Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the International Society for Heart and Lung Transplantation, over 6,000 heart transplant operations were conducted globally in 2024. This volume of procedures directly sustains the demand for biopsy instruments, as patients typically require multiple surveillance biopsies during the crucial first year following transplantation. Despite this consistent demand, the market encounters significant obstacles due to the invasive nature of the technique; the potential risks of complications, such as cardiac perforation, are driving interest in and development of non-invasive diagnostic options like cardiac magnetic resonance imaging.

Market Drivers

The growing number of heart transplant procedures worldwide serves as the main engine for market expansion, as these surgeries require strict post-operative monitoring to identify allograft rejection. Because endomyocardial biopsy is the established clinical standard for this purpose, every transplant generates a recurring necessity for device usage throughout a patient's recovery process. Data from the United Network for Organ Sharing in January 2024 highlighted that healthcare providers completed 4,519 heart transplants in the United States in 2023. This high volume reinforces the demand for surveillance, a pattern observed globally; for instance, NHS Blood and Transplant reported that the active heart transplant waiting list in the United Kingdom included 328 patients by the end of 2024, signaling continued pressure on cardiac units to maintain strong biopsy capabilities for future patients.At the same time, the rising prevalence of myocarditis and cardiomyopathies necessitates precise tissue characterization to direct treatment plans. When non-invasive imaging fails to clarify the cause of heart failure, doctors depend on tissue extraction to distinguish between complex disorders such as cardiac amyloidosis and giant cell myocarditis. As reported by the American Heart Association in January 2024, roughly 6.7 million adults in the United States currently suffer from heart failure. This significant burden of disease guarantees a continuous need for diagnostic biopsies, as physicians increasingly emphasize histological analysis to identify the best management approaches for patients with unexplained cardiac dysfunction.

Market Challenges

The central obstacle hindering the Global Endomyocardial Biopsy Market is the invasive character of the procedure, which presents a significant hurdle to widespread usage. Extracting heart muscle tissue involves intrinsic risks of serious complications, such as arrhythmias, valve damage, and cardiac perforation. These safety issues discourage clinicians from performing biopsies frequently, even in cases where longitudinal tracking is clinically advised. As a result, medical providers are progressively favoring non-invasive diagnostic substitutes, including cardiac magnetic resonance imaging, which provide safer methods for identifying pathologies without the morbidity risks linked to physical tissue removal.This operational constraint directly limits the market's capacity to leverage the rising prevalence of cardiovascular diseases. According to the Heart Failure Society of America, approximately 6.7 million adults in the United States were living with heart failure in 2024. Although this extensive disease burden offers a vast addressable market for diagnostic monitoring, the dangers associated with biopsies prevent the technique from becoming the routine standard of care for this growing patient population. Consequently, the market is confined to a smaller segment of critical cases where the invasive risks are considered acceptable, thereby restricting overall growth potential.

Market Trends

The move toward genomic and molecular-based rejection monitoring is fundamentally transforming the Global Endomyocardial Biopsy Market by shifting the clinical standard from fixed procedural timetables to targeted surveillance. Rather than subjecting heart transplant patients to frequent invasive checks, healthcare providers are increasingly using non-invasive liquid biopsies to screen for graft injury, limiting tissue extraction to patients who exhibit elevated molecular markers. This change in protocol significantly lowers the total number of unnecessary procedures while ensuring strict monitoring of graft health; for example, a May 2024 press release from CareDx, Inc. regarding the SHORE registry noted that cardiologists performed 40% fewer biopsies in the second post-transplant year when using multimodal molecular surveillance compared to traditional biopsy-led protocols.Concurrently, the adoption of AI-enhanced digital pathology workflows is modernizing the post-procedural analysis stage, resolving the major bottleneck of histological variability in interpreting biopsies. By moving from manual microscopy to digitized slide scanning combined with deep learning algorithms, labs can automate the measurement of rejection markers like lymphocyte infiltration, ensuring better diagnostic consistency across various cardiac centers. This technological convergence improves the clinical value of every biopsy, justifying the invasive nature of the procedure through superior data retrieval. According to an article in CAP TODAY from December 2024, the adoption rate of digital pathology solutions in clinical labs has reached roughly 10%, signaling a critical shift toward automated diagnostics that enable high-precision tissue analysis.

Key Players Profiled in the Endomyocardial Biopsy Market

- Argon Medical Devices Inc.

- Cordis

- Mermaid Medical Group

- Terumo Corp.

- Scholten Surgical Instruments, Inc.

- Changzhou Toolmed Medical Instrument Co., Ltd.

- Fehling Surgical Instruments Inc.

- SternMed GmbH

- Olympus Corporation of the Americas

- Heart Medical Europe BV

Report Scope

In this report, the Global Endomyocardial Biopsy Market has been segmented into the following categories:Endomyocardial Biopsy Market, by Product:

- Forceps

- Accessories

Endomyocardial Biopsy Market, by Tip:

- Maxi-curved

- Straight

- Pre-curved

- Others

Endomyocardial Biopsy Market, by End-Use:

- Hospitals

- Ambulatory Surgical Centers

- Others

Endomyocardial Biopsy Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Endomyocardial Biopsy Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Endomyocardial Biopsy market report include:- Argon Medical Devices Inc.

- Cordis

- Mermaid Medical Group

- Terumo Corp.

- Scholten Surgical Instruments, Inc.

- Changzhou Toolmed Medical Instrument Co., Ltd.

- Fehling Surgical Instruments Inc.

- SternMed GmbH

- Olympus Corporation of the Americas

- Heart Medical Europe BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

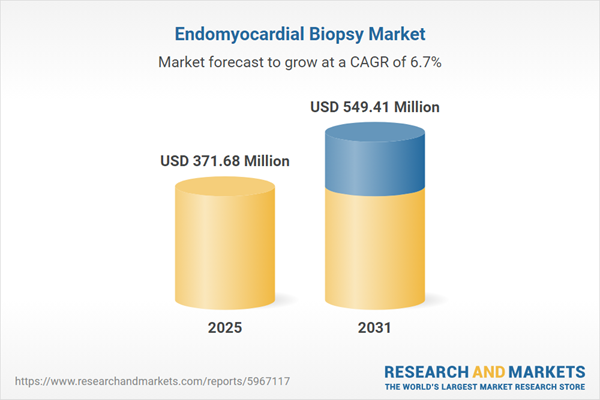

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 371.68 Million |

| Forecasted Market Value ( USD | $ 549.41 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |