The Asia Pacific region witnessed 44% revenue share in the market in 2023. As the birthplace of anime, countries like Japan, South Korea, and China continue to dominate the market in terms of both production and consumption. The strong fanbase, increasing availability of anime merchandise, and the popularity of anime across all age groups have contributed to the region’s leading position. In addition, the growing adoption of anime in countries outside Japan, such as Southeast Asia, further fuelled the region’s dominance.

Anime’s reach has expanded globally, appealing to various demographics beyond its traditional Japanese audience. The rise of streaming platforms like Netflix, Crunchyroll, and Amazon Prime has brought anime to global households, allowing fans worldwide to engage with their favorite series. Popular shows like Attack on Titan, Demon Slayer, and Naruto have garnered massive fanbases, driving the demand for merchandise related to these franchises. In conclusion, the rising global popularity of anime across diverse demographics drives the market's growth.

Additionally, the anime merchandising market thrives on the growing number of licensing and franchising agreements between anime production houses and international retailers. These agreements allow studios to monetize their intellectual properties effectively, ensuring the global availability of anime merchandise. Popular franchises like Pokémon and Dragon Ball have partnered with brands like Uniqlo, Adidas, and Funko to release exclusive merchandise collections. Thus, expansion of licensing and franchising agreements is driving the market's growth.

However, Limited-edition and premium anime merchandise, such as high-quality figurines, collector’s box sets, and designer collaborations, often come with hefty price tags. At the same time, these items are highly sought after by hardcore fans and collectors; their high cost limits accessibility for casual consumers. For instance, intricately crafted figurines can cost hundreds or even thousands of dollars, making them unaffordable for a significant portion of the fanbase. In conclusion, the high cost of premium and limited-edition merchandise is hampering the market's growth.

Driving and Restraining Factors

Drivers

- Rising Global Popularity Of Anime Across Diverse Demographics

- Expansion Of Licensing And Franchising Agreements

- Integration Of E-Commerce And Anime Merchandising

Restraints

- High Cost Of Premium And Limited-Edition Merchandise

- High Prevalence Of Counterfeit Anime Merchandise

Opportunities

- Growing Presence Of Anime-Themed Events And Conventions Worldwide

- Rising Popularity Of Limited-Edition And Collector’s Merchandise

Challenges

- Fluctuating Trends And Short Lifecycles Of Popular Anime Series

- Cultural And Regional Differences In Consumer Preferences

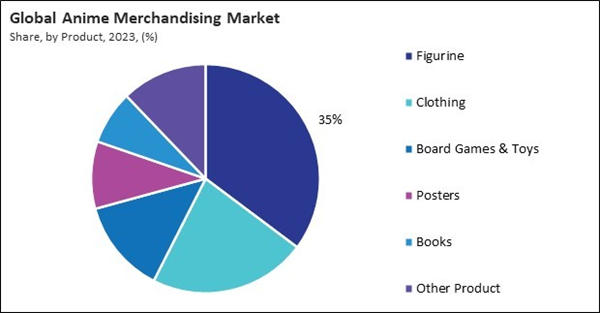

Product Outlook

Based on product, the market is divided into figurine, clothing, books, board games & toys, posters, and others. The clothing segment held 22% revenue share in the market in 2023. From T-shirts and hoodies to accessories like socks and hats, anime-inspired clothing has become popular for fans to express their love for specific series and characters. Collaborations between anime studios and fashion brands have also significantly boosted the popularity of anime-themed clothing.Distribution Channel Outlook

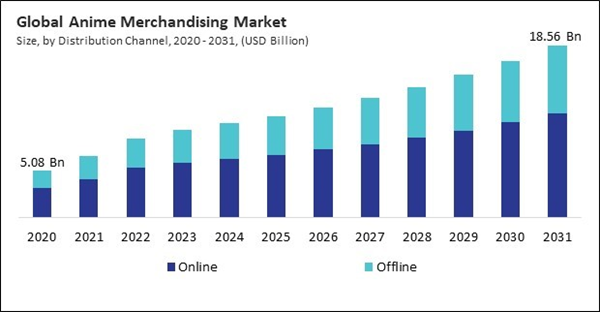

On the basis of distribution channel, the market is segmented into online and offline. In 2023, the offline segment attained 37% revenue share in the market. Physical stores, such as anime specialty shops, conventions, and pop-up events, play a significant role in connecting fans with anime merchandise. Fans often prefer the in-person experience to see and touch items before purchase, which is especially important for collectibles like figurines.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region generated 27% revenue share in the market. The rise of streaming platforms, such as Netflix, Crunchyroll, and Funimation, which have brought anime to a broader audience, has significantly contributed to the growing demand for anime-related products. Furthermore, a strong fan culture and the increasing number of anime conventions have provided a solid foundation for the market in North America.List of Key Companies Profiled

- Bandai Namco Holdings Inc.

- Good Smile Company, Inc.

- Diamond Select Toys

- Studio Ghibli, Inc.

- Crunchyroll, LLC

- Bioworld Merchandising, Inc.

- Bushiroad Inc.

- Medicom Toy Corporation

- Atomic Flare

Market Report Segmentation

By Distribution Channel

- Online

- Offline

By Product

- Figurine

- Clothing

- Board Games & Toys

- Posters

- Books

- Other Product

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Bandai Namco Holdings Inc.

- Good Smile Company, Inc.

- Diamond Select Toys

- Studio Ghibli, Inc.

- Crunchyroll, LLC

- Bioworld Merchandising, Inc.

- Bushiroad Inc.

- Medicom Toy Corporation

- Atomic Flare