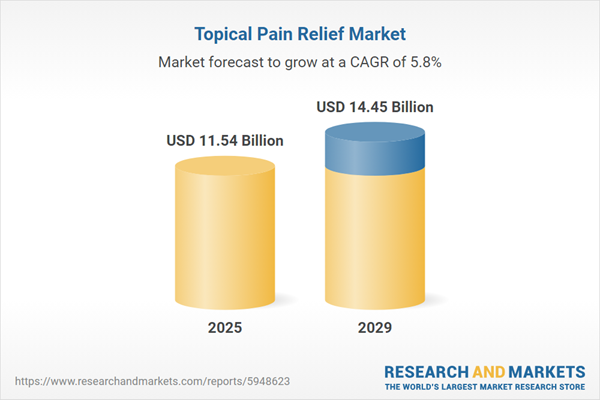

The topical pain relief market size has grown strongly in recent years. It will grow from $10.74 billion in 2024 to $11.54 billion in 2025 at a compound annual growth rate (CAGR) of 7.4%. The growth in the historic period can be attributed to prevalence of chronic conditions, prevalence of sports-related injuries, understanding of online pharmacy, increase in prevalence of arthritis, increase in the number of older people.

The topical pain relief market size is expected to see strong growth in the next few years. It will grow to $14.45 billion in 2029 at a compound annual growth rate (CAGR) of 5.8%. The growth in the forecast period can be attributed to growing prevalence of joint pains and arthritis, increasing demand among athletes, increasing adoption of pain management devices and patches, e-commerce platform growth, rising drug development, rising healthcare costs. Major trends in the forecast period include increasing number of cancer patients, easy product availability, advent of home delivery models, increasing number of individuals participating in sports activities, innovation in formulations.

The increasing prevalence of arthritis and bone-related disorders is anticipated to drive the growth of the topical pain relief market in the future. Arthritis and bone-related disorders refer to various medical conditions that impact the joints, bones, and surrounding tissues. Topical pain relief treatments are commonly employed to alleviate localized pain, inflammation, and discomfort associated with these conditions, particularly affecting more superficial joints. For example, in February 2024, the Centers for Disease Control and Prevention (CDC), a US-based health protection agency, reported that in 2022, 18.9% of adults experienced arthritis, with a higher prevalence in women (21.5%) compared to men (16.1%). The condition was more common among older adults, peaking at 53.9% for those aged 75 and older, and was notably higher among Black and White non-Hispanic adults. Furthermore, prevalence rates decreased with increasing income and in urban areas. Thus, the rising incidence of arthritis and bone-related disorders is propelling the growth of the topical pain relief market.

Major companies in the topical pain relief market are concentrating on developing innovative products, such as pain-relieving creams, to meet the rising demand for effective pain relief solutions. Pain-relieving creams, external creams providing penetrating pain relief for minor joint and muscle soreness, are gaining popularity. In August 2023, Kenvue Inc., a US-based consumer health company, introduced Tylenol, a new topical pain-relieving cream. This precise pain-relieving cream offers maximum-strength lidocaine (4%) without a prescription, available in rapid-absorbing formula and rollerball formats for hands-free, no-mess application. The cream, featuring a fragrance-free option and fresh scent choices, is designed to cater to consumers seeking convenient and effective pain relief solutions.

In December 2023, Wellnex Life Limited, an Australia-based health and wellness company, acquired Painaway Australia Pty Ltd. for $13.6 million. This acquisition allows Wellnex Life to significantly enhance its scale in the topical pain relief market by integrating Painaway's established product line into its 100%-owned brand portfolio. The move is expected to materially strengthen Wellnex's position in the industry, leveraging Painaway Australia’s expertise as a manufacturer of topical pain relief products.

Major companies operating in the topical pain relief market report are Pfizer Inc., Johnson & Johnson, Abbvie Inc., Bayer AG, Novartis AG, Sanofi S.A., Bristol Myers Squibb Co., GlaxoSmithKline PLC, Acella Pharmaceuticals LLC, Eli Lilly and Company, Reckitt Benckiser Group PLC, Viatris Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V., Astellas Pharma Inc., Sun Pharmaceutical Industries Ltd., Perrigo Company PLC, Galderma S.A., Dr. Reddy's Laboratories Ltd., Aurobindo Pharma Limited, Cipla Ltd., Lupin Limited, Almirall S.A., AdvaCare Pharma, Roivant Sciences Inc., Topical BioMedics Inc.

North America was the largest region in the topical pain relief market in 2024. The regions covered in the topical pain relief market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the topical pain relief market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The topical pain relief market consists of sales of such as lotions, instant relief creams, roll-ons, pumps of lotion, analgesic creams, powders and rubs. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Topical pain relief involves the application of analgesic medications directly to the skin or mucous membranes with the aim of alleviating pain. These products are specifically formulated to offer localized relief by delivering active ingredients directly to the area of pain or inflammation. Topical pain relief is commonly used to address conditions such as muscle aches, joint pain, arthritis, or injuries, providing targeted and localized relief without affecting the entire body.

Topical pain relief comes in two main types such as prescription pain relief and over-the-counter (OTC) pain relief. Prescription pain relief involves medications or treatments that can only be obtained with a prescription from a healthcare professional. These prescription options are available in various formulations, such as creams, gels, sprays, patches, and others. They may include both non-opioid and opioid therapeutics and are typically distributed through pharmacies, drug stores, e-commerce platforms, as well as retail and grocery store channels.

The topical pain relief market research report is one of a series of new reports that provides topical pain relief market statistics, including topical pain relief industry global market size, regional shares, competitors with a topical pain relief market share, detailed topical pain relief market segments, market trends and opportunities, and any further data you may need to thrive in the topical pain relief industry. This topical pain relief market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Topical Pain Relief Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on topical pain relief market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for topical pain relief? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The topical pain relief market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Prescription Pain Relief; Over-The-Counter (OTC) Pain Relief2) By Formulation: Cream; Gel; Spray; Patch; Other Formulations

3) By Therapeutic: Non-Opioids; Opioids

4) By Distribution Channel: Pharmacies And Drug Stores; E-Commerce; Retail And Grocery Stores

Subsegments:

1) By Prescription Pain Relief: Prescription Creams And Gels; Prescription Patches; Compounded Topical Analgesics2) By Over-The-Counter (OTC) Pain Relief: Nonsteroidal Anti-Inflammatory Drugs (NSAIDs); Counterirritants; Analgesic Creams And Gels

Key Companies Mentioned: Pfizer Inc.; Johnson & Johnson; Abbvie Inc.; Bayer AG; Novartis AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Topical Pain Relief market report include:- Pfizer Inc.

- Johnson & Johnson

- Abbvie Inc.

- Bayer AG

- Novartis AG

- Sanofi S.A.

- Bristol Myers Squibb Co.

- GlaxoSmithKline Plc

- Acella Pharmaceuticals LLC

- Eli Lilly and Company

- Reckitt Benckiser Group plc

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Astellas Pharma Inc.

- Sun Pharmaceutical Industries Ltd.

- Perrigo Company PLC

- Galderma S.A.

- Dr. Reddy's Laboratories Ltd.

- Aurobindo Pharma Limited

- Cipla Ltd.

- Lupin Limited

- Almirall S.A.

- AdvaCare Pharma

- Roivant Sciences Inc.

- Topical BioMedics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.54 Billion |

| Forecasted Market Value ( USD | $ 14.45 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |