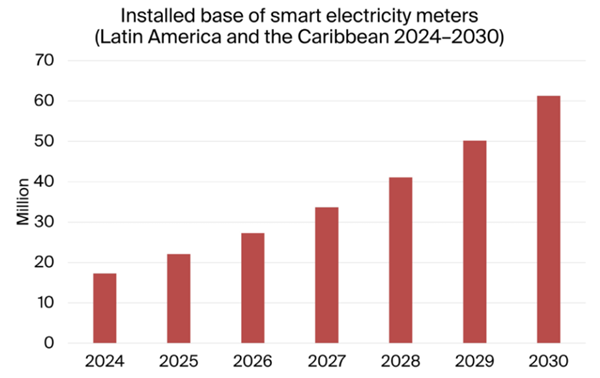

Smart electricity meter adoption in Latin America and the Caribbean set for strong growth by 2030

Smart Metering in Latin America and the Caribbean is strategy market report analysing the latest smart metering developments in this dynamic region covering both electricity and gas. The countries covered in-depth include Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Panama, Paraguay, Peru, Puerto Rico, Trinidad and Tobago and Uruguay. This strategic research report provides you with over 200 pages of unique business intelligence, including 6-year industry forecasts, expert commentary and real-life case studies on which to base your business decisions.

Smart metering is widely regarded as a cornerstone for future smart grids and is currently being deployed all over the developed world, with a growing number of large-scale initiatives now also being launched in developing countries. With more than 223 million electricity customers, Latin America and the Caribbean constitute a large market with significant potential, as well as a significantly lower penetration rate of smart meters in comparison to regions such as East Asia, Europe and North America. The annual demand for electricity meters in Latin America and the Caribbean ranges from 20 to 30 million units, out of which Brazil and Mexico together account for over 65%. With the exception of the South and Central American countries Uruguay, Costa Rica and Belize, along with Barbados, Jamaica, Trinidad and Tobago and Puerto Rico in the Caribbean, the region has not yet seen the implementation of nationwide smart metering projects. However, a number of utilities in the region are scaling up their smart metering initiatives. Overall, high non-technical electricity losses due to the prevalence of energy theft throughout Latin America and the Caribbean will continue to be a major driver for smart metering investments in the region.

The analyst forecasts that the installed base of smart electricity meters in Latin America and the Caribbean - defined as the South American countries Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru and Uruguay, the Central American countries Belize, Costa Rica, El Salvador, Guatemala, Honduras, Mexico and Panama and the Caribbean countries and territories Bahamas, Barbados, the Dominican Republic, Jamaica, Puerto Rico and Trinidad and Tobago - will grow at a compound annual growth rate of 23.5% from 17.3 million in 2024 to 61.3 million in 2030. New installations will largely be driven by deployments in the two largest markets in the region - Brazil and Mexico - while countries such as Argentina, Colombia, Ecuador and Peru are expected to grow their share of annual shipment volumes throughout the forecast period. The analyst projects that 48.5 million new smart electricity meters will be installed in Latin America and the Caribbean during 2024-2030. Annual shipment volumes are forecasted to grow from 2.8 million units in 2024 to nearly 11.3 million units in 2030. The smart meter penetration rate across Latin America and the Caribbean is meanwhile forecasted to reach 24.8% in 2030 - up from 7.7% in 2024.

South America is home to 70% of all electricity users in Latin America and the Caribbean and accounts for around 60% of the installed base of smart electricity meters in the region. South America will also constitute the fastest growing regional smart metering market in Latin America and the Caribbean throughout the forecast period. Brazil in particular is a highly interesting market for smart metering solution vendors with its 94 million electricity users and low penetration rate of smart meters - 6.5% in 2024. The market is set to see significant growth over the coming years as the government has recently introduced a number of new laws and policies that actively promote the deployment of smart meters on a large scale, while several utilities such as Cemig, COPEL, Enel and CPFL have already began to invest significantly in AMI. Further Brazilian utilities are expected to increase their investments in the technology in the coming few years and the country is forecasted to account for more than half of the shipped smart electricity meters in Latin America and the Caribbean during the forecast period.

In Uruguay, the nationwide rollout by the state-owned utility UTE had largely been completed by the end of 2024 and the country has therefore become the first country in South America to reach near universal smart metering coverage. In neighbouring Argentina, the analyst estimates that the installed base of smart meters will increase more than six-fold from around 730,000 units in 2024 to more than 4.6 million in 2030. Smart metering deployments in Chile meanwhile peaked in 2018-2019 and have since decreased, mainly due to regulatory ambiguity. There is however potential for a more positive market development should the regulatory environment in the country improve. Colombia is another country which - despite the existence of a regulatory framework for smart metering - has suffered from a lack of policy uncertainty which has impacted the development of smart metering negatively. The installed base of smart meters in the country is nonetheless expected to increase significantly driven by deployments by the largest utility group Grupo EPM alongside Enel Colombia. Peru is a more nascent market, although a series of positive regulatory developments during the past two years has set the country up for a largescale rollout that is proposed to start in the late 2020s. In Ecuador, investments in smart metering are similarly expected to increase throughout the forecast period. The only two landlocked countries in South America - Bolivia and Paraguay - are also two of the least mature smart metering markets in Latin America and the Caribbean. The analyst expects that both markets will see moderate growth and continue to be largely in the smart metering pilot phase throughout the forecast period.

Central America is the most nascent smart metering market in Latin America and the Caribbean, although a few countries have made notable progress with significant smart metering projects now underway. The rollout of smart electricity meters in Costa Rica progresses steadily and the country has now reached a smart meter penetration rate above 50%. Honduras has long deployed smart meters as a tool to reduce non-technical losses and ended 2024 with an installed base of more than 500,000 units. The small country Belize meanwhile initiated a nationwide smart metering rollout in 2024 which is set to be completed within three years. El Salvador, Guatemala and Panama are all countries with relatively low installed bases of smart meters and the analyst expects that these markets will slowly increase the scope and scale of their deployments. In Panama, several important policy developments that promote the deployment of smart meters have recently taken place, while El Salvador is also making significant strides spearheaded by the country’s two main utilities. In the largest country in Central America - Mexico - the state-owned utility CFE has an ongoing project that seeks to scale the conversion of basic electronic and electromechanical meters to smart meters.

Utilities in the Caribbean were in contrast to their counterparts in South and Central America early to implement smart metering. Trinidad and Tobago as well as the US jurisdiction of Puerto Rico are already underway with a second wave of smart metering installations, although their existing meter parks are mainly made up of smart meters with very basic functionalities. Barbados has rolled out smart meters for effectively all customers, while Jamaica has achieved a smart meter penetration rate of more than 75%. The main utility in the Bahamas is meanwhile about to embark on a smart meter rollout, while deployments in the Dominican Republic are expected to steadily increase in line with the country’s national electricity loss reduction plan.

Highlights from the report:

- In-depth market profiles of Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Panama, Paraguay, Peru, Puerto Rico, Trinidad and Tobago and Uruguay.

- 360-degree overview of next-generation PLC, RF and cellular technologies for smart grid communications.

- Profiles of the key players in the smart metering industry in Latin America and the Caribbean.

- New forecasts for smart electricity metering until 2030.

- Analysis of the latest market and industry developments in each country.

- Case studies of smart metering projects by the leading energy groups.

Questions answered in the report:

- How are the national energy policies driving the adoption of smart metering?

- What is the current deployment status of major utilities across this region?

- How are market-liberalising reforms changing the energy utility sector in this region?

- Which countries are leading the adoption of smart gas metering technology in this region?

- Which communications technologies are being used for smart metering?

- Which are the leading smart metering solution providers in Latin America and the Caribbean?

- What is the outlook for the first wave of smart metering rollouts in this region?

- Which are the main electricity and gas utilities in each country?

Who should read this report?

Smart Metering in Latin America and the Caribbean is the foremost source of information about the ongoing transformation of the metering sector in this region. Whether you are a solution vendor, utility, telecom operator, investor, consultant or government agency, you will gain valuable insights from this in-depth research.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Aclara (Hubbell)

- América Móvil

- Ativa Soluções

- Aviat Networks (4RF)

- CAS Tecnologia

- Cisco

- Copel

- Corinex

- Discar

- Elgama Elektronika (Linyang Energy)

- EPAM Neoris

- Fluentgrid

- Gridspertise

- Grupo ICE

- Harris Utilities

- Hexing Electrical

- Holley Technology

- Honeywell (Elster)

- IBM

- Indra (Minsait)

- Iskraemeco

- Itron

- KAIFA Technology

- Landis+Gyr

- Light

- Networked Energy Services

- NTT

- NuriFlex

- Sagemcom

- Sanxing Electric (Nansen)

- SAP

- Siemens

- Silexis

- Tantalus Systems

- Telecom Italia (TIM)

- Telefónica

- Trilliant

- Trópico

- UTE

- Wasion

- WEG Group

- ZIV