Speak directly to the analyst to clarify any post sales queries you may have.

The smoke ingredients market is advancing as manufacturers and food service operators respond to evolving consumer expectations around flavor, transparency, and sustainability. Industry leaders benefit from early insights into global trends, regulatory changes, and innovation strategies shaping the future landscape.

Market Snapshot: Growth and Competitive Outlook

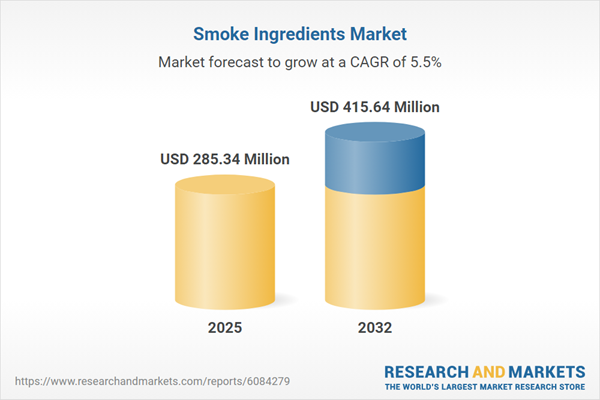

The smoke ingredients market grew from USD 271.13 million in 2024 to USD 285.34 million in 2025. It is forecast to continue with a compound annual growth rate (CAGR) of 5.48%, reaching USD 415.64 million by 2032. This trajectory is fueled by consistent product innovation, enhanced regulatory frameworks, and the growing appeal of smoky flavors in culinary and beverage applications. Expansion across industries is underpinned by the transition from traditional smoking to advanced formulations designed for clean-label and sustainability standards.

Scope & Segmentation of the Smoke Ingredients Market

This report analyzes the smoke ingredients sector with extensive segmentation, revealing growth avenues and operational contexts:

- Product Types: Liquid smoke variants (such as hickory, mesquite, and original); solid smoke ingredients including powdered smoke and wood chips

- Flavor Types: Exotic smokes, smoky flavors, and spicy smokes, illustrating demand for both innovative and traditional profiles

- Source: Natural smoke ingredients prized for authenticity; synthetic versions leveraged for efficiency and consistency

- Packaging Formats: Bulk packaging for large-scale operators; retail-ready packaging for consumer-facing channels

- End Users: Beverage industry, food processing firms, hotels and restaurants, catering services, and household users, each with distinct purchasing drivers

- Distribution Channels: Offline networks, direct and retail sales, and online sales capturing the shift towards digital commerce

- Geographic Regions: Americas, Europe, Middle East & Africa, Asia-Pacific—covering key markets, cultural flavor dynamics, and regulatory nuances

- Prominent Companies: Azelis Holding S.A, B&G Foods Inc., BASF SE, Bell Flavors & Fragrances Inc., Besmoke Ltd, Essentia Protein Solutions, Frutarom Industries Ltd., International Flavors & Fragrances Inc., Kerry Group plc, Lallemand Inc., McCormick & Company, Inc., Sensient Technologies Corporation, Symrise AG, T. Hasegawa Co., Ltd., Takasago International Corporation, Wixon, Inc., Stringer Flavour. Ltd.

Key Takeaways for Decision-Makers

- Ongoing product development is informed by both artisanal heritage and modern extraction technologies, meeting complex flavor and safety requirements.

- Sustainability drives sourcing strategies, with companies increasing use of certified biomass and sustainable forestry to minimize environmental impact.

- Clean-label trends are steering demand for natural ingredients and reducing reliance on chemical additives.

- Collaboration with culinary professionals enables the launch of custom smoke profiles that elevate both commercial and premium consumer offerings.

- Adapting to regulatory frameworks and responding to evolving policy environments remains central to sustained market access and profitability.

- Digital channel growth and enhanced traceability continue to redefine distribution efficiencies and customer engagement strategies.

Tariff Impact: Responding to Policy Shifts

The 2025 United States tariff adjustments have created new dynamics in trade flows, cost structures, and supplier diversification. Regulatory changes encourage operational efficiency, regional production partnerships, and innovative reformulation as participants recalibrate sourcing and pricing. The market has demonstrated resilience, adapting to maintain supply chain stability and support new growth opportunities in both domestic and international segments.

Methodology & Data Sources

Our research combines in-depth primary interviews with senior executives and product developers and thorough quantitative surveys of end users. Secondary data originates from regulatory, trade, and industry sources, validated through triangulation and peer review. Proprietary segmentation and forecasting frameworks ensure objectivity and actionable insight for strategic decision-making.

Why This Report Matters

- Enables senior leaders to forecast demand and allocate resources by region, segment, and technology use.

- Supports proactive management of operational, regulatory, and supply chain risks through timely intelligence.

- Empowers strategy teams with beyond-the-numbers context for innovating offerings and entering new channels or geographies.

Conclusion

Understanding the smoke ingredients market’s evolution aids executive teams in aligning operations, innovation, and sourcing strategy. Stakeholders can leverage insights to secure sustained value, maintain compliance, and capture shifting consumer preferences with agility.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Smoke Ingredients Market report include:- Azelis Holding S.A

- B&G Foods Inc.

- BASF SE

- Bell Flavors & Fragrances Inc.

- Besmoke Ltd

- Essentia Protein Solutions

- Frutarom Industries Ltd.

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Lallemand Inc.

- McCormick & Company, Inc.

- Sensient Technologies Corporation

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

- Wixon, Inc.

- Stringer Flavour. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 285.34 Million |

| Forecasted Market Value ( USD | $ 415.64 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |