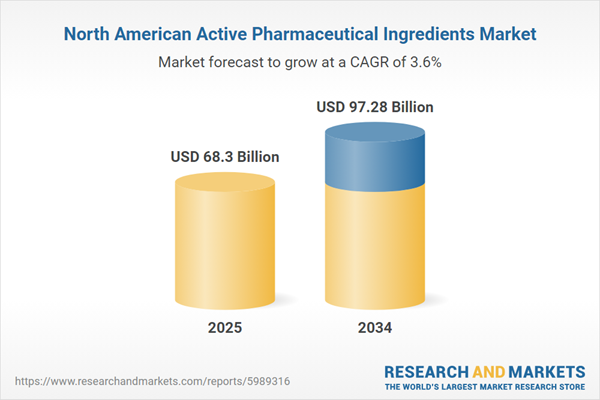

North America Active Pharmaceutical Ingredients Market Overview

Active pharmaceutical ingredient (API) is defined as the biologically active constituent of a drug product that delivers the desired therapeutic effect. APIs can be produced synthetically through chemical processes or can be biologically derived via biotechnological methods. In North America, the rising burden of chronic diseases, the increasing advancements in API production, and the growth of the generic drug sector are significantly contributing to the expansion of the global active pharmaceutical ingredients (API) market. The outsourcing of API production is a major market trend that helps pharmaceutical companies reduce manufacturing costs and focus more on their core competencies. Additionally, factors such as the rise in strategic partnerships among pharma companies, increasing investment in research and development, and the presence of a positive regulatory environment are shaping the market landscape in North America.North America Active Pharmaceutical Ingredients Market Growth Drivers

Substantial Investment in API Production to Meet Rising Market Demand

In May 2024, pharmaceutical giant Eli Lilly and Company announced a USD 5.3 billion investment in its manufacturing site in Lebanon (Indiana, United States) to boost the production capacity of active pharmaceutical ingredients (APIs). The investment was intended particularly for its type 2 diabetes and obesity drugs, namely, Mounjaro® (tirzepatide) injection and Zepbound® (tirzepatide) injection. This major investment is reported as the largest manufacturing investment in the company’s history and the biggest synthetic medicine API manufacturing investment in the United States' history. Such significant financial commitments by the key market players to expand the API manufacturing capacity and capabilities are anticipated to propel the market growth in the forecast period.North America Active Pharmaceutical Ingredients Market Trends

The market is witnessing several trends and developments to improve the current scenario in North America. Some of the notable trends are as follows:

Increase in Generic Drug Production

The market is impacted by the rising patent expiration of branded drugs which has led to a surge in generic drug production. This increase in generic drug manufacturing impacts the demand for generic active pharmaceutical ingredients, thereby boosting market growth.Advancements in API Manufacturing

One of the major market trends is the rising technological advancements in API manufacturing. The adoption of continuous manufacturing processes has resulted in improved efficiency and a reduction in API production costs. Moreover, innovations such as automation, digitalization, and advanced analytics, are enhancing API production processes and quality control, which is likely to augment North America active pharmaceutical ingredients market demand.Shift Towards Contract Development and Manufacturing Organizations (CDMOs)

The market is influenced by the growing outsourcing trends, with many pharmaceutical companies increasingly seeking contract development and manufacturing organizations' services for API production. This is leading to the capacity expansion of CDMOs, which is projected to elevate the market value in the coming years.

Rising Healthcare Expenditure

The market is benefitting from the rising government spending on healthcare and pharmaceuticals which drives growth and innovation in the market. Additionally, the pharmaceutical and API manufacturing sectors are increasingly attracting fundings from private investors, which is projected to support market expansion.North America Active Pharmaceutical Ingredients Market Segmentation

Market Breakup by Drug Type

- Innovative Active Pharmaceutical Ingredients (API)

- Generic Active Pharmaceutical Ingredients (API)

Market Breakup by Type of Manufacturer

- Captive Manufacturers

- Merchant API Manufacturers

Market Breakup by Type of Synthesis

- Synthetic Active Pharmaceutical Ingredients (API)

- Biotech Active Pharmaceutical Ingredients (API)

Market Breakup by Application

- Communicable Disease

- CNS & Neurology

- Oncology

- Endocrinology

- Gastroenterology

- Other Therapeutic Application

Market Breakup by Country

- United States

- Canada

North America Active Pharmaceutical Ingredients Market Share

Market Segmentation Based on Type of Synthesis is Anticipated to Witness Substantial Growth

Based on the type of synthesis, the market is segmented into synthetic active pharmaceutical ingredients and biotech active pharmaceutical ingredients. Synthetic APIs are chemically synthesized through various chemical processes whereas biotech APIs are derived from biological sources through certain biotechnological processes. The synthetic APIs segment covers a major market share owing to its cost-effectiveness compared to biotech APIs as well as high scalability which allows their mass production. The rising advancements in chemical synthesis technologies and their widespread use in various therapeutic areas also aid in the segment's growth.North America Active Pharmaceutical Ingredients Market Analysis by Region

Based on the region, the United States covers the largest share of the active pharmaceutical ingredient market in North America. The market share can be attributed to its advanced pharmaceutical sector and a supportive regulatory framework. The presence of leading biotech companies and research institutions involved in the development of new therapies in the region further bolsters the market demand for high-quality APIs.Canada also contributes significantly to the North America active pharmaceutical ingredients market growth. With the pharmaceutical infrastructure witnessing continuous expansion in the region, the demand for APIs is expected to surge in the coming years. Additionally, increased focus on domestic production of APIs is likely to influence market dynamics in the Canadian market.

Leading Players in the North America Active Pharmaceutical Ingredients Market

The key features of the market report comprise the patent analysis, funding and investment analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:AbbVie Inc.

Headquartered in North Chicago (Illinois), AbbVie Inc. is a global biopharmaceutical company that is known for its significant investment in R&D to enhance its active pharmaceutical ingredient offerings in the fields of oncology, immunology, and virology, among others.Bristol-Myers Squibb Company

Leading biopharmaceutical company Bristol-Myers Squibb leverages its advanced research facilities to develop high-quality active pharmaceutical ingredients (APIs) and is recognized for its pipeline of drugs in oncology, cardiovascular diseases, and immunology.Merck & Co., Inc.

New Jersey-based Merck & Co., Inc. is a multinational pharmaceutical company that offers small molecule API process development and manufacturing services. It provides APIs across various therapeutic areas including vaccines and infectious diseases.Eli Lilly and Company

American pharmaceutical firm Eli Lilly and Company has a robust presence in the market and is actively engaged in efforts to enhance its API development and production capabilities. The company has made substantial investments in synthetic medicine active pharmaceutical ingredient (API) manufacturing to boost its production capacity.Key Questions Answered in the North America Active Pharmaceutical Ingredients Market Report

- What was the North America active pharmaceutical ingredients market value in 2024?

- What is the North America active pharmaceutical ingredients market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is the market segmentation based on the drug type?

- What is the market breakup based on the type of manufacturer?

- What is the market segmentation by type of synthesis?

- What is the market segmentation based on application?

- What are the major factors aiding the North America active pharmaceutical ingredients market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How do the prevalence and incidence of chronic diseases affect the market landscape?

- What are the major North America active pharmaceutical ingredients market trends?

- How do the advancements in API manufacturing technologies impact the market size?

- Which drug type will dominate the market share?

- Which type of manufacturer will experience the highest demand in the market segment?

- Which type of synthesis is projected to contribute to the highest market growth?

- Which application area is expected to have a high market value in the coming years?

- Who are the key players involved in the North America active pharmaceutical ingredients market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Eli Lilly and Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 68.3 Billion |

| Forecasted Market Value ( USD | $ 97.28 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 4 |