Global Electronic Toll Collection (ETC) Systems Market - Key Trends & Drivers Summarized

Electronic Toll Collection (ETC) systems represent a significant advancement in traffic management, providing a seamless and efficient method for toll collection on highways and bridges. These systems use various technologies, including RFID, GPS/GNSS, and video tolling, to automate toll payments, reducing the need for physical toll booths and manual transactions. By facilitating automatic toll payments, ETC systems help to reduce traffic congestion, minimize delays, and improve overall travel efficiency. Vehicles equipped with an electronic tag or transponder can pass through toll plazas without stopping, as the toll amount is automatically deducted from the user's account. This automation not only enhances the user experience but also reduces operational costs and increases toll revenue collection efficiency for operators.Construction of new roads and highways and refurbishment or expansion of existing networks is being undertaken by countries across the world to address traffic congestion. Public sector investments into infrastructure development projects including mega-scale road projects continues to gain momentum across the world, especially in developing economies.

Technological advancements have played a crucial role in the evolution of ETC systems. RFID technology, widely used in ETC, enables quick and accurate vehicle identification and toll deduction. The integration of GPS/GNSS has further expanded the capabilities of ETC systems, allowing for distance-based tolling and real-time traffic monitoring. Video tolling, which uses advanced camera systems and license plate recognition technology, provides an alternative for vehicles without electronic tags, ensuring that all vehicles are accounted for. Additionally, the development of interoperable ETC systems, which allow seamless toll payments across different regions and operators, has greatly enhanced the convenience and usability of these systems. Innovations in data analytics and mobile payment solutions have also contributed to the sophistication and user-friendliness of ETC systems, making them more accessible to a broader audience.

The growth in the Electronic Toll Collection market is driven by several factors, including technological advancements, government initiatives, and changing consumer behavior. The ongoing development of advanced technologies, such as RFID, GPS/GNSS, and video analytics, has significantly improved the efficiency and accuracy of ETC systems, making them more reliable and effective. Government initiatives aimed at reducing traffic congestion, lowering emissions, and improving road infrastructure are also propelling the adoption of ETC systems worldwide. The increasing trend towards smart city projects and intelligent transportation systems (ITS) further boosts the demand for ETC solutions. Consumer behavior is shifting towards a preference for convenient and hassle-free travel experiences, leading to a higher adoption rate of ETC systems. Additionally, the rising number of vehicles and the need for efficient toll collection mechanisms to support infrastructure development are key factors contributing to the market's expansion.

Report Scope

The report analyzes the Electronic Toll Collection (ETC) Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (RFID, DSRC, Other Technologies); Application (Highways, Urban Areas).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the RFID Technology segment, which is expected to reach US$13.7 Billion by 2030 with a CAGR of 9%. The DSRC Technology segment is also set to grow at 8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 10.1% CAGR to reach $2.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electronic Toll Collection (ETC) Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electronic Toll Collection (ETC) Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electronic Toll Collection (ETC) Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abertis, Sanef, Atlantia S.p.A, Conduent, Inc., Cubic® Transportation Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 77 companies featured in this Electronic Toll Collection (ETC) Systems market report include:

- Abertis

- Sanef

- Atlantia S.p.A

- Conduent, Inc.

- Cubic® Transportation Systems, Inc.

- DENSO Corporation

- Efkon Gmbh

- Far Eastern Electronic Toll Collection Co., Ltd. (FETC)

- G.E.A.

- GeoToll

- International Road Dynamics Inc.

- Kapsch Trafficcom AG

- Magnetic Autocontrol GmbH

- Neology, Inc.

- Perceptics LLC

- Q-Free ASA

- Siemens AG

- Star Systems International Ltd.

- Thales Group

- Toll Collect GmbH

- Toshiba Corporation

- TransCore

- TRMI Systems Integration

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abertis

- Sanef

- Atlantia S.p.A

- Conduent, Inc.

- Cubic® Transportation Systems, Inc.

- DENSO Corporation

- Efkon Gmbh

- Far Eastern Electronic Toll Collection Co., Ltd. (FETC)

- G.E.A.

- GeoToll

- International Road Dynamics Inc.

- Kapsch Trafficcom AG

- Magnetic Autocontrol GmbH

- Neology, Inc.

- Perceptics LLC

- Q-Free ASA

- Siemens AG

- Star Systems International Ltd.

- Thales Group

- Toll Collect GmbH

- Toshiba Corporation

- TransCore

- TRMI Systems Integration

Table Information

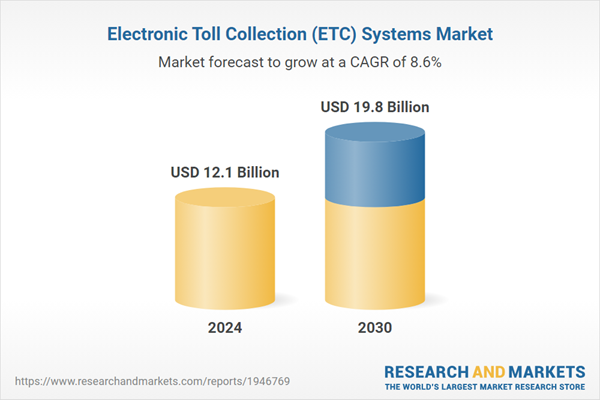

| Report Attribute | Details |

|---|---|

| No. of Pages | 410 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 19.8 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |