The electric baby stroller market is poised for significant growth, driven by increasing demand for convenience, stringent safety regulations, and technological advancements. These strollers, designed to transport newborns and infants with features like padded seats and electric motors, are gaining traction due to their ease of use and innovative functionalities.

Market Drivers

High Convenience Driving Adoption

Electric baby strollers are experiencing rising demand due to their unparalleled convenience, particularly among working parents in both developed and developing economies. The growing number of childbirths, coupled with an expanding working-class population, has fueled the need for products that simplify parenting tasks. For instance, according to the Centers for Disease Control and Prevention, the United States recorded 3,667,758 births in 2022, a slight increase from 2021, reflecting a sustained demand for baby-related products. Electric strollers, with features like assisted mobility and smart functionalities, cater to busy parents, enabling them to manage daily activities more efficiently. This trend is expected to drive market growth over the next five years.Government Safety Initiatives

Government regulations emphasizing infant safety are significantly boosting the electric baby stroller market. The Consumer Product Safety Commission mandates that strollers comply with standards such as the ASTM International Standard Consumer Safety Performance Specification for Carriages and Strollers. These products must undergo third-party testing for compliance with safety regulations, including limits on lead paint, lead content, and phthalates. Manufacturers are compelled to produce safer, high-quality electric strollers, incorporating advanced materials and technologies to meet these standards, thereby fueling market expansion.Technological Advancements

The integration of cutting-edge technologies, such as IoT and automation, is transforming the electric baby stroller market. Manufacturers are leveraging innovations to differentiate their products in a competitive landscape. Features like AI-powered mobility, app-controlled functionalities, and enhanced motor support are becoming standard. For example, advanced electric strollers now offer features like self-rocking capabilities and uphill assistance, appealing to tech-savvy parents. These technological advancements enhance user experience and position electric strollers as premium, must-have products for modern parenting.Geographical Outlook

United States as a Growth Hub

The United States is anticipated to be the fastest-growing market for electric baby strollers in North America. The rise in single-parent households and the increasing presence of manufacturers are key drivers. Electric strollers enable parents to navigate public spaces like parks and shopping malls with ease, supporting active lifestyles. The growing working population, particularly women, is also contributing to demand. According to the World Bank, women comprised 56% of the U.S. workforce in 2022, a figure expected to rise, creating a larger market for convenience-driven products like electric strollers. Additionally, a March 2023 U.S. government press release noted that 23% of the U.S. population in 2023 was under 18, significantly higher than the global average of 7%, underscoring the substantial market potential for baby products.Key Developments

In January 2023, Canadian startup Glüxkind Technologies launched the AI-powered Ella stroller at the Consumer Electronics Show in Las Vegas. This battery-powered stroller, equipped with electric motors for assisted pushing and self-rocking features, received the CES Innovation Award Honoree title. In May 2023, Mercedes-AMG, in collaboration with Hartan, introduced a limited-edition pram inspired by AMG automobiles, targeting premium consumers. In July 2023, MomPush launched a lightweight electric pram designed for modern parents, emphasizing functionality and reliability. These developments highlight the industry’s focus on innovation and premiumization to meet evolving consumer needs.The electric baby stroller market is experiencing robust growth, driven by the demand for convenience, stringent safety regulations, and technological advancements. The United States stands out as a key growth region, fueled by demographic trends and an increasing working population. With ongoing innovations, such as AI integration and premium designs, the market is well-positioned to expand, catering to the needs of modern, busy parents seeking safe and efficient solutions for infant mobility.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Segmentation:

By Component

- Hardware

- Software

By Distribution Channel

- Online

- Offline

By Mechanism

- Manual

- Electric

- Hybrid

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- CYBEX (Goodbaby International Holdings Limited)

- Emmaljunga

- Smartbe (Indiegogo, Inc.)

- Foppapedretti S.p.a.

- JINHUA COMFORT VEHICLE.CO., LTD

- UPPAbaby

- Cybex

- Baby Jogger

Table Information

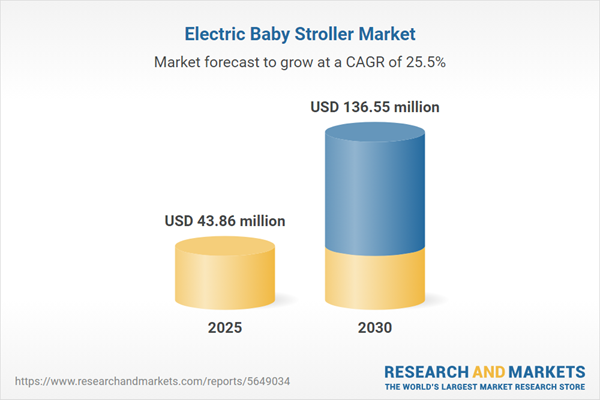

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 43.86 million |

| Forecasted Market Value ( USD | $ 136.55 million |

| Compound Annual Growth Rate | 25.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |