Increasing Adoption of Sustainable Aviation Fuel (SAF) Bolsters Middle East & Africa Airframe MRO Market

The aviation industry is intensifying its efforts to reduce carbon emissions and achieve sustainability goals, compelling MRO companies to adopt sustainable aviation fuel (SAF). By offering SAF-related services and technologies, MRO providers can position themselves as leaders in environmental sustainability and contribute to the industry's commitment to greener aviation practices. This opportunity aligns with the growing demand for eco-friendly aviation solutions and can open new revenue streams while fostering a more sustainable future for the sector.In February 2023, Boeing entered into agreements to acquire 5.6 million gallons (equivalent to 21.2 million liters) of blended sustainable aviation fuel (SAF) from Neste, a global leader in SAF production. As airlines increasingly prioritize eco-friendly operations, MRO companies can offer services related to SAF integration and usage. This includes retrofitting aircraft to accommodate SAF, conducting SAF-related maintenance, and ensuring compliance with SAF standards and regulations. Thus, the increasing adoption of sustainable aviation fuels (SAFs) and related services is likely to present a significant opportunity for airframe MRO providers during the forecast period.

Middle East & Africa Airframe MRO Market Overview

The MEA has recorded higher air traffic capacity, resulting in a significant supply of capacity offered by almost all major operators in the region. However, the limited economic activity in the region might adversely impact the growth of the airline industry in the coming years. Further, the Gulf countries are economically developed countries, while the African countries are yet to measure to the economic conditions of the Gulf countries.The construction of new airports in the major cities of the Gulf countries is one of the primary drivers for growth in the number of aircraft fleets in the MEA, which further drives the demand for MRO services for aircraft fleets. The countries in the Middle East, such as the UAE, Saudi Arabia, and Turkey, spend significantly higher amounts on the procurement of new defense aircraft and MRO activities of the existing aircraft fleet. The increasing number of airports and aircraft with tremendous growth in the aviation industry is bolstering the market growth. For instance, according to the Federal Aviation Administration, the aviation industry in the Middle East is witnessing annual growth of 10%. The growing aviation industry is creating a surge in the demand for airframe MRO solutions in order to manage air traffic efficiently.

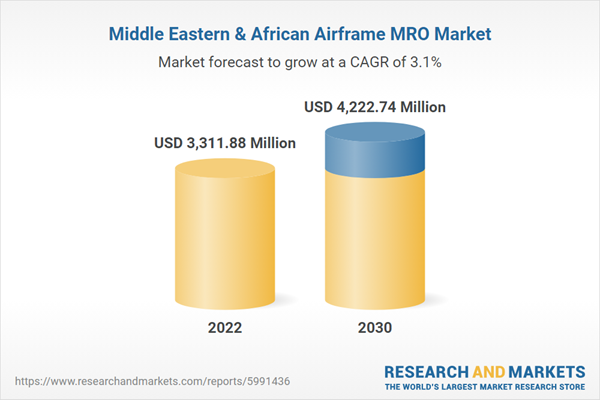

Middle East & Africa Airframe MRO Market Revenue and Forecast to 2030 (US$ Million)

Middle East & Africa Airframe MRO Market Segmentation

The Middle East & Africa airframe MRO market is segmented based on aircraft type, component, and country.Based on aircraft type, the Middle East & Africa airframe MRO market is bifurcated into fixed wing aircraft and rotary wing aircraft. The fixed wing aircraft segment held a larger share in 2022.

In terms of component, the Middle East & Africa airframe MRO market is segmented into fuselage, wings and rotors, landing gear, and others. The fuselage segment held the largest share in 2022.

Based on country, the Middle East & Africa airframe MRO market is categorized into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa airframe MRO market in 2022.

AAR CORP, Barnes Group Inc, GE Aviation, Turkish Technic Inc., Singapore Technologies Engineering Ltd, Lufthansa Technik, Delta TechOps, Rolls-Royce Holdings Plc, and Collins Aerospace are some of the leading companies operating in the Middle East & Africa airframe MRO market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa airframe MRO market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Middle East & Africa airframe MRO market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- AAR CORP

- Barnes Group Inc

- GE Aviation

- Turkish Technic Inc.

- Singapore Technologies Engineering Ltd

- Lufthansa Technik

- Delta TechOps

- Rolls-Royce Holdings Plc

- Collins Aerospace

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 79 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 3311.88 Million |

| Forecasted Market Value ( USD | $ 4222.74 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 9 |