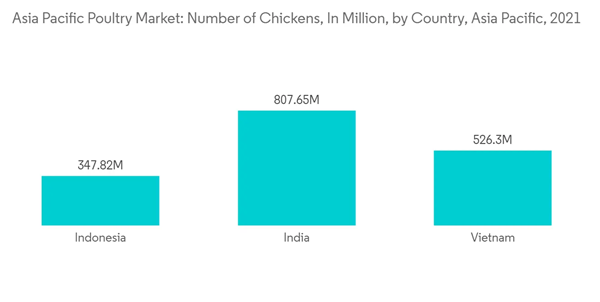

Asia Pacific is expected to witness substantial growth in the poultry products market. With the increasing popularity of poultry meat, rapid urbanization, and rising disposable income, the demand for poultry has witnessed significant growth across developing countries of the Asia Pacific region. Furthermore, the poultry industry plays a crucial role in and fastest-growing agriculture sector in achieving food security, higher incomes, and farmers' welfare. Advance ent in breeding technologies and a growing share of cold storage and transport facility farmers have further evolved the poultry industry in the Asia Pacific region. Since most, Asia-Pacific countries depend on their agricultural production and exports, the availability of poultry feed has made the business witness new entrants regularly. In the Asia-Pacific region, China and India countries hold a significant share of the poultry market, rapid world's According to the National Action Plan for egg and poultry - 2022 prepared by the Department of Animal Husbandry, more than 80% of poultry output, particularly in the broiler segment, is produced by organized commercial farms, Major poultry companies have vertically integrated operations which comprise 60-70% of the total poultry meat production. Thus, India has emerged as the third-largest egg producer and the sixth-largest broiler meat producer.

The rising consumer health consciousness, coupled with the escalating inclination towards protein-rich food products, is primarily driving the poultry market in India. Additionally, the increasing exposure to global cuisines, changing consumer food habits, and growing adoption of an eggetarian diet propel the demand for chicken meat and eggs. Furthermore, improving consumer living standards and elevating preferences for healthy lifestyles are significant growth-inducing factors. Apart from this, the launch of numerous initiatives undertaken by the Indian government to encourage poultry farming in the country is also bolstering market growth. Several government bodies, such as the Department of Animal Husbandry & Dairying, are introducing capital fund schemes to support poultry businesses and educate farmers to improve their yield quality, propelling the market growth.

APAC Poultry Market Trends

Growing Demand, Leading to Increase in Infrastructure Capacity

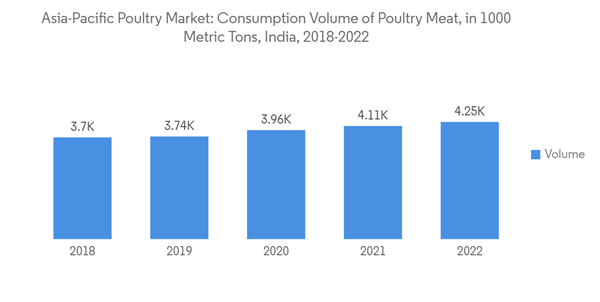

The poultry sector in the Asia Pacific region has entered a mass scale of production, strongly driven by demand through in-house consumption or the growing share of food service outlets. Conversely, the availability of poultry products at a lower price caused by the increasing middle-class population has acted positively for the industry. Furthermore, the advancement in breeding has given rise to birds that achieve specialized purposes and are increasingly productive. Similar developments ly, the development related to the procurement of feed, machine slaughter, and processing technologies, has led to a growing share of safety and efficiency, favoring large-scale units rather than small-amounts rapidly developments in the wake of a growing urban population, have shown the poultry industry to scale up concentrate close to final markets. Poultrygrowprocessing companies are increasingly using 3D imaging systems to optimize yields. 3Dpercentageimaging plans model the poultry bird using sensors and actuators to determine the position of the cut. This enables the system to perform optimal approaches for each bird regardless of size and shape. It is a data-driven process that maximizes the yield and minimizes the per-unit cost for poultry meat processing companies in the region are also acquiring expansion as their strategy to maintain their position in the market. For instance, in December 2021, IB Group chose Royal Pas Reform as its partner for their multi-location hatchery expansion program across the Indian subcontinent. These state-of-the-art installations would feature single-stage incubators, fully integrated climate-control systems, and complete hatchery automation making them among the most modern facilities in India. It adopted a single-stage incubation process - giving the superior post-hatch performance in terms of growth, mortality, and feed conversions - vital to producing high-quality broiler chicks.Growing India's Share of Poultry Consumption

India has been a growing industry in terms of both poultry production and consumption. The improvement in the varieties of ‘Low technology input birds’, which are dual purpose, i.e., capable of producing eggs and meat, are now being bred in India for the purpose of backyard or family production. Preference for fresh or chilled meat products is gaining interest in the emerging local butchers and is driven by new certified product offerings in the country. Fresh poultry is excessively consumed in the country since the availability of slaughterhouses is mainly found near consumer vicinity. Increased consumption of broiler meat and eggs is a result of the industry for food services, which is expanding rapidly and includes fast food restaurants, chain restaurants, and restaurants. Both traditional Indian non-vegetarian cuisine and fast food recipes in India include broiler meats and eggs, making them a substantial component of the cooking process. Food service channels, such as KFC and Domino's Pizza, also added new meat products to their menus, and they are expected to add more to cater to the demand. The growing number of outlets of these food service channels also aids the growth of poultry meat in the market. Companies are also focusing on product launches in order to satisfy consumer demand, for instance, in April 2022, Hartmann India Ltd launched New Egg trays “HIL-Medium” & “HIL-Large”. Hartmann’s Indian team co-developed new egg trays for 30 eggs (Medium & Large sizes). Using an existing new product as a base for development had been better suited for the specific needs in India which propelling the market growth.APAC Poultry Market Competitor Analysis

The Asia Pacific Poultry market is highly fragmented and competitive, with the presence of local and international players. On the other hand, local players have well-established reputations in the regional markets and can easily cater to different types of consumers. The major players operating in the Asia Pacific Poultry Market are Suguna Foods, Cargill, Tyson Foods, Inc., VH Group, and NH Foods Ltd., adopting strategic approaches such as product launches, expansion, and partnerships to gain market share. For instance, in December 2021, Suguna Foods, a market leader in the Indian poultry sector, went for a brand restructuring and launched a new brand, Delfrez, in the processed food segment. Delfrez offers both online and offline retail formats and has various poultry products from the house of Suguna. The group had invested over USD 12 million in the new brand and planned to launch over 1,000 outlets by 2025.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Suguna Foods

- Cargill Inc

- VH Group

- Tyson Foods, Inc.

- NH Foods Ltd.

- New Hope Liuhe

- Charoen Pokphand Group

- Doyoo Group

- Wen's Food Group

- Sunner Development Co