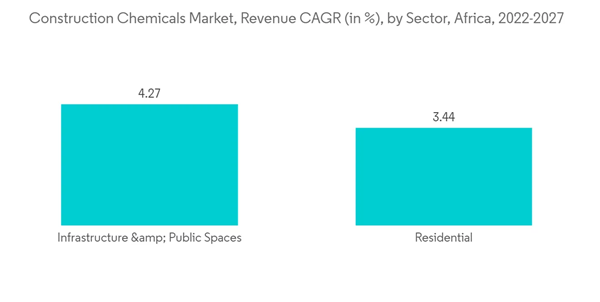

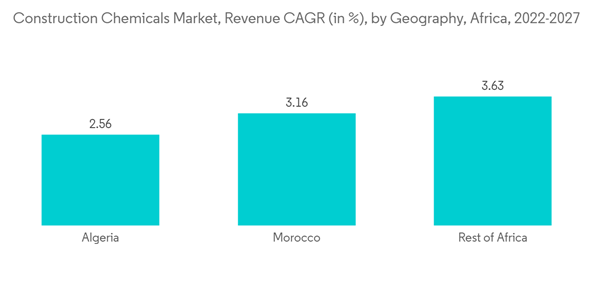

The African construction chemicals market is expected to register a CAGR of over 3% during the forecast period.

COVID-19 has slowed construction activity, resulting in a drop in demand for construction chemicals. Supply chain disruptions and labor shortages have exacerbated the situation. Furthermore, the drop in oil prices has had a negative impact on the market, as it has reduced government spending on infrastructure projects. However, in 2021 the market recovered as governments invested heavily in infrastructure projects to stimulate economic growth.

This product will be delivered within 2 business days.

COVID-19 has slowed construction activity, resulting in a drop in demand for construction chemicals. Supply chain disruptions and labor shortages have exacerbated the situation. Furthermore, the drop in oil prices has had a negative impact on the market, as it has reduced government spending on infrastructure projects. However, in 2021 the market recovered as governments invested heavily in infrastructure projects to stimulate economic growth.

Key Highlights

- Over the short term, the need for construction chemicals is being driven by construction activities, a rising population, and urbanization in the area.

- However, the high cost of construction chemicals is expected to hamper the market growth.

- Nevertheless, opportunities for the market over the forecast period may emerge from the future market for green building materials. The growing demand for energy-efficient and sustainable building materials is expected to create opportunities for the African construction chemicals market.

- In terms of revenue, South Africa is expected to dominate the African construction chemicals market during the forecast period.

Africa Construction Chemicals Market Trends

Growing Infrastructure Sector

- Africa is constructing major infrastructure improvements to accommodate its expanding economy and population. This includes investments in roads, railways, ports, airports, energy, and water.

- As of 2021, Nigeria accounted for the largest number of projects in West Africa, with 21 projects valued at USD 54.2 billion. Thus, creating an opportunity for selected construction chemicals.

- Egypt's expansion of green buildings to boost energy efficiency and high-end infrastructure, as well as active public-private partnerships, are the key drivers of construction growth. The Egyptian government plans to relocate to a vast 'New Administrative Capital' 30 miles east of Cairo by the end of 2022. The new capital is being built to relieve Cairo's overcrowding, reduce traffic congestion, and provide the country with modern infrastructure. The USD 45 billion projects will include a new airport, government offices, residential areas, business districts, and green spaces.

- Egypt has declared that a high-speed train will be built, with several phases connecting the entire nation, according to the International Trade Administration. Siemens received a USD 8.7 billion contract to complete this project as the principal contractor. Up to 14 additional smart cities could be built in Egypt, according to plans. The Minister of Housing claims that in less than two years, Egypt finished infrastructure projects valued at roughly USD 106.25 billion.

- Overall, the African construction chemicals market is expected to expand rapidly in the coming years as infrastructure development investments increase. Governments across the continent are heavily investing in infrastructure development, fueling demand for construction chemicals.

- With the rapid urbanization of African countries, there is an increased demand for construction chemicals as more buildings and structures are built. Rising demand for green building materials and growing environmental awareness are driving industry growth.

South Africa to Dominate the Market

- South Africa's construction industry is expected to expand in the coming years. This is due to increased government infrastructure spending as well as private sector investment in residential and commercial developments. The government has committed to invest USD 47.43 billion in infrastructure projects over the next three years. This is expected to increase demand for construction services and materials.

- South Africa launched project SONA 2021, a USD 58.38 million infrastructure plan for network sectors, including telecommunications, water, energy, and transportation. The project calls for the construction of 68 000 homes in the province of Gauteng as well as the Student Housing Infrastructure Program, which intends to offer 300,000 student beds.

- Similarly, the SONA 2022 budget includes USD 5.61 billion for student housing, social housing, telecommunications, water and sanitation, and transportation projects. Several projects worth USD 1.23 billion began in 2022, with the government contributing USD 0.15 billion and the private sector and development finance institutions contributing the rest.

- In addition, the government has announced plans to increase the housing supply, which should help boost demand for residential construction. Furthermore, the country's population is expected to grow over the next decade, supporting demand for residential construction.

- The market for construction chemicals in South Africa is expected to grow steadily throughout the forecast period.

Africa Construction Chemicals Market Competitor Analysis

The African construction chemicals market is partially consolidated in nature. Some of the major players in the market include BASFSE, Sika South Africa, Dow, Chryso, SOCHEM, and other companies.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size in Value)

6 COMPETITIVE LANDSCAPE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Chryso

- Dow

- Sika South Africa

- SOCHEM