More attention is being paid to insurtech, which is essentially the technological advancement utilization to reduce costs and increase efficiency in the present insurance sector paradigm. By adopting a variety of technologies, including data analysis, IoT, and AI, insurtech enables products to be priced more affordably. Effective claim processing, risk assessment, contract processing, and policy underwriting are all possible with insurtech. Hence, it is projected that the market expansion will be aided by private players' growing reliance on technological developments to streamline and expedite the entire claim settlement process.

On the other hand, challenges such as lack of awareness about the medicare supplement health insurance among individuals are limiting the growth of the market. Nonetheless, increasing efforts by private companies to improve public awareness of the Medicare Supplement Health Insurance Plan are anticipated to increase this awareness among people and boost plan sales over the projection period.

U.S. Medicare Supplement Health Insurance Market Report Highlights

- The Individuals aged 65 or over dominated the market in 2022 with the highest market share owing to a large number of individuals opting for medigap from this category

- The individuals aged under 65 with an eligible disability segment is anticipated to experience significant growth over the forecast period due to rising disability cases among the younger population in the country

- The agents segment accounted for the highest market share in 2022 as maximum sales are achieved through this sales channel

- A shift towards online sales to purchase policies is leading to maximum growth of the website segment

- South U.S. region dominated the market due to the widespread insured population in the region

- The West region is expected to undergo maximum growth due to the rise in healthcare spending in states like California

Table of Contents

Chapter 1. Methodology and Scope1.1. Market Segmentation & Scope

1.1.1. Demographic

1.1.2. Sales Channel

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in the U.S.

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Premium price

1.6.2. Country-wise market estimation using bottom-up approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Demographic Outlook

2.2.2. Sales Channel Outlook

2.2.3. Regional Outlook

2.3. Competitive Insights

Chapter 3. U.S. Medicare Supplement Health Insurance Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing Sales Channel for Insurance

3.4.1.2. High Healthcare Costs

3.4.1.3. Benefits of Medigap insurance

3.4.2. Market restraint analysis

3.4.2.1. Lack of Awareness about the Medigap Insurance

3.5. U.S. Medicare Supplement Health Insurance Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4. U.S. Medicare Supplement Health Insurance: Demographic Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Individuals Aged 65 or Older

4.1.2. Individuals Aged Under 65 with an Eligible Disability

4.2. Demographic Market Share, 2022 & 2030

4.3. Segment Dashboard

4.4. U.S. Medicare Supplement Health Insurance Market by Demographic Outlook

4.5. Market Demographic & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5.1. Individuals aged under 65 or older

4.5.1.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

4.5.2. Individuals aged under 65 with an eligible disability

4.5.2.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

Chapter 5. U.S. Medicare Supplement Health Insurance: Sales Channel Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Agents

5.1.2. Brokers

5.1.3. Website

5.1.4. Others

5.2. Sales Channel Market Share, 2022 & 2030

5.3. Segment Dashboard

5.4. U.S. Medicare Supplement Health Insurance Market by Sales Channel Outlook

5.5. Market Sales Channel & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5.1. Agents

5.5.1.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.2. Brokers

5.5.2.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.3. Website

5.5.3.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.4. Others

5.5.4.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

Chapter 6. U.S. Medicare Supplement Health Insurance Market: Regional Estimates & Trend Analysis

6.1. Regional market share analysis, 2022 & 2030

6.2. Regional Market Dashboard

6.3. U.S. Regional Market Snapshot

6.4. Regional Market Share and Leading Players, 2022

6.4.1. U.S.

6.5. Market Service, & Forecasts and Trend Analysis, 2018 to 2030:

6.6. U.S.

6.6.1. Northeast

6.6.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

6.6.1.2. Connecticut

6.6.1.2.1. Connecticut Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.1.3. Massachusetts

6.6.1.3.1. Massachusetts Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.1.4. Pennsylvania

6.6.1.4.1. Pennsylvania Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.1.5. New Jersey

6.6.1.5.1. New Jersey Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.1.6. New York

6.6.1.6.1. New York Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.1.7. Others (Maine, New Hampshire, Rhode Island, Vermont)

6.6.1.7.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2. Midwest

6.6.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

6.6.2.2. Illinois

6.6.2.2.1. Illinois Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.3. Indiana

6.6.2.3.1. Indiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.4. Michigan

6.6.2.4.1. Michigan Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.5. Ohio

6.6.2.5.1. Ohio Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.6. Wisconsin

6.6.2.6.1. Wisconsin Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.7. Iowa

6.6.2.7.1. Iowa Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.8. Minnesota

6.6.2.8.1. Minnesota Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.9. Missouri

6.6.2.9.1. Missouri Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.2.10. Others (Kansas, Nebraska, North Dakota, South Dakota)

6.6.2.10.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3. South

6.6.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

6.6.3.2. Florida

6.6.3.2.1. Florida Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.3. Georgia

6.6.3.3.1. Georgia Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.4. Maryland

6.6.3.4.1. Maryland Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.5. North Carolina

6.6.3.5.1. North Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.6. South Carolina

6.6.3.6.1. South Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.7. Virginia

6.6.3.7.1. Virginia Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.8. Alabama

6.6.3.8.1. Alabama Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.9. Kentucky

6.6.3.9.1. Kentucky Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.10. Tennessee

6.6.3.10.1. Tennessee Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.11. Louisiana

6.6.3.11.1. Louisiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.12. Texas

6.6.3.12.1. Texas Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.3.13. Others (Delaware, West Virginia, Mississippi, Arkansas, Oklahoma)

6.6.3.13.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4. West

6.6.4.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

6.6.4.2. Arizona

6.6.4.2.1. Arizona Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.3. Colorado

6.6.4.3.1. Colorado Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.4. Nevada

6.6.4.4.1. Nevada Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.5. California

6.6.4.5.1. California Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.6. Oregon

6.6.4.6.1. Oregon Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.7. Washington

6.6.4.7.1. Washington Market estimates and forecast, by product, 2018 - 2030 (Billion)

6.6.4.8. Others (Idaho, Montana, New Mexico, Utah, Wyoming, Alaska, Hawaii)

6.6.4.8.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.2.1. Innovators

7.2.2. Market Leaders

7.2.3. Emerging Players

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company market share analysis, 2022

7.3.4. Cigna Health & Life Insurance Company

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. Anthem Blue Cross

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. United Healthcare Insurance Company

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Mutual of Omaha

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. Humana

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. State Farm Mutual Automobile Insurance Company

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. National Health Insurance Company

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. United American Insurance Company

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. Washington National Insurance Company

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives

7.3.13. Everence Association, Inc.

7.3.13.1. Company overview

7.3.13.2. Financial performance

7.3.13.3. Product benchmarking

7.3.13.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 U.S. medicare supplement health insurance market, by region, 2018 - 2030 (USD Billion)

Table 3 U.S. medicare supplement health insurance market, by demographic, 2018 - 2030 (USD Billion)

Table 4 U.S. medicare supplement health insurance market, by sales channel, 2018 - 2030 (USD Billion)

Table 5 Northeast medicare supplement health insurance market, by demographic, 2018 - 2030 (USD Billion)

Table 6 Northeast medicare supplement health insurance market, by sales channel, 2018 - 2030 (USD Billion)

Table 7 Midwest medicare supplement health insurance market, by demographic, 2018 - 2030 (USD Billion)

Table 8 Midwest medicare supplement health insurance market, by sales channel, 2018 - 2030 (USD Billion)

Table 9 South medicare supplement health insurance market, by demographic, 2018 - 2030 (USD Billion)

Table 10 South medicare supplement health insurance market, by sales channel, 2018 - 2030 (USD Billion)

Table 11 West medicare supplement health insurance market, by demographic, 2018 - 2030 (USD Billion)

Table 12 West medicare supplement health insurance market, by sales channel, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in the U.S.

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 U.S. medicare supplement health insurance: market outlook

Fig. 10 U.S. medicare supplement health insurance market competitive insights

Fig. 11 Parent market outlook

Fig. 12 Related/ancillary market outlook

Fig. 13 Penetration and growth prospect mapping

Fig. 14 Industry value chain analysis

Fig. 15 U.S. medicare supplement health insurance market driver impact

Fig. 16 U.S. medicare supplement health insurance market restraint impact

Fig. 17 U.S. medicare supplement health insurance market strategic initiatives analysis

Fig. 18 U.S. medicare supplement health insurance market: demographic movement analysis

Fig. 19 U.S. medicare supplement health insurance market: demographic outlook and key takeaways

Fig. 20 Individuals aged 65 or older estimates and forecast, 2018 - 2030

Fig. 21 Individuals aged under 65 with an eligible disability estimate and forecast, 2018 - 2030

Fig. 22 U.S. medicare supplement health insurance market: sales channel movement analysis

Fig. 23 U.S. medicare supplement health insurance market: sales channel outlook and key takeaways

Fig. 24 Agents estimates and forecast, 2018 - 2030

Fig. 25 Brokers estimates and forecast, 2018 - 2030

Fig. 26 Website estimates and forecast, 2018 - 2030

Fig. 27 Others estimates and forecast, 2018 - 2030

Fig. 28 U.S. medicare supplement health insurance market: Regional movement analysis

Fig. 29 U.S. medicare supplement health insurance market: regional outlook and key takeaways

Fig. 30 U.S. market share and leading players

Fig. 31 U.S. SWOT

Fig. 32 U.S.

Fig. 33 U.S. market estimates and forecast, 2018 - 2030

Fig. 34 Northeast

Fig. 35 Northeast market estimates and forecast, 2018 - 2030

Fig. 36 Midwest

Fig. 37 Midwest market estimates and forecast, 2018 - 2030

Fig. 38 South

Fig. 39 South market estimates and forecast, 2018 - 2030

Fig. 40 West

Fig. 41 West market estimates and forecast, 2018 - 2030

Fig. 42 Participant categorization- U.S. medicare supplement health insurance market

Fig. 43 Market share of key market players - U.S. medicare supplement health insurance market

Companies Mentioned

- Cigna Health & Life Insurance Company

- Anthem Blue Cross

- United Healthcare Insurance Company

- Mutual of Omaha

- Humana

- State Farm Mutual Automobile Insurance Company

- National Health Insurance Company

- United American Insurance Company

- Washington National Insurance Company

- Everence Association, Inc.

Table Information

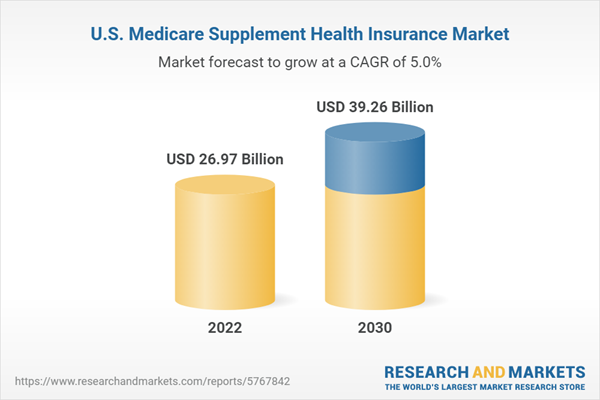

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 26.97 Billion |

| Forecasted Market Value ( USD | $ 39.26 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |