Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters a significant obstacle arising from the rapid transition toward vehicle electrification. As the automotive industry increasingly adopts battery electric trucks that typically utilize direct-drive mechanisms instead of traditional friction clutches, the long-term necessity for standard pressure plates is anticipated to decline. This technological shift compels manufacturers to adapt to an evolving environment where conventional transmission components face diminished application in future fleet procurements aimed at meeting zero-emission mandates.

Market Drivers

The expansion of global commercial vehicle production acts as a primary catalyst for the clutch pressure plate market, directly determining the volume of components required for new heavy-duty and light commercial fleets. As assembly lines ramp up to meet industrial needs, the integration of robust transmission systems remains essential, ensuring a steady baseline of OEM orders, particularly in major manufacturing hubs. According to the China Association of Automobile Manufacturers, in January 2025, the annual production of commercial vehicles in China reached 3.81 million units for 2024, emphasizing the massive industrial requirement for powertrain parts. The market is further supported by resilience in the light commercial sector, evidenced by the European Automobile Manufacturers' Association reporting an 8.3% increase in new van registrations within the European Union during 2024.Concurrently, the surge in logistics and e-commerce transportation activities serves as a critical multiplier for market growth. The escalating volume of freight, driven by online retail and just-in-time supply chains, forces fleet operators to utilize vehicles more intensively, resulting in accelerated mechanical wear and a frequent need for replacement parts. This operational intensity ensures that pressure plates, which endure significant thermal and mechanical stress, remain in constant circulation through the aftermarket channel. Per the American Trucking Associations in January 2025, the United States trucking industry transported an estimated 11.27 billion tons of freight in 2024, reflecting the colossal scale of cargo movement that necessitates reliable, well-maintained transmission components to prevent costly downtime.

Market Challenges

The accelerating transition toward vehicle electrification presents a fundamental impediment to the Global Commercial Vehicle Clutch Pressure Plate Market. Unlike internal combustion engine vehicles that require complex friction clutch systems to modulate power transfer, battery electric trucks predominantly utilize direct-drive mechanisms or single-speed transmissions that eliminate the need for traditional pressure plates. This technological displacement directly reduces the addressable market for these components in Original Equipment Manufacturer (OEM) production, as the mechanical necessity for clutch systems becomes obsolete in emerging zero-emission platforms.This structural shift is effectively shrinking the installation base for conventional transmission components. According to the European Automobile Manufacturers’ Association (ACEA), in the first nine months of 2025, the market share of electrically chargeable trucks in the European Union increased to 3.8%, rising from 2.1% during the same period in the previous year. As fleet operators increasingly prioritize these electric architectures to comply with stringent environmental mandates, the volume of new vehicles requiring pressure plates contracts, resulting in a permanent reduction in production demand for friction-based clutch systems.

Market Trends

The development of pressure plates designed for Automated Manual Transmissions (AMTs) is fundamentally reshaping the sector as fleet operators prioritize fuel efficiency and driver retention. Unlike traditional manuals, AMTs utilize electronically controlled actuators to manage clutch engagement, necessitating pressure plates with distinct clamp load characteristics and enhanced durability to withstand frequent, computer-modulated cycling. This technological adoption is accelerating rapidly across major markets as OEMs integrate these systems into heavy-duty platforms to optimize powertrain performance. According to Eaton Cummins Automated Transmission Technologies in August 2025, the joint venture achieved a significant milestone with the production of its 500,000th Endurant automated transmission, underscoring the massive scale of the industry's transition toward these advanced powertrain architectures.Simultaneously, the proliferation of clutch remanufacturing is gaining traction as a critical strategy to lower the total cost of ownership and meet increasingly stringent sustainability targets. Manufacturers are continuously recovering worn pressure plates to restore them to original equipment specifications, a process that significantly reduces the environmental footprint of fleet maintenance compared to producing virgin components. This circular economy approach offers substantial resource efficiency, becoming a core element of aftermarket support strategies for aging fleets. According to the Volvo Group in September 2025, the company reported that its remanufacturing operations utilize up to 85% less raw material and 80% less energy than new production, driving a structural shift toward sustainable aftermarket solutions in the commercial vehicle industry.

Key Players Profiled in the Commercial Vehicle Clutch Pressure Plate Market

- Makino Auto Industries

- Sassone SRL

- Anand Group

- ALPS Automotive Industries

- Hebeitengda Auto Parts co. Ltd.

- Raicam Clutch Ltd.

- Macas Automotive

- California Custom Clutch Corporation

- Setco Automotive Ltd.

- S.K Auto Industries.

Report Scope

In this report, the Global Commercial Vehicle Clutch Pressure Plate Market has been segmented into the following categories:Commercial Vehicle Clutch Pressure Plate Market, by Vehicle Type:

- LCV

- M&HCV

Commercial Vehicle Clutch Pressure Plate Market, by Demand Category:

- OEM

- Replacement

Commercial Vehicle Clutch Pressure Plate Market, by Product Type:

- Coil Spring Type

- Diaphragm Type

Commercial Vehicle Clutch Pressure Plate Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Vehicle Clutch Pressure Plate Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Commercial Vehicle Clutch Pressure Plate market report include:- Makino Auto Industries

- Sassone SRL

- Anand Group

- ALPS Automotive Industries

- Hebeitengda Auto Parts co. Ltd.

- Raicam Clutch Ltd.

- Macas Automotive

- California Custom Clutch Corporation

- Setco Automotive Ltd.

- S.K Auto Industries.

Table Information

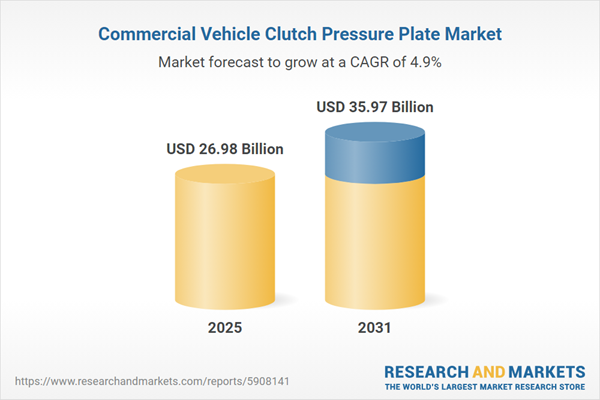

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 26.98 Billion |

| Forecasted Market Value ( USD | $ 35.97 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |