Speak directly to the analyst to clarify any post sales queries you may have.

The rhubarb market is undergoing meaningful evolution, driven by sustainability commitments, shifting end-user expectations, and advancements in processing and supply chain technologies. For senior decision-makers, understanding how these influences shape the sector is essential for navigating competitive and operational priorities.

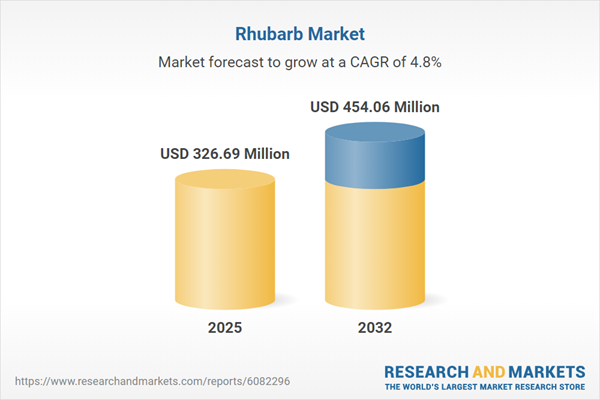

Market Snapshot: Rhubarb Market Size and Growth Trajectory

Spanning culinary, nutraceutical, and industrial sectors, the global rhubarb market is exhibiting stable expansion. It reached USD 312.83 million in 2024 and is projected to grow to USD 326.69 million in 2025, on track to achieve USD 454.06 million by 2032 at a CAGR of 4.76%. This momentum reflects rising interest in authentic, functional, and differentiated ingredients tailored to evolving supply chain demands.

Scope & Segmentation: Rhubarb Market

- Product Forms: Includes fresh rhubarb in the form of bulbs, leaves, and stalks, as well as processed types such as dried, frozen, concentrate, powdered extract, and juice blend, designed for a wide spectrum of end uses.

- Product Applications: Encompasses jams, wines, juices, bakery goods, confectionery items, powdered supplements, and wellness-centric product lines.

- Packaging Solutions: Spans bottles, boxes, cans, and assorted pouches, each selected to meet premium and convenience-oriented market segments.

- Source Categories: Details both standard conventional supply and certified organic sourcing, allowing access to mass wholesale and niche premium channels.

- Distribution Channels: Covers offline retail networks such as supermarkets, hypermarkets, and convenience stores alongside e-commerce and direct-to-brand online platforms.

- End-User Applications: Includes major uses in food and beverage—focused on bakery, beverage, and confectionery—as well as growth within cosmetics and pharmaceutical industries.

- Regional Analysis: Analyzes activity across the Americas (notably North and Latin America), Europe, Middle East and Africa, and Asia-Pacific, highlighting local production, trade patterns, and adoption of advanced production technologies.

- Technology Adoption: Features sustainable cultivation, organic conversion, cold-chain logistics, modern extraction and drying processes, advancement in traceability such as blockchain, and systemization of e-commerce strategies.

- Company Developments: Reflects on leadership strategies from firms including Bixa Botanical International, Casa Komos Brands Group, Dole Food Company, Driscoll’s, and emerging innovators advancing competitiveness and sector growth.

Key Takeaways for Senior Leaders

- Rhubarb is transitioning from a staple ingredient to a source of product differentiation across more categories, influencing both legacy and emerging sectors.

- The rise of regenerative agriculture and organic certification continues to alter sourcing and supply procedures, emphasizing measurable sustainability outcomes.

- Advancements in processing—spanning drying, extraction, and concentration—are elevating product uniformity and fulfilling modern health-focused expectations.

- Expansion of sourcing approaches and new trade routes enables organizations to remain agile amidst regulatory variability and global policy shifts.

- Digitalization via online and direct e-commerce offers diverse growth channels for specialty producers while strengthening market transparency.

- Diversification into cosmetic, pharmaceutical, and upscale food applications underscores rhubarb’s capacity to broaden both channel reach and application portfolios.

Tariff Impact: Navigating Policy Shifts in the Rhubarb Value Chain

Changes in US tariff structures have created new pressures in global sourcing strategies, particularly for rhubarb processors reliant on imports. Corporate responses include establishing new supplier collaborations outside traditional export geographies, optimizing logistics, and favoring domestic procurement where feasible. For executives, monitoring these dynamics is critical to improve supply stability and manage ongoing negotiation outcomes as pricing and trade agreements evolve.

Methodology & Data Sources

This analysis incorporates structured interviews from stakeholders throughout the value chain—spanning growers to brand managers—and employs data triangulation using customs records, industry publications, trade analyses, and logistics tracking. Executive-level surveys and detailed case studies underpin the report’s recommendations, ensuring decision relevance for senior leaders.

Why This Report Matters

- Helps organizations identify strategic growth opportunities and respond to regulatory developments in an evolving rhubarb market.

- Provides an actionable framework for benchmarking sustainability initiatives and digital transformation against sector leaders.

- Enables informed planning in investment, research, and global supply chain management—scalable for diverse business portfolios.

Conclusion

Continued advances in sustainability, technology, and cross-sector collaboration are driving the rhubarb market’s progress. Organizations that embed innovation and operational efficiency into their strategies will be prepared to leverage upcoming opportunities and manage future challenges.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Rhubarb market report include:- Bixa Botanical International

- Casa Komos Brands Group

- Dole Food Company

- Driscoll's, Inc.

- Eat Me Food Private Limited

- JK Botanicals Private Limited

- Nature's Answer, Inc.

- Organically Grown Company

- Pacific Rhubarb Inc.

- Rhubarb Farms Co.

- S.A. Herbal Bioactives LLP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 326.69 Million |

| Forecasted Market Value ( USD | $ 454.06 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |