Key Highlights

- As per reports, with the pandemic's reduction, the shipping environment should become more steady than during 2019-2021. It is anticipated that by post-pandemic, international container exports will increase by 2-3%. This is owing to the delayed revival of the maritime shipping sector and the backlogs from previous year. Additionally, it is anticipated that port congestion will return to normal in the upcoming period.

- Although maritime freight costs have dropped recently, they are still almost ten times more than before the pandemic. According to experts, the demand and supply balance in the container market will remain constant through at least the middle of 2022. Additionally, a 30% reduction in container shipping costs is anticipated over the next few months.

- Purchasing new ships is the simplest option for shipping corporations to address the space problem. For fleet expansion, shipping firms invest in new and used boats. This is a big move to address the threats from the competition and the issues facing the sector.

- For example, CMA CGM has strengthened its position in the Baltic region by purchasing ten ice-breaking cargo ships. Shipping companies like Maersk and CMA CGM are growing their fleets and purchasing aircraft fleets. The Mediterranean Shipping Company has entered the cruise ship business after purchasing 12 new ships.

Shipping Containers Market Trends

Increase in Demand for Cargo Transportation through Ships Driving the Market

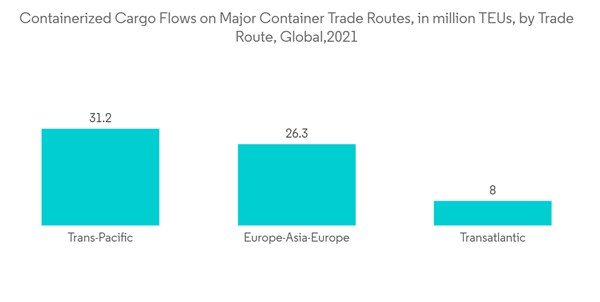

- Despite these setbacks, world trade rose to record levels in 2021. UNCTAD predicted global trade to expand by 23% from 2020 to approximately USD 28 trillion in 2021. Trade in goods reached record levels in the third quarter of 2021, and trade in services grew faster but still lagged behind pre-pandemic levels. During the second half of 2021, global trade growth steadied and increased by 1% Q-o-Q. Although trade growth has remained uneven among nations and industries, it has a more extensive base in the third quarter of 2021 than in the first and second quarters.

- Due to an anticipated rise in regional trade cooperation within Africa and the Asia-Pacific region, geopolitical factors such as regionalization of trade flows and implementation of regional trade agreements, such as the Regional Comprehensive Economic Partnership and the African Continental Free Trade Area, may have an impact on global trade patterns.

- In addition to the aforementioned key variables, the economic recovery from the pandemic in 2021 has been marked by significant and erratic swings in demand, which have increased the stress on supply chains and resulted in a scene never before seen of disruptions in logistical networks and unheard-of increases in shipping costs.

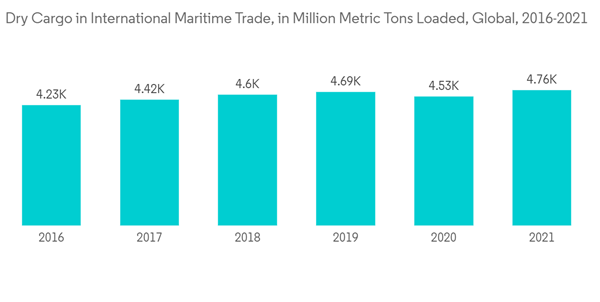

Demand for Dry Containers offering traction to the market

- The majority of dry bulk (62%), which climbed by 14% in 2021 to reach 59.9 million tonnes, was made up of dry bulk. An increase in biomass, which reflects the transition to renewable fuels, can be partly blamed for the expansion in this category during the previous few years. According to research, wood pellets make up the majority of the biomass burned in UK power plants. These trade figures reveal that wood pellet imports have increased five-fold over the last ten years, but this does not fully explain the pattern because the increase in other dry bulk is greater than the increase in wood pellets.

- Sea dredging aggregates provide another factor for the rise in other dry bulk, as seen by a high 29% increase in domestic one-port traffic in 2021. Traffic to and from offshore areas, including sea dredging, is included in one-port tonnage. Construction uses sea dredging aggregates, and according to the ONS, overall construction production climbed 12.7% in 2021 over 2020.

Shipping Containers Market Competitor Analysis

The Shipping Containers Market is consolidated, with a few players dominating the market. The top 3 companies hold more than 70% of the market share. The leading shipping container vendors include China International Marine Containers (Group) Ltd (CIMC), Dong Fang International Container (Hong Kong) Co. Ltd, and Maersk Container Industry AS. Digitalization is shaping the industry as companies are working to increase their freight volume despite the challenges rising in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- TLS Offshore Containers International Pvt. Ltd

- China International Marine Containers Co. Ltd

- Maersk Container Industry AS

- W&K Container Inc.

- Singamas Container Holdings Limited

- YMC Container Solutions

- Sea Box Inc

- Dong Fang International Container (Hong Kong) Co. Ltd

- CXIC (Changzhou Xinhuachang Int'l Containers) Co. Ltd

- Storstac Inc.

- China Eastern Containers

- CARU Containers BV

- American Intermodal Container Manufacturing Company (AICM)

- Valisons & Co.

- Ritveyraaj Cargo Shipping Containers