 6: India: Warehouse Market Forecast: Sales Value (in Billion INR), 2025-2033

Figure 7: India: Warehouse Industry: SWOT Analysis

Figure 8: India: Warehouse Industry: Value Chain Analysis

Figure 9: India: Warehouse Industry: Porter’s Five Forces Analysis

Figure 10: India: Warehouse Market (Industrial Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 11: India: Warehouse Market Forecast (Industrial Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 12: India: Warehouse Market (Agricultural Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 13: India: Warehouse Market Forecast (Agricultural Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 14: India: Warehouse Market (Private Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 15: India: Warehouse Market Forecast (Private Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 16: India: Warehouse Market (Public Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 17: India: Warehouse Market Forecast (Public Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 18: India: Warehouse Market (Bonded Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 19: India: Warehouse Market Forecast (Bonded Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 20: India: Warehouse Market (General Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 21: India: Warehouse Market Forecast (General Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 22: India: Warehouse Market (Speciality Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 23: India: Warehouse Market Forecast (Speciality Warehouses): Sales Value (in Billion INR), 2025-2033

Figure 24: India: Warehouse Market (Refrigerated Warehouses): Sales Value (in Billion INR), 2019 & 2024

Figure 25: India: Warehouse Market Forecast (Refrigerated Warehouses): Sales Value (in Billion INR), 2025-2033

List of Tables

Table 1: India: Warehouse Market: Key Industry Highlights, 2024 and 2033

Table 2: India: Warehouse Market Forecast: Breakup by Sector (in Billion INR), 2025-2033

Table 3: India: Warehouse Market Forecast: Breakup by Ownership (in Billion INR), 2025-2033

Table 4: India: Warehouse Market Forecast: Breakup by Type of Commodities Stored (in Billion INR), 2025-2033

Table 5: India: Warehouse Market: Competitive Structure

Table 6: India: Warehouse Market: Key Players

Table Information

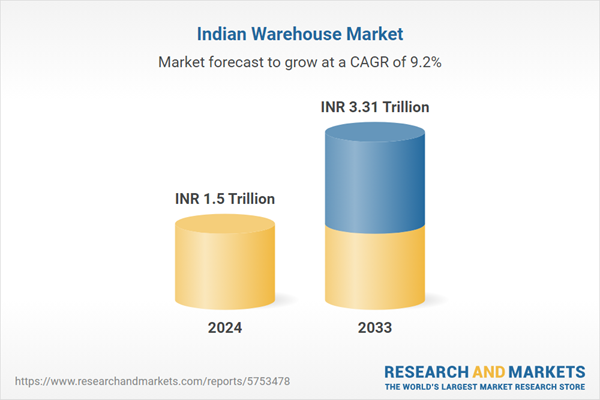

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( INR | INR 1.5 Trillion |

| Forecasted Market Value ( INR | INR 3.31 Trillion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | India |