The segment is projected to benefit from more recent additions to the dairy-based yogurt drink category that feature new ethnic and artisanal flavors. For instance, Raymundo's Food Group, a well-known U. S. producer of ethnic foods, introduced a yogurt brand there in July 2021 and increased the scope of its product offering to include Indian beverages like Lassi, Yoghurt Drinks, and Whole Milk Flavored Dahi (Indian-style Yoghurt). Kombucha dominated the probiotic drink market. Kombucha is widely available in health food stores, supermarkets, and even some cafes and restaurants. It has become a go-to choice for individuals seeking a refreshing and probiotic-rich beverage that offers potential health benefits. This fermentation process of kombucha produces a tangy, effervescent beverage with a unique flavor profile. The drink comes in various flavors, often achieved by adding fruits, herbs, or spices during the fermentation or bottling process. Popular flavors include ginger, berry, lemon, and green tea.

The sales of yogurt & probiotic drink through offline distribution channels dominated the U. S. market. Supermarkets and hypermarkets are among the largest offline distribution channels for yogurts and probiotic drinks. Supermarkets & hypermarkets, such as Target and Walmart, continue to dominate the distribution of yogurts and probiotic drinks in the U. S. and stock a wide range of these products to cater to growing consumer demand. Similarly, market players are launching vegan yogurt through prominent supermarket chains in the U. S. to gain a competitive edge. Players in the U. S. yogurt & probiotic drink market are likely to focus on launching products with innovative flavors that attract more consumers. In addition, there is a focus on healthy claims, convenient packaging, and health-conscious options, given the increasing demand for these attributes in consumer products.

U. S. Yogurt and Probiotic Drink Market Report Highlights

- The probiotic drinks segment is expected to witness prominent growth during the forecast period, owing to increased demand for functional beverages

- The probiotic water segment is projected to grow at a lucrative growth rate over the forecast period of 2023 to 2030, due to beverage manufacturers expanding their portfolios to include products in the water-based category

- Based on the distribution channel, the online segment is projected to witness a lucrative growth rate during the forecast period

- Online retailers witnessed a dramatic increase in demand on multiple fronts throughout 2020, including the demand for value-added health-oriented probiotic products

Table of Contents

Companies Mentioned

- Yakult Honsha Co. Ltd.

- Chobani LLC

- Danone

- Grupo Lala

- Califia Farms LLC

- Bio K+ Kerry Company

- Harmless Harvest

- Goodbelly Probiotics

- KeVita

- Lifeway Foods Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 93 |

| Published | August 2023 |

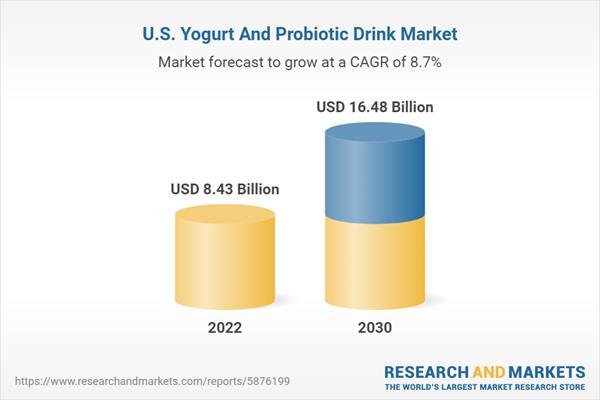

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 8.43 Billion |

| Forecasted Market Value ( USD | $ 16.48 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |