Global Class 2 Trucks Market - Key Trends & Drivers Summarized

Why Are Class 2 Trucks Emerging as a Core Segment in Light-Duty Vehicle Demand?

Class 2 trucks - defined in the U.S. classification system as those with a Gross Vehicle Weight Rating (GVWR) between 6,001 and 10,000 pounds - represent a critical bridge between light passenger vehicles and heavier-duty commercial fleets. This category primarily includes full-size pickup trucks, light-duty chassis cabs, and utility vans that are widely used across residential, commercial, and industrial sectors. As urban and suburban economies evolve, Class 2 trucks are becoming essential tools in construction, utility services, landscaping, trades, delivery logistics, agriculture, and independent contracting work. Their ability to haul moderate payloads and tow equipment without the complexity or licensing requirements of heavier truck classes makes them highly versatile. Additionally, their dual-utility appeal - as both work vehicles and personal lifestyle transports - has positioned them as a top choice among small businesses and owner-operators alike. In rural and semi-urban regions, Class 2 trucks are often used for farm logistics, ranch operations, and light construction. In urban centers, service providers rely on them for mobile operations such as HVAC servicing, plumbing, electrical repair, and parcel delivery. As business ecosystems decentralize and demand for mobile, self-reliant, and multi-role vehicles grows, Class 2 trucks are proving indispensable across a broadening range of use cases.How Are Electrification and Powertrain Advancements Shaping the Class 2 Truck Landscape?

As the global automotive sector transitions toward low-emission and electric mobility, the Class 2 truck segment is undergoing a profound transformation. Increasing regulatory pressure to reduce greenhouse gas emissions and fuel consumption is prompting OEMs to introduce hybrid and battery-electric models in this weight category. Many leading manufacturers have already launched electric or plug-in hybrid Class 2 trucks, particularly in the form of light commercial vans and pickup trucks aimed at urban delivery, public fleet electrification, and green construction sectors. Unlike heavier trucks that face infrastructure and battery load limitations, Class 2 trucks are better positioned for electrification due to their lower energy demands and compatibility with existing charging systems. Concurrently, there is a strong push to improve traditional powertrains through turbocharging, variable valve timing, advanced transmissions, and lightweight materials - all designed to meet rising fuel economy standards without compromising performance. Clean diesel and natural gas variants are also gaining attention in specific industrial applications. As powertrain innovation continues to evolve, buyers of Class 2 trucks now have a wider choice of efficient and environmentally compliant models, many of which offer comparable towing and payload performance to larger trucks but with better operational cost profiles. This shift is not only modernizing the segment but also expanding its accessibility across regions transitioning toward sustainable transport solutions.Is Product Innovation and Configuration Customization Expanding Market Appeal?

Class 2 trucks are witnessing a wave of innovation, with OEMs introducing increasingly sophisticated features, configurations, and customization options that appeal to diverse end-users across industries. These vehicles are no longer viewed merely as utilitarian tools - they are now integrated with premium comfort features, advanced safety technologies, and digital connectivity platforms. Manufacturers are equipping Class 2 trucks with driver-assist technologies (ADAS), lane-keeping systems, blind spot monitoring, adaptive cruise control, and integrated telematics, transforming the driving experience while enhancing safety and operational oversight. Connectivity tools such as fleet management apps, vehicle health monitoring, over-the-air updates, and cloud-based diagnostics are being widely adopted by both commercial fleet owners and individual operators. Furthermore, customizable chassis configurations and modular body options are enabling customers to tailor trucks for specific industries - from cargo vans for parcel delivery to crew-cab pickups for construction crews and tradesmen. In the aftermarket and specialty upfitting sector, there is a booming demand for purpose-built truck bodies including refrigeration units, utility boxes, mobile service labs, and even off-grid expedition conversions. As lifestyle-based ownership increases among outdoor enthusiasts, campers, and overlanding communities, OEMs are also offering Class 2 trucks with off-road performance packages, enhanced suspension systems, and all-terrain capability. This broadening of design, functionality, and application scope is significantly driving both B2B and B2C demand, positioning Class 2 trucks as highly versatile assets across the mobility value chain.What’ s Fueling the Sustained Growth of the Global Class 2 Trucks Market?

The growth in the Class 2 trucks market is driven by several factors rooted in commercial activity trends, evolving consumer usage patterns, technology proliferation, and supportive regulatory frameworks. A key driver is the continued expansion of service-based economies and mobile workforce models, where Class 2 trucks serve as the backbone for trades, technicians, delivery operators, and field service professionals. Additionally, the growing focus on electrification - especially among municipal fleets and last-mile delivery services - is accelerating demand for Class 2 electric trucks and vans that balance cargo capacity with environmental compliance. Rising infrastructure development, suburban housing growth, and small-scale construction activity are also fueling demand for utility vehicles that can efficiently operate in constrained urban environments. At the consumer level, lifestyle shifts toward multi-purpose vehicle ownership are driving demand for Class 2 pickup trucks that serve dual roles as family transport and recreational haulers. Moreover, better fuel efficiency, improved powertrains, tax incentives for commercial vehicle upgrades, and access to fleet electrification grants are further supporting adoption across developed markets. The emergence of digital fleet platforms, vehicle subscription models, and telematics-based usage optimization is opening new market channels and boosting appeal among small businesses. Meanwhile, increasing manufacturing investments in emerging markets such as Southeast Asia, Latin America, and Africa are helping to localize Class 2 truck production and meet region-specific needs. Together, these economic, technological, and behavioral forces are contributing to a steady and sustained global growth trajectory for Class 2 trucks, ensuring their continued relevance in the evolving mobility ecosystem.Report Scope

The report analyzes the Class 2 Trucks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Engine Type (Gasoline Engine, Diesel Engine, Hybrid Engine, Electric Engine, Other Engines); Drive Configuration (All-Wheel Drive, Rear-Wheel Drive, Front-Wheel Drive).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gasoline Engine Trucks segment, which is expected to reach US$593.6 Million by 2030 with a CAGR of a 9%. The Diesel Engine Trucks segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $187.6 Million in 2024, and China, forecasted to grow at an impressive 12.6% CAGR to reach $236.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Class 2 Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Class 2 Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Class 2 Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BMW AG, Fiat Chrysler Automobiles (Ram Trucks), Ford Motor Company, General Motors Company (Chevrolet, GMC), Honda Motor Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Class 2 Trucks market report include:

- Ashok Leyland

- BMW Group

- Fiat Professional (part of Stellantis)

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Iveco Group

- Kia Corporation

- Mahindra & Mahindra Limited

- Mercedes-Benz Group

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Peugeot S.A. (part of Stellantis)

- Renault Group

- Stellantis (Ram Trucks)

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashok Leyland

- BMW Group

- Fiat Professional (part of Stellantis)

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Iveco Group

- Kia Corporation

- Mahindra & Mahindra Limited

- Mercedes-Benz Group

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Peugeot S.A. (part of Stellantis)

- Renault Group

- Stellantis (Ram Trucks)

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

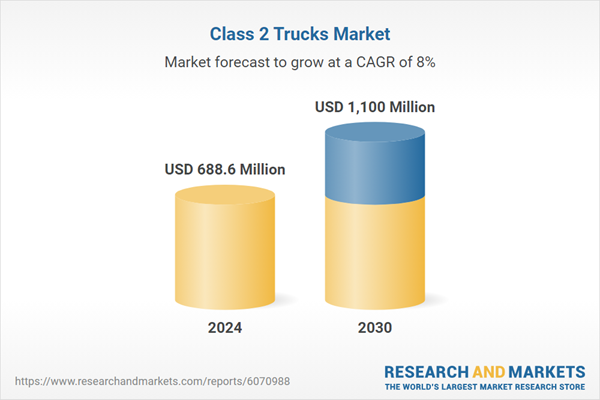

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 688.6 Million |

| Forecasted Market Value ( USD | $ 1100 Million |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |