Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The COVID-19 pandemic has had a significant impact on the water treatment chemicals market in Europe. Initially, the market experienced a slowdown due to disrupted supply chains and reduced industrial activity caused by the pandemic. However, the pandemic also increased awareness about the importance of clean water and the need for proper water treatment. As a result, the market is expected to rebound and witness long-term growth.

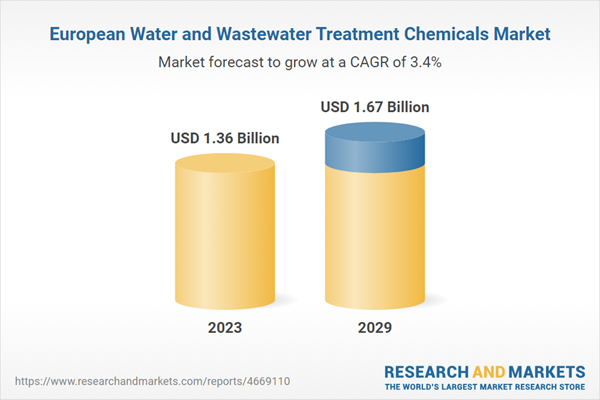

Looking ahead, the future of the Europe Water and Wastewater Treatment Chemicals market appears promising, with ample opportunities in both the municipal and industrial sectors. The increasing population and urbanization in Europe, along with stringent environmental regulations regarding the discharge and treatment of industrial waste, are key drivers for this market. Additionally, the growing use of water treatment chemicals in industrial cooling water systems further contributes to the market's growth potential.

The European water and wastewater treatment chemicals market is poised for substantial growth in the coming years. The rising concerns about the environment and the growing need for clean water are expected to drive significant demand for water treatment chemicals. This presents a lucrative opportunity for businesses operating in this market to expand their operations and cater to the increasing demand.

Key Market Drivers

Growing Demand of Water and Wastewater Treatment Chemicals in Pharmaceutical Industry

Water plays a critical and multifaceted role in the pharmaceutical industry. It is essential in various processes such as medication production, equipment cleaning, equipment cooling, formulation development, quality control, and laboratory analysis. The reliable and consistent supply of high-quality water is crucial to ensuring the efficacy, safety, and compliance of pharmaceutical products.According to the European Commission, the pharmaceutical industry in Europe generates approximately 30,000 tonnes of pharmaceutical wastewater annually, much of which contains harmful chemicals, including active pharmaceutical ingredients (APIs) and metabolites. This wastewater, if discharged untreated into the environment, can harm aquatic ecosystems and pose risks to public health. This growing concern is driving the need for effective water and wastewater treatment solutions.

The pharmaceutical industry’s wastewater contains not only conventional pollutants but also bioactive substances like APIs, which can persist in the environment. For example, a study by the European Medicines Agency (EMA) highlighted that traces of APIs were found in surface waters across Europe, raising environmental and health concerns. As a result, there is an urgent demand for robust and efficient water and wastewater treatment solutions that can remove or neutralize these contaminants, ensuring the responsible and sustainable management of pharmaceutical wastewater.

The increasing awareness of environmental sustainability and the need for regulatory compliance are significant drivers of the demand for water and wastewater treatment chemicals in the pharmaceutical industry. The European Union’s stringent environmental regulations, such as the EU Water Framework Directive (2000/60/EC), require the pharmaceutical sector to reduce the release of pollutants, including pharmaceutical residues, into water bodies. According to the European Environment Agency (EEA), pharmaceutical residues in wastewater have become a significant environmental concern, prompting the need for advanced treatment technologies.

These regulations have contributed to the rising demand for specialized water and wastewater treatment chemicals. These chemicals are specifically formulated for pharmaceutical applications to remove a wide range of contaminants, prevent corrosion in water distribution systems, and inhibit the growth of harmful microorganisms. For instance, chemical treatments are used to neutralize APIs, heavy metals, and other harmful substances commonly found in pharmaceutical wastewater. As the pharmaceutical sector continues to expand in Europe, driven by advancements in research, development, and manufacturing, the demand for these treatment chemicals is expected to rise steadily.

In 2023, the European pharmaceutical sector was valued at over USD 363.78 billion, with a significant portion of this industry dedicated to meeting the growing demand for pharmaceutical products. This growth, coupled with increasing concerns about sustainability and stringent water regulations, is expected to further boost the market for water and wastewater treatment chemicals in the coming years. Moreover, the rising focus on innovation and technological advancements in the water treatment field is helping to meet these challenges.

As Europe moves toward greater environmental responsibility, stakeholders in the pharmaceutical industry are focusing more on comprehensive water management strategies that prioritize resource efficiency, environmental protection, and public health. This includes the adoption of water recycling and advanced wastewater treatment methods that align with the EU’s sustainability goals, such as the European Green Deal, which aims to achieve carbon neutrality by 2050.

The growing demand for water and wastewater treatment chemicals in the pharmaceutical industry reflects the sector's increasing commitment to sustainability and regulatory compliance. This trend is expected to shape the future of water treatment in the pharmaceutical sector, driving innovation and improved water management practices across Europe.

Growing Demand of Water and Wastewater Treatment Chemicals in Chemical Industry

Water is an essential and irreplaceable component in various processes within the chemical industry. It plays a crucial role as a solvent, coolant, and is involved in the production of a wide range of chemical products. This extensive reliance on water makes the chemical industry one of the largest consumers of water on a global scale. Additionally, the chemical industry generates a significant amount of wastewater, which often contains hazardous substances that require careful treatment before being discharged into the environment. The treatment of this wastewater is not only important from an environmental perspective but is also mandated by regulatory authorities. Consequently, there is an increasing demand for effective water and wastewater treatment solutions specifically tailored for the chemical industry.The growing and wastewater treatment need for water and wastewater treatment in the chemical industry has consequently led to a surge in demand for treatment chemicals. These chemicals play a vital role in removing contaminants, reducing corrosion, and controlling microbial growth. As the chemical industry continues to expand in Europe, driven by factors such as technological advancements and the increased demand for chemical products, the need for these treatment chemicals is expected to rise even further.

As the European chemical industry experiences steady growth, driven by increase in chemical production, manufacturers offering sustainable and efficient water and wastewater treatment solutions are set to benefit from this expanding market. The European Commission has also outlined plans to reduce industrial water use and improve wastewater treatment efficiency by 30% by 2030, further propelling the demand for advanced treatment chemicals. Manufacturers who provide innovative, eco-friendly treatment options can help meet the industry's growing needs while contributing to the sustainability of the chemical sector.

Key Market Challenges

Volatility in Cost of Treatment Chemicals

The cost of water and wastewater treatment chemicals has been subject to significant fluctuations over the years. Several factors have contributed to this volatility, including rising prices of raw materials, increasing operational costs, and disruptions in supply chains. These challenges have been further exacerbated by the ongoing COVID-19 pandemic, leading to even greater unpredictability in the cost of treatment chemicals.The impact of cost volatility extends beyond just the profit margins of manufacturers. It also affects the affordability of treatment solutions for end-users, potentially hindering the widespread adoption of water and wastewater treatment methods and impeding overall market growth.

Europe, known for its well-established industrial sector, particularly in pharmaceutical and chemical industries, heavily relies on water treatment chemicals. The fluctuations in the cost of these chemicals can significantly impact operational costs and sustainability efforts in these industries.

Furthermore, Europe's stringent environmental regulations necessitate the treatment of wastewater before discharge, driving up the demand for treatment chemicals. The unpredictability in the cost of these chemicals poses budgeting challenges for municipalities and industries alike, further complicating the situation. This highlights the need for proactive strategies to mitigate the impact of cost volatility and ensure stable and sustainable water and wastewater treatment practices.

Key Market Trends

Growing Demand of Smart Water Management

Smart water management involves the strategic utilization of cutting-edge technology, comprehensive data analysis, and advanced analytics to optimize the efficiency of water and wastewater treatment processes. This innovative approach encompasses a wide array of sophisticated tools, including advanced water meters, sensor networks, powerful software systems, and top-notch services, all working in harmony to monitor, analyze, and optimize water usage.By leveraging the power of real-time data and intelligent algorithms, smart water management solutions enable the detection of leaks, identification of inefficiencies, and improvement of overall water infrastructure performance. These state-of-the-art systems not only enhance operational efficiency but also facilitate proactive maintenance, ensuring the longevity and reliability of water treatment facilities.

The rise in popularity of smart water management practices is significantly impacting the demand for water and wastewater treatment chemicals. With the integration of advanced monitoring and control capabilities, these innovative solutions enable the optimal utilization of treatment chemicals, reducing wastage and improving cost-efficiency.

Furthermore, as more industries and municipalities embrace smart water management solutions, the need for compatible treatment chemicals is expected to experience a substantial surge. This growing demand for compatible chemicals is poised to drive the overall growth of the water and wastewater treatment chemicals market, fostering innovation and propelling advancements in the field.

As Europe continues to prioritize sustainable practices and embraces the era of digitization, the demand for smart water management solutions is anticipated to rise further. This progressive trend not only signifies the continent's commitment to environmental stewardship but also presents immense opportunities for the expansion and development of the water and wastewater treatment chemicals market.

Segmental Insights

End User Insights

The oil & gas segment was projected to experience rapid growth during the forecast period. Stringent regulations in Europe regarding the production and disposal of wastewater have necessitated the use of water and wastewater treatment chemicals in the oil and gas industry. These regulations aim to protect the environment and public health by ensuring that wastewater from oil and gas operations is properly treated before it is discharged or reused.The oil and gas industry involves complex processes such as extraction, refining, and transportation, which often result in the production of large volumes of wastewater. This wastewater typically contains various contaminants including oils, greases, salts, and heavy metals that need to be removed before the water can be reused or discharged. The use of water and wastewater treatment chemicals is critical in effectively treating this wastewater.

Moreover, the oil and gas industry is increasingly focusing on water reuse and recycling to reduce its water footprint and comply with stringent environmental regulations. Water and wastewater treatment chemicals play a crucial role in enabling the reuse and recycling of water by effectively removing contaminants and improving the overall quality of water. By implementing these measures, the industry can mitigate its impact on freshwater resources and promote sustainable practices in line with environmental goals.

Country Insights

Germany emerged as the dominant region in the Europe Water and Wastewater Treatment Chemicals Market in 2023, holding the largest market share in terms of value. Germany, known for its robust industrial sector, boasts one of the largest economies in Europe. This economic powerhouse encompasses various industries such as manufacturing, pharmaceuticals, and chemicals. These sectors, responsible for generating substantial amounts of wastewater, understand the importance of treating it before disposal. The demand for water and wastewater treatment chemicals in Germany is therefore significant, contributing to the nation's dominance in the market.In addition to its thriving industries, Germany also upholds stringent environmental regulations to ensure water quality and proper wastewater discharge. These regulations create a compelling need for effective water and wastewater treatment processes, further driving the demand for treatment chemicals in the country. By prioritizing sustainable practices and compliance, Germany continues to lead the way

Key Market Players

- Ecolab Europe GmbH

- Kurita Europe GmbH

- BASF SE

- Kemira Oyj

- SUEZ SA

- Solenis Switzerland GmbH

- Buckman Laboratories, N.V.

- Lonza AG

Report Scope:

In this report, the Europe Water and Wastewater Treatment Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Water and Wastewater Treatment Chemicals Market, By Chemical Type:

- Coagulant & Flocculant

- Biocide & Disinfectant

- Corrosion & Scale Inhibitor

- pH Adjuster

- Others

Europe Water and Wastewater Treatment Chemicals Market, By End User:

- Oil & Gas

- Pharmaceutical

- Chemicals

- FMCG

- Others

Europe Water and Wastewater Treatment Chemicals Market, By Country:

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Water and Wastewater Treatment Chemicals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ecolab Europe GmbH

- Kurita Europe GmbH

- BASF SE

- Kemira Oyj

- SUEZ SA

- Solenis Switzerland GmbH

- Buckman Laboratories, N.V.

- Lonza AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | December 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.36 Billion |

| Forecasted Market Value ( USD | $ 1.67 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 8 |