The growing incidence of infectious diseases such as tuberculosis, hepatitis, and respiratory infections, along with chronic conditions like diabetes, cardiovascular diseases, and cancer, is a major driver of the UAE’s IVD market. According to industry report, in the United Arab Emirates, patients under 40 years of age accounted for 25.4% of all cancer cases diagnosed; this percentage was comparable for both men and women, as well as for Emirati and non-Emirati patients. The high burden of these diseases has increased demand for early diagnosis, routine screenings, and monitoring solutions, driving the adoption of advanced IVD technologies. Moreover, as a global medical tourism hub, the UAE attracts international patients seeking high-quality diagnostics and treatments. The expansion of hospitals, diagnostic laboratories, and specialized testing centers ensures increased adoption of advanced IVD solutions, reinforcing UAE in-vitro diagnostics devices market growth.

Innovations in molecular diagnostics, automation, artificial intelligence (AI), and point-of-care testing have significantly improved the efficiency and accuracy of diagnostics. The rise of PCR, immunoassays, next-generation sequencing (NGS), and AI-driven diagnostic tools has enhanced disease detection, enabling personalized and precision medicine. Additionally, the demand for rapid, home-based, and minimally invasive tests is rising, contributing to market expansion. For instance, in May 2024, a brand-new facility that provides immune profile testing and sophisticated molecular diagnostics has launched in the United Arab Emirates. The project was put into service by Burjeel Holdings, who teamed up with OncoHelix, a Canadian company, to handle the operational and technical facets.

UAE In-Vitro Diagnostics Devices Market Trends:

Rising Prevalence of Infectious and Chronic Diseases

The increasing incidence of infectious diseases like tuberculosis, hepatitis, and COVID-19, along with chronic conditions such as diabetes and cardiovascular diseases, is a major driver of the UAE in-vitro diagnostics (IVD) market. According to the Dubai Health Authority (DHA), almost 30% of people in the United Arab Emirates are either diabetic or pre-diabetic, making diabetes a very common global and regional health issue. According to a survey published by the International Diabetes Federation (IDF), 1.17 million people in the 20-79 age range may have diabetes by 2030. Early detection and disease management programs fuel demand for advanced diagnostic solutions. Government-led screening initiatives and public health awareness campaigns further drive the adoption of IVD devices. Furthermore, the growing senior population, which is more vulnerable to chronic diseases, demands regular diagnostic testing, which contributes to market expansion.Technological Advancements in Diagnostics

Innovations in molecular diagnostics, automation, artificial intelligence (AI), and point-of-care testing represent the one of the major UAE in-vitro diagnostics devices market trends. AI-powered diagnostics enhance accuracy and efficiency, while automation improves lab throughput. For instance, in December 2024, The UAE's Technology Innovation Institute (TII) introduced a digital avatar driven by artificial intelligence (AI) that can decipher complicated multi-omics medical data, marking a revolutionary advancement in personalized healthcare. A major step toward precision medicine in the Middle East, this ground-breaking technology, which was demonstrated at Gitex Global 2024, delivers individualized health counsel by fusing TII's Falcon language model with genetic, epigenetic, and metabolic insights. Advanced PCR, immunoassay, and next-generation sequencing (NGS) technologies enable precise disease detection, driving adoption among healthcare providers. The growing demand for minimally invasive and home-based testing solutions, such as rapid antigen tests and wearable diagnostics, further accelerates market growth.Growing Medical Tourism and Expanding Healthcare Facilities

The UAE is a global hub for medical tourism, attracting patients seeking high-quality healthcare services. According to industry reports, every year, more than 15,000 medical tourists visit Abu Dhabi to benefit from its medical facilities. The influx of international patients increases the demand for advanced diagnostics, as hospitals and laboratories invest in cutting-edge IVD technologies to maintain global standards. Additionally, the expansion of private hospitals, specialized diagnostic centers, and reference laboratories enhances accessibility to high-end diagnostic tests. This growing healthcare ecosystem supports the continuous growth of the UAE in-vitro diagnostics devices market. According to industry reports, Dubai has become one of the top healthcare destinations in the globe in recent years because of several elements that appeal to both patients and healthcare professionals. The Dubai Health Authority (DHA) revealed official figures for 2022, showing that the emirate has an astonishing 4,482 private medical facilities a 45% increase in just five years.UAE In-Vitro Diagnostics Devices Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the UAE in-vitro diagnostics devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and end-user.Analysis by Application:

- Infectious Diseases

- Diabetes

- Blood Test

- Nephrology

- Cardiology

- Oncology

- Autoimmune Diseases

- Others

Analysis by End-User:

- Hospital-Based Centres

- Diagnostics Chains

- Standalone Centres

- Others

Competitive Landscape:

The UAE in-vitro diagnostics devices market shows high competition where global and local players include Abbott, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific and BD (Becton, Dickinson and Company). Their leadership stems from diagnostic technology superiority combined with robust distribution infrastructure and perpetual advancement in molecular and point-of-care testing methods. Local healthcare providers and their community team up through partnerships supported by government health programs. Occupational safety is a driving factor in IVD market demand due to increasing requirements for infectious disease testing along with chronic disease monitoring and personalized medicine needs. Strategic alliances coupled with automation advancements and artificial intelligence adoption ensure fierce competition will continue to drive the United Arab Emirates' expanding IVD sector.Key Questions Answered in This Report

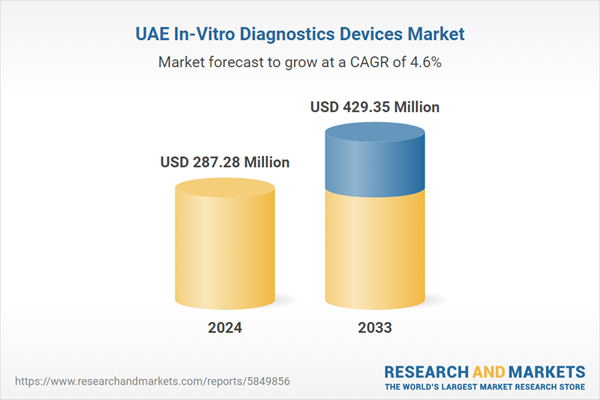

1. How big is the in-vitro diagnostics devices market in the UAE?2. What factors are driving the growth of the UAE in-vitro diagnostics devices market?

3. What is the forecast for the in-vitro diagnostics devices market in the UAE?

4. Which segment accounted for the largest UAE in-vitro diagnostics devices application market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 UAE In-Vitro Diagnostics Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by End-User

5.5 Market Breakup by Application

5.6 Market Forecast

5.7 SWOT Analysis

5.7.1 Overview

5.7.2 Strengths

5.7.3 Weaknesses

5.7.4 Opportunities

5.7.5 Threats

5.8 Value Chain Analysis

5.8.1 Overview

5.8.2 Research and Development

5.8.3 Component Manufacturing

5.8.4 Assembling

5.8.5 Distribution

5.8.6 End-Use Industries

5.8.7 Retailer

5.8.8 Consumer

5.9 Porters Five Forces Analysis

5.9.1 Overview

5.9.2 Bargaining Power of Buyers

5.9.3 Bargaining Power of Suppliers

5.9.4 Degree of Competition

5.9.5 Threat of New Entrants

5.9.6 Threat of Substitutes

6 Market Breakup by End-User

6.1 Hospital-Based Centres

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Diagnostics Chains

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Standalone Centres

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Application

7.1 Infectious Diseases

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Diabetes

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Blood Test

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Nephrology

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Cardiology

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Oncology

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Autoimmune Diseases

7.7.1 Market Trends

7.7.2 Market Forecast

7.8 Others

7.8.1 Market Trends

7.8.2 Market Forecast

8 Competitive Landscape

8.1 Market Structure

8.2 Key Players

List of Figures

Figure 1: UAE: In-Vitro Diagnostics Devices Market: Major Drivers and Challenges

Figure 2: UAE: In-Vitro Diagnostics Devices Market: Sales Value (in Million USD), 2019-2024

Figure 3: UAE: In-Vitro Diagnostics Devices Market: Breakup by End-User (in %), 2024

Figure 4: UAE: In-Vitro Diagnostics Devices Market: Breakup by Application (in %), 2024

Figure 5: UAE: In-Vitro Diagnostics Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 6: UAE: In-Vitro Diagnostics Devices Industry: SWOT Analysis

Figure 7: UAE: In-Vitro Diagnostics Devices Industry: Value Chain Analysis

Figure 8: UAE: In-Vitro Diagnostics Devices Industry: Porter’s Five Forces Analysis

Figure 9: UAE: In-Vitro Diagnostics Devices (Hospital-Based Centres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: UAE: In-Vitro Diagnostics Devices (Hospital-Based Centres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: UAE: In-Vitro Diagnostics Devices (Diagnostics Chains) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: UAE: In-Vitro Diagnostics Devices (Diagnostics Chains) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: UAE: In-Vitro Diagnostics Devices (Standalone Centres) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: UAE: In-Vitro Diagnostics Devices (Standalone Centres) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: UAE: In-Vitro Diagnostics Devices (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: UAE: In-Vitro Diagnostics Devices (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: UAE: In-Vitro Diagnostics Devices (Infectious Diseases) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: UAE: In-Vitro Diagnostics Devices (Infectious Diseases) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: UAE: In-Vitro Diagnostics Devices (Diabetes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: UAE: In-Vitro Diagnostics Devices (Diabetes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: UAE: In-Vitro Diagnostics Devices (Blood Test) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: UAE: In-Vitro Diagnostics Devices (Blood Test) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: UAE: In-Vitro Diagnostics Devices (Nephrology) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: UAE: In-Vitro Diagnostics Devices (Nephrology) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: UAE: In-Vitro Diagnostics Devices (Cardiology) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: UAE: In-Vitro Diagnostics Devices (Cardiology) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: UAE: In-Vitro Diagnostics Devices (Oncology) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: UAE: In-Vitro Diagnostics Devices (Oncology) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: UAE: In-Vitro Diagnostics Devices (Autoimmune Diseases) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: UAE: In-Vitro Diagnostics Devices (Autoimmune Diseases) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: UAE: In-Vitro Diagnostics Devices (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: UAE: In-Vitro Diagnostics Devices (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: UAE: In-Vitro Diagnostics Devices Market: Key Industry Highlights, 2024 and 2033

Table 2: UAE: In-Vitro Diagnostics Devices Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 3: UAE: In-Vitro Diagnostics Devices Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: UAE: In-Vitro Diagnostics Devices Market: Competitive Structure

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 287.28 Million |

| Forecasted Market Value ( USD | $ 429.35 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United Arab Emirates |