Global Class 1 Trucks Market - Key Trends & Drivers Summarized

What Is Driving Renewed Interest in Class 1 Trucks Across Urban and Light-Duty Transport Applications?

Class 1 trucks, defined in the U.S. vehicle classification system as trucks with a gross vehicle weight rating (GVWR) of up to 6,000 lbs (typically including compact pickup trucks and smaller utility vehicles), are gaining renewed attention across both commercial and personal mobility ecosystems. Their compact size, versatility, and cost-effectiveness make them highly suitable for urban deliveries, light-duty utility services, and small-scale logistics operations. As urbanization intensifies and last-mile delivery demands rise, Class 1 trucks are increasingly being adopted for intra-city transport due to their ease of maneuverability, lower fuel consumption, and ability to access congested or restricted urban zones. Additionally, the growing gig economy, home services sector, and independent contractor landscape have elevated the importance of smaller trucks that offer both cargo flexibility and operational affordability. In rural and semi-urban settings, Class 1 trucks continue to serve dual roles - as personal vehicles and light commercial workhorses for agriculture, construction, and small business operations. As fleet operators and small enterprises look for affordable, functional vehicles for daily operations, the practical advantages of Class 1 trucks are bringing this vehicle segment back into strategic focus.How Are Electrification and Fuel Efficiency Trends Transforming the Class 1 Truck Segment?

The global push toward vehicle electrification and fuel efficiency is transforming the product development and market positioning of Class 1 trucks. Original equipment manufacturers (OEMs) are increasingly introducing hybrid and battery-electric variants to align with emission regulations and shifting consumer preferences. These lightweight trucks, which inherently consume less energy than their heavier counterparts, are well-suited to electrification - making them a crucial entry point for automakers expanding their electric light-duty vehicle portfolios. Several OEMs have already launched or are planning compact electric pickups and light commercial EVs that fall within the Class 1 category, especially targeted at urban fleet owners, municipalities, and environmentally conscious small businesses. The lower energy requirements of Class 1 trucks also make them more compatible with evolving charging infrastructure, including Level 2 home charging setups - providing a cost advantage over heavier electric vehicles. Additionally, fuel-efficient internal combustion engine (ICE) models continue to be in demand in regions where EV infrastructure is nascent, with automakers optimizing engine design, aerodynamics, and weight distribution to meet stricter fuel economy norms. These transitions are not only modernizing the segment but also expanding the consumer base for Class 1 trucks into younger, eco-conscious, and urban-centric demographics.Is Product Versatility and Technological Integration Reshaping Class 1 Truck Utility?

Class 1 trucks are undergoing a product evolution as OEMs enhance these vehicles with advanced features, technology integrations, and modular designs that appeal to a broader array of users. Traditional entry-level models are now being offered with upgraded infotainment systems, digital cockpits, ADAS (Advanced Driver Assistance Systems), and connectivity solutions - once exclusive to higher vehicle classes. This digital transformation is not only improving safety and user experience but also elevating the perception of Class 1 trucks from bare-bones utility vehicles to smart, multi-purpose machines. The modularity of cargo configurations is another area of innovation, with truck beds, roof racks, storage compartments, and payload optimization features being tailored for specific commercial or recreational use cases. Additionally, OEMs are offering factory-fitted customization options for tradespeople, delivery services, and mobile repair technicians - enabling more efficient, ready-to-deploy vehicles straight from production lines. Fleet telematics integration and cloud-based vehicle monitoring tools are further improving operational efficiency for small business fleets, allowing owners to manage routes, fuel use, maintenance schedules, and vehicle diagnostics in real time. This fusion of traditional utility with smart features and modular adaptability is redefining the role of Class 1 trucks in modern transportation ecosystems.What’ s Driving the Accelerated Growth in the Global Class 1 Trucks Market?

The growth in the Class 1 trucks market is driven by several factors that are rooted in end-use diversification, technology transition, cost dynamics, and consumer behavior. The surge in last-mile delivery demand - driven by e-commerce expansion and urban logistics needs - is pushing logistics operators and SMEs toward compact, cost-efficient delivery vehicles like Class 1 trucks. Rising fuel costs and stricter emissions norms are prompting fleet owners and individual operators to seek lightweight vehicles that deliver better fuel economy or offer electric variants for urban use. Moreover, increasing adoption of Class 1 electric trucks by government agencies, public utilities, and urban service contractors is creating new demand corridors in both public and private sectors. The growth of gig-based and freelance workforces, including mobile services, food delivery, and parcel distribution, is also catalyzing individual ownership of small commercial trucks, adding volume to the segment. In rural markets, Class 1 trucks continue to be popular for light construction, agricultural logistics, and dual-purpose use as both family and work vehicles - supporting market resilience in non-urban geographies. Furthermore, affordability, lower insurance premiums, easier financing options, and compatibility with emerging digital fleet platforms are making Class 1 trucks an attractive value proposition. As OEMs continue to expand model portfolios with eco-friendly, connected, and customizable options, and as infrastructure improves for electrification and digital servicing, Class 1 trucks are poised for strong and sustained global growth across both commercial and personal mobility segments.Report Scope

The report analyzes the Class 1 Trucks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Engine Type (Diesel Engines, Gasoline Engines, Hybrid Engines, Electric Engines, Other Types); Application (Personal Class 1 Truck, Commercial Class 1 Truck).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Diesel Engine Trucks segment, which is expected to reach US$834.4 Billion by 2030 with a CAGR of a 5.6%. The Gasoline Engine Trucks segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $477.0 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $482.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Class 1 Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Class 1 Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Class 1 Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agarwal Life Sciences Pvt. Ltd., Agro Products & Agencies, AOS Products Pvt. Ltd., Aroma Chemical Services International GmbH, Berjé Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Class 1 Trucks market report include:

- BMW AG

- Fiat Chrysler Automobiles (Ram Trucks)

- Ford Motor Company

- General Motors Company (Chevrolet, GMC)

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Limited

- Kia Corporation

- Mahindra & Mahindra Limited

- Mazda Motor Corporation

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Peugeot S.A.

- Renault S.A.

- Subaru Corporation

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BMW AG

- Fiat Chrysler Automobiles (Ram Trucks)

- Ford Motor Company

- General Motors Company (Chevrolet, GMC)

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Limited

- Kia Corporation

- Mahindra & Mahindra Limited

- Mazda Motor Corporation

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Nissan Motor Corporation

- Peugeot S.A.

- Renault S.A.

- Subaru Corporation

- Suzuki Motor Corporation

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

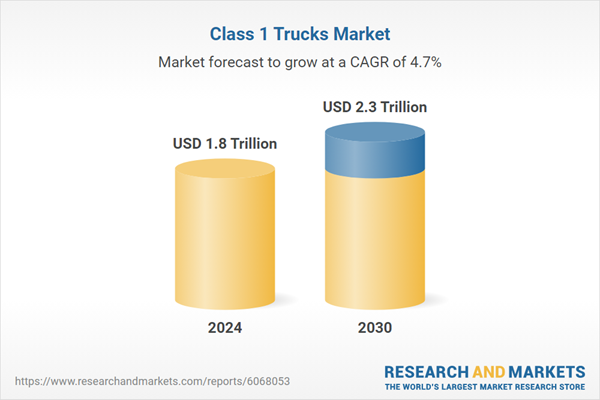

| Estimated Market Value ( USD | $ 1.8 Trillion |

| Forecasted Market Value ( USD | $ 2.3 Trillion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |