Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their ability to enhance operational precision, minimize worker fatigue, and support high-volume fastening tasks makes nutrunners indispensable on modern assembly lines. Technological advancements such as integrated torque sensors and digital controllers have further increased their utility, enabling real-time torque monitoring and improving quality assurance. In sectors where performance consistency and safety are crucial, nutrunners offer a reliable and efficient solution.

Key Market Drivers

Rapid Industrialization and Infrastructure Expansion

The expansion of the UAE’s industrial base and large-scale infrastructure projects is significantly boosting demand for nutrunners. As the nation diversifies its economy beyond hydrocarbons, strategic investments are being made in sectors like construction, manufacturing, logistics, and renewable energy - each requiring high-precision assembly tools.Massive infrastructure projects such as new airports, metro lines, commercial towers, and industrial parks necessitate the use of reliable fastening systems, with nutrunners favored for their consistent torque output and productivity benefits. The manufacturing ecosystem, particularly in industrial zones such as Dubai Industrial City and KIZAD, is also growing, bringing increased demand for automation-ready and efficient assembly tools.

The automotive and aerospace sectors in the UAE further amplify the need for nutrunners. As the country becomes a hub for vehicle sales, servicing, and EV assembly, precision fastening tools are crucial for assembling high-spec components like battery modules and structural frames. These trends collectively support the robust adoption of nutrunners in a wide range of industrial applications.

Key Market Challenges

High Capital Cost and Budget Constraints in Non-Oil Sectors

A notable challenge in the UAE nutrunner market is the high initial cost associated with advanced nutrunner systems, especially electronic and digital variants. While these tools offer long-term benefits through higher accuracy and efficiency, their steep upfront costs can deter adoption, particularly among small and mid-sized businesses.Sectors such as construction and small-scale manufacturing often operate under constrained budgets and may opt for more affordable alternatives like manual wrenches, limiting the adoption of high-end nutrunners. Moreover, many emerging non-oil industries in the UAE are still in developmental stages and often lack the financial support or incentives enjoyed by the oil and gas sector. This lack of subsidy or leasing options further discourages investment in advanced toolkits.

Without enhanced financial accessibility or government-backed support schemes, wider adoption of nutrunners in these developing sectors remains slow, despite awareness of their productivity and safety benefits.

Key Market Trends

Increasing Shift Toward Battery-Powered and Cordless Nutrunners

A key trend shaping the UAE nutrunner market is the rising preference for battery-operated and cordless tools. These models are gaining popularity due to their portability, user-friendly design, and ability to eliminate hazards associated with cords and compressed air hoses.Cordless nutrunners are especially valuable in large or remote work sites where power access is limited, such as in construction zones or field maintenance operations. The shift is supported by technological improvements in lithium-ion batteries, which now offer longer runtimes, faster recharging, and torque outputs comparable to pneumatic models.

Smart battery management systems that prevent overheating and extend battery life are increasingly standard features, making these tools suitable for the UAE’s demanding industrial environments. As safety, efficiency, and flexibility become top priorities, cordless nutrunners are expected to see growing adoption across construction, automotive, and oil & gas sectors.

Key Market Players

- Atlas Copco Group

- Estic Corporation

- Sanyo Machine Works, Ltd.

- Ingersoll Rand Inc.

- Daiichi Dentsu Ltd.

- Maschinenfabrik Wagner GmbH & Co. KG

- Aimco Global

- Stanley Engineered Fastening

Report Scope:

In this report, the UAE Nutrunner Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Nutrunner Market, By Type:

- Electric Nutrunner

- Pneumatic Nutrunner

- Hydraulic Nutrunner

UAE Nutrunner Market, By Distribution Channel:

- In Store

- Online

UAE Nutrunner Market, By End User:

- Construction

- Industrial

- Automotive

- Others

UAE Nutrunner Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Nutrunner Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Atlas Copco Group

- Estic Corporation

- Sanyo Machine Works, Ltd.

- Ingersoll Rand Inc.

- Daiichi Dentsu Ltd.

- Maschinenfabrik Wagner GmbH & Co. KG

- Aimco Global

- Stanley Engineered Fastening

Table Information

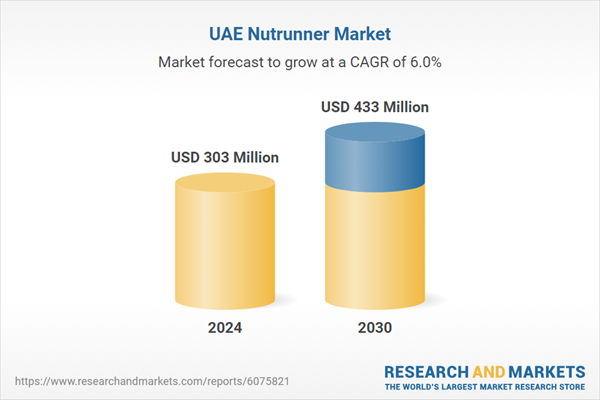

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 303 Million |

| Forecasted Market Value ( USD | $ 433 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 8 |