Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction to trailer assist systems emphasizing sensor fusion, integration challenges, and operational priorities for manufacturers and fleet operators

Trailer assist systems have evolved from convenience features to critical components that enhance vehicle safety, operational efficiency, and driver confidence across a wide range of transport use cases. Modern solutions combine sensor fusion, real-time processing, and embedded control logic to support complex maneuvers such as low-speed parking, hitch alignment, blind spot management, and automated collision mitigation. These systems integrate with vehicle electronics, telematics, and fleet management platforms, creating new synergies and new integration challenges for original equipment manufacturers and aftermarket providers alike.Understanding this foundational context is essential for decision-makers evaluating product roadmaps, supplier partnerships, or retrofit strategies. As technology stacks mature, attention shifts from basic functionality to robustness, cybersecurity, and the human-machine interface. Reliable sensor performance under varied environmental conditions, seamless interoperability with existing vehicle architectures, and end-to-end validation workflows are now non-negotiable attributes. Consequently, engineering teams must balance hardware selection, data processing architectures, and user-centered design to deliver solutions that earn operator trust and meet regulatory scrutiny.

Analysis of pivotal technology, regulatory, and software architecture shifts that are reshaping how trailer assist systems are developed, validated, and deployed

The landscape for trailer assist systems is experiencing transformative shifts driven by advances in sensing technologies, software-defined control, and an increasing expectation for integrated safety ecosystems. Lidar and radar capabilities have become more accessible while high-resolution cameras and edge compute have enabled richer perception stacks. Simultaneously, software architectures are transitioning from monolithic ECUs toward modular, middleware-driven platforms that support over-the-air updates and continuous improvement, which changes the cadence of innovation and aftermarket service models.In parallel, regulatory emphasis on active safety and driver assistance has intensified, prompting manufacturers to prioritize system validation, explainability, and audit trails. This regulatory momentum intersects with a stronger focus on cybersecurity and functional safety practices, which together elevate development costs but also raise barriers to entry and thus create differentiation opportunities for firms with demonstrated compliance pathways. As a result, companies that can integrate robust sensing, resilient software, and validated safety cases will capture greater credibility with both commercial fleets and consumer buyers.

Assessment of how the United States tariff measures in 2025 influenced procurement choices, supplier footprints, and supply chain diversification for trailer assist components

Tariff policies implemented in the United States during 2025 have created tangible adjustments in procurement strategies, supplier selection, and supply chain planning for components used in trailer assist systems. These trade measures affected the relative cost structures for imported sensors, electronic control units, and certain semiconductor components, prompting sourcing teams to reassess supplier footprints and to accelerate engagement with domestic or tariff-exempt vendors. In turn, companies reconsidered bill-of-materials optimization and contractual terms to protect margins without diluting product quality.Consequently, procurement teams emphasized diversification to mitigate single-source exposure and to reduce lead-time volatility. Engineers and program managers began to specify alternative components where possible, while commercial teams renegotiated pricing and logistics terms to absorb or pass through incremental costs. At the same time, some suppliers reacted by relocating elements of production or by qualifying secondary manufacturing sites that fall outside the tariff scope, thereby reshaping the supplier landscape. These dynamics underscore the importance of coherent trade strategy aligned with technical due diligence and long-term supplier development plans.

In-depth segmentation analysis revealing how sensor types, real-world applications, and distinct end-user priorities determine technical demands and commercialization pathways

Insights derived from segmentation illuminate where performance requirements and commercial expectations diverge across sensor type, application, and end user. When evaluating sensors, camera options are split between monocular systems and stereo configurations, offering differing trade-offs between cost, depth perception, and computational demand; lidar choices span mechanical units and solid-state designs, the former historically providing long-range fidelity while the latter offers miniaturization and cost advantages; radar selection is navigated across long-range, medium-range, and short-range variants, each optimized for specific detection envelopes; and ultrasonic sensors continue to serve as complementary short-range proximity detectors. These sensor-level distinctions directly influence system architecture, calibration workflows, and maintenance regimes.Turning to application segmentation, system requirements vary significantly across blind spot monitoring, collision avoidance, parking assistance, and reverse assistance. Blind spot functions demand persistent lateral awareness and high false-positive resilience, collision avoidance prioritizes high-fidelity object classification and fail-safe braking interfaces, parking assistance emphasizes fine-grained positioning and smooth human override, while reverse assistance balances visibility enhancement with obstacle detection in confined environments. Finally, end-user considerations drive feature packaging and service models: fleet operators require ruggedized systems with telematics integration and predictable lifecycle support, individual owners prioritize intuitive interfaces and ease of retrofit, and rental companies focus on rapid deployment, cost-efficiency, and minimal downtime. Synthesizing these segmentation vectors helps identify where product differentiation, warranty design, and go-to-market approaches should be concentrated to match technical capabilities with buyer economics and operational constraints.

Key regional dynamics and regulatory nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific that shape adoption, supplier strategy, and product localization

Regional dynamics exert a substantial influence on technological adoption, supplier ecosystems, and regulatory expectations for trailer assist systems. In the Americas, a combination of large fleet operators, varied climate conditions, and a progressive regulatory posture stimulates demand for robust, telematics-enabled solutions that can demonstrate operational ROI and compliance with safety mandates. As a result, companies targeting this region often prioritize integration with fleet management platforms and emphasize scalability for heavy-duty and light-duty vehicle classes.In Europe, the Middle East & Africa region, regulatory harmonization across many European markets and a strong emphasis on pedestrian and cyclist safety shape system design and validation requirements, while wider geographic and infrastructure diversity across the Middle East and Africa create niche opportunities for ruggedized and climate-hardened solutions. Companies operating here invest in localization, multi-standard compliance, and partnerships with regional integrators. Across Asia-Pacific, a dense combination of urban centers, rapid vehicle turnover rates, and strong local manufacturing ecosystems encourage fast adoption of camera and radar-based solutions, as well as close collaboration with tier suppliers that support cost-sensitive production scales. Understanding these regional distinctions is critical for prioritizing R&D investments, setting distribution strategies, and tailoring field validation programs.

Strategic competitive insights showing how technological differentiation, integration partnerships, and field-proven service models determine success for suppliers and integrators

Competitive positioning within the trailer assist systems ecosystem is increasingly defined by a combination of technological depth, integration capability, and demonstrated field performance. Leading suppliers invest in multi-sensor fusion, scalable software stacks, and extensive validation suites to reduce deployment risk for vehicle manufacturers and fleet customers. Meanwhile, specialized vendors focus on narrow segments-such as short-range ultrasonic modules or stereo camera subsystems-and compete on cost, proven reliability, and ease of integration into existing vehicle electrical architectures.Partnership models have become central to building end-to-end solutions; systems integrators, tier suppliers, and telematics platforms often collaborate to deliver turnkey offerings that reduce the integration burden on OEMs. Intellectual property around perception algorithms, calibration techniques, and latency-optimized data paths emerges as a key differentiator. Additionally, companies that can document robust field data, structured maintenance plans, and aftermarket support packages stand to win trust among fleet operators and rental companies, where uptime and predictable serviceability outweigh marginal cost savings. These competitive forces reward firms that combine product innovation with disciplined program execution and a strong channel strategy.

Actionable recommendations for manufacturers, suppliers, and fleet operators to strengthen resilience, accelerate validation, and align product roadmaps with commercial needs

Industry leaders should prioritize a set of pragmatic actions that align engineering priorities with commercial realities and regulatory expectations. First, commit resources to sensor fusion validation and environmental robustness testing to ensure consistent performance across diverse operating conditions. Second, design modular software architectures that enable incremental feature rollouts, support over-the-air updates, and simplify certification pathways. Third, establish diversified supplier relationships and contingency sourcing plans to mitigate geopolitical and tariff-related disruptions while maintaining quality standards.Moreover, build cross-functional teams that include systems engineers, regulatory specialists, and customer-facing personnel to accelerate feedback loops between field data and product improvements. Invest in transparent documentation of safety cases and cybersecurity hygiene to streamline audits and to instill confidence with purchasing stakeholders. Finally, cultivate partnerships with fleet operators and rental providers for large-scale pilots and phased rollouts; these collaborations generate real-world validation, reveal operational edge cases, and create advocacy channels that amplify adoption and inform iterative product enhancements.

Research methodology detailing evidence sources, validation approaches, and triangulation techniques used to generate reliable insights for trailer assist systems stakeholders

This research synthesized technical literature, product specifications, regulatory frameworks, and structured interviews with system architects, procurement leads, and field operations managers to construct a coherent view of the trailer assist systems landscape. Primary inputs included qualitative interviews conducted with engineering and commercial stakeholders, while secondary inputs encompassed regulatory guidance, product datasheets, and peer-reviewed literature on sensor performance and system safety. The analysis places particular emphasis on cross-referencing vendor claims with independent validation practices to ensure robustness of conclusions.Triangulation methods were applied to reconcile discrepancies among sources, and sensitivity checks were used to identify areas where assumptions materially affect strategic implications. Where appropriate, scenario analysis helped surface plausible responses to tariff shifts, supply chain disruptions, and regulatory changes. Throughout, the approach emphasized reproducibility and transparency: methodologies for assessing sensor performance, integration complexity, and supplier risk are documented so that readers can replicate or extend the analysis within their own organizational context. This disciplined approach underpins the report's recommendations and supports confident decision-making.

Concluding synthesis that connects technological maturity, regulatory shifts, and supply chain dynamics to practical strategic priorities for stakeholders

In conclusion, trailer assist systems have matured into strategic capabilities that influence vehicle safety, operational efficiency, and customer satisfaction across commercial and consumer segments. Technological advances in sensing, compute, and software architecture are enabling richer perception and more sophisticated control, while regulatory and trade developments are reshaping procurement and supplier strategies. Together, these forces increase the importance of rigorous validation, modular software design, and resilient supply chain practices.For organizations engaged in this space, success will depend on aligning technical choices with user expectations and regulatory requirements, while maintaining flexibility to respond to evolving trade and component landscapes. Firms that prioritize integrated sensor stacks, robust validation methodologies, and strong field partnerships will be best positioned to convert technical capability into durable commercial advantage. Moving from insight to implementation requires disciplined execution, transparent risk management, and close collaboration across engineering, procurement, and commercial teams.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Trailer Assist System Market

Companies Mentioned

The key companies profiled in this Trailer Assist System market report include:- Aptiv PLC

- Continental AG

- Ford Motor Company

- Garmin Ltd.

- General Motors Company

- Hyundai Mobis Co., Ltd.

- Jaguar Land Rover Limited

- Magna International Inc.

- Mobileye Global Inc.

- Robert Bosch GmbH

- Valeo SA

- Volkswagen AG

- Westfalia-Automotive GmbH

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

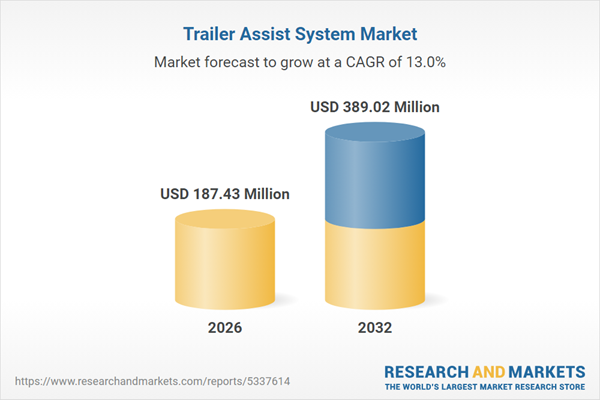

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 187.43 Million |

| Forecasted Market Value ( USD | $ 389.02 Million |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |