The COVID-19 pandemic significantly impacted the market's growth due to the postponement of elective surgeries during the pandemic. For instance, according to the data published by the World Economic Forum in 2020, around 28 million elective surgeries across the globe were canceled during 12 ring 12 weeks of peak disruption during the COVID-19 pandemic. Such circumstances have decreased the demand for bariatric surgery devices and limited the market's growth during the pandemic. However, during the post-pandemic period, the relaxation of restrictions has increased the patient influx, increasing the demand for bariatric surgery devices and contributing to market growth.

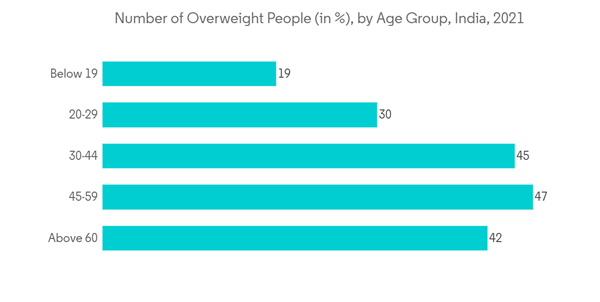

The major factors, such as the increasing burden of obesity and the rising prevalence of diabetes and cardiovascular diseases, are expected to drive market growth in the forecast period. The data published by the European Heart Network in 2021 reported that more than 60 million people were living with cardiovascular disease in the European Union, and nearly 13 million new cases of cardiovascular diseases were diagnosed. Similarly, data from the International Diabetes Federation published in 2021 stated that globally, around 537 million adults were living with diabetes as of 2021. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. The increase in chronic diseases such as diabetes and cardiovascular diseases among the global population is one of the crucial factors associated with obesity or being overweight, leading to the increasing demand for bariatric surgery devices, attributed to the market growth.

Additionally, according to the WHO data published in May 2022, it was found that over 60% of adults were obese in European countries during the year 2021, whereas 29% of adult males and 27% of adult females were overweight or obese. The same report stated that overweight and obesity rank fourth among the region's risk factors for non-communicable diseases, after high blood pressure, unhealthy eating, and smoking. Hence, owing to the high burden of obesity and the increasing prevalence of risk factors for obesity are expected to fuel growth in the bariatric surgery devices market over the forecast period.

Therefore, it is observed that the growing prevalence of diabetes and obesity is likely to drive the market for bariatric surgery devices over the upcoming years. However, the high surgery cost and lack of knowledge and awareness in developing and underdeveloped nations may restrain market growth.

Bariatric Surgery Devices Market Trends

The Assisting Devices segment is Expected to Hold a Major Market Share in the Bariatric Surgery Devices Market

The assisting devices are expected to hold a dominating share in the studied market during the forecast period. This is mainly due to the increasing prevalence of the obese population across the globe, leading to the demand for bariatric surgery devices, thereby propelling the market's growth. Various factors, such as unhealthy habits or lack of physical activity, cause obesity. For instance, the World Health Organization (WHO) published in 2021 that modifiable behavioral risk factors such as tobacco use account for over 7.2 million deaths yearly, and 1.6 million deaths annually can be attributed to insufficient physical activity in the United States.Additionally, increasing innovative launches to simplify surgeries are expected to drive the market's growth. For instance, in July 2022, the United States FDA provided de novo authorization for Apollo Endosurgery to market its Apollo ESG and Apollo REVISE endoscopic systems for the treatment of patients with obesity. With such new launches, the segment studied is expected to grow considerably during the forecast period.

Furthermore, in September 2021, Olympus launched the POWERSEAL advanced bipolar surgical energy devices to strengthen its surgical portfolio. The POWERSEAL devices can be used in numerous forms of surgical intervention, including bariatric surgical procedures.

Thus, due to the new launches and rising prevalence of obesity, the assisting devices segment is expected to propel over the forecast period.

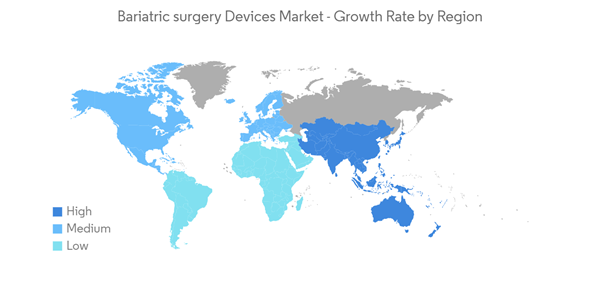

North America is Expected to Hold a Significant Share in the Market

The market for bariatric surgery devices in the United States is driven by the increasing use of advanced technology in healthcare systems and the country's rising burden of chronic diseases. The major factors attributing to the market growth include a sedentary lifestyle, lack of physical activity, lack of proper diet, anxiety, and stress resulting in chronic diseases such as diabetes and obesity. For instance, in 2022, the CDC mentioned that more than 795,000 people in the United States have a stroke yearly. About 610,000 of these are first or new strokes. To avoid the further complications associated with obesity, there is a growing demand for bariatric surgeries across the region.As per the United States National Health Statistics Reports published in June 2021, obesity was 41.9%, severe obesity was 9.2%, and diabetes was 14.8% among adults aged 20 and over. The increase in the prevalence of obesity among the population is expected to drive the bariatric surgery market in the United States.

Moreover, product launches by the key market players in the region are expected to boost market growth. For instance, in May 2021, Standard Bariatrics announced the launch of its novel Titan SGS stapling technology, specifically designed for bariatric sleeve surgery. Also, the device has been cleared by the FDA. These new product launches by major players for new closure devices propel the studied market's growth. Similarly, in June 2021, Ethicon, part of the Johnson & Johnson Medical Devices Companies, launched the ENSEAL X1 Curved Jaw Tissue Sealer for colorectal, gynecological, bariatric surgery, and thoracic procedures. These new product launches by major players for new closure devices propel the studied market's growth.

Thus, due to the factors mentioned above, the market is expected to witness a boost in growth in this region during the forecast period.

Bariatric Surgery Devices Industry Overview

The Bariatric Surgery Devices Market is fragmented competitive and consists of several major players. In terms of market share, a few major players dominate the market. Some companies currently dominating the market are Apollo Endo Surgery Inc., Johnson & Johnson, TransEnterrix Inc., Allergenc, Inc., Reshape Medical, Inc., Medtronic plc, Entero Medica Inc., Asprie Bariatrics Inc., and others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apollo Endosurgery Inc

- Johnson& Johnson

- TransEnterrix Inc

- Allergenc, Inc

- ReShape Medical, Inc

- Medtronic Plc

- Entero Medica, Inc

- Aspire Bariatrics Inc