Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Diesel Power Plant Evolution Amidst Shifting Energy Demands and Technological Breakthroughs in Modern Infrastructure

In an era defined by fluctuating energy demands and evolving climate priorities, diesel power plants remain a critical component of global energy infrastructure, offering both baseline and auxiliary power capabilities. Their inherent flexibility and reliability have long positioned them as the backbone for backup power in industries ranging from manufacturing facilities and data centers to healthcare institutions and remote mining operations. Moreover, the modular nature of diesel power generation equipment allows for rapid deployment in off-grid regions, addressing immediate electricity shortages and bolstering grid resilience during peak demand periods. The fuel supply chain for diesel generators is well-established, with widespread availability of refined fuels and extensive service networks, factors that contribute to their enduring appeal in both developed and developing markets.Throughout this introductory exploration, the enduring relevance of diesel power technology is examined against the backdrop of mounting regulatory pressures, shifting environmental expectations, and emergent alternative solutions. Consequently, industry players must navigate a complex landscape where cost efficiency intersects with environmental stewardship, and long-term asset performance must be balanced against upfront investment. As urbanization and industrial activities continue to intensify in emerging economies, demand for dependable off-grid and standby power solutions is projected to sustain capital flows toward diesel-based installations.

In parallel, legacy plants are undergoing modernization to incorporate advanced control systems, remote monitoring platforms, and emission reduction technologies aimed at meeting stringent air quality standards. Furthermore, the evolving workforce landscape and skill requirements underscore the importance of targeted training programs for technicians and plant managers, ensuring operational continuity and safety compliance. In addition, the integration of data analytics for performance benchmarking and lifecycle cost optimization is gaining traction as operators seek actionable insights from real-time telemetry. By establishing this foundational context, decision-makers will gain a clearer understanding of the forces shaping current operations and potential strategic inflection points in the diesel power plant sector.

Navigating Transformative Shifts as Environmental Regulations, Renewable Integration, and Digitalization Redefine the Global Diesel Power Plant Landscape

As environmental regulations tighten worldwide, diesel power plant operators face mounting pressure to reduce emissions and enhance overall efficiency across all stages of power generation. Stricter limits on nitrogen oxides and particulate matter have spurred widespread adoption of selective catalytic reduction systems, diesel particulate filters, and advanced exhaust gas recirculation technologies, fundamentally altering engine specifications and aftertreatment configurations. At the same time, the rising penetration of renewable energy sources such as wind and solar has introduced variability into traditional power systems, prompting complementary diesel generators to provide critical grid balancing services and inertia support.Furthermore, digital transformation is revolutionizing plant management through real-time performance monitoring, predictive maintenance algorithms, and remote diagnostics, enabling stakeholders to detect potential failures before they occur and optimize maintenance schedules. Transitioning toward cleaner fuels, forward-thinking operators are investing in pilot projects that blend biodiesel and hydrotreated vegetable oils with conventional diesel to lower lifecycle greenhouse gas emissions without sacrificing reliability. Meanwhile, geopolitical shifts and disruptions in global supply chains have heightened the importance of local sourcing strategies and modular plant designs, empowering rapid response to emergent energy demands and reducing dependency on distant manufacturing hubs.

As legacy assets undergo comprehensive retrofits, integration of cloud-based asset management platforms has become industry standard, ensuring seamless data flows between original equipment manufacturers, service providers, and end-users. Additionally, the convergence of artificial intelligence and edge computing is enabling autonomous operational adjustments that improve fuel consumption patterns and extend engine life. Consequently, the diesel power plant landscape is undergoing a profound transformation, characterized by the convergence of sustainability imperatives, digital innovation, and adaptive operational strategies that collectively redefine the value proposition of diesel generation technologies.

Assessing the Comprehensive Impact of New United States Tariffs Implemented in 2025 on Diesel Power Plant Supply Chains and Cost Structures

As of 2025, the imposition of new United States tariffs on imported power generation equipment and critical components has generated significant ramifications across the entire diesel power plant value chain. Tariffs targeting alternators, engine blocks, control modules, and auxiliary assemblies have elevated capital procurement costs, compelling original equipment manufacturers, project developers, and plant operators to reevaluate traditional sourcing strategies. In response, many stakeholders are exploring nearshoring alternatives, establishing strategic partnerships with domestic suppliers, and engaging in vendor diversification to mitigate exposure to tariff-induced price volatility. Additionally, the elevated cost environment has accelerated consolidation within the aftermarket sector, as larger service providers absorb smaller entities to achieve economies of scale and offset margin pressures.To maintain financial viability, operators are renegotiating long-term maintenance contracts, extending service intervals through advanced condition monitoring techniques, and implementing performance-based service agreements that align incentives on asset uptime. Consequently, project timelines have been adjusted to account for extended lead times on imported assemblies, leading to proactive inventory management practices that emphasize higher safety stock levels and buffer capacity. Despite these challenges, the industry has demonstrated resilience by leveraging strategic procurement, optimizing manufacturing footprints, and adopting modular design frameworks that simplify customs clearance.

Moreover, the tariffs have inadvertently catalyzed innovation, with OEMs investing in tariff-compliant product lines and component standardization initiatives that reduce the number of unique parts subject to import duties. As project developers adapt, financing structures are evolving to accommodate increased upfront costs, with lenders placing greater emphasis on supply chain transparency and cost pass-through mechanisms. As a result, the cumulative impact of these policy measures is reshaping competitive differentiators, underscoring the importance of supply chain agility, pricing flexibility, and stakeholder collaboration in navigating a new tariff landscape.

Unlocking Critical Segmentation Insights Encompassing Components, Power Plant Types, Construction Approaches, Fuel Variants, Applications, and End Users

In examining the diesel power plant market through a segmentation lens, it becomes evident that component diversity forms the backbone of industry analysis. Core systems such as air intake mechanisms, cooling architectures, and lubrication networks define the physical scope of each plant, while the diesel engine itself bifurcates into either four-stroke or two-stroke configurations to suit varying performance requirements. Cooling methodologies further subdivide into air, oil, and water channels, each offering distinct thermal management advantages tailored to site-specific conditions. Fuel delivery and exhaust management modules work in concert to optimize combustion efficiency and emissions compliance, and engine starting systems influence reliability during emergency deployments.When viewing the sector by plant typology, mobile units offer rapid deployment flexibility, contrasting with stationary installations that excel in long-term power provision. Construction approaches range from containerized modules engineered for swift site integration to open-frame assemblies favored in high-volume industrial settings. The choice of fuel type underscores strategic objectives as well, with biodiesel blends presenting a sustainability angle while fossil diesel maintains cost and availability benefits. Application scenarios span central power hubs to peak load and standby operations, illustrating the adaptability of diesel solutions across critical infrastructures.

Finally, end-user profiles span industrial operations, residential backup needs, and utility provision, with subsegments in manufacturing, marine, mining, and public versus private enterprise utilities demonstrating the breadth of sector engagement. By dissecting these dimensions, stakeholders can pinpoint market niches and align product portfolios with emerging demand patterns, optimizing deployment strategies and service models to capture high-value segments. This holistic segmentation framework serves as a strategic guide for vendors and operators to allocate resources, tailor offerings, and identify collaboration opportunities across the diesel power plant ecosystem.

Mapping Regional Variations and Growth Catalysts Throughout the Americas, Europe, Middle East & Africa, and Asia-Pacific Diesel Power Plant Markets

Regional dynamics play a pivotal role in shaping the trajectory and growth potential of diesel power plants. In the Americas, established energy infrastructures and stringent emission frameworks coexist with vast rural and remote regions where access to reliable grid power remains limited, sustaining demand for robust diesel solutions. Investment in infrastructure refurbishment and capacity expansion is driving growth, as aging grids require supplemental power during maintenance cycles and peak load periods.In many parts of Europe, Middle East & Africa, policy mandates on carbon reduction are accelerating the adoption of low-emission technologies, with incentives for hybrid systems that couple diesel generators with renewable installations. Government programs are encouraging the integration of battery storage and waste heat recovery for district heating applications, creating new value propositions for legacy assets. Across the Middle East, abundant hydrocarbon resources coexist with a growing emphasis on sustainability, resulting in pilot initiatives that test high-efficiency generators and alternative fuel conversions.

Meanwhile, the Asia-Pacific region exhibits a dual narrative: rapid industrialization and urban expansion drive a surge in centralized and decentralized power plants, while archipelagic nations rely heavily on containerized units to electrify remote islands. Ongoing investments in microgrid and off-grid projects underscore the strategic importance of diesel power in supporting economic growth corridors. In Africa, collaborative projects funded by multilateral development banks are leveraging containerized diesel solutions to electrify communities, emphasizing cost-effective and resilient power delivery. Supply chain considerations also diverge regionally, with proximity to engine manufacturers and component fabrication hubs influencing delivery timelines and cost structures, underscoring the necessity for nuanced market entry strategies and bespoke service frameworks.

Analyzing Top-Ranked Industry Leaders, Their Strategic Alliances, Innovations, and Competitive Moves Shaping the Diesel Power Plant Sector Dynamics

Industry leaders are actively shaping the competitive landscape through strategic alliances, product innovation, and service expansion. Established original equipment manufacturers continue to refine engine architectures, integrating advanced combustion techniques and digital controls to enhance efficiency and uptime. Partnerships with emission control specialists have become commonplace, enabling turnkey solutions that meet the most rigorous air quality standards. In parallel, service providers are broadening their aftermarket portfolios to include remote monitoring, predictive maintenance, and performance optimization services, thereby creating recurring revenue streams and deepening customer engagement.Joint ventures between global OEMs and regional distributors are expanding market reach, particularly in emerging economies where local presence and technical support are critical. Additionally, merger and acquisition activities within the spare parts sector are consolidating supply chains to deliver end-to-end asset management offerings. As competition intensifies, companies with integrated digital platforms and agile customization capabilities differentiate themselves, catering to unique site requirements and evolving fuel specifications.

Beyond established OEMs, nimble technology startups and localized fabricators are entering the market with specialized digital platforms, offering subscription-based monitoring services and rapid prototyping for custom gen-set configurations. This infusion of entrepreneurial energy is accelerating feature development and increasing competitive pressure on legacy players to continuously enhance their value-added services. Furthermore, an emphasis on sustainability has prompted leading players to pilot alternative fuel demonstrations and retrofitting initiatives, signaling a shift toward ecosystem-driven portfolios.

Actionable Strategic Recommendations to Boost Operational Excellence, Regulatory Compliance, and Competitiveness for Diesel Power Plant Operators

To thrive amid intensifying regulatory scrutiny and evolving market dynamics, industry leaders must adopt a multifaceted strategy that balances operational excellence with innovation. First, embracing advanced digital twin frameworks can streamline maintenance workflows and predictive diagnostics, thereby reducing unplanned downtime and extending equipment lifecycles. By investing in modular designs and standardized interfaces, manufacturers can accelerate delivery schedules and simplify component upgrades in response to emerging regulations.Collaboration with fuel research entities offers opportunities to validate biodiesel blends or synthetic alternatives, positioning operators at the forefront of decarbonization efforts. Strengthening local supply chains through partnerships with regional fabricators and service bureaus will buffer against tariff fluctuations and logistical constraints. Additionally, implementing comprehensive training programs for field technicians on emission control retrofits and data analytics tools will bolster in-house expertise.

Engaging proactively with policymakers and industry associations can shape favorable regulatory outcomes while ensuring that technological advancements are recognized within standards frameworks. From a portfolio standpoint, diversifying service offerings to include performance contracts and energy management consultations will create new revenue avenues and foster deeper client relationships. Furthermore, embracing circular economy principles in component remanufacturing and end-of-life recycling can generate additional cost savings and support corporate sustainability objectives. By integrating digital platforms with advanced procurement analytics, operators can optimize spare parts inventory and reduce wastage, contributing to overall operational resilience.

Detailing a Robust Multi-Phase Research Approach Integrating Expert Interviews, Secondary Sources, Data Triangulation, and Validation Protocols

This research leverages a rigorous methodology to ensure data integrity and actionable insights. Primary data was collected through in-depth interviews with plant operators, OEM representatives, component suppliers, and end-user stakeholders, providing firsthand perspectives on operational challenges and technology adoption. Secondary research encompassed a comprehensive review of industry reports, regulatory publications, technical journals, and corporate disclosures, offering contextual background and trend validation.Data triangulation was employed to reconcile disparate sources, reinforcing the credibility of key findings. Quantitative inputs were normalized against historical performance metrics and benchmark studies to mitigate outliers and ensure robustness. Furthermore, expert panels convened to peer-review the analysis, offering critical appraisal of assumptions and interpretations. Cost structures and tariff scenarios were tested using sensitivity analyses to gauge potential market reactions under varying policy environments.

Throughout the research phases, continuous feedback loops ensured that emerging findings were validated against industry benchmarks and evolving market realities. Regular progress briefings with steering committees facilitated iterative refinement of analytical frameworks, resulting in a high-confidence, up-to-date representation of sector dynamics. Collectively, this multi-phase approach yields a comprehensive and credible foundation upon which strategic decisions can be confidently based.

Concluding Synthesis Emphasizing Emerging Trends, Market Drivers, and Strategic Imperatives to Guide Investment and Operational Decisions

In summary, the diesel power plant sector stands at a critical juncture, shaped by converging trends in environmental policy, supply chain dynamics, and digital transformation. The intensified focus on emission compliance and grid stability has catalyzed rapid evolution in engine technologies and aftertreatment systems. Simultaneously, tariff regimes introduced in 2025 are redefining procurement strategies and underscoring the imperative for supply chain resilience.Segmentation analysis reveals diverse submarkets, from mobile units in remote applications to large-scale stationary plants, each responding to unique regulatory and operational drivers. Regional insights underscore the importance of tailored approaches, as growth opportunities in the Americas, EMEA, and Asia-Pacific are influenced by distinct infrastructural and policy landscapes. Competitive dynamics continue to revolve around innovation partnerships, service excellence, and strategic alliances, highlighting the necessity for proactive adaptation.

As stakeholders navigate these developments, actionable recommendations focus on digital integration, local collaboration, and sustainable fuel adoption to maintain competitiveness. Looking ahead, convergence between diesel power solutions and decentralized energy architectures-such as microgrids and peer-to-peer energy trading platforms-presents novel use cases that can further extend the lifecycle and strategic relevance of diesel assets. Stakeholders that embrace hybrid operational models and align with broader decarbonization initiatives will be well positioned to lead the sector into its next phase of transformation.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Diesel Power Plant Market

Companies Mentioned

The key companies profiled in this Diesel Power Plant market report include:- AGCO Corporation

- Atlas Copco

- Caterpillar, Inc.

- Cummins Inc.

- Daihatsu Diesel Mfg. Co., Ltd.

- DEUTZ AG

- Doosan Corporation

- Generac Power Systems, Inc.

- Goel Power Engineers LLP

- Hyundai Heavy Industries Co. Ltd.

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- Kirloskar Oil Engines Ltd

- Kubota Corporation

- Könner & Söhnen

- Mahindra Powerol

- Man Energy Solutions

- Mitsubishi Heavy Industries, Ltd.

- MKC Group of Companies

- Rehlko

- Rolls-Royce plc

- Société Internationale des Moteurs Baudouin

- Volvo Group

- Wärtsilä Corporation

- Yanmar Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

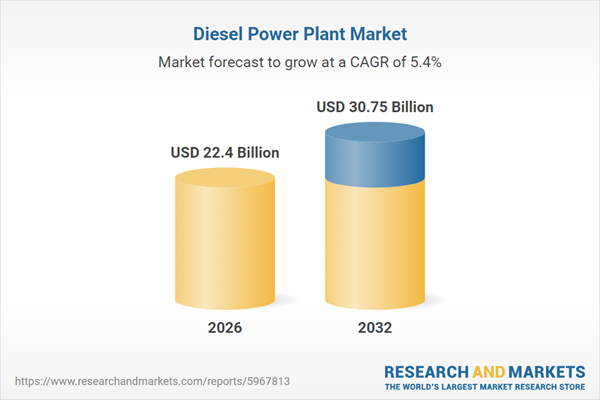

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 22.4 Billion |

| Forecasted Market Value ( USD | $ 30.75 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |