Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Major growth drivers include increased vehicle parc and the need for frequent tire replacement due to seasonal changes. The surge in electric vehicle (EV) sales is accelerating demand for specially engineered low-noise, durable tires. Rising consumer awareness toward road safety and performance is pushing tire manufacturers to invest in premium products with advanced tread technologies. Smart tire development, which involves integrating sensors for real-time monitoring, is opening up new business opportunities. The growing market for sustainable and recycled tire materials also aligns with the broader European Green Deal and ESG regulations.

Market Drivers

Rising Vehicle Parc Across Segments

The growing number of registered vehicles in Europe is one of the most fundamental drivers of tire demand. As more vehicles are added to the roads each year ranging from passenger cars to light and heavy commercial vehicles there is a proportional rise in both OEM and aftermarket tire consumption.According to the European Tyre and Rubber Manufacturers’ Association (ETRMA), Europe’s tire market saw mixed trends in 2024. Replacement passenger car tire sales declined by 5%, with 202.1 million units sold compared to 212.3 million in 2023, largely due to inflation and delayed consumer spending. On the other hand, truck and bus tire sales grew by 3%, reaching 12.3 million units, supported by strong freight activity in Eastern Europe. Motorcycle and scooter tires also rose by 4%, with 10.4 million units sold, driven by increasing urban mobility and tourism. However, agricultural tire sales dropped sharply by 12%, reflecting weak demand in the farming sector. ETRMA also highlighted a growing preference for eco-friendly tires, such as low rolling resistance and all-season variants, as consumers respond to EU tire labeling regulations and sustainability goals.

Key Market Challenges

Volatility in Raw Material Costs

The tire industry is heavily dependent on key raw materials such as natural rubber, synthetic rubber, carbon black, and petroleum-based products. Price fluctuations in these inputs have a direct impact on production costs and profit margins. In Europe, raw material sourcing is often tied to global commodity markets, making the region vulnerable to external supply shocks, geopolitical tensions, and currency volatility.For example, disruptions in rubber-producing countries or increased energy costs due to regulatory restrictions can lead to significant cost pressures. These unpredictable pricing dynamics force manufacturers to adjust pricing strategies, which can impact competitiveness and consumer demand. The industry also faces increased shipping and logistics costs tied to global supply chain imbalances. Frequent cost adjustments complicate long-term planning and reduce the financial flexibility required for innovation and sustainability investments, posing a long-term challenge for consistent market growth and pricing stability.

Key Market Trends

Rise of Smart and Connected Tires

Smart tire technology is gaining traction across Europe, driven by the growing demand for real-time vehicle monitoring, predictive maintenance, and fleet efficiency.For instance, in 2022, Bridgestone introduced its new connected vehicle platform, Bridgestone Fleetcare, in Europe, combining tire and vehicle maintenance with telematics and data insights to optimize fleet operations. The system offers predictive maintenance, real-time monitoring, and advanced tire management. The launch supports Bridgestone’s strategy to enhance fleet efficiency, safety, and sustainability.

These advanced tires are equipped with sensors that collect data on pressure, temperature, tread depth, and road conditions. This information can be transmitted to onboard systems or cloud platforms for analysis, allowing drivers and fleet managers to take proactive maintenance actions, improving safety and performance. Smart tires are particularly valuable in commercial fleets and electric vehicles where uptime, cost-efficiency, and range optimization are critical. The integration of connected tire systems with telematics platforms and AI-driven analytics enhances vehicle lifecycle management. As vehicle automation advances, smart tires are expected to play a pivotal role in data feedback loops for autonomous driving. This trend is opening up new service-based revenue streams for tire manufacturers and accelerating the shift toward digital ecosystems in the mobility sector.

Key Market Players

- Manufacture Française des Pneumatiques Michelin

- Continental AG

- Pirelli & C. S.p.A.

- BRIDGESTONE EUROPE NV

- Goodyear Tyre & Rubber Company

- Kumho Tire Europe GmbH

- Nokian Tyres plc

- Cooper Tire & Rubber Company Europe Limited

- Yokohama Europe GmbH

- Hankook Tire & Technology Co., Ltd.

Report Scope:

In this report, the Europe Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Tire Market, By Vehicle Type:

- Passenger Car

- LCV

- M&HCV

- OTR

- Two-Wheeler

- Three-Wheeler

Europe Tire Market, By Demand Category:

- OEM

- Aftermarket

Europe Tire Market, By Tire Construction Type:

- Radial

- Bias

Europe Tire Market, By Country:

- Germany

- United Kingdom

- Spain

- France

- Italy

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Tire Market.Available Customizations:

Europe Tire Market report with the given market data, TechSci Research, offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Manufacture Française des Pneumatiques Michelin

- Continental AG

- Pirelli & C. S.p.A.

- BRIDGESTONE EUROPE NV

- Goodyear Tyre & Rubber Company

- Kumho Tire Europe GmbH

- Nokian Tyres plc

- Cooper Tire & Rubber Company Europe Limited

- Yokohama Europe GmbH

- Hankook Tire & Technology Co., Ltd.

Table Information

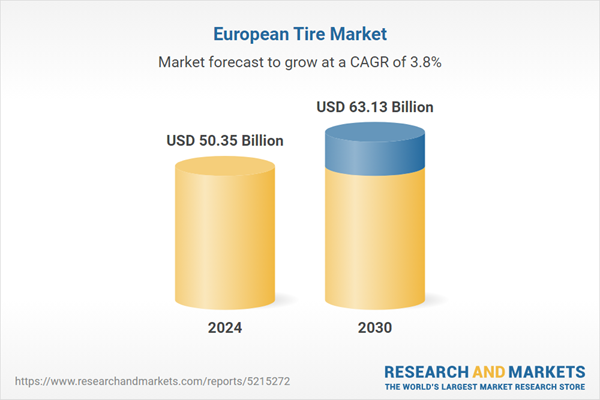

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 50.35 Billion |

| Forecasted Market Value ( USD | $ 63.13 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |