Global Granite, Marble and Stone Market - Key Trends & Drivers Summarized

Granite, marble, and stone are natural materials widely used in the construction and decoration of buildings due to their durability, aesthetic appeal, and versatility. These materials are favored for applications such as countertops, flooring, wall cladding, and monuments. Granite is known for its hardness and resistance to wear and tear, making it ideal for high-traffic areas. Marble, with its distinctive veining and elegance, is often used in luxurious interior designs and sculptures. Other natural stones, including limestone, slate, and sandstone, offer unique textures and colors that enhance architectural and landscaping projects.The quarrying and processing of granite, marble, and stone involve advanced techniques to extract and refine these materials into usable forms. Cutting-edge machinery and technology enable the precise cutting, polishing, and finishing of stone slabs, ensuring high-quality products that meet the demands of modern construction standards. Sustainable practices in quarrying and processing are increasingly being adopted to minimize environmental impact, including water recycling systems and the use of renewable energy sources. The global trade of these materials is robust, with major producers and exporters including countries like China, India, Brazil, and Italy.

The growth in the granite, marble, and stone market is driven by several factors. Firstly, the increasing demand for aesthetically pleasing and durable building materials in residential and commercial construction is a significant driver. Secondly, advancements in quarrying and processing technologies are enhancing the efficiency and quality of stone products. Thirdly, the rising trend of home renovation and remodeling is boosting the demand for granite, marble, and stone in interior applications. Additionally, the growing popularity of natural materials in sustainable building practices is promoting their use. Furthermore, the expansion of the global construction industry, particularly in emerging markets, is creating new opportunities for stone suppliers. Lastly, the increasing use of stone in outdoor landscaping and architectural projects is further driving market growth.

Report Scope

The report analyzes the Granite, Marble and Stone market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Granite, Marble and Stone).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

- Regional Analysis: Gain insights into the U.S. market, valued at 1.9 Billion Metric Tons in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach 11.2 Billion Metric Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Granite, Marble and Stone Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Granite, Marble and Stone Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Granite, Marble and Stone Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ablegroup Berhad, American Marazzi Tile, Inc., Antolini Luigi & C. S.p.A., Aro Granite Industries Ltd., Asian Granito India Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 206 companies featured in this Granite, Marble and Stone market report include:

- Ablegroup Berhad

- American Marazzi Tile, Inc.

- Antolini Luigi & C. S.p.A.

- Aro Granite Industries Ltd.

- Asian Granito India Limited

- Benchmark Building Supplies Ltd.

- CaesarStone

- California Crafted Marble, Inc.

- Cambria

- Cosentino SA

- CUPA Group

- Dakota Granite Company

- Daltile Corporation

- Dermitzakis Bros S.A.

- Dimpomar, Rochas Portuguesas, Lda

- Duracite, Inc.

- Fox Marble Holdings plc

- Granite Transformations

- Hellenic Granite Co. S.A.

- Hilltop Granites

- Internacional De Ceramica SA DE CV

- Levatina y Asociados Minerals SA

- LSR Group

- Marazzi Group S.r.l

- MARGRAF

- Mohawk Industries

- Pokarna Limited

- Polycor Inc.

- RANAMAR

- Southland Stone USA, Inc.

- Temmer Marble

- Topalidis S.A. - Marble & Granite

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ablegroup Berhad

- American Marazzi Tile, Inc.

- Antolini Luigi & C. S.p.A.

- Aro Granite Industries Ltd.

- Asian Granito India Limited

- Benchmark Building Supplies Ltd.

- CaesarStone

- California Crafted Marble, Inc.

- Cambria

- Cosentino SA

- CUPA Group

- Dakota Granite Company

- Daltile Corporation

- Dermitzakis Bros S.A.

- Dimpomar, Rochas Portuguesas, Lda

- Duracite, Inc.

- Fox Marble Holdings plc

- Granite Transformations

- Hellenic Granite Co. S.A.

- Hilltop Granites

- Internacional De Ceramica SA DE CV

- Levatina y Asociados Minerals SA

- LSR Group

- Marazzi Group S.r.l

- MARGRAF

- Mohawk Industries

- Pokarna Limited

- Polycor Inc.

- RANAMAR

- Southland Stone USA, Inc.

- Temmer Marble

- Topalidis S.A. - Marble & Granite

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 510 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

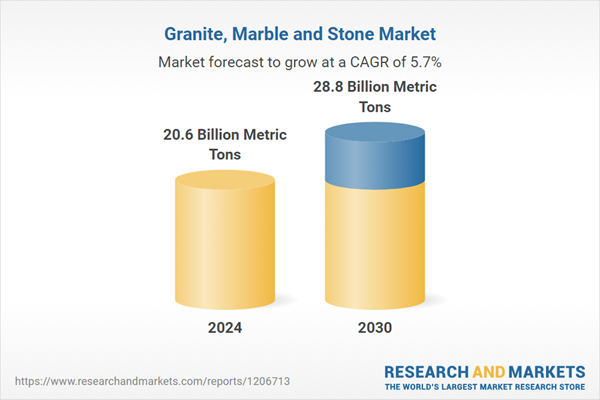

| Estimated Market Value in 2024 | 20.6 Billion Metric Tons |

| Forecasted Market Value by 2030 | 28.8 Billion Metric Tons |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |