Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Government support for sanitation improvement and investment in urban infrastructure development are further reinforcing the requirement for modern, multi-functional vacuum trucks. For instance, In 2023, the United Kingdom's market sector investment reached $17.25 billion, marking a 3.9% increase from 2022 and a $0.63 billion rise in 2021 constant prices.

The growth was driven by higher spending in five key industry groups, notably mining and quarrying (up $0.75 billion, 19.6%), telecommunications (up $0.25 billion, 21.8%), and water supply (up $0.25 billion, 14.7%). Meanwhile, investment in energy declined by $0.88 billion (13.1%), reaching its lowest level since 2011 at $5.75 billion. The "other" industries category, including agriculture, manufacturing, and entertainment, hit a record $2.63 billion, surpassing its previous peak in 2019. This marks the second consecutive year of steady infrastructure investment growth, following a $16.63 billion spend in 2022.

Key growth drivers include technological advancements in truck design, such as improved suction power, automation, and GPS tracking, which enhance operational efficiency and reduce manual labor. Increasing awareness about hygiene and public health standards has prompted municipalities and private players to adopt vacuum trucks for urban cleanliness and flood water removal. Trends such as the integration of hybrid powertrains and smart monitoring systems are reshaping product offerings, while rental-based vacuum truck services are gaining popularity among smaller contractors looking for cost-effective solutions without long-term ownership.

Despite strong growth potential, the market faces challenges including high initial investment costs, maintenance requirements, and limited awareness among small-scale users. There is a growing need for skilled operators and service technicians to handle complex machinery. However, this presents an opportunity for training providers and aftermarket service businesses. Market players focusing on compact and fuel-efficient models, as well as customization for specific industrial needs, are well-positioned to capitalize on emerging demand. Strategic partnerships with waste management companies and utilities will play a vital role in expanding market reach and building long-term customer engagement.

Market Drivers

Stringent Waste Management Regulations

Environmental policies and waste disposal regulations are becoming increasingly strict. Regulatory bodies are mandating safe and efficient removal of hazardous materials from industrial, municipal, and commercial areas. Vacuum trucks provide a reliable solution for compliance, which is fueling demand across sectors. Companies are compelled to follow these standards to avoid penalties and improve their environmental footprint. This regulatory push has created a consistent demand for vehicles capable of advanced suction, secure containment, and safe disposal. Waste management companies are expanding their fleets to meet service requirements, particularly in industrial zones.As policies evolve, vacuum trucks are being upgraded with features that ensure regulatory alignment. For instance, the UK recycling and waste management sector has unveiled an ambitious plan to achieve net zero greenhouse gas emissions by 2040 - ten years ahead of the government’s target - through a £10 billion ($12.5 billion) investment and the creation of 40,000 new jobs over the next decade.

Spearheaded by members of the Environmental Services Association, the strategy aims to increase recycling infrastructure, slash methane emissions from landfills by 85% by 2030, and fully decarbonise waste treatment processes. The plan includes shifting to zero-emissions collection vehicles by 2030 and adopting carbon capture technology at energy-from-waste facilities. Achieving the sector's net zero target would be equivalent to removing 7 million cars from UK roads, underscoring the environmental impact of this transition.

Key Market Challenges

High Initial Purchase and Ownership Costs

Vacuum trucks are capital-intensive assets. Their advanced features and heavy-duty components make them costly to acquire and maintain, limiting access for small businesses or municipal bodies with constrained budgets. The return on investment for these vehicles can take several years, depending on usage rates and contract availability. Financing options are limited, particularly for operators with low creditworthiness. Maintenance and insurance add to the total cost of ownership, making budget planning more complex. These financial barriers discourage fleet expansion and delay new market entries.Key Market Trends

Rising Popularity of Rental and Leasing Models

Many operators prefer short-term access to vacuum trucks instead of investing in ownership. Leasing and rental services are growing rapidly, offering businesses flexibility without the burden of capital costs or long-term maintenance obligations. This model is particularly attractive for contractors handling seasonal or project-based workloads. Companies can upscale or downscale their fleet size based on demand cycles. Rental providers are expanding their service packages to include training, maintenance, and emergency support. This trend is lowering the entry barrier and democratizing access to advanced vacuum truck technology.Key Market Players

- Federal Signal Corporation

- Vac-Con (Holden Industries, Inc.)

- KOKS Group bv

- Keith Huber Corporation

- Sewer Equipment Company of America

- Alamo Group Inc.

- Hol-Mac Corporation

- FULONGMA GROUP Co., Ltd.

- Super Products LLC

- GapVax, Inc.

Report Scope:

In this report, the United Kingdom Vacuum Truck Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Vacuum Truck Market, By Product Type:

- Dry & Liquid Suctioning

- Liquid Suctioning Only

United Kingdom Vacuum Truck Market, By Propulsion Type:

- ICE

- Electric

United Kingdom Vacuum Truck Market, By Application Type:

- Industrial

- Excavation

- Municipal

- General Cleaning

- Others

United Kingdom Vacuum Truck Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Vacuum Truck Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Federal Signal Corporation

- Vac-Con (Holden Industries, Inc.)

- KOKS Group bv

- Keith Huber Corporation

- Sewer Equipment Company of America

- Alamo Group Inc.

- Hol-Mac Corporation

- FULONGMA GROUP Co., Ltd.

- Super Products LLC

- GapVax, Inc.

Table Information

| Report Attribute | Details |

|---|---|

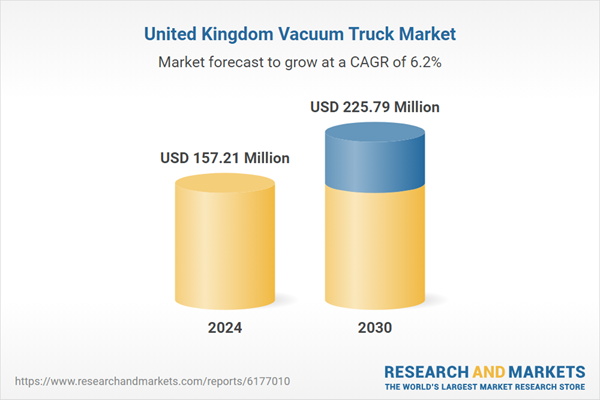

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 157.21 Million |

| Forecasted Market Value ( USD | $ 225.79 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |