Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces a significant hurdle due to the stringent regulatory framework governing the approval of medical claims and active ingredients. Manufacturers are required to navigate rigorous clinical testing and safety validations to substantiate efficacy, resulting in high operational costs and extended development timelines. This complex compliance environment creates high barriers to entry and limits the speed at which new treatments can be introduced to the global consumer base.

Market Drivers

The growing prevalence of chronic scalp ailments, such as dandruff, psoriasis, and seborrheic dermatitis, acts as the primary catalyst for the expansion of the Global Medicated Shampoo Market. As these conditions affect a larger portion of the global population due to lifestyle changes and environmental stressors, there is a critical need for therapeutic hair care formulations containing active pharmaceutical ingredients. This rising disease burden compels consumers to switch from cosmetic shampoos to functional treatments designed to manage symptoms like desquamation and inflammation. According to the National Psoriasis Foundation's 'Psoriasis Health Indicator Report' from August 2024, approximately 7.5 million adults in the United States, or about 3% of the adult population, are affected by psoriasis, underscoring the significant addressable market for specialized management solutions.Concurrently, a surge in dermatologist recommendations and clinical prescriptions is elevating medicated hair care from optional hygiene to essential health maintenance. Manufacturers are increasingly validating their products through rigorous testing to secure medical endorsements, which significantly influences consumer purchasing decisions. This trend toward "medicalization" allows brands with strong clinical heritage to outperform the broader market. For instance, L'Oréal's '2023 Annual Report' released in February 2024 noted that its Dermatological Beauty division achieved 28.4% like-for-like sales growth, driven by demand for expert-recommended formulations. Similarly, Procter & Gamble reported high single-digit organic sales growth in its Hair Care segment in 2024, fueled by a favorable mix of premium and performance-centric products.

Market Challenges

The stringent regulatory framework controlling the approval of active ingredients and medical claims acts as a major impediment to the growth of the Global Medicated Shampoo Market. Manufacturers must navigate complex clinical testing and safety validations to prove the efficacy of their therapeutic formulations. This rigorous process inevitably results in inflated operational costs and significantly prolonged development timelines, preventing companies from swiftly responding to emerging consumer needs. Consequently, the financial burden associated with compliance discourages investment in novel active agents, thereby stalling the introduction of innovative treatments that could drive broader market adoption.This high-compliance environment establishes formidable barriers to entry, particularly for smaller entities that often lack the capital reserves to sustain extended approval phases. This dynamic is especially critical given the industry's composition; according to Cosmetics Europe, the European personal care industry comprised more than 9,600 small and medium-sized enterprises (SMEs) in 2024. The vulnerability of such a large volume of smaller market participants to these regulatory pressures restricts their ability to launch niche therapeutic products, ultimately limiting the diversity of solutions available to the global consumer base and hampering overall market expansion.

Market Trends

The Global Medicated Shampoo Market is being reshaped by the emergence of microbiome-friendly and probiotic infusions, shifting product development from simple pathogen eradication to holistic scalp ecosystem management. Manufacturers are increasingly prioritizing formulations that preserve the stratum corneum and balance the scalp’s natural flora, rather than solely stripping away bacteria or fungi with harsh active agents. This scientific evolution aligns with the "skinification" of hair care, utilizing ingredients traditionally found in facial skincare, such as prebiotics and urea, to repair the scalp barrier. This focus on dermatological efficacy is yielding significant commercial returns; according to Beiersdorf AG’s 'Annual Report 2024' from February 2025, the company's Derma business unit, which houses the Eucerin brand, achieved organic sales growth of 10.6%, validating rising consumer demand for scientifically advanced, barrier-supporting care.Simultaneously, the development of multi-functional therapeutic products is driving premiumization as consumers refuse to compromise on hair aesthetics for the sake of scalp health. The market is witnessing a convergence of medicinal utility and cosmetic elegance, where new formulations are designed to treat underlying pathologies while delivering salon-grade benefits such as volumizing, color protection, and texture enhancement. This trend addresses the historical trade-off between the unpleasant sensory attributes of clinical shampoos and the beautifying effects of standard hair care, encouraging consistent usage and higher price points. According to Unilever PLC’s 'Full Year 2024 Results' released in February 2025, the Beauty & Wellbeing division reported underlying sales growth of 6.5%, attributed to the successful premiumization of core portfolios including new scalp-focused innovations that combine health benefits with superior cosmetic results.

Key Players Profiled in the Medicated Shampoo Market

- Procter & Gamble

- Johnson & Johnson

- Himalaya Herbal Healthcare

- Farnam Companies, Inc.

- Sanofi-Aventis Groupe

- Summers Laboratories Inc.

- Maruho Co. Ltd.

- Kao Corporation

- Coty Inc.

- Avalon Natural Products, Inc.

Report Scope

In this report, the Global Medicated Shampoo Market has been segmented into the following categories:Medicated Shampoo Market, by Product Type:

- Dandruff & Seborrheic Dermatitis

- Psoriasis

- Others

Medicated Shampoo Market, by Sales Channel:

- Supermarkets/Hypermarkets

- Pharmacy & Drug Stores

- Departmental Stores

- Online

- Others (Direct Sales etc.)

Medicated Shampoo Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medicated Shampoo Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Medicated Shampoo market report include:- Procter & Gamble

- Johnson & Johnson

- Himalaya Herbal Healthcare

- Farnam Companies, Inc.

- Sanofi-Aventis Groupe

- Summers Laboratories Inc.

- Maruho Co. Ltd.

- Kao Corporation

- Coty Inc.

- Avalon Natural Products, Inc.

Table Information

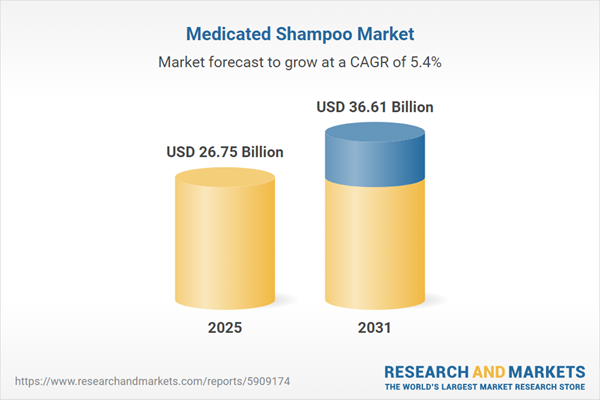

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 26.75 Billion |

| Forecasted Market Value ( USD | $ 36.61 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |